Tariffs and talent scarcity: Are there enough steel workers in the US?

The US has raised tariffs on steel imports to 50% to defend its steelmaking sector. Image: REUTERS/Carlos Osorio

- The US has raised tariffs on steel imports to 50% to defend its steelmaking sector.

- It says the move could create more jobs – but, amid skills shortages, would there be enough skilled workers to fill them?

- 1 in 2 manufacturing workers will need upskilling in the coming years, according to the World Economic Forum’s Frontline Talent of the Future initiative.

When the US hiked tariffs on imported steel from 25% to 50%, the government stated the move would strengthen America’s manufacturing industry and potentially create millions of jobs.

This is understandable, given that steel is symbolic of the country’s industrial prowess. The backbone of industries from car-making to construction, it is essential for continued economic development and critical to the energy sector, used in everything from wind turbines to power grid expansion.

But amid an ongoing shortage of manufacturing talent, the administration’s move to bolster homegrown steel by taxing imports has raised some key questions: will more jobs be created, and does the country have enough workers to meet new demand if it does?

The impact of tariffs

That new levies on steel will lead to net job creation is not a given. Tariffs – and retaliatory tariffs – can reduce employment because they raise input costs, resulting in higher prices for downstream manufacturers. These increases can affect demand for goods and cause manufacturers that use steel to reduce employment.

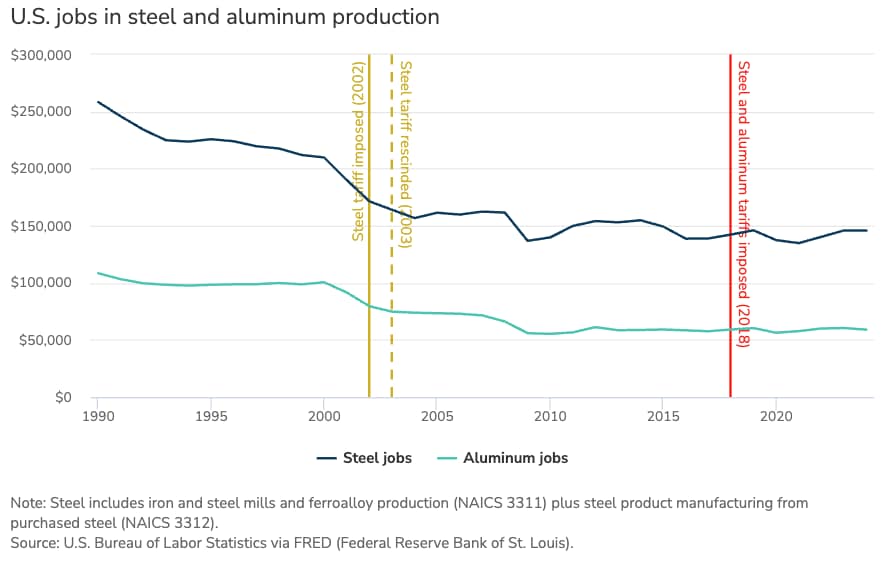

When the first Trump administration set tariffs on steel and aluminium in 2018, jobs were added at some US steelmakers but manufacturers that use steel lost more jobs than the steel sector gained. And, overall, the move did little to reverse a decades-long decline of production jobs in the steel industry.

Labour and skills gaps

If new jobs are created, filling them presents a challenge. The US makes about three-quarters of the steel it uses. Potentially reshoring the remaining 25% comes as the US, like much of the world, has a labour shortage.

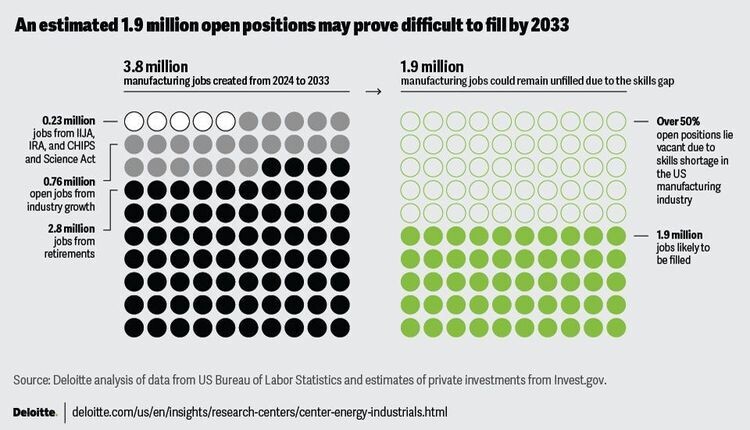

There are more than 400,000 open manufacturing jobs in the country. With ageing workforces starting to retire and an insufficient pipeline of new workers to replace them, nearly 1.9 million additional manufacturing jobs projected to be needed in the US over the next decade could go unfilled.

The issue is not just about finding labour but finding the right kind of labour. Manufacturers across the country are reporting shortages of skilled workers – a fifth of plants that said they failed to produce at full capacity in recent Census Bureau data cited a shortage of specific skills as a key reason. One manufacturing CEO told The New York Times that for every 20 positions, there is just one qualified candidate.

Industry disruption

Alongside ageing workforces, other forces are combining to make it difficult for firms to find workers with the skills that they need.

Hands-on training and vocational education have declined over the decades. Negative perceptions among Americans of working in manufacturing are playing a part. And industries are being disrupted by technological changes that mean that the skills needed to work in a factory today are different from those required 25 years ago.

Take US Steel, which was recently acquired by Japanese steelmaker Nippon Steel, as an example. The deal is expected to create about 70,000 jobs and Nippon is investing $11 billion in modernizing ageing facilities, including by introducing advanced steelmaking technologies.

New skillsets needed

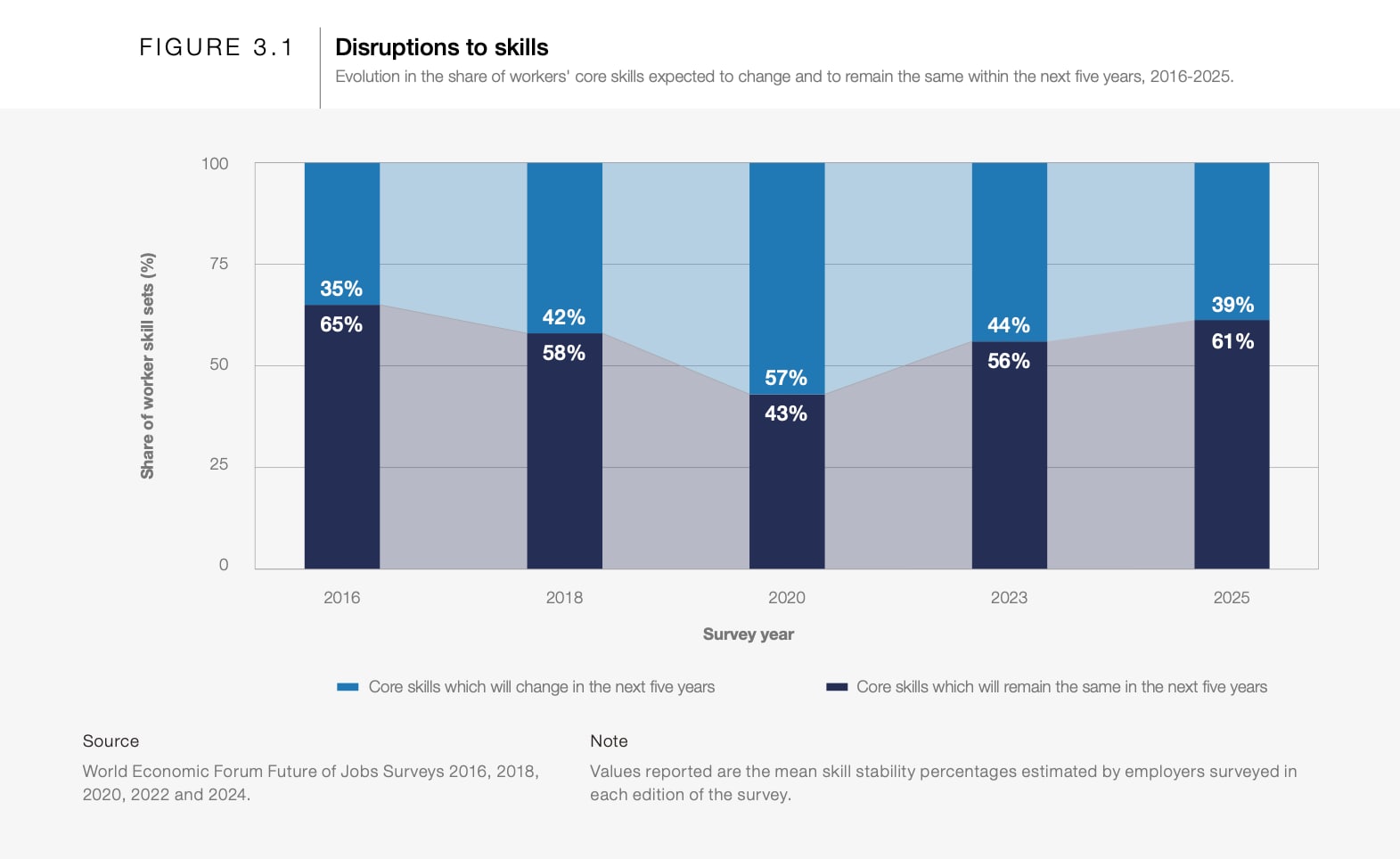

Across industries, about 40% of workers’ core skill sets will change dramatically or become obsolete by 2030, according to the World Economic Forum’s Future of Jobs Report 2025.

The Forum’s Frontline Talent of the Future initiative expects this figure to translate to manufacturing. In the coming years, one in two people will need some sort of upskilling and training, according to the initiative, which collaborates with senior leaders to build human-centric, high-performing operations that prepare the workforce for the factories and supply chains of the future.

This means a host of new competencies are needed – especially for US manufacturing firms as they invest in more automated and expensive plants to offset higher wage bills and remain competitive. In steelmaking, skills required range from the technical and digital expertise required to run and maintain automated systems or new technology like electric arc furnaces, to the knowledge of advanced materials that will drive innovation, as well as sustainability and soft skills.

A white paper called Putting Talent at the Centre: An Evolving Imperative for Manufacturing says that no matter how advanced new technologies become, people must remain at the heart of the future of production. A fresh approach to talent that embraces innovative practices for attracting, retaining, upskilling and reskilling workers will be central to this.

The US steel industry, like many others, will need to navigate this evolving landscape to fill roles with the talent who will ensure future productivity, growth and innovation.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

United States

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Economic GrowthSee all

Martin Jacob

February 17, 2026