It's time to start investing in infrastructure for electric trucks

Road freight accounts for 2% of traffic in Europe, but 22% of emissions from the transport sector Image: REUTERS/Pascal Rossignol

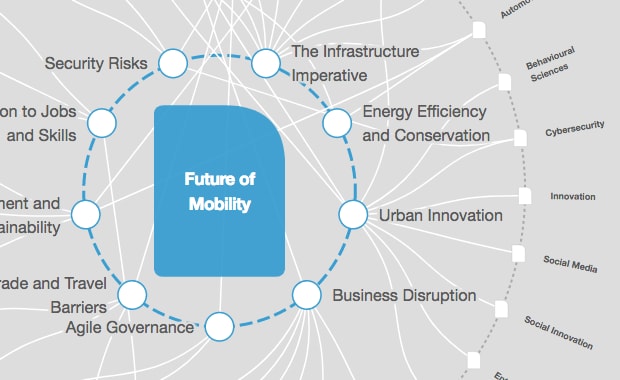

Explore and monitor how Mobility is affecting economies, industries and global issues

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Mobility

- Road freight is a major source of transport emissions, and decarbonizing this sector is key to meeting the Paris Agreement's climate goals.

- But limited availability of truck-specific charging infrastructure is slowing down the uptake of battery-electric trucks on European highways.

- Here's what needs to happen - and how.

Decarbonizing the transport sector has become increasingly important if we want to meet the Paris Agreement's climate goals. The public debate and constant pressure on car manufacturers have led to increased investments in research and development for improving battery-electric private passenger cars – but although a lot has happened in the e-mobility sector, the road freight sector’s emission trajectory is far from Paris-compatible, in spite of the positive momentum and great technological advancements in batteries and efficiency improvements.

In Europe, trucks account for approximately 2% of vehicles on the road. That can be hard to believe, considering that European highways are highly congested most of the time.

Those 2% of vehicles are, however, responsible for 22% of the CO2 emissions from land-based transport. And growing demand for transportation services suggests that emissions will even increase in the future; from around 2.5 Gigatonnes (Gt) today to 4.6 Gt by mid-century. Despite the importance of reducing emissions in heavy-duty road freight, this specific sector has received little attention in the public debate about the future of mobility.

What has happened so far?

The latest data from the European Automobile Manufacturers Association (ACEA) shows that 97.9% of new trucks registered in the EU run on diesel. Purely electric vehicles only accounted for 0.2% of total new truck sales in 2019, and alternatively-powered vehicles have a market share of approximately 2%. Despite the marginal market share, what is important to note is the year-over-year comparison. In 2019 the demand for electric trucks grew significantly by 109.2%. Additionally, a survey conducted by Bain & Company finds that customers are increasingly interested in low-emission vehicles. Around 40% of survey respondents indicated they are considering buying one or more electric hybrid or electric trucks in their next purchase.

This is good news – especially because Europe has set itself ambitious targets to decarbonize heavy-duty transport.

In August 2019, the new EU regulation on CO2 emission standards for heavy-duty vehicles entered into force. To align heavy duty vehicle emissions with the targets of the Paris Agreement, the regulation lays out that emissions in 2025 need to be reduced by 15% compared to 2019, and by 30% by 2030.

Infrastructure is key

The cost for batteries has dropped significantly over the past decade. Whereas in 2010 the cost per kWh was $1,183, it had dropped to $156/kWh in 2019. Truck manufacturing giants such as Daimler, MAN and Volvo have been ramping up their production of zero-emission trucks and the demand for their products seems to be steadily increasing. Supply-side actors such as Carrefour, IKEA, Unilever, Heineken and Nestlé have pledged to lower their carbon footprint and have demanded more public support to facilitate the greening of transport industry.

These are positive developments. There is just one minor problem: infrastructure.

Studies suggests that the uptake of battery-electric private passenger vehicles strongly correlates not just to their total cost of ownership (TCO), but also to the availability of sufficient public charging infrastructure.

The devil is in the details

Whereas investment in charging infrastructure over the last decades and numerous national incentive schemes have led to a significant increase in battery-electric private passenger cars, there is as yet no harmonized approach to scaling up public charging infrastructure specifically for the use of electric trucks. It is important to note that the technical specifications of charging infrastructure needed for heavy duty vehicles are distinct from those for passenger cars. In order to recharge a battery-electric truck, more powerful charging points are required, and these would be best located along European highways in locations that can provide sufficient parking spots. Charging a heavy-duty truck with a charger intended for battery-electric private passenger cars would currently take six entire days – but with more powerful charging points, that would drop to just 45 minutes.

The current state of suitable charging points for heavy duty trucks, according to a recent study published by ACEA in March 2020, indicates that there are zero charging points available which meet these vehicles' energy and power requirements (they require chargers that operate at 500kW or more).

By 2030, it is estimated that around 200,000 battery-electric heavy-duty vehicles (of more than 3.5 tonnes in weight) will be operating in Europe. According to the European Automobile Manufacturers Association, this will require at least 20,000 high-power public charging points along European highways by 2030.

In addition, charging depots for overnight charging and destination chargers at logistics centres are needed to cover entire transport routes. It is estimated that about 80% of the energy demand needs to be covered by depot charging overnight, while 15% should be covered by destination charging. The remaining 5%, however, needs to be covered by public charging points.

Call for action

European legislation, more investment in infrastructure and a harmonized approach across Europe is needed to make battery-electric trucks a viable substitute for internal combustion engine trucks fuelled by diesel. Binding member state targets set out by the European Commission for charging infrastructure alongside industry initiatives to drive forward the electrification of heavy-duty road freight in Europe are needed. Initiatives by industry players, such as the eTruck Charging Initiative by Daimler, need to be supported politically by providing common standards and regulations.

The World Economic Forum's new Decarbonizing Road Freight Initiative will bring together stakeholders from across the e-trucking ecosystem to accelerate the transition towards and adoption of zero-emission heavy-duty vehicles in Europe. The initiative will work to co-create actionable roadmaps, de-risking pilots and financing models for demand and supply-side actors of the eco-system. In addition, the initiative aims to contribute to the policy work of renowned think tanks and established cross-industry initiatives such as Transport & Environment, RAP, ICCT and ECTA.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Supply Chains and TransportationSee all

Nick Pickens and Julian Kettle

April 22, 2024

Rida Tahir

April 9, 2024

Kimberley Botwright and Spencer Feingold

March 27, 2024

Andrea Willige

March 19, 2024