Industrial demand management: A hidden lever for a resilient and competitive energy system

Does industrial electricity demand require a new management approach? Image: Photo by Nikola Johnny Mirkovic on Unsplash

Jessika E. Trancik

Professor, Institute for Data, Systems, and Society, Massachusetts Institute of Technology (MIT)Christine Gschwendtner

Lecturer, Smart and Sustainable Urban Futures, University College London (UCL)- Industrial demand flexibility can significantly reduce grid storage requirements, while turning energy consumption into a source of revenue.

- Scaled participation depends on structured, predictable programmes that align with operational constraints and planning cycles.

- Governments and corporates that embed flexibility into long-term strategies can lower energy costs, enhance resilience and strengthen decarbonization economics.

As electricity demand surges and infrastructure expansion strains under regulatory, physical and financial constraints, an often-overlooked asset is emerging as central to the future of resilient, cost-effective energy systems. If properly valued and integrated, industrial demand flexibility offers a structural alternative to infrastructure overbuild, enabling companies to transform energy consumption from a passively managed input into a strategic, monetizable resource. As markets once restructured to accommodate renewables, they are now moving towards mechanisms that allow industrials to monetize flexibility in ways that preserve operational continuity and unlock new revenue streams.

Supply is no longer sovereign

As electricity demand accelerates globally, pressure is mounting on energy systems to scale reliably and affordably. The conventional approach of meeting load growth solely through additional generation capacity is fast becoming inefficient. In the United States, the Federal Energy Regulatory Commission (FERC) forecasts a 128 GW increase in peak demand by 2029, largely from industrial users and data centres. This increase far exceeds the sub-1% annual load growth seen in previous decades. Similar dynamics are unfolding across advanced economies, where electricity demand is rising while grid expansion is increasingly constrained by land use, permitting hurdles, labour shortages and capital intensity.

While over $4.5 trillion in annual investments are projected to be required to expand global grid infrastructure and integrate renewables by 2030, these investments are colliding with physical and institutional bottlenecks among others. Solely relying on supply-side interventions can delay progress and undermine affordability and reliability in the near term. A potentially more expedient and effective alternative lies on also drawing from the demand side, specifically within the industrial sector.

Industrial demand flexibility can provide dynamic load-shaping that can support renewable integration at scale. It can reduce system strain during peak periods, minimize curtailment and displace expensive grid-scale storage. In doing so, it realigns electricity use with market conditions and renewables output, with the potential of reducing the need for additional physical infrastructure and preserving natural capital.

A data-backed case for action

A joint study between MIT and Accenture, focused on a cluster of seven industrial facilities in the Iberian Peninsula, has begun to quantify the value of demand flexibility in real-world settings. Drawing on two decades of electricity consumption and renewable generation data, paired with system cost modelling and over 40 hours of interviews, the study assessed the operational, economic and regulatory levers required to activate flexibility at scale.

Initial findings from Phase 1 of the study indicate that better integrating industrial flexibility into electricity markets can fundamentally shift the role of energy use, from a binding operational cost to a dynamic source of value. By participating in demand flexibility schemes, industrials can earn revenue by adjusting electricity consumption in response to price signals and grid needs, selling flexibility in energy and capacity markets.

How the Forum helps leaders navigate the transition of energy and materials systems

Rewriting the rules of engagement

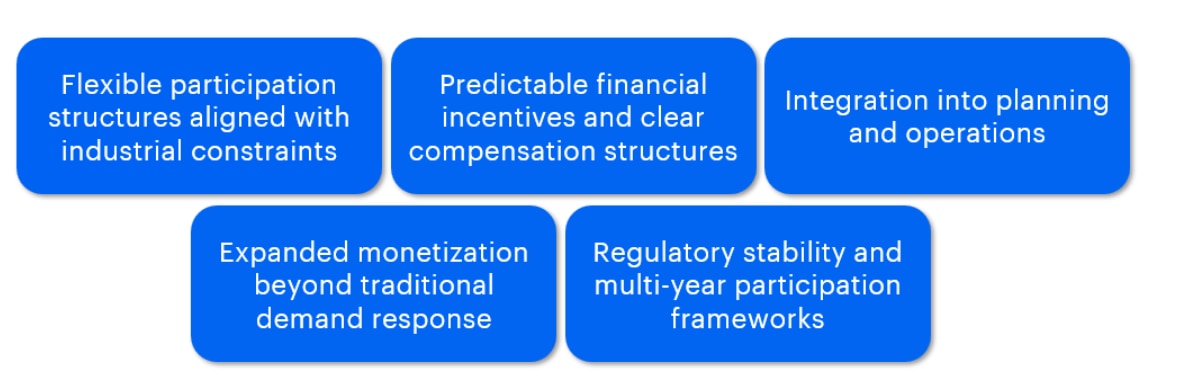

Industrial demand response has long been treated as a last-resort emergency measure, limiting participation and positioning flexibility as a disruption, rather than a value stream. While some legacy programmes exist, the next generation offers the potential for greater compensation, more advanced prediction capabilities and overall designs that align with the planning rigour required by energy-intensive industries. To embed flexibility as a viable market mechanism, five structural shifts are recommended:

1. Flexible participation structures aligned with industrial constraints

Programmes should move beyond binary curtailment to allow partial, tiered or performance-based engagement. Facilities with modular production lines or batch operations, for instance, can provide flexibility without compromising planned throughput or contractual obligations.

2. Predictable financial incentives and clear compensation structures

Programmes should provide clear capacity targets, transparent pricing mechanisms and facility-specific modelling tools for cost and value estimation. Without these tools, there may be a disconnect between market design and real economic contribution and the potential of flexibility might systemically be undervalued.

3. Integration into planning and operations

Participants can embed flexibility into operational cycles – considering downtime, maintenance windows and adjustable industrial processes – to enable participation without disruption. Programmes should offer activation notices, ranging from real-time to day-ahead, with annual minimum participation thresholds to encourage advanced commitments.

4. Expanded monetization beyond traditional demand response

Flexibility’s value extends beyond balancing supply and demand. Industrial participants should be enabled to access capacity markets, ancillary services and emissions-reduction incentives, allowing participants to capture the full value of flexibility.

5. Regulatory stability and multi-year participation frameworks

Long-term, stable incentive structures are essential to unlocking industrial demand flexibility at scale as industrials operate on long investment cycles. Contracts should offer fixed incentive rates and allow consortia of industrials — such as regional clusters — to participate collectively.

From compliance cost to competitive advantage

The paradigm of treating energy as a binding operating cost is evolving. As energy markets become more dynamic, the ability to modulate consumption in line with system needs becomes a source of competitive advantage. For utilities, industrial flexibility presents a scalable alternative to infrastructure overbuild and peak-time pricing volatility. For system operators, it can enhance reliability and potentially improve load forecasting and reduce reliance on emergency interventions. For industrials, it can create entirely new value pools, while reinforcing cost control.

Digital platforms utilizing AI can further accelerate this shift, enabling real-time optimization, better forecasting and seamless integration of flexibility into complex production environments.

Countries and companies that lead in embedding industrial flexibility into market design can reduce the cost of decarbonization while also supporting energy innovation. The opportunity is no longer in piloting demand-side participation, but rather in determining and building optimal systems for scaled participation in markets valuing demand flexibility.

Accenture is a Knowledge Partner of the Future of Power Systems initiative and a collaborator in advancing work on demand flexibility, as well as the forthcoming Innovation Playbook for Future Power Systems. The Playbook will be launched at the 2026 Annual Meeting in Davos, showcasing practical, scalable solutions driving the transformation of global power systems. The Trancik Lab at MIT evaluates new technologies and engineered systems for next-generation energy systems.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Energy Transition

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Energy TransitionSee all

Abhinav Jindal and Sandeep Pai

February 18, 2026