The UK will pay workers’ wages during the coronavirus pandemic

Government grants would cover 80% of the salary of retained workers. Image: REUTERS

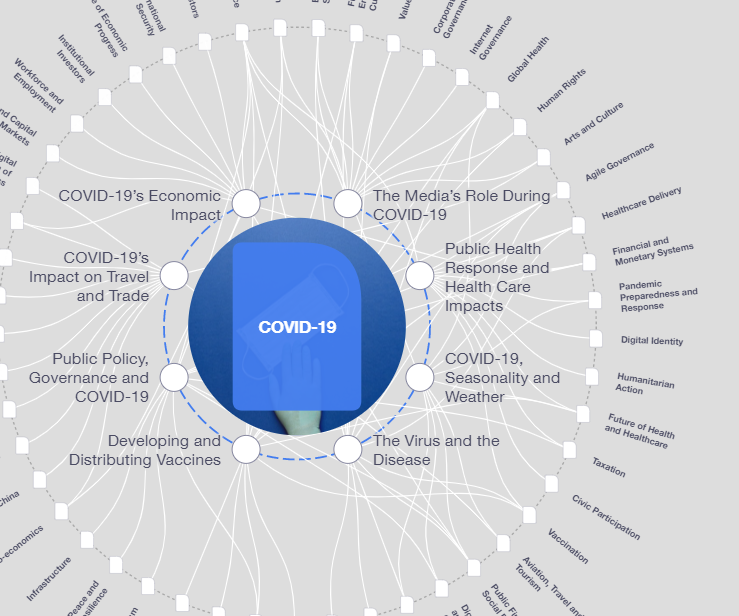

Explore and monitor how COVID-19 is affecting economies, industries and global issues

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

COVID-19

- UK Chancellor of the Exchequer Rishi Sunak announced extraordinary measures to help workers and companies through the COVID-19 pandemic.

- The government will cover 80% of the salary of workers who would otherwise be laid off.

- The Chancellor also announced major steps to help renters, businesses and self-employed workers.

Chancellor of the Exchequer Rishi Sunak said the government would help to pay wages of companies in an unprecedented step as it unveiled a programme of support for working, self-employed and unemployed people, as well as businesses.

Below are details of the policies Sunak announced.

Government-paid wages

Sunak said the government would step in and help to pay people’s wages for the first time ever, as part of a new Coronavirus Job Retention Scheme, for which every employer in the country will be eligible.

“Employers will be able to contact HMRC (revenue and customs) for a grant to cover most of the wages of people who are not working that are furloughed and kept on payroll rather than being laid off,” Sunak said.

Government grants would cover 80% of the salary of retained workers to a total of 2,500 pounds a month.

“That means workers ... can retain their job, even if their employer cannot afford to pay them.”

The scheme will cover the cost of wages backdated to March 1 and will initially be open for three months, though Sunak said he may extend it if needed.

“I am placing no limit on the amount of funding available for the scheme,” he said.

Business Loan Scheme

Sunak said the previously announced coronavirus business interruption loan scheme would now be interest-free for 12 months, rather than the 6 months announced initially. The loans would be available from Monday.

He said he would announce more steps next week so larger and medium sized firms could access credit they need.

Tax Holiday for Businesses

Sunak said he would defer the next quarter of VAT payments for businesses.

“That means no business will pay any VAT from now until the end of June and you’ll have until the end of the financial year to repay those bills,” he said.

“That is a direct injection of over 30 billion pounds of cash to businesses, equivalent to 1.5% of GDP.”

Benefits and Self-Employed

Acknowledging that it would not be possible to avoid job losses, Sunak said Britain would raise its main state-paid benefit.

He said the universal credit standard allowance for the next 12 months would increase by 1,000 pounds a year, with the working tax credit basic element rising by the same amount as well.

“Together the measures will benefit over 4 million of our most vulnerable households,” he said.

Sunak added that Britain would also suspend the minimum income floor for self-employed people affected by the economic impact of coronavirus, meaning that they could access universal credit at a rate equivalent to statutory sick pay for workers.

“Taken together, I’m announcing nearly 7 billion pounds of extra support through the welfare system,” he said.

In addition, Sunak said that the next self-assessment payments for self-employed workers would be deferred until January 2021.

Renting

Sunak said that he would support renters after previously announcing support for homeowners via a mortgage holiday.

“I’m announcing today nearly 1 billion pounds of support for renters by increasing the generosity of housing benefit and universal credit so that the local housing allowance will cover at least 30% of market rents in your area,” he said.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on COVID-19See all

Charlotte Edmond

January 8, 2024

Charlotte Edmond

October 11, 2023

Douglas Broom

August 8, 2023

Simon Nicholas Williams

May 9, 2023

Philip Clarke, Jack Pollard and Mara Violato

April 17, 2023