How venture capital can help stem the flow of ocean plastic waste

The Philippines is one of the countries that would most benefit from targeted investment in plastic waste reduction Image: REUTERS/Eloisa Lopez

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Davos Agenda

- Economic growth has exacerbated the plastic waste problem - but it contains the solution, too.

- Targeted investment can bridge the finance gap hampering Asia's waste sector.

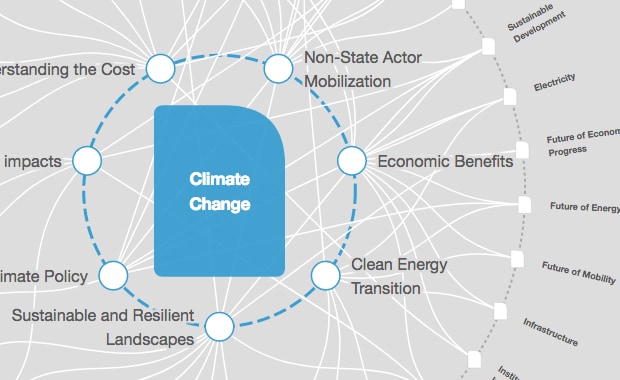

- Investment in just five countries could reduce plastic ocean flows by 45%.

Asia’s exponential growth has made it into a powerful economic force, but it also has placed the region at the heart of the ocean pollution crisis. More than half of the plastic that flows into the ocean comes from South and Southeast Asia. The meteoric rise in consumption, and the single-use, disposable mindset that comes along with it, have far outpaced the modernization of recycling and waste management systems needed to cope with the consequences.

The good news is that this economic growth means that there is capital available. So while we acknowledge that there’s no silver bullet for solving this challenge, we see capital investment as a solution, albeit with one barrier: who’s going to pay for it?

The numbers make the case for addressing the financing gap between private capital and the resources needed by Asia’s waste sector very clear: 19 Asian countries account for 82% of global plastic waste flowing into the ocean. Meanwhile, the public sector in Asia funds about 90% of infrastructure development. According to the World Bank, waste management is often the largest single-budget item for many local governments in low-income countries, and yet it receives next to zero support from international development agencies.

The challenges of funding a robust waste-management industry are amplified because of the lack of a formal ecosystem that supports collection, sorting, recycling and the circular economy. Over 90% of waste in countries across the Southeast Asia region is still openly dumped or burned, which is why it often easily makes its way into the ocean.

Investing in these sectors in just five countries in Asia – namely China, Indonesia, the Philippines, Thailand, and Viet Nam – could have an enormous impact, leading to as much as a 45% reduction in the amount of plastic leakage into the ocean.

This will, however, require an estimated $5 billion investment per year. Research estimates that there is a net financing gap for plastic waste collection of between $28 – $40 per metric ton in these five countries. Closing the financing gap will allow the funding of new technologies. It will encourage creative ideas from entrepreneurs that will contribute to the much-needed disruption of the waste and recycling industry, fast-tracking the transition to a circular economy.

Across South and Southeast Asia, new solutions in waste management and recycling, particularly in terms of new technologies, have seen rapid growth. It's a sector ripe for disruption. Here are some of those new solutions:

Banyan Nation: A plastic recycling and technology company based in Hyderabad, India, that provides recycled plastic to large brands through a mobile software platform. This software connects waste pickers to materials that need to be recycled, thus increasing processing capacity by cutting out middlemen. They won the People's Choice Award at the World Economic Forum’s Circulars Awards in 2018.

Kabadiwalla Connect: Also based in India, this company is supercharging a similar idea – leveraging a city’s existing informal waste infrastructure for the collection and processing of post-consumer waste. The product works like an Uber for waste management – a two-way software platform that connects waste pickers with waste and recycling facilities.

Tridi Oasis: This majority women-owned and managed plastic recycling business in Indonesia is producing sheet-grade recycled plastic and is planning to expand into higher-quality recycling within the next year. They also aim to expand their sourcing area for feedstock. The primary supply channels include restaurants and hotels, housing developments, schools and universities, trash banks, post-industrial material, and the 'informal sector'.

What is the World Economic Forum doing about plastic pollution?

The only way capital markets will act at scale is if investors believe this is a money-making opportunity. Today, the pool of investors is still limited due to the lack of track records, a strong pipeline of opportunities, or intermediated investment products.

At each stage of a company’s growth, different forms of capital are necessary for the type of expansion that can enable conversion of waste into value. Patient and risk-tolerant capital is needed to incubate and invest in businesses and projects that will become the future of waste management and recycling across the region. Corporate investors are uniquely positioned to meet this need, because they can derive value from recycled material for their supply chains instead of expecting a higher return on investment.

Last month saw the world’s first investment fund of $106m dedicated to addressing Asia’s plastic crisis. This fund will help incubate and finance start-ups and SMEs to treat waste more effectively so it doesn’t end up as ocean plastic. The fund’s objective is to unlock billions of dollars from public and private institutional investors and to demonstrate that investment in ocean plastic solutions can, and will, provide financial returns.

But this solution cannot work without systemic change. It demands a disruption of the entire ecosystem that generates and remediates ocean plastic – developing a circular economy that takes old plastic and turns it into a new, reusable resource for future materials. The process will require the creation of a different value chain, one that holds the promise of turning ocean plastic from a problem into a new financial opportunity for emerging markets. Now that’s one path to a new world order.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Davos AgendaSee all

Kate Whiting

April 17, 2024

Andrea Willige

March 27, 2024

Shyam Bishen

March 20, 2024

Simon Torkington

March 15, 2024

Miranda Barker

March 7, 2024