3 reasons why consumer demand matters for the post-COVID-19 recovery

The COVID-19 pandemic put consumer spending in the spotlight Image: REUTERS

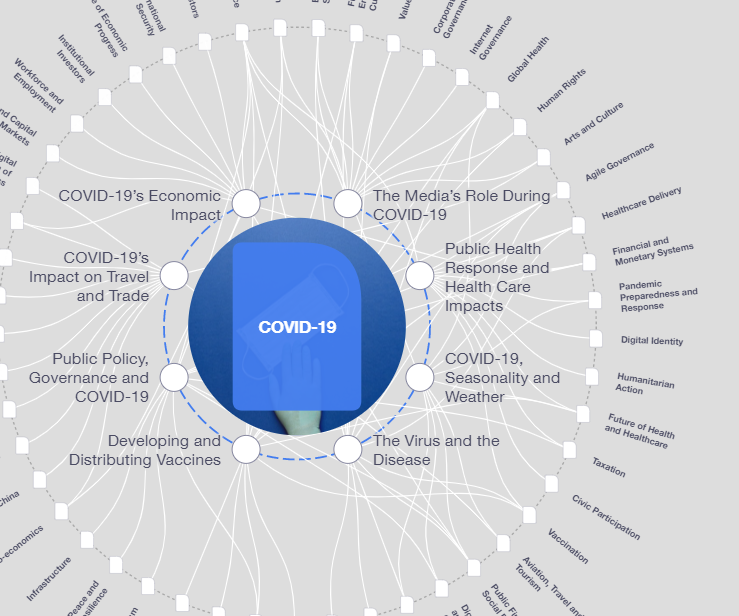

Explore and monitor how COVID-19 is affecting economies, industries and global issues

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

COVID-19

- The COVID-19 recession is dominated by the collapse in consumer spending making the consumer more important than ever to economic recovery;

- The uneven impact of the pandemic means consumer profiles post-pandemic will differ from before;

- Consumer behaviour has also been changed by new behaviours adopted or encouraged by the pandemic.

Consumer spending is the engine of the economy, accounting for about two-thirds of economic activity and underpinning the roadmap for businesses to invest and plan. The COVID-19 pandemic put consumer spending in the spotlight. Here are three reasons to keep it there:

1. Consumer spending is more important than ever to the economic recovery

The pandemic caused an almost immediate consumption shock, resulting from the forced shutdown of entire consumer service industries. Consumer spending in the US and major Western European economies (France, Germany and the UK) declined between 11% and 26% respectively in Q2 2020 versus Q4 2019.

In China, the consumption drop in Q1 2020 was also severe, about 17%. The drop in consumption is by far the largest since the 1930s Great Depression in the US and since World War II in Europe. For the US, the 11% consumption drop from peak to trough during 2020 was about five times larger compared with the Great Recession of 2007-2009. In contrast to past recessions, the decline in consumer spending occurred primarily in services, which contributed between 70% and 90% of the peak-to-trough fall in consumer spending in the US, Western Europe and China.

On the flip side, there was a rise in household savings. In a typical recession, savings rates rise by a few percentage points and remain elevated for several years during the recovery. This was the case during the Great Recession when US household savings grew by almost seven percentage points over five years as households paid down their mortgages and the credit card debt accumulated before 2008. Yet in 2020, the savings rate spiked by 18 percentage points in less than six months, causing aggregate savings of US households in 2020 to climb to almost $3 trillion – more than double 2019 savings.

This means the COVID-19 recession was dominated by the collapse in consumer spending and the rise in savings, making the consumer more important than ever as a trigger for investment decisions and achieving economic recovery.

2. The recovery in consumer spending will be uneven

The uneven impact of the pandemic means there won’t be a single uniform consumer spending recovery; rather there will be many different recoveries based on circumstances, geographies, age and income. Indeed, the uneven impact, especially the difference between high and low-income cohorts, makes the COVID‑19 recession different from the Great Recession and that means understanding the path of each consumer segment matters a lot more now than it has in the past.

Our analysis indicates a strong but unequal consumption recovery in the US with variations among income and age segments and a more balanced although slower recovery in Europe. Demand from high-income households, which accounted for two-thirds of the consumption drop and roughly half of the savings increase in the US, will be critical to the strength and speed of the recovery.

However, young and low-income households, who are disproportionately working in hard-hit service-sector jobs and occupations with hastened digitization and automation, are likely to face purchasing power constraints when government stimulus packages end. As a result, we may see widening polarization of consumer demand and an increase in inequality, especially in the US.

3. Consumer spending is going to be different after the pandemic

The economic collapse of the 1930s produced a generation of careful savers. The oil price shock of 1974 kickstarted a lasting movement to look for energy-efficient products and to reduce the environmental impact of consumption. The pandemic is sure to leave lasting marks on consumer behaviour as long-standing habits – more spending on services, greater digital adoption and more time and money spent out of the home – have been interrupted, expedited or reversed.

To determine whether these pandemic-induced behaviours might stick, we examined consumption shifts across consumer life using our stickiness test that takes into account actions by consumers, companies and governments. The pandemic hastened the adoption of digital products and services with a step-change in healthcare, a near doubling of online grocery shopping and widespread adoption of streaming services that will continue.

Additionally, home nesting will remain an enduring lifestyle for many, facilitated by consumers’ elevated rates of investment in home improvement and continuing opportunities to work from home. The definition of home now includes work, fitness and entertainment. Our analysis indicates other behaviours that were interrupted (leisure air travel, in-person education and in-person dining) will resume but with modifications like contactless restaurant menus or selective use of digital tools in education.

While vaccination programmes are still being rolled out and there is uncertainty linked to new variants of the virus, a recovery is coming. It is likely to be different from past economic recoveries as the pandemic leaves indelible marks on consumer purchasing power and behaviour. Now more than ever, understanding how consumer demand is shifting by income, age and geography will be important for decision-makers and managers alike.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on COVID-19See all

Charlotte Edmond

January 8, 2024

Charlotte Edmond

October 11, 2023

Douglas Broom

August 8, 2023

Simon Nicholas Williams

May 9, 2023

Philip Clarke, Jack Pollard and Mara Violato

April 17, 2023