The energy trilemma: Why the rules for energy innovation differ and why that matters

Energy innovation must balance three often-conflicting goals: security, equity and sustainability Image: REUTERS/Ricardo Moraes

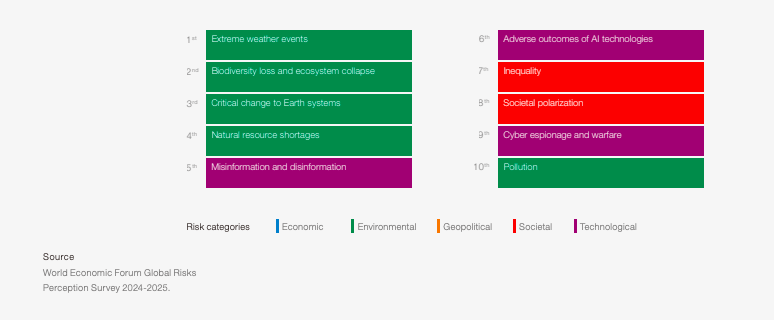

- The energy trilemma defines the rules of innovation as any reform must balance three often-conflicting goals: security, equity and sustainability, making energy innovation uniquely complex.

- Innovation is shaped by systemic and political constraints, which can impact the viability of innovation projects, making governments and policy-makers essential partners.

- Because energy underpins economies and security, even small failures can cause cascading disruptions, making the sector highly risk-averse and delaying technology adoption.

Energy is the backbone of economic growth and development and energy innovation has always played a key role in the progress of society and industry. Yet, unlike other sectors, innovation in the energy ecosystem carries a unique complexity that requires its own set of rules and approach.

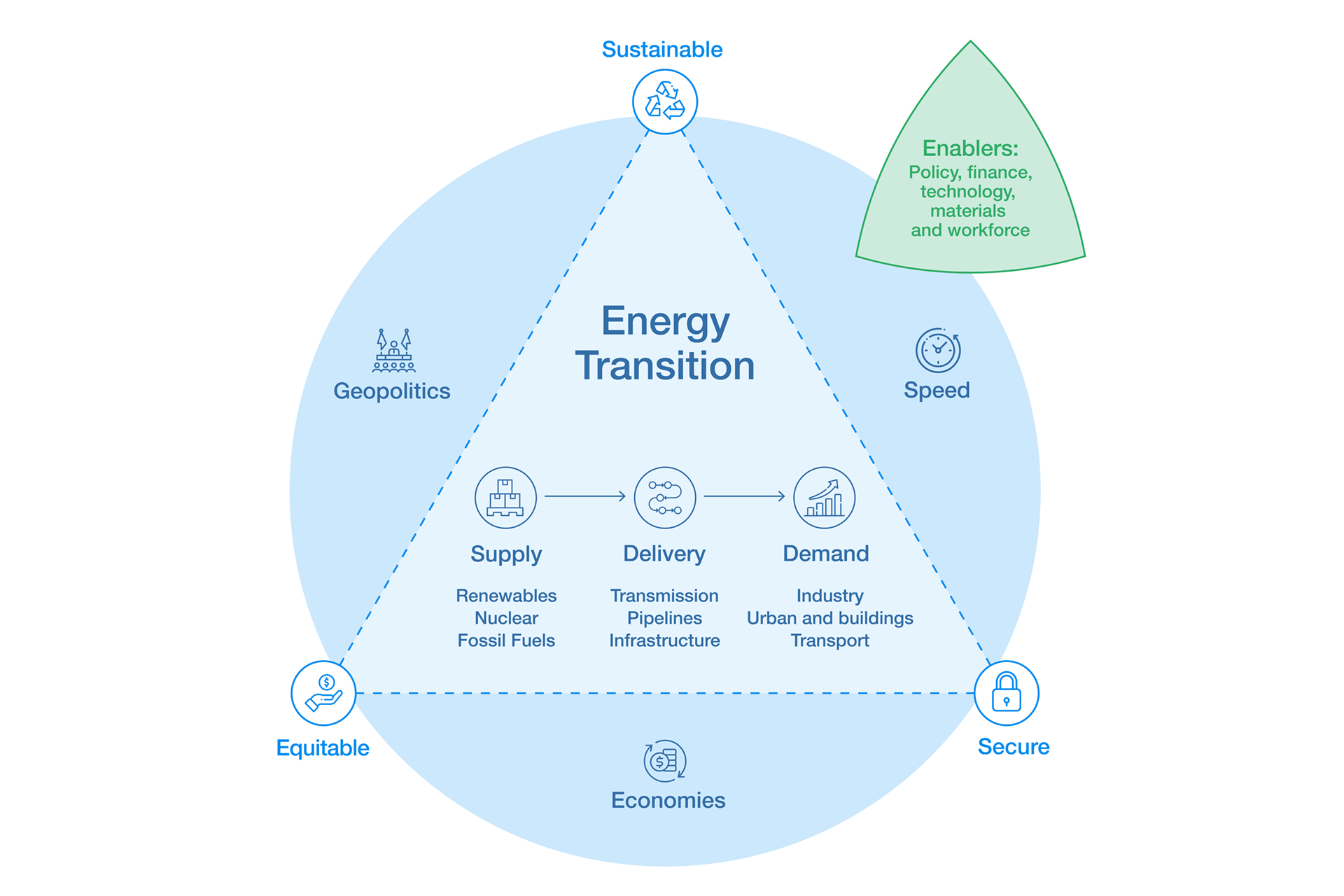

One fundamental rule is the “energy trilemma,” which requires balancing energy security (including supply chain security and resilience), equity (universal and fair access) and environmental sustainability (fighting climate change).

Balancing these three goals, which often conflict, needs to be at the centre of the energy sector’s innovation process.

At the same time, energy innovation cannot succeed in isolation. The World Economic Forum’s Global Future Council on Energy Technology Frontiers is currently exploring which stakeholder groups and domains are essential for building a supportive innovation ecosystem, underscoring that only broad collaboration can overcome the sector’s challenges.

At the heart of this complexity are three interrelated factors:

- Physical ecosystem dependencies

- Political, geopolitical and regulatory challenges

- High-risk potential with extreme risk aversion

These must all be understood and addressed for innovation to succeed.

1. Physical ecosystem dependencies

The energy sector is not just a sector but rather a physical ecosystem comprising numerous assets and stakeholders that interact with each other and often have conflicting interests, which complicate decision-making.

At its core value chain, there are three relevant functions:

- Energy supply (production or extraction)

- Energy delivery (transportation, transmission and distribution)

- Energy demand (industry, urban, transport)

Unlike other industries, these functions share a tightly connected infrastructure that has evolved over decades.

This infrastructure combines new digital technologies with legacy systems that cannot be easily replaced or upgraded. Large capital-intensive investments underpin it, meaning the introduction of any new technology must account for system-wide dependencies and implications.

Energy innovation, therefore, requires multidisciplinary teams with a deep understanding of both technical challenges and ecosystem interconnections.

2. Political, geopolitical and regulatory challenges

The energy sector is heavily regulated in individual countries and influenced by supranational decisions, such as the Paris Agreement or the European Green Deal. Unlike finance or pharma, governments are not just regulators but active participants in energy decision-making.

Innovation efforts face numerous challenges.

Each country has its own energy policy that can tilt the balance towards one of the energy trilemma’s goals, offering financial support and creating adequate conditions for one or another type of energy or technology to thrive.

However, governments change and the rules can also change, creating uncertainty for investors and endangering the viability or profitability of long-term investments.

In addition, regulation in the energy sector not only addresses sustainability and reliability but also establishes strict market rules impacting prices. As energy prices are a key component of a country’s economy, potential energy price intervention and changes in market rules may severely affect the return on investments.

The energy transmission and distribution functions are often owned by governments and licensed to private companies under strict rules and complex regulatory financing processes that require approval for any new project and may limit investments.

Even in the often more liberalized generation or extraction business, investments must obtain permits and undergo lengthy approval processes that sometimes take decades and are susceptible to political interests and corruption.

Finally, as we have seen in recent geopolitical conflicts, global energy trades are susceptible to political tensions and international conflicts, which can lead to significant supply chain disruptions and sudden changes in energy policy and market prices.

For these reasons, energy innovators must work hand-in-hand with regulators and policy-makers, while also preparing mitigation strategies for shifting political and regulatory risks.

3. High-risk potential with extreme risk aversion

Energy has a critical role in a country’s normal functioning and development. It powers industries, transportation, communication systems and households and supports national security and emergency services.

Due to the physical interdependencies, an incident in an individual energy asset may have a cascading effect on the entire system, inducing a massive blackout and potentially provoking severe environmental damage, as well as threatening human lives.

There is no appetite for operational risks in this sector; this is consequently reflected in most regulations and is certainly a barrier to innovation. In fact, the energy sector has traditionally been a late adopter of new technologies.

As well as the usual financial, legal, technical and market risks inherent in any innovation project, energy innovation projects are subject to significant political, geopolitical and regulatory risks, as discussed earlier, as well as complex operational risks that are challenging to manage.

For instance, energy assets are increasingly exposed to more frequent extreme weather events and are sensitive to changes in magnetic fields, making these risks difficult to predict and manage.

Additionally, with the introduction of new digital technologies in the energy ecosystem, cybersecurity risks have become a key challenge, particularly given the need to coexist with legacy systems that are difficult to protect.

Moreover, due to the high potential to harm, the energy system is the focus of numerous malicious threat actors, including terrorists and hostile nation-states.

Energy innovation projects have a high risk potential and face extreme risk aversion; they must have at their core a strong risk management framework that enables them to address and demonstrate their ability to handle this complex risk landscape.

All these factors, while barriers, also highlight why innovation is so necessary. New solutions are needed to manage risks, navigate the energy trilemma and modernize the system. However, success depends on creating a tailored energy innovation ecosystem that recognizes these unique complexities and operates under its own set of rules.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Energy Transition

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Energy TransitionSee all

Namit Agarwal

February 25, 2026