Why real estate's next major value-add opportunity is sustainability

Sustainability is now a key part of best-in-class real estate, according to JLL. Image: Alex Tai/Unsplash

- Best-in-class real estate nowadays consist of buildings that measure up on operational performance, employee experience and tech enablement.

- With potentially obsolete property stock sitting in high-value markets, sustainable retrofits are a significant value-add opportunity for investors.

- Not only is improving sustainability in property an environmental imperative, it's a way to generate significant financial returns in real estate.

The days of cheap debt and low interest rates are long gone, and will likely never return. No longer will real estate investors be able to coast on market momentum, rather than treat real estate as a physical asset class with unique obsolescence and liquidity characteristics.

Today’s definition of a best-in-class building has evolved – and those that don’t measure up on operational performance, employee experience and tech enablement are becoming more expensive to run and less attractive to tenants.

At the same time, tough market conditions in the last three years have led to many building owners postponing major investments and strategic moves, amid reduced capex spend on retrofits, a slow-down in transaction activity, and lower values in many sectors and geographies.

Yet it would be wrong to write off buildings now falling short of market expectations. In many key real estate markets, obsolescence – when a property is out of date or no longer in line with market requirements – presents a value-add opportunity rather than a risk. It is the biggest signal yet that we have reached the bottom of a cycle.

The real estate market drivers at work

Converging market fundamentals are making the business case for value creation through low-carbon, energy-smart strategies stronger than ever.

1. Tenant demand

One of the strongest drivers is tenant demand for low carbon buildings in markets where supply is severely lagging. The attributes of these buildings not only support corporate goals to lower emissions, but also provide the technology-enabled, energy-efficient space that tenants want. Economical running costs and low environmental impact are now priority criteria alongside traditional location and amenities considerations.

2. Energy demand

Energy market dynamics are coming to the fore as volatile prices and reliability concerns increase in the face of soaring energy demand and ageing energy infrastructure.

In high-cost US energy markets including Chicago and Los Angeles, electricity expenses can reach nearly 26% of rental income. These can increase tenfold when building users want to connect electric vehicles to the building power supply, particularly in logistics facilities. This provides a new opportunity for building owners to achieve a substantial return on investment through targeted energy performance upgrades.

3. Local regulation and physical risk

In the background, regulation is tightening as policy-makers around the world target lower emissions — often directly through building performance standards. Climate risk mitigation is rising up the agenda for private and public institutions amid costly disruption and damage from extreme weather events.

4. Investment momentum

As with all value-add strategies, capital expenditure is needed. In the wider real estate market, growing investment momentum can provide the capital needed to upgrade outdated stock, with sustainability offering a strategic framework for competitive, future-ready buildings.

Together, these drivers put sustainability at the next frontier of value creation.

Realizing value from energy-smart buildings

The scale of the opportunity to transform obsolete stock into high-performing, energy-smart buildings is huge. Around 1.5 billion square feet, equating to 70% of potentially obsolete stock, sits in markets with high sustainability value-add scores, according to JLL research. Markets where the drivers for sustainability value-add are strongest include London, Paris, New York, Toronto and Singapore.

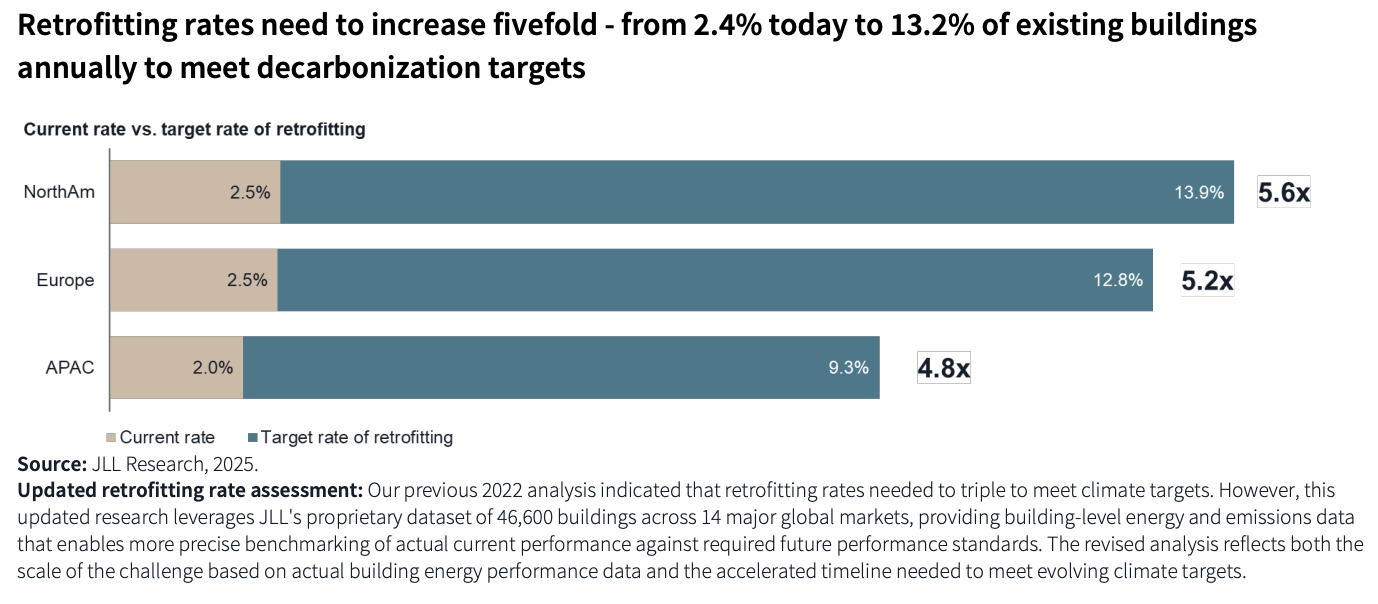

The answer to unlocking long-term value lies in retrofitting – and the rate needs to increase fivefold from 2.4% today to 13.2% annually to meet decarbonization targets. Buildings are real assets and just like any physical infrastructure, they require maintenance and regeneration to remain relevant.

Low interest rates and high liquidity lulled many owners into a false sense of security, reducing capital programmes to maximize short term returns. Now, the time is right to return to retrofit fundamentals based around energy-smart strategies, technology integration, employee experience and climate resilience.

However, it is not a one-size-fits-all approach. Understanding the differences in value-add drivers between sectors is key to implementing the right strategy to successfully future-proof and deliver long-term financial benefits.

Power-intensive sectors like logistics, data centres and advanced manufacturing facilities are most impacted by energy market dynamics. In contrast, demand for low-carbon leases is particularly strong in the office market where a high number of corporate tenants with net-zero pledges is transforming leasing choices and creating a more pronounced gap between top-tier and underperforming properties.

Future-forward thinking on energy

Solutions to growing global energy supply challenges must be central to strategies to retrofit tomorrow’s buildings. For example, smart buildings can be decentralized, distributed energy hubs rather than passive consumers of energy by implementing on-site energy generation and battery storage.

By working collaboratively with utility grids, they can also better manage peak demand energy use, improve operational resilience, support grid stability and accelerate the transition to a low-carbon economy.

The convergence of ever-increasing tenant demand for low-carbon space, volatile energy costs and tightening regulations has created a perfect storm of opportunity. With so much potentially obsolete stock sitting in high-value markets, the race is on to capture what may be the most significant value-add opportunity commercial real estate has seen in decades.

The proof points are undeniable: 32% above-average rents at One Madison Avenue in New York, 30% premium at One Post Office Square in Boston for buildings that have invested in low-carbon transformations. These aren't outliers – they're harbingers of a new reality where sustainability isn't just an environmental imperative, it's a way to generate significant financial returns.

The window of peak opportunity is closing. Entrepreneurial leaders who realize that sustainability is now a key part of best-in-class buildings are already mobilizing capital toward real estate retrofits, while others watch from the sidelines. And the value gap between buildings that make the grade and those that don’t is only going to get bigger.

What is the World Economic Forum doing to promote sustainable urban development?

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Sustainable Development

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Built Environment and InfrastructureSee all

Fabienne Robert

February 18, 2026