Mind the adaptation gap: Despite rising climate costs, few companies have adaptation plans

Climate change could cost companies $1.2 trillion annually by the 2050s. Image: Kaylar Photo/Unsplash

- S&P Global research shows climate change could cost companies $1.2 trillion annually by the 2050s without adaptation.

- Only 35% of companies, however, have context-specific climate adaptation plans.

- Sectors lagging face mounting risks, while adaptation solutions present both urgent needs and major investment opportunities.

Governments, businesses and civil society are poised to convene in New York City this September for the United Nations General Assembly, the World Economic Forum’s Sustainable Development Impact Meetings and Climate Week NYC. Together, these events provide an opportunity to spotlight the rising costs resulting from climate change. Research by S&P Global finds that these costs, already measured in the billions of dollars annually, are projected to rise over time, even under a climate change scenario in which strong global action is taken to lower emissions (SSP2-4.5).

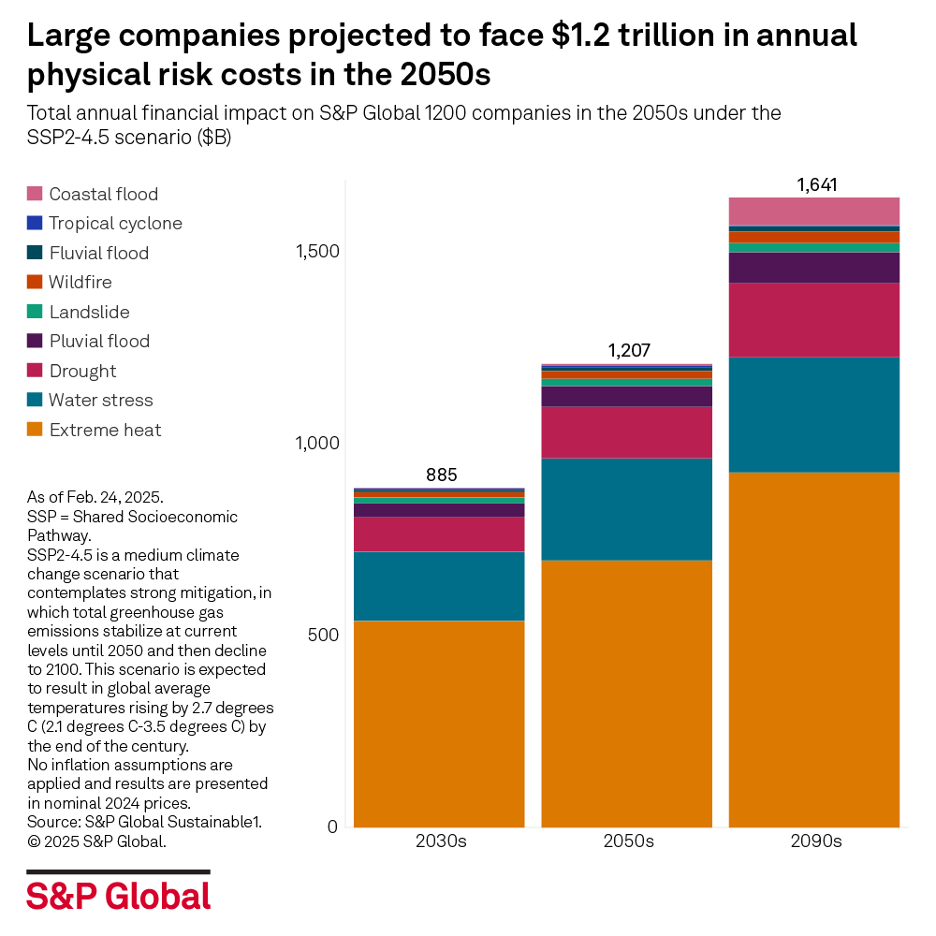

Without adaptation, the annual financial impact of climate physical risk is projected to total $1.2 trillion by the 2050s for major companies globally (as represented by the constituents of the S&P Global 1200 index). Extreme heat and water stress are projected to cause most of this impact. The utilities, financials and energy sectors face the largest costs through the 2050s. These numbers use projections from the S&P Global Sustainable1 Physical Risk dataset.

What companies are saying about their climate commitments

At S&P Global, we hear consistently from clients and market participants that climate change remains a priority — even as policy and market dynamics shift in some parts of the world. This was evident in the momentum at London Climate Action Week, which more than doubled in size from 2024, drawing more than 45,000 attendees across more than 700 events, according to Reuters.

Dozens of S&P Global interviews conducted with business leaders for the All Things Sustainable podcast in summer 2025 also highlight the corporate world’s continued focus on prioritizing climate action. For example, the group chief sustainability officer at Singapore’s biggest bank said that customers increasingly see climate as a “business imperative.”

In an interview for the same podcast, the executive director of UN Global Compact Ukraine affirmed that Ukrainian companies continue to embrace sustainability topics like climate, even amid the ongoing war with Russia.

In Latin America, several participant companies in the UN Global Compact Mexico are taking steps to advance their sustainability efforts and adapt to the physical impacts of climate change. As one executive at a Mexico-based company explained it, "Nobody is really giving up because the cost of inaction is much higher than that of the transformation."

One of Southeast Asia’s largest pension funds is even “doubling down” on climate and sustainability. “Climate disasters are more frequent, more severe and affecting every corner of business and society,” the fund’s head of corporate sustainability told us. “There is a real need to move beyond climate mitigation towards climate adaptation.”

Mind the adaptation gap

Without adaptation measures, climate change poses big potential costs to corporate assets and companies around the world are paying attention to these risks. However, S&P Global data suggests there is a gap between the reality of climate physical risk and corporate action to prepare for it, as many large companies globally have yet to create climate adaptation plans to build resilience to these hazards.

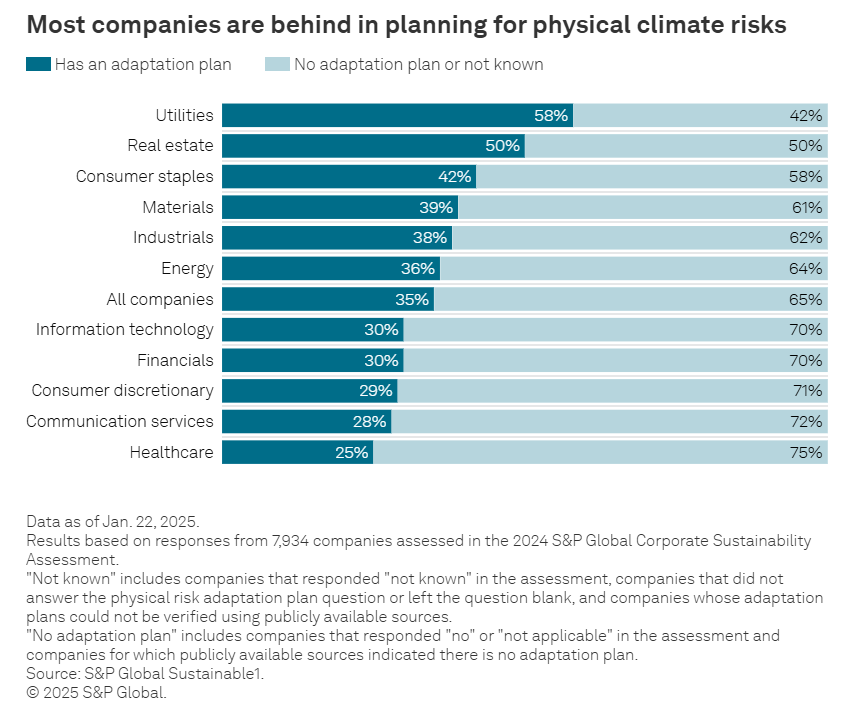

Only 35% of companies have a climate physical risk adaptation plan, according to data collected in the 2024 S&P Global Corporate Sustainability Assessment. The Corporate Sustainability Assessment asks companies whether they have a context-specific adaptation plan, which describes how the company will adapt to risks based on the location, vulnerabilities and other attributes that are specific to its operations. A context-specific plan integrates physical and nonphysical measures aimed at reducing — to the extent possible and on a best-efforts basis — all material risks that have been identified.

Some sectors are more advanced than others. The utilities and real estate sectors disclosed the highest rates of physical risk adaptation planning at 58% and 50%, respectively. Both sectors are heavily reliant on physical infrastructure, which will increasingly be at risk of damage and disruption from storms, flooding and other climate hazards, absent adaptation.

Five sectors are behind on adaptation planning compared with the cross-sector average of 35%, including the information technology and financial sectors, in which 30% of companies reported having an adaptation plan. Banks, insurers, asset managers and asset owners are exposed to the wider economy through lending, investing or underwriting across industries, which can expose them to the economic and physical impacts of climate change. Financial institutions also play a key role in financing the transition and facilitating the flow of the trillions of dollars needed to mitigate and adapt to climate change.

In the consumer discretionary and communication services sectors, 29% and 28% of companies, respectively, disclosed having an adaptation plan. Only 25% of healthcare companies reported having an adaptation plan. Some of these sectors have historically been less directly exposed to physical climate risks, but this could change over the coming decades, absent adaptation. Hospitals in major coastal cities may need to adapt to rising sea levels and more severe storms. Internet and cloud computing firms that rely on infrastructure such as server facilities must contend with heat waves that can interrupt operations and raise cooling costs.

Climate change also creates investment opportunities

A report that S&P Global jointly published with Singapore sovereign wealth fund GIC examined some readily available climate adaptation solutions for nonresidential real estate, such as green or cool roofs and wet or dry floodproofing. Estimated annual demand for these solutions in nonresidential real estate will reach approximately $29 billion globally through 2050 (or $726 billion in total). Coupled with strong policy support and timely deployment, these solutions could reduce the costs of climate physical risks. Wet and dry floodproofing, for example, could offset physical hazard costs by $3.55 for every $1 invested, according to the research.

Looking forward

The gap between more frequent and severe physical climate risks and many companies’ slow progress on adaptation planning presents a growing risk to the global economy. The World Economic Forum’s Global Risks Report 2025 ranked extreme weather events as the most significant global risk over the next decade, followed by other environmental risks such as biodiversity loss and ecosystem collapse, critical change to earth systems and natural resource shortages.

Investments in adaptation will need to increase to cope with the rising costs from physical climate risks such as extreme heat, flooding and drought. Alongside those investments, adaptation planning is a key tool to help companies prepare for the effects of extreme weather events on their business and the broader economy.

All Things Sustainable, a podcast from S&P Global, explores the critical sustainability topics transforming the business landscape. Listen here.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Climate Indicators

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on BusinessSee all

Maria Basso and Michael Römer

February 12, 2026