How Artificial General Intelligence will drive an inclusive financial sector in Latin America

The next form of AI, Artificial General Intelligence (AGI), has the potential to reshape financial services, especially for underbanked and unbanked populations. Image: Unsplash/David Dvořáček

- The next form of AI, Artificial General Intelligence (AGI), has the potential to reshape financial services, especially for underbanked and unbanked populations.

- With AGI-driven solutions, the financial inclusion of these populations could happen at an unprecedented pace.

- By delegating routine analytical tasks to AGI, financial experts can focus on building a more innovative, client-focused approach to finance.

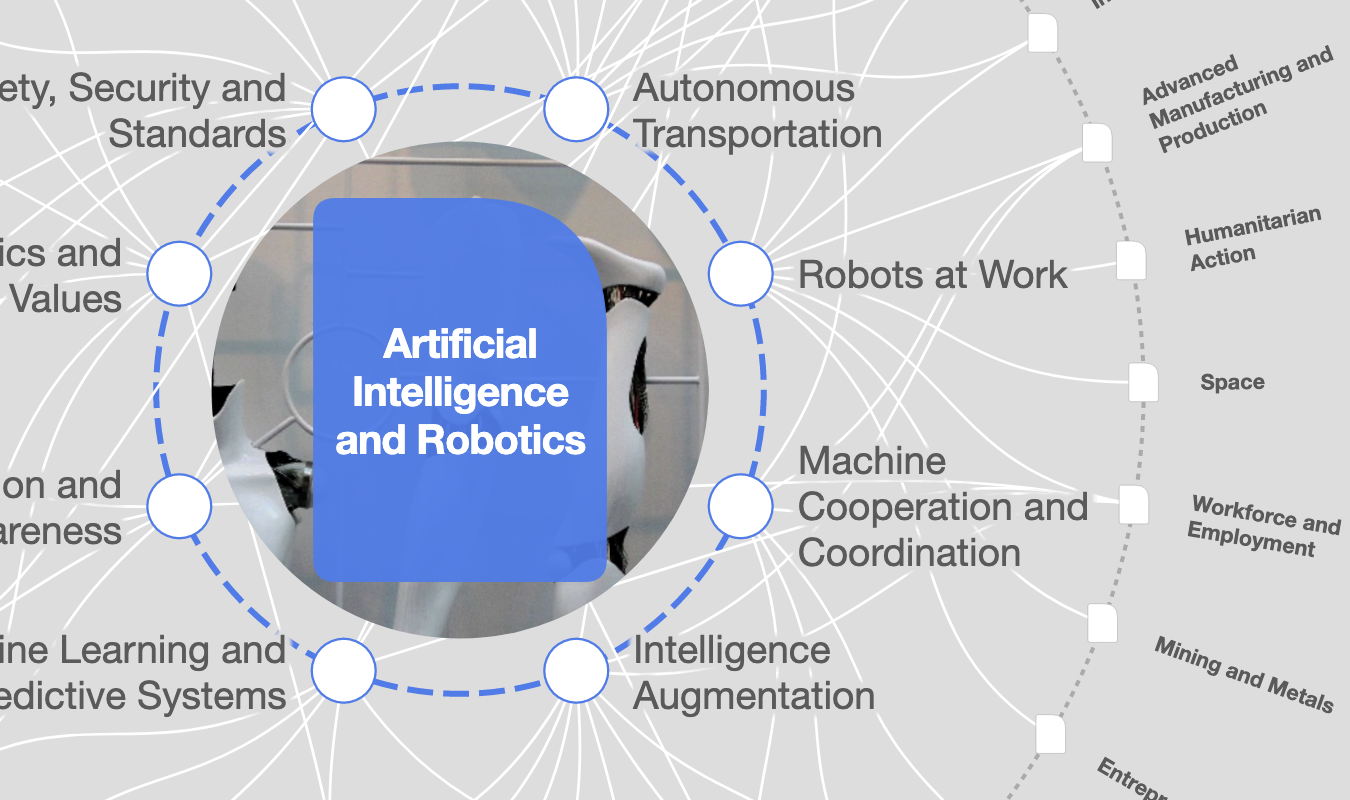

Reflecting on the transformative development of generative artificial intelligence (AI), particularly since the advent of ChatGPT in 2022, I've seen it evolve from a novel concept to a ubiquitous tool reshaping our daily lives. This AI revolution, fueled by sophisticated large language models, is driving a global technological race between major corporations, innovative startups, and academic luminaries. Considering the investment and brilliance behind this global race, I believe the next form of AI, Artificial General Intelligence (AGI), will emerge much sooner than many expect, possibly within the next few years, marking a significant leap in AI's trajectory.

AGI's promise lies in its capacity to emulate human-like thought and action, transcending mere content replication. I envision AGI as a force for good, potentially transforming all kinds of sectors. It could revolutionize urban planning by analyzing traffic and suggesting improvements to reduce congestion, enhancing daily commutes.

In environmental science, it could predict climate patterns with unprecedented accuracy to help mitigate natural disasters. In the sphere of governance, AGI could streamline bureaucratic processes, making public services more efficient and accessible. These examples only scratch the surface of AGI's potential to not just coexist with humanity, but elevate it, fostering a society where human creativity is amplified by artificial intellect.

Have you read?

Paving the way for financial inclusion in Latin America

AGI has the potential to be a key driver in reshaping financial services, especially for the underbanked and unbanked populations.

The applications are numerous: it can break down traditional barriers to financial access by creating tailored financial products and services based on a deeper understanding of individual needs and circumstances. AGI can also play a pivotal role in expanding credit access by identifying and mitigating risks associated with lending to those with limited credit history. I

t could assist in financial education, providing personalized guidance and advice to help individuals make informed financial decisions, ultimately leading to a more inclusive and equitable financial ecosystem. Reliable chatbots and voice assistants, powered by AGI, will revolutionize customer service while enhancing the monitoring and mitigation of risk and fraud activities.

This technological integration promises a more secure financial environment for end-users, albeit not without the challenges associated with biases in AI decision-making, particularly in regions like Latam with intricate credit landscapes. Striking the right balance is essential to ensure that AGI-driven advancements promote financial empowerment without reinforcing existing disparities — a task in which AI-based fintechs will play a crucial role.

The LatAm Tech Report 2023 by Latitud Ventures highlights a significant increase in bank account penetration in the region, rising from 55% to 74% of the population between 2017 and 2021. However, disparities remain, as seen in countries like Mexico and Peru, where bank account ownership is still below 60%. With AGI-driven solutions, the financial inclusion of these populations could happen at an unprecedented pace, in months rather than years.

For instance, AI-powered mobile banking apps have already made significant strides in reaching rural and remote communities, where traditional banking infrastructure is sparse. AI simplifies the account setup process, making it more accessible for people with limited literacy or tech skills. AI-driven financial platforms are enabling micro-entrepreneurs and small business owners to access banking services and credit, which were previously out of reach due to strict requirements and limited physical bank branches. Also, AI has been instrumental in personalizing financial advice and products for individuals based on their spending habits and income levels, encouraging more people to open and actively use bank accounts.

With more than 600 venture-backed fintechs across Latin America, we are already seeing a shift from traditional banking and the potential for an exponential growth trajectory for AGI applications in the region, heralding a new era of financial empowerment and innovation. These advancements are not just about increasing the number of bank accounts; they represent a broader shift towards financial education, stability, and empowerment for traditionally underserved communities.

How is the World Economic Forum fostering a sustainable and inclusive digital economy?

AGI, driving a new era of strategic thinking in finance

The rise of generative AI has been reshaping the landscape of work, particularly in the financial sector, but the advent of AGI is set to bring an even more transformative shift. This technology isn't just about automating routine tasks; it represents an opportunity to amplify human creativity and strategic thinking in finance. Similar to past technological revolutions that mechanized labor or streamlined clerical work, AGI promises to liberate financial professionals from mundane tasks, allowing them to focus on innovative and high-value activities.

In finance, AGI will take over complex data analysis, risk assessment, and even decision-making processes with a level of speed and accuracy unattainable by humans. With its ability to sift through vast amounts of market data to identify trends and opportunities, or as a compliance tool that navigates the ever-changing landscape of financial regulations, financial workers will be able to concentrate on creative strategy development and personalized client interactions. It's not about replacing roles; it's about enhancing the strategic and creative aspects of financial work, enabling professionals to innovate and provide more value to their clients.

It is my deep conviction that the unique value of humans in the financial sector lies in their ability to understand client needs, empathize, and develop tailored solutions – capabilities machines cannot replicate. By delegating routine analytical tasks to AGI, financial experts can focus on the human-centric aspects of their work. This synergy between AGI's analytical prowess and human creativity will not just streamline operations, but foster a more innovative, client-focused approach to finance. AGI will be a catalyst for creativity and strategic innovation, enhancing the human element in the financial sector.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Artificial Intelligence

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.