Global Risks Report 2023

1. Global Risks 2023: Today’s Crisis

1.1 Current crises

With the global landscape dominated by manifesting risks, we introduce this year three time frames for understanding global risks: 1) current crises (i.e. global risks which are already unfolding), 2) risks that are likely to be most severe in two years, and 3) risks that are likely to be most severe in 10 years. This chapter address the outlook for the first two time frames.

Most respondents to the 2022-2023 Global Risks Perception Survey (GRPS) chose “Energy supply crisis”; “Cost-of-living crisis”; “Rising inflation”; “Food supply crisis” and “Cyberattacks on critical infrastructure” as among the top risks for 2023 with the greatest potential impact on a global scale (Figure 1.1). Those that are outside the top 5 for the year but remain concerns include: failure to meet net-zero targets; weaponization of economic policy; weakening of human rights; a debt crisis; and failure of non-food supply chains.

News headlines all over the world make these results largely unsurprising. Yet their implications are profound. Our global “new normal” is a return to basics – food, energy, security – problems our globalized world was thought to be on a trajectory to solve. These risks are being amplified by the persistent health and economic overhang of a global pandemic; a war in Europe and sanctions that impact a globally integrated economy; and an escalating technological arms race underpinned by industrial competition and enhanced state intervention. Longer-term structural changes to geopolitical dynamics – with the diffusion of power across countries of differing political and economic systems – are coinciding with a more rapidly changing economic landscape, ushering in a low-growth, low-investment and low-cooperation era and a potential decline in human development after decades of progress.

The result is a global risks landscape that feels both wholly new and eerily familiar. There is a return of “older” risks that are understood historically but experienced by few in the current generations of business leaders and public policy-makers. In addition, there are relatively new developments in the global risk landscape. These include widespread, historically high levels of public and in some cases private sector debt; the ever more rapid pace of technological development and its unprecedented intertwining with the critical functioning of societies; and the growing pressure of climate change impacts and ambitions in an ever-shorter time frame for transition. Together, these are converging to shape a unique, uncertain and turbulent 2020s.

1.2 The path to 2025

The complex and rapid evolution of the global risks landscape is adding to a sense of unease. More than four in five GRPS respondents anticipated consistent volatility over the next two years at a minimum, with multiple shocks accentuating divergent trajectories (Figure 1.10).

Respondents to the GRPS see the path to 2025 dominated by social and environmental risks, driven by underlying geopolitical and economic trends (Figure 1.2).

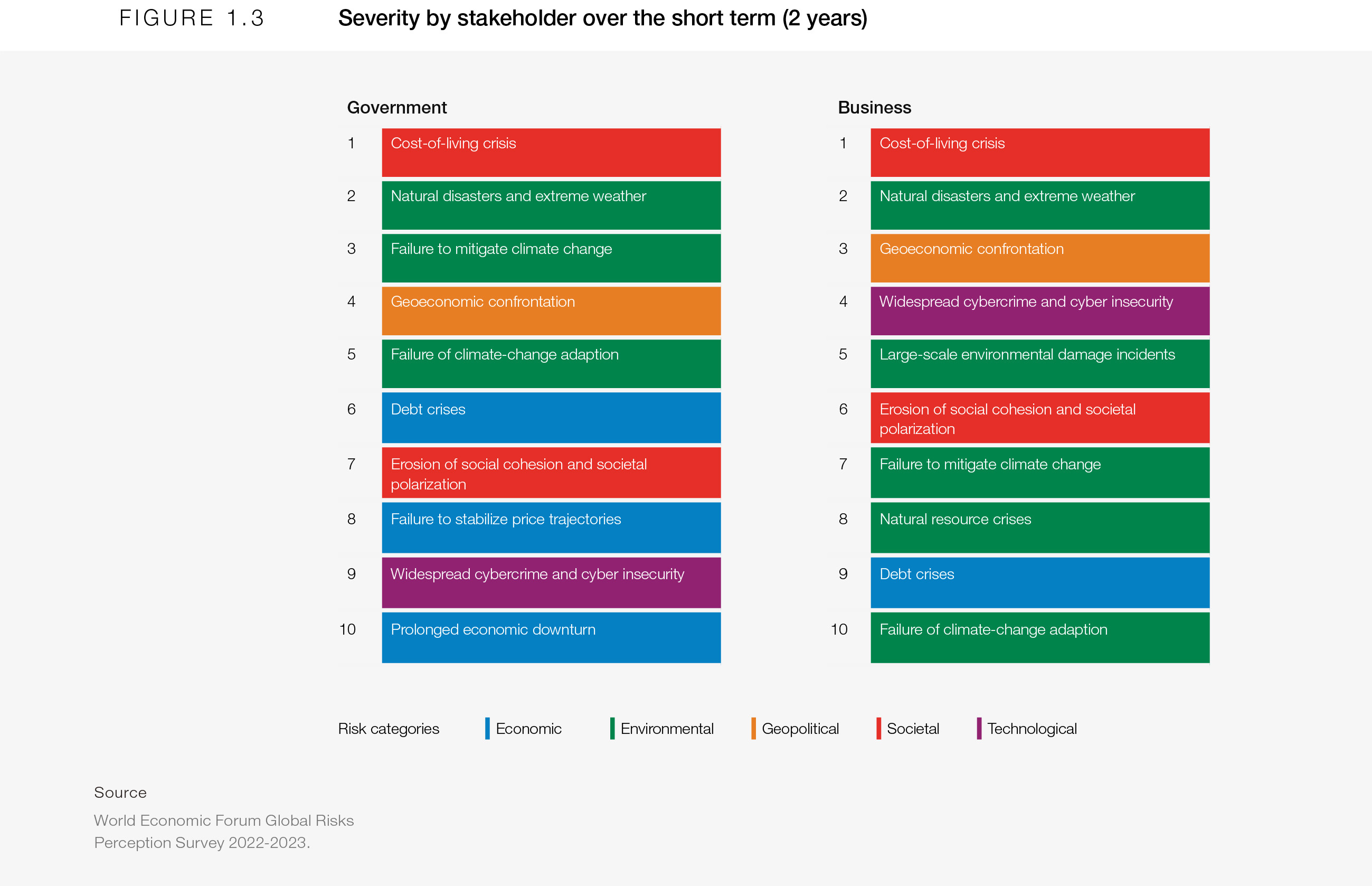

There were some notable differences between the responses of government and business respondents, with “Debt crises”, “Failure to stabilize price trajectories”, “Failure to mitigate climate change” and “Failure of climate change adaptation” featuring more prominently for governments, and “Widespread cybercrime and cyber insecurity” and “Large-scale environmental damage incidents” featuring higher for business (Figure 1.3).

The following sections explore the most severe global risks that many expect to play out over the next two years, within the context of the mounting impacts and constraints being imposed by the numerous crises felt today. These are: cost-of-living crisis, economic downturn, geoeconomic warfare, climate action hiatus and societal polarization. We describe current trends associated with each risk, briefly cover the reasons behind them and then note their emerging implications and knock-on effects.

Cost-of-living crisis

Ranked as the most severe global risk over the next two years by GRPS respondents, a global Cost-of-living crisis is already here, with inflationary pressures disproportionately hitting those that can least afford it. Even before the COVID-19 pandemic, the price of basic necessities – non-expendable items such as food and housing – were on the rise.1 Costs further increased in 2022, primarily due to continued disruptions in the flows of energy and food from Russia and Ukraine. To curb domestic prices, around 30 countries introduced restrictions, including export bans, in food and energy last year, further driving up global inflation.2 Despite the latest extension, the looming threat of Russia pulling out of the Black Sea Grain Export Deal has also led to significant volatility in the price of essential commodities.

Although global supply chains have partly adapted, with pressures significantly lower than the peak experienced in April last year,3 price shocks to core necessities have significantly outpaced general inflation over this time (Figure 1.4). The FAO Price Index hit the highest level since its inception in 1990 in March last year.4 Energy prices are estimated to remain 46% higher than average in 2023 relative to January 2022 projections.5 The relaxation of China's COVID-19 policies could drive up energy and commodity prices further - and will test the resilience of global supply chains if policy changes remain unpredictable as infections soar.

Cost-of-living crisis was broadly perceived by GRPS respondents to be a short-term risk, at peak severity within the next two years and easing off thereafter. But the persistence of a global cost-of-living crisis could result in a growing proportion of the most vulnerable parts of society being priced out of access to basic needs, fueling unrest and political instability. Continued supply-chain disruptions could lead to sticky core inflation, particularly in food and energy. This could fuel further interest rate hikes, raising the risk of debt distress, a prolonged economic downturn and a vicious cycle for fiscal planning.

Despite some improvement during the pandemic, household debt has been on the rise in certain economies. Global mortgage rates have reached their highest level in more than a decade. Some estimates suggest that the increase in rates amounts to a 35% increase in mortgage payments for homeowners.6 Rent inflation has also followed suit – in the United States of America, it is estimated to peak at over 8% in May this year before easing,7 disproportionately affecting lower socioeconomic groups who are more likely to rent but least able to afford rental price hikes. Retirees will also be impacted as pensions fail to keep pace with higher inflation.8 Higher costs of food, energy and housing, causing lower real incomes, will result in trade-offs in essential spending, worsening health and wellbeing outcomes for communities.

Economic impacts are often cushioned by expansive fiscal policy and government programmes in countries that can afford them.9 Advanced economies continue to roll out measures, many of which have been broad-brush in approach – ranging from caps on electricity bills, fuel rebates and subsidized public transport tickets for consumers, to export controls on food, tax relief, enhanced state aid and support for affected companies. The resulting pressure on fiscal balances may exacerbate debt sustainability concerns, leaving emerging and developing countries with far less fiscal room to protect their populations in the future.

Both affordability and availability of basic necessities can stoke social and political instability. Last year, the increase in fuel prices alone led to protests in an estimated 92 countries, some of which resulted in political upheaval and fatalities, alongside strikes and industrial action.10 The impact of insecurity will continue to be felt most acutely in already vulnerable states – including Somalia, Sudan, South Sudan and the Syrian Arab Republic – but may also exacerbate instability in countries facing simultaneous food and debt crises, such as Tunisia, Ghana, Pakistan, Egypt and Lebanon.11

A combination of extreme weather events and constrained supply could lead the current cost-of-living crisis into a catastrophic scenario of hunger and distress for millions in import-dependent countries or turn the energy crisis towards a humanitarian crisis in the poorest emerging markets. Energy shortages – as a result of supplier shut-offs or natural, accidental or intentional damage to pipelines and energy grids – could cause widespread blackouts and fatalities if combined with seasonal extreme weather. There is also a material possibility of a global food supply crisis occurring in 2023, with the continuation of the war in Ukraine, the lagged effect of a price spike in fertilizer last year and the impact of extreme weather conditions on food production in key regions. Estimates suggest that over 800,000 hectares of farmland were wiped out by floods in Pakistan – increasing commodity prices significantly in a country that was already grappling with record 27% inflation.12 Predicted droughts and water shortages may cause a decline in harvests and livestock deaths across East Africa, North Africa and Southern Africa, exacerbating food insecurity.13

Although some regions anticipate above-average yields next year, unexpected production or transportation shocks in key exporters – including water shortages in the Netherlands and droughts and large-scale insect loss in the United States of America and Brazil14 – or controls imposed by these countries could further destabilize global food security, explored in Chapter 3: Resource Rivalries. “Severe commodity price shocks or volatility” was a top-five risk over the next two years in 47 countries surveyed by the Forum’s Executive Opinion Survey (EOS), while “Severe commodity supply crises” registered as a more localized risk, as a top-five concern across 34 countries, including in Switzerland, South Korea, Singapore, Chile and Türkiye. The catastrophic effects of famine and loss of life can also have spill-over effects further afield, as the risk of widespread violence grows and involuntary migration rises.

Economic downturn

Last year’s edition of the Global Risks Report warned that inflation, debt and interest rate rises were emerging risks. Today, governments and central banks – led by developed markets, notably the United States of America, Eurozone and the United Kingdom of Great Britain – are walking a tightrope between managing inflation without triggering a deep or prolonged recession, and protecting citizens from a cost-of-living crisis, while servicing historically high debt loads. Public-sector respondents to the GRPS ranked Debt crises (#6), Failure to stabilise price trajectories (#8) and “Prolonged economic downturn” (#10) in the top 10 risks over the next two years (Figure 1.3).

Managing inflation is a worldwide concern. “Rapid and / or sustained inflation” was also highlighted as a top-five risk over the next two years in 89 of the countries surveyed in the EOS, a significant increase from 2021 (Figure 1.5). It was ranked as the top threat in a number of G20 countries – including Brazil, South Korea and Mexico – although inflationary pressures have affected both developed and developing economies. Inflation rates rose above 80% in Argentina and Türkiye, while Zimbabwe, the Bolivarian Republic of Venezuela, Lebanon, the Syrian Arab Republic and Sudan witnessed triple-digit inflation. Inflation in the United States of America peaked above 9% in June last year and hit record highs in the United Kingdom of Great Britain and the Eurozone in October last year, at 11.1% and 10.7%, respectively, forcing interest rates higher and inflicting more pain on emerging economies.15

The IMF’s most recent projections anticipate a decline in global inflation from almost 9% in 2022 to 6.5% this year and 4.1% in 2024, with a sharper disinflation in advanced economies.16 However, downside risks to the outlook loom large. The complexity of inflationary dynamics is creating a challenging policy environment for both the public sector and central banks, given the mix of demand and supply-side drivers, including a prolonged war in Ukraine and associated energy-supply crunch, potential for escalating sanctions, and continued bottlenecks from a lingering pandemic or new sources of supply-side controls.

Given currently low headline unemployment in advanced economies, persistent price pressures will likely lead to higher interest rates to avoid inflation de-anchoring. Central banks have sped up the post-pandemic normalization of monetary policy. Nearly 90% (33 of 38) of central banks monitored by the Bank for International Settlements raised interest rates in 2022, a dramatic shift away from the loose financial conditions that characterized the previous decade.17 With a rapid rise in rates, the risk of unintended consequences and policy error is high, with possible overshoot leading to a deeper and more prolonged economic downturn and potential global recession.

Even if the economic fallout remains comparatively contained, global growth is forecast to slow to 2.7% in 2023, with around one-third of the world’s economy facing a technical recession – the third-weakest growth profile in over 20 years.18 This downturn will be led by advanced markets, with projected growth falling to 1.1% in 2023, while the largest economies – the EU, China and the United States of America – face continued challenges to growth. However, for developing economies, there is a risk of further economic distress and tougher trade-offs. Stubbornly high inflation and more disorderly containment will raise the likelihood of stagnant economic growth, liquidity shocks and debt distress on a global scale. Energy importers in particular will bear the brunt of higher energy prices stemming from a strengthened US dollar, but its continued strength is importing inflation worldwide.

Globalized capital flows over recent decades have increased exposure of emerging and developing markets to rising interest rates, especially those with a high proportion of USD-denominated debt, such as Argentina, Colombia and Indonesia.19 Early tightening of monetary policy in many markets – including Brazil, Mexico, Chile, Peru and Colombia – minimized initial exposure. But while some countries have resorted to foreign-exchange interventions to limit currency depreciation and debt-servicing loads, heightened volatility continues to drive demand for US assets. This has led to record capital outflows from markets with weaker macroeconomic fundamentals, with investors already withdrawing $70 billion from emerging market bond funds by October last year.20

Growth agendas, including the critical pivot to greener economies, have been based on the availability of cheap debt. The extent to which countries can continue to finance development will be dependent on domestic political and debt dynamics. Sri Lanka’s recent crisis provides a very real example of the spiraling risks to human security and health that can arise from economic distress, where a debt default and shortage in foreign currency limited imports; disrupted access to food, fuel, healthcare and electricity; and led to violent protests and the resignation of the President.

The scale of sovereign debt defaults could significantly rise in weaker emerging markets over the next two years, in terms of both the percentage value of total global debt and number of states in default (Figure 1.6). Although unlikely under the current trajectory to reach globally destabilizing levels, the proportion of countries in or at high risk of debt distress has already doubled from 2015 levels.21 This will increase the global influence of creditor nations and heighten state fragility as the capacity to address simultaneous crises in food and energy will be limited.22 Some countries will be unable to contain future shocks, invest in future growth and green technologies or build future resilience in education, healthcare and ecological systems, with impacts exacerbated by the most powerful and disproportionately borne by the most vulnerable, as explored in Chapter 2.6: Economic stability.

Geoeconomic warfare

“Geoeconomic confrontation” was ranked the third-most severe risk over the next two years by GRPS respondents. Interstate confrontations were anticipated by both GRPS and EOS respondents to remain largely economic in nature over the short term. Geoeconomic confrontation – including sanctions, trade wars and investment screening – was considered a top-five threat over the next two years among 42 countries surveyed by the EOS and featured as the top risk in many East and South-East Asian countries, among others. In comparison, “Interstate conflict” was ranked as a top-five risk in 28 countries surveyed by the EOS (Figure 1.7).

The weaponization of economic policy between globally integrated powers has highlighted vulnerabilities posed by trade, financial and technological interdependence – for the public and private sector alike. The Ukraine conflict triggered the imposition of sanctions, nationalization of key players, and government appropriation of assets, such as Germany’s seizure of Russian energy companies’ stakes in local refineries last year.24 Reputational and legal risks for multinational company operations in certain markets also grew: consumer good companies faced boycotts after continuing to provide basic necessities to Russia, and a European energy company was accused of “complicity in war crimes” due to linkages to a Russian gas field.25

In the face of vulnerabilities highlighted by the pandemic and then war, economic policy, particularly in advanced economies, is increasingly directed towards geopolitical goals. Countries are seeking to build “self-sufficiency”, underpinned by state aid, and achieve “sovereignty” from rival powers, through onshoring and “friend-shoring” global supply chains. Defensive measures to boost local production and minimize foreign interference in critical industries include subsidies, tighter investment screening, data localization policies, visa bans and exclusion of companies from key markets.

While initially driven by tensions between the United States of America and China, many policies are extra-territorial in nature or have been similarly adopted by other markets, with spill-over effects across a broad range of industries. For example, Switzerland is considering the introduction of a general cross-sectoral foreign direct investment screening regime for the first time. Expanded state aid to support self-sufficiency in “strategically important products”, including climate mitigation and adaptation, has also heightened competition within global blocs. The EU has already raised concerns about the USA’s Inflation Reduction Act, which includes significant tax credits and subsidies for local green technologies.26

Economic levers are also being used to proactively constrain the rise of rivals. This includes delisting of foreign companies, extensive use of the foreign direct product rule and export controls on key technologies and intellectual property, as well as broad constraints on citizens and entities working with designated foreign companies. The introduction of an outbound investment screening regime has also been contemplated by the United States of America.27

Together, these trends towards geo-economic warfare risk creating widespread spillovers. More extensive deployment of economic levers to meet geopolitical goals risks a vicious and escalating cycle of distrust. Financial and technological ramifications may highlight further vulnerabilities, leading states to proactively wind back other interdependencies in the name of national security and resilience over the next two years. This may spur contrary outcomes to the intended objective, driving resilience and productivity growth lower and marking the end of an economic era characterized by cheaper and globalized capital, labour, commodities and goods.

This will likely continue to weaken existing alliances as nations turn inwards, with enhanced state intervention perceived to drive a “race to the bottom”. Further pressure will be placed on multilateral governance mechanisms that act as mitigants to these risks, potentially mirroring the politicization of the World Health Organization (WHO) during the COVID-19 pandemic and the near paralysis of trade enforcement on more contentious issues by the World Trade Organization (WTO) in recent years.28 It will also likely embed the importance of broader geopolitical spheres of influence in “dependent” markets, with global powers extensively exercising trade, debt and technological power. Although some developing and emerging markets may wield critical resources as leverage, considered in Chapter 3: Resource Rivalries, anticipated controls on capital, labour, knowledge and technological flows risk widening the developmental divide.

In addition, spheres of influence will not be purely contained to global powers, nor “dependent” developing and emerging markets. The influence and alignment of the Middle East in regional and global politics will shift. Although the challenge of longer-term economic diversification remains a significant distraction domestically, the current energy crisis will raise economic, military and political capital of numerous countries over the next two years. Comparative ties of the United States of America and China will have significant ramifications for the balance of power in the region, as well as global military dynamics, considered further in Chapter 2.4: Human security.29

Strategies to enhance security may also come at a wider economic cost. Intensified geopolitical tensions risk weakening the economic landscape even further, resulting in lingering inflation or depressed growth even if current pressures subside. If on- and friend-shoring continue to be prioritized – particularly in strategic industries such as technology, telecommunications, financial systems, agriculture, mining, healthcare and pharmaceuticals – consumers will potentially face rising costs well into the future. As costs of compliance with divergent political and economic systems climb, multinational companies may pragmatically pick a side, speeding up divergence between various market models.

While intended to lower risks associated with geopolitical and economic disruption, shortened supply chains may also unintentionally heighten exposure to geographically concentrated risks, including labour shortages, civil unrest, pandemics and natural weather events. Geopolitical risks posed by geographic hotspots that are critical to the effective functioning of the global financial and economic system, in particular in the Asia-Pacific, also pose a growing concern.

Climate action hiatus

Despite 30 years of global climate advocacy and diplomacy, the international system has struggled to make the required progress on climate change. The potential failure to address this existential global risk first entered the top rankings of the Global Risks Report over a decade ago, in 2011. Today, atmospheric levels of carbon dioxide, methane and nitrous oxide have all reached record highs. Emission trajectories make it very unlikely that global ambitions to limit warming to 1.5°C will be achieved.30

A Failure to mitigate climate change is ranked as one of the most severe threats in the short term but is the global risk we are seen to be the least prepared for, with 70% of GRPS respondents rating existing measures to prevent or prepare for climate change as “ineffective” or “highly ineffective” (Figure 4.1). According to the Intergovernmental Panel on Climate Change (IPCC), the chance of breaching the 1.5°C target by as early as 2030 stands at 50%. Current commitments made by the G7 private sector suggest an increase of 2.7°C by mid-century, way above the goals outlined in the Paris Agreement.31

Recent events have exposed a divergence between what is scientifically necessary and what is politically expedient. Current pressures should result in a turning point, encouraging energy-importing countries to invest in “secure”, cleaner and cheaper renewable energy sources.32 Yet geopolitical tensions and economic pressures have already limited – and in some cases reversed – progress on climate change mitigation, at least over the short term. For example, the EU spent at least EUR50 billion on new and expanded fossil-fuel infrastructure and supplies, and some countries restarted coal power stations.33

Despite some longer-term government action on the energy transition, such as the USA’s Inflation Reduction Act and the EU’s REPowerEU plan, overall momentum for climate mitigation is unlikely to rapidly accelerate in the next two years. Negotiations at the Conference of the Parties of the UNFCCC (COP27) failed to reach a much-needed agreement to phase out all fossil fuels, laying bare the difficulty of balancing short-term needs with longer-term ambitions. Policy-makers are increasingly confronted by perceived trade-offs between energy security, affordability and sustainability. The stark reality of 600 million people in Africa without access to electricity illustrates the failure to deliver change to those who need it and the continued attraction of quick fossil-fuel powered solutions – despite the risks of stranded assets, energy security challenges of exported fossil fuel commodities and lifetime carbon emissions that exceed the 1.5°C limit.

There is also growing recognition that not only the pace of the transition but also effectiveness and integrity matter: climate litigation is increasing and concerns about emissions under-reporting and greenwashing have triggered calls for new regulatory oversight for the transition to net zero.34 While some countries have made disclosure mandatory, much of the corporate world have not yet assessed or started to manage their climate risks. In the absence of clearer policy signals and consistent regulation and enforcement, mitigation efforts will be shaped by increasingly disruptive climate activism, raising the likelihood of stranded assets – as well as people. A just transition that supports those set to lose from decarbonization is increasingly invoked by countries heavily dependent on fossil-fuel industries as a reason to slow down efforts. These challenges, against the backdrop of a deteriorating economic landscape and inflated input costs, may postpone investments in greener production methods – particularly in heavier, “dirtier” industries.35

All of this implies that the risks of a slower and more disorderly transition (extensively covered in last year’s Global Risks Report) have now turned into reality, potentially leading to dire planetary and societal consequences. Any rollback of government and private action will continue to amplify risks to human health (explored in Chapter 2.3: Human health) and spur the deterioration of natural capital, as discussed in Chapter 2.2: Natural ecosystems. Climate change will also increasingly become a key migration driver and there are indications that it has already contributed to the emergence of terrorist groups and conflicts in Asia, the Middle East and Africa.36

Indeed, with 1.2°C of warming already in the system, the compounding effect of a changing climate is already being felt, magnifying humanitarian challenges such as food insecurity, and adding another hefty bill to already stretched fiscal balances.37 In the GRPS results, “Natural disasters and extreme weather events” was considered the second-most severe risk over the next two years. As with many of the global risks featured in this year’s report, the impact of these events disproportionately affects low- and middle-income countries. It registered as a top-five risk in 25 countries surveyed by the EOS, in particular in developing coastal states across Latin America, Africa and South-East Asia.

As floods, heatwaves, droughts and other extreme weather events become more severe and frequent, a wider set of populations will be affected. In parallel, a consolidation of public- and private- sector resources may set up emerging and pressing trade-offs between disaster recovery, loss and damage, adaptation and mitigation. Although climate mitigation has been overwhelmingly favoured over adaptation in terms of financing to date, particularly in the private sector,38 EOS results indicate that climate adaptation may now be seen as a more immediate concern in the short term by business leaders. Failure of climate change mitigation only featured in the top five risks over the next two years in one economy, Zambia, whereas the Failure of climate-change adaptation was a top-five risk in 16 countries, such as the Netherlands, where it ranked first (Figure 1.8). The diversion of attention and resources towards adaptation may further slow progress on global-warming targets in the economies that remain the biggest contributors to greenhouse gas (GHG) emissions.39

Despite plans for a global goal on adaptation to be agreed at COP28, there has been insufficient progress towards the support required for infrastructure and populations already affected by the fallout from climate change. Adaptation has not been adequately funded, with 34% of climate finance currently allocated to adaptation worldwide.40 Nor do new investments in infrastructure or capital allocation decisions adequately consider current and future risks. Investors and policy-makers are locking themselves into costly futures, likely to be borne by the most vulnerable. Disagreements on what constitutes adaptation, and the lack of shared goals and best practices, robust regulatory frameworks and metrics, add to a high risk of overshooting and undershooting adaptation efforts.

Limits to adaptation are also increasingly evident. This has been highlighted by the Loss and Damage agenda which, after decades on the sidelines of the climate discourse, has now reached the mainstream. A new financing mechanism was tentatively agreed at COP27, although the contribution to this fund by high-emitting economies remains unclear. Even as more funding is unlocked, there is a risk of ignoring or avoiding climate-proofing against future disasters, as governments scramble to provide relief and support in disaster-hit areas. Market-based mechanisms for managing financial shocks are inadequate and may diminish further within the next two years. There is a risk of retreat by insurers from some areas of natural catastrophe coverage, with the gap in insurance estimated to have grown from $117 billion in 2020 to $161 billion in 2021.41 Only 7% of economic losses from flood events in emerging markets – and 31% in advanced economies – have been covered by insurance in the last 20 years.42

Societal polarization

“Erosion of social cohesion and societal polarisation” has been climbing in the ranks of perceived severity in recent years.43 Defined as the loss of social capital and fracturing of communities leading to declining social stability, individual and collective wellbeing and economic productivity, it ranked as the fifth-most severe global risk faced in the short term by GRPS respondents. It was also seen as one of the most strongly influenced risks in the global network, triggered by many other short- and longer-term potential risks – including debt crises and state instability, cost-of-living crises and inflation, a prolonged economic downturn and climate migration (Figure 1.9).

A widening gap in values and equality is posing an existential challenge to both autocratic and democratic systems, as economic and social divides are translated into political ones. Polarization on issues such as immigration, gender, reproductive rights, ethnicity, religion, climate and even secession and anarchism44 have characterized recent elections, referendums and protests around the world – from the United States of America and China to the Islamic Republic of Iran. Mounting citizen frustration at perceived gaps in direct governmental action, human development and social mobility manifested in frequently divisive and unruly civil protests last year. More protests were observed between January and October than in all of 2021.45

Consequences of societal polarization are vast, ranging from a drag on growth to civil unrest and deepening political fissures. And there are indications that increasing polarization is contributing to the decline of democracies and accompanying rise in hybrid regimes, with the share of the world’s population living in autocratizing countries rising from 5% in 2011, to 36% in 2021. Only 13% of the world’s population are currently living under a liberal democracy, compared to 44% living under an electoral autocracy.46

The erosion of the social and political centre risks becoming self-perpetuating. Divisions incentivize the adoption of short-term, more extreme policy platforms to galvanize one side of the population and perpetuate populist beliefs. Notably, the contest between two, non-centrist candidates or positions is often close.47 Although heralded as a resurgence of leftist movements, the Brazilian presidential election of 2022 was won by President Lula by 1.8 points – the slimmest margin recorded since it became a democratic nation.48 As such, a large proportion of the population can feel alienated and angered by leadership in the following term, acting as a multiplier to existing societal concerns and civil unrest. This is further amplified by social media, which increases polarization and distrust in institutions alongside political engagement.49

“Misinformation and disinformation” are, together, a potential accelerant to the erosion of social cohesion as well as a consequence. With the potential to destabilize trust in information and political processes,50 it has become a prominent tool for geopolitical agents to propagate extremist beliefs and sway elections through social media echo chambers. It was perceived as a moderately severe risk by GRPS respondents, ranking 16th over the short term. Regulatory constraints and educational efforts will likely fail to keep pace, and its impact will expand with the more widespread usage of automation and machine-learning technologies, from bots that imitate human-written text to deepfakes of politicians.51

Polarization undermines social trust and, in some cases, has reflected power struggles within a political elite more than underlying divisions in ideologies.52 Often, hardened polarization on key issues lead to government gridlocks. “Swings” between parties each electoral cycle may stymie the adoption of a longer-term policy outlook, causing greater strife, especially when navigating the difficult and uncertain economic outlook of the coming years. Additionally, although less likely in more democratically robust states, an increasing presence of anocracies (those forms of government that are part democracy, part autocracy, referred to in Chapter 2.5: Digital rights) and factionalism may radicalize polarization. This could lead to increased incidences of threat campaigns and political violence, hate crimes, violent protests and even civil war.53

Social and political polarization may also further reduce the space for collective problem-solving to address global risks. The far right has been elected in Italy and are now the second largest party in Sweden, while the left has resurged in Latin America. National elections will take place in several G20 countries within the next two years, including United States of America, South Africa, Türkiye, Argentina, Mexico and Indonesia. The election of less-centrist leaders and adoption of more “extreme” policies in economic superpowers may fracture alliances, limit global collaboration and lead to a more volatile dynamic.

1.3 Looking ahead

The way risks play out over the next two years has ramifications for the decade to come. Nearly one in five respondents to the GRPS felt optimistic about the outlook for the world in the longer term, predicting limited volatility with relative – and potentially renewed – stability over the next 10 years (Figure 1.10). Yet, over half anticipated progressive tipping points and persistent crises leading to catastrophic outcomes over the next 10 years, or consistent volatility and divergent trajectories. Notably, younger age groups were more hopeful for the future: one in three respondents under the age of 40 shifted to a neutral or positive stance over the longer time frame.

Shocks of recent years – most notably, the war in Ukraine and COVID-19 pandemic – have reflected and accelerated an epochal change to the global order. Risks that are more severe in the short term are embedding structural changes to the economic and geopolitical landscape that will accelerate other global threats faced over the next 10 years. And as the confluence of current crises distracts focus and resources from risks arising over the medium to longer-term horizon, we may face increasing burdens on natural and human ecosystems. Some of these risks are close to a tipping point, but there is a window to shaping a more secure future. Understanding them is vital.

The next chapter considers the potential global shocks we are heading towards over the next decade, highlighting worrying developments emerging from the crises of today that are eroding the resilience and stability of the global system. It highlights a series of such emergent risks – the shocks of tomorrow – that can be reduced through collective attention and action today.