Natural disasters have cost us $162 billion this year. Insurance covered most of it.

A damaged wind turbine blown over in Ireland during Storm Eowyn. Insurance is playing an increasingly important role in climate resilience. Image: Reuters/Clodagh Kilcoyne

- Despite rising damage caused by climate-related events, the amount of uninsured global losses has dropped to a record low of 38%.

- This reflects the growing maturity of the US market – but the gap persists outside of high-income countries.

- The insurance industry must shift from merely transferring risk to managing and mitigating it.

The first half of 2025 marks a new inflection point in the global climate risk landscape. According to leading professional services firm Aon, global insured losses from natural catastrophe events reached $100 billion, the second-highest 1H total on record, surpassed only by the $140 billion seen in 2011.

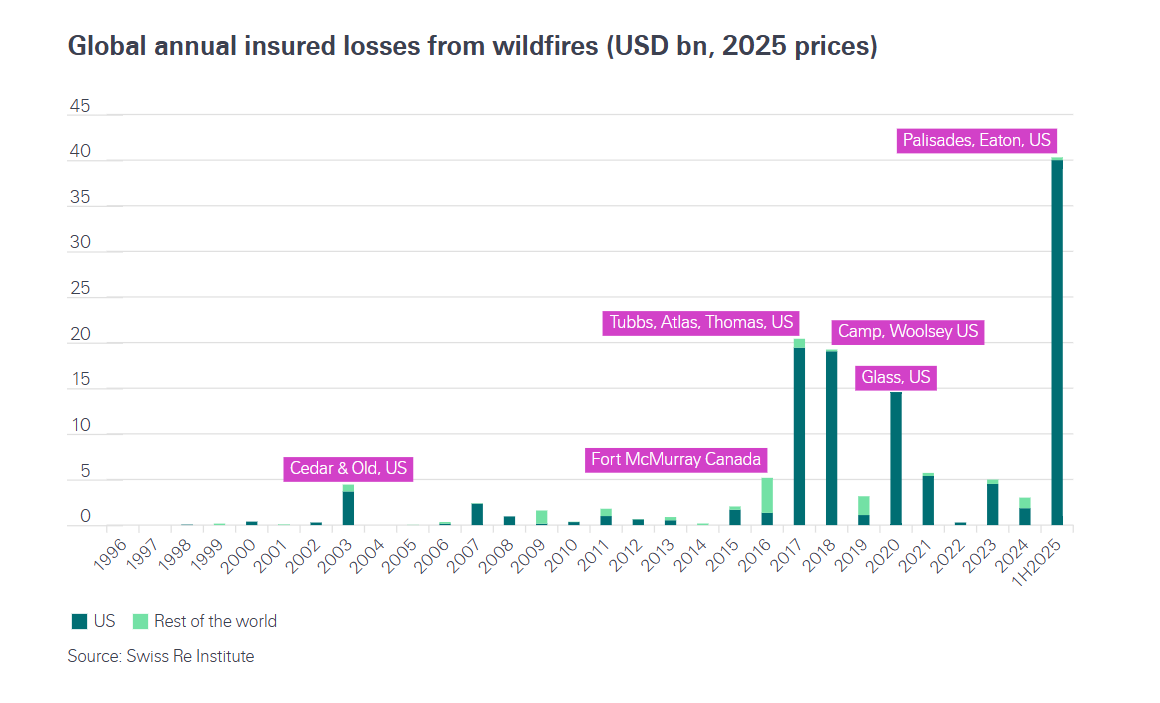

Largely driven by Los Angeles wildfires and a series of severe convective storms across the US, the losses highlight the growing financial impact of climate-related weather volatility alongside growing exposure in event-prone areas. The moment presents a powerful opportunity for the insurance industry to not only adapt to rising climate volatility, but to lead the way – driving innovation, resilience and proactive solutions that redefine how risk is understood and managed in a changing world.

The growing cost of climate extremes

The new data reveals that the 1H 2025 insured loss figure of $100 billion is 40% higher than in H1 2024 ($71 billion) and more than double the 21st-century average of $41 billion.

Total global economic losses from natural catastrophe – including both insured and uninsured losses – rose to $162 billion in the first half of 2025 (up from $156 billion the previous year).

The US alone accounted for a staggering $126 billion of that total – marking the costliest first half for the US on record. This figure represents the costliest first half on record for the US and is about triple the average 1H loss of $41 billion since 2000.

Increasingly frequent and severe climate perils across the globe highlight key questions and concerns in the response to climate’s impact:

- Notable floods in Queensland and New South Wales, along with Cyclone Alfred, triggered a high volume of claims, emphasizing the need for a better understanding of climate’s impact on extreme rainfall.

- The glacier collapse in Blatten, Switzerland caused significant damage, yet early evacuations limited fatalities. This event raises critical questions about climate change and the power of preparedness.

- Despite a quiet start, above-normal cyclone activity is forecasted for the Atlantic, while the Eastern Pacific has already seen six named storms. Rapid intensification and early warnings show the growing importance of advanced analytics in disaster response.

US leads in both risk and resilience

Of the $100 billion in global insured losses, more than 90% occurred in the US. While the scale of loss is sobering, Aon’s data also tells a more nuanced story. Despite the massive financial impact, the insurance protection gap – the portion of total economic losses that is uninsured – reached a record low of 38% globally. This is far below the 21st-century average of 69%, largely due to strong insurance penetration in the US market.

This means that for the first time, a majority of weather-related losses were absorbed by insurers rather than borne entirely by governments, businesses or individuals. It reflects a growing maturity in the US insurance market, but also points to persistent gaps in protection outside of high-income countries.

Increasingly frequent and intense wildfires are driving rising economic losses in the US. The 2024 Palisades fire, now estimated to be the most expensive wildfire in history, has caused economic losses of up to $275 billion. Wildfire risk is evolving due to expanding settlement patterns and longer fire seasons, with climate change compounding the threat. This is adding volatility to global natural catastrophe losses and making them more difficult to predict.

The protection gap: a global resilience imperative

The narrowing of the US protection gap underscores the power of well-developed insurance systems to absorb economic shocks. But the global picture remains uneven. Many countries facing rising climate risks – particularly in Asia, Africa and Latin America – still lack adequate insurance infrastructure and risk modelling capabilities.

Catastrophe experts stress the need for scaling insurance protection and loss mitigation strategies in underserved regions. Doing so would not only reduce future economic shocks but also improve long-term resilience and development outcomes.

This effort will require more than traditional underwriting and underscores the importance of data and analytics. Tools such as Aon’s Impact Forecasting catastrophe modelling suite, which covers 12 perils across 90 territories, apply the latest climate science to help organizations quantify their risks for better informed reinsurance, underwriting and exposure management.

From risk transfer to risk reduction

The insurance industry is increasingly being called upon not just to transfer risk, but to help anticipate, mitigate and manage it. In this regard, the sector is positioned to play a catalytic role in the global resilience agenda.

To do so effectively, insurers must work in closer partnership with governments, multilateral institutions and the private sector to embed resilience into infrastructure planning, zoning and financial regulation. Climate-informed risk modelling, scaleable public-private partnerships and climate-resilient construction standards all have a role to play. Addressing the mounting costs of climate disasters is no longer a future concern – it is a present-day governance, investment and equity challenge.

A defining moment for climate risk systems

The first half of 2025 offers both a warning and a window of opportunity. With catastrophe losses at historic levels but a narrowing protection gap in key markets, the moment is ripe for accelerating innovation and reform in the way societies and businesses manage climate risk.

If the insurance sector continues to evolve from a financial safety net into a driver of proactive resilience, it could help redefine how economies withstand the shocks of a warming world. But ensuring this shift benefits all communities, not just those with mature financial systems, remains a central challenge.

How the Forum helps leaders understand change in global financial systems

The path forward will require data transparency, global coordination and targeted investment in models, in markets and in people. As the climate era unfolds, resilience will not be measured only in dollars, but in the ability of systems to anticipate, absorb and adapt to what comes next.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Climate Crisis

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on BusinessSee all

Maira Martini and Katja Bechtel

February 24, 2026