The new Five Forces: a blueprint for business in a turbulent world

Heightened climate risk is one of the new Five Forces now confronting business. Image: Reuters

- Devised in the 1970s, the famous Five Forces business framework is ripe for an update in the light of the current turmoil facing corporations.

- Macro considerations like technology and climate are now more important than business-logistical ones like supplier power.

- The examples of Moderna and Microsoft show how companies can profit from or fall foul of the new forces at play.

The first thing any MBA learns in their strategy course are the Five Forces, devised by Harvard business professor Michael Porter. The Five Forces are a blueprint for succeeding against competitors in any given industry. The framework, which highlights the biggest threats to a corporation within their industry, has long been considered the benchmark for how to "win" in business.

Porter's original Five Forces – competitive rivalry, supplier power, buyer power, threat of substitutes and barriers to entry – were designed for a world of stable industries, clear boundaries and predictable competition. But they were created in the late 1970s, a time when industries were clearly defined, before technology transformed both personal and professional environments, and in a much more stable (and local) environment. It was a world in which companies could easily plan for a three- to five-year horizon.

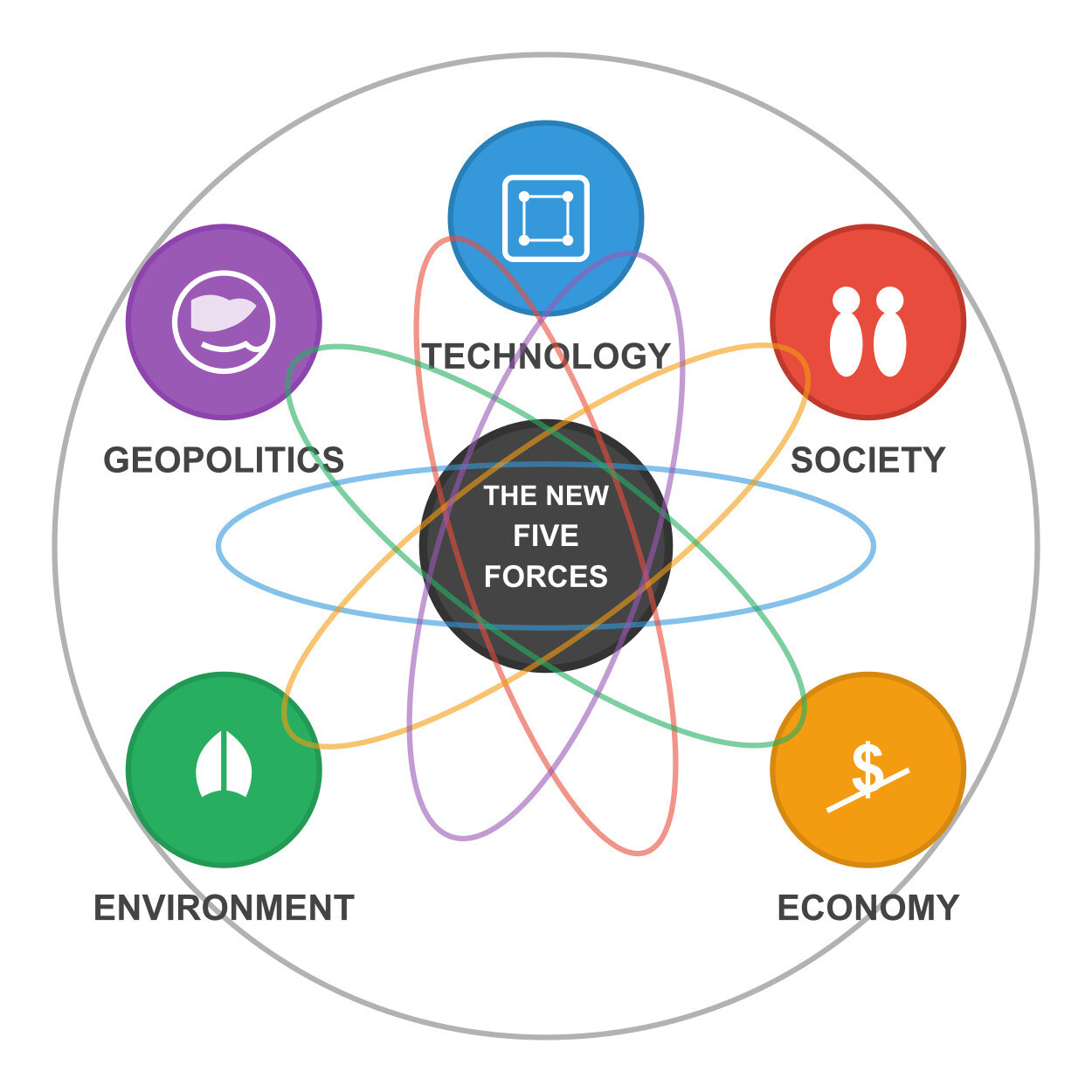

The business landscape is now shifting on a near-daily basis. And what shapes business success is far more than competition across peers. It’s the ability to navigate technological, environmental, societal, economic and geopolitical challenges – all at the same time.

We need a new framework for how corporations can manage threats and thrive: the New Five Forces. Firstly, technology is at an inflection point; the world is preparing for the moment AI will surpass human intelligence. Second, as climate change changes weather patterns and regulations, corporations are paying attention to the environment. Third, societal shifts in norms and values are playing out with “culture wars” that have corporations in the crossfire. Fourth, the economy is top of mind, with inflation, high interest rates and a volatile stock market. And finally, corporations are increasingly becoming enmeshed in geopolitical battles.

Each of the New Five Forces is a formidable threat on its own. Technology, for example, is upending industries. And where Porter’s original framework described the threat of substitutes, today’s companies are not being replaced with new offerings. Instead, entire industries are being taken out of the equation.

Professional services, from law firms to consulting, are racing to adapt before becoming extinct. AI excels in research, analysis and formulaic document creation. Will clients continue to pay (and wait) for human document reviews and flashy PowerPoints when AI could complete the same tasks within minutes? Professional services are also more vulnerable than other industries that have experienced prior technological transformations. They have not had to adapt their model in nearly a century.

Similarly, the energy sector’s biggest threat is the environment. As global, regional and national regulations aim to limit carbon emissions, the energy sector is investing in clean energy to avoid obsolescence. The world now invests more in clean energy than fossil fuels, according to the International Energy Agency. A significant portion comes from oil and gas corporations as well as state-owned energy companies.

But the New Five Forces cannot be viewed as isolated threats – they must be considered holistically.

Consider Moderna, which successfully navigated multiple forces during the COVID-19 pandemic. The company leveraged technology to build vaccines quickly, through its mRNA platform, digital manufacturing and machine learning capabilities. mRNA vaccines are also more environmentally sustainable, requiring less complex manufacturing infrastructure and the option of more distributed production. And Moderna partnered with governments at the height of the pandemic, positioning its vaccines as an integral part of national health security. It received funding, regulatory support and other advantages as a result.

However, Moderna’s inability to successfully navigate social and economic forces has led to a recent decline in sales and reduction in stock price. As business models in the biotech space continue to evolve, Moderna’s singular approach means its next big success may be several years away. Additionally, as vaccine hesitancy grows and the COVID-19 pandemic becomes more distant, demand for its blockbuster vaccine is down.

Similarly, Microsoft, which was in a precarious position a decade ago, recently surpassed a $4 trillion market cap. How did Microsoft reverse course, after lagging in cloud computing and failing in its entry to the mobile phone market, to become the second most valuable company in the world? It leaned into economic and social forces while maintaining its focus on technology.

Historically reliant on Windows and Office sales, Microsoft recognized that corporate and consumer purchasing trends were evolving. As a result, the company transformed its core business into a subscription model. It led in cloud computing by providing usage-based pricing and built new revenue streams through LinkedIn and other strategic acquisitions.

Additionally, Microsoft transformed its culture, leaning into diverse hiring practices, decentralized decision-making and greater collaboration (both internally and with other tech giants.) It also maintained its strong position in the environmental and geopolitical forces through net zero commitments and deep partnership with the UN. By turning these threats into opportunities, Microsoft reinvented itself with notable success.

As CEOs navigate an increasingly complex world, they must understand how the New Five Forces are impacting their organizations. Traditional competitive analysis falls short in this unprecedented time. Corporations need a new framework – one that accounts for constant and consistent transformation.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

The Digital Transformation of Business

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on BusinessSee all

Maira Martini and Katja Bechtel

February 24, 2026