4 key steps to decommissioning coal-fired power plants

Investment is moving away from new coal-fired thermal power plants. Image: Pexels.

- The race is on to meet climate goals – highlighting the urgent need to invest in renewable sources of energy.

- Large-scale decommissioning of coal-fired power plants, particularly in emerging markets is a mammoth task.

- We tackle four key issues which must be addressed in order to successfully progress decommissioning.

Concerns surrounding a global climate emergency have brought into sharp focus the need to mobilize increased investment flows towards clean energy. Such flows are needed to fund incremental power generating capacities that are non-polluting.

Capital is already shying away from backing new coal-fired thermal power plants. These complementary imperatives and trends are essential to moderate incremental growth rates in greenhouse gas (GHG) emissions. However, even with heightened climate awareness this does not appear sufficient enough anymore.

Emerging markets will have the bulk of growth in global electricity demand over the next two decades, and they are already showing strong signs of a leapfrog to renewables. So, is the power sector in emerging markets the right place to commence a discussion around emissions reduction? And if so, how will their legacy electricity infrastructure be decommissioned?

In India, about 40% of its GHG emissions can be traced to just 633 individual thermal power units (25 MW and above capacity) operating at 189 thermal power plants. There are 1,066 iron and steel units in India, and there are about 300 cement plants excluding mini plants which in aggregate account for a tiny amount of output. But at 5% and 6% respectively, iron and steel and cement account for a far lower share of emissions.

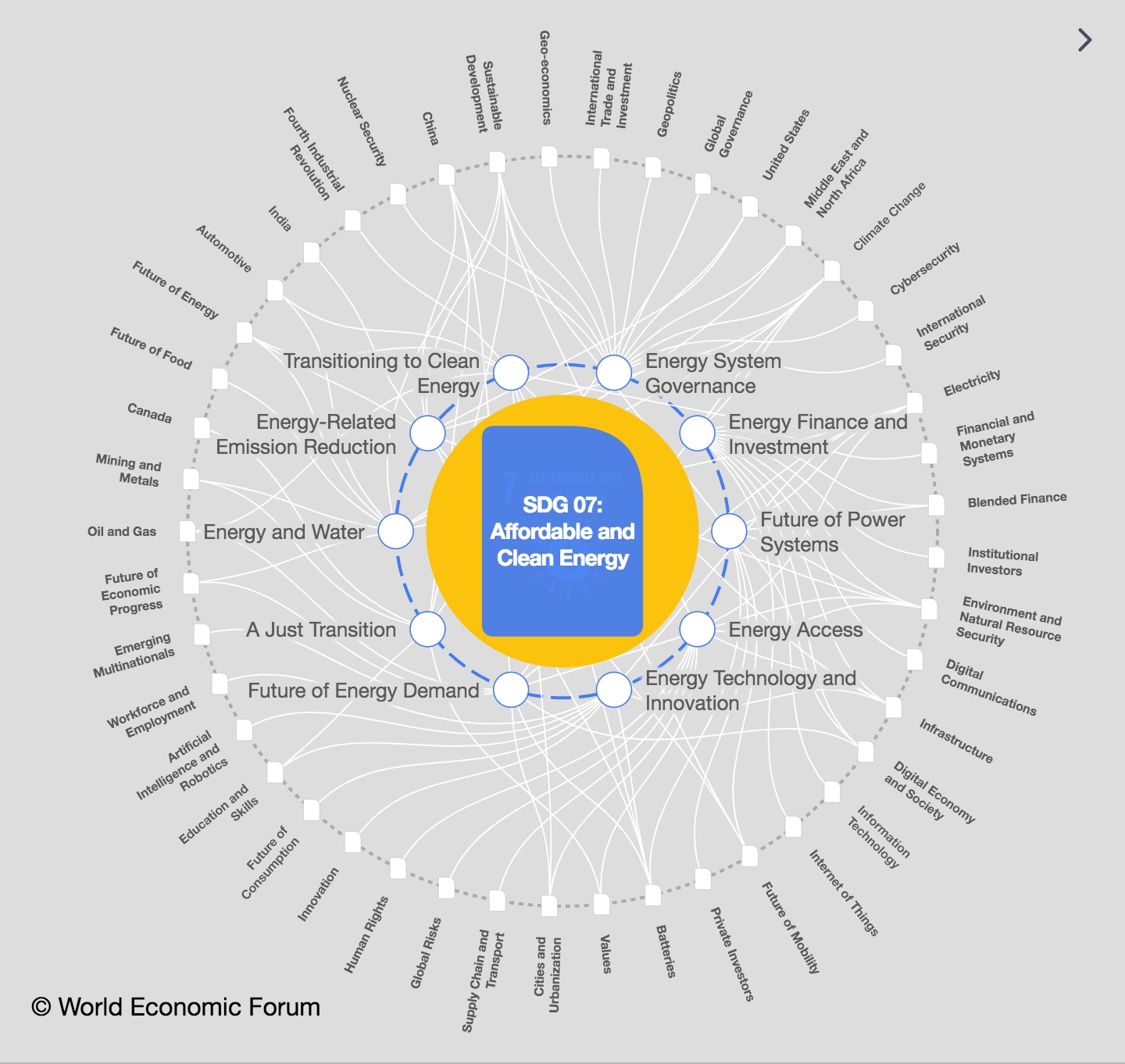

What's the World Economic Forum doing about the transition to clean energy?

On the other hand, road transportation accounts for a sizeable 9% of India’s emissions, but it also has millions of vehicles and owners behind those emissions. The modest number of thermal power units, combined with their outsized contribution to emissions, thus makes the power sector an ideal starting point for any discussion on emissions reduction.

Any large-scale decommissioning of thermal capacities is easier said than done. Four key questions need to be addressed:

1. How much thermal capacity can be reasonably retired?

Examining the energy future that India has charted out for itself helps to put the first question into perspective. By 2030 India is targeting 450 GW of renewable energy-based generating capacity. This is up from 94 GW today. One way of looking at it is that the incremental amount of power expected to be generated from renewables could result in a scope to retire significant thermal capacities. But the reality is more nuanced. In the absence of viable storage at scale, India could arguably need more stable thermal, not less of it, by 2030. After all, the inevitable increase in demand 10 years down the line will also manifest during the times when variable solar and wind simply do not generate.

Approaching the same question from an efficiency perspective yields an altogether different answer. As a recent study concluded, by prioritizing power dispatch from more efficient (and less-polluting) units, India could switch off between 30 GW and 50 GW of thermal capacity without adversely impacting generation and save over $1 billion annually.

2. How much will the retirement cost?

Whatever the capacity sought to be decommissioned, there will be associated costs. These include payouts to equity investors and creditors, who originally financed construction. They also include payments to the workforce impacted by decommissioning. Another recent study mapped a large cross-section of India’s thermal fleet and estimated the costs associated with retirement ranged on average between $0.41 million per MW to $0.59 million per MW. Not surprisingly, older units mapped were found to be significantly cheaper to decommission, with much lower per MW costs than the above mentioned average range.

3. What is the most appropriate retirement mechanism?

Germany and South Africa have given serious consideration to thermal decommissioning. The former even progressed to successfully conduct its first auction to retire capacity late last year. There was healthy competition for the pool of capital on offer to operators of thermal capacity. Average price discovery came in far lower (approximately 60% lower in fact) than the maximum €/MW compensation and subsequent auctions will have successively lower per MW maximum compensation thresholds.

Robustly designed mechanisms can ensure that decommissioning need not be the onerously expensive exercise that it is often perceived to be. That said, for successful decommissioning, it would be vital to ensure that the political economy aspects of individual countries – regional disparities, impacts on state revenues, etc – are adequately addressed.

4. Who should pay for the retirement?

Perhaps the most contentious of the four questions is how to fund the decommissioning costs. Even the most well-designed mechanisms cannot eliminate them altogether. The fact that emissions reduction benefits transcend borders points squarely in the direction of an equitable sharing of the costs involved as desirable. This is particularly relevant for the many developing economies which host significant thermal fleets but which have not contributed to the bulk of the aggregate concentrations of GHGs in the atmosphere. Meeting their rising energy needs and financing the energy transition/leapfrog in emerging markets will be central to a successful outcome at COP26.

Finalising the Article 6.4 market mechanism of the Paris Agreement – and the associated challenge of transitioning Clean Development Mechanism activities and associated certified emission reductions – features high on the agenda. Including decommissioning as an eligible activity under the Article 6.4 regime would be one of several ways in which equitable sharing of costs could be explored.

Moving forward

The idea of decommissioning polluting thermal capacities at scale has moved from the margins of the climate change discourse squarely to its centre. There are a number of countries, both developed and developing, which host significant thermal capacities. Millions of people in these countries generate livelihoods, directly and indirectly, thanks to thermal power. Hundreds of billions of dollars of capital have been invested into thermal power. Progressing thermal decommissioning from discourse to action essentially involves answering the four questions highlighted above and helping countries chart their respective decommissioning pathways. Wishing away a problem is no solution to the climate crisis; it needs strategic attention and engagement.

This agenda blog is part of a series dedicated to Mobilizing Investment for Clean Energy in Emerging Economies. The project, driven by multiple stakeholders associated with the World Economic Forum, is designed to uncover barriers, identify solutions and enable collaborative actions to significantly scale investments for clean energy in emerging and developing markets.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Decarbonizing Energy

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.