Employers and employees disagree on retirement readiness. What does it mean for our financial futures?

Nearly two-thirds of US retirees say their money will need to last longer than anticipated. Image: Unsplash/James Hose Jr

- A new survey reveals a disparity in confidence on retirement savings between employers and workplace savers in the US.

- As average lifespan increases, many retirees believe employers should step in to provide more comprehensive retirement-income provisions.

- Financial institutions, policy-makers and employers must collaborate to empower savers to secure their financial futures.

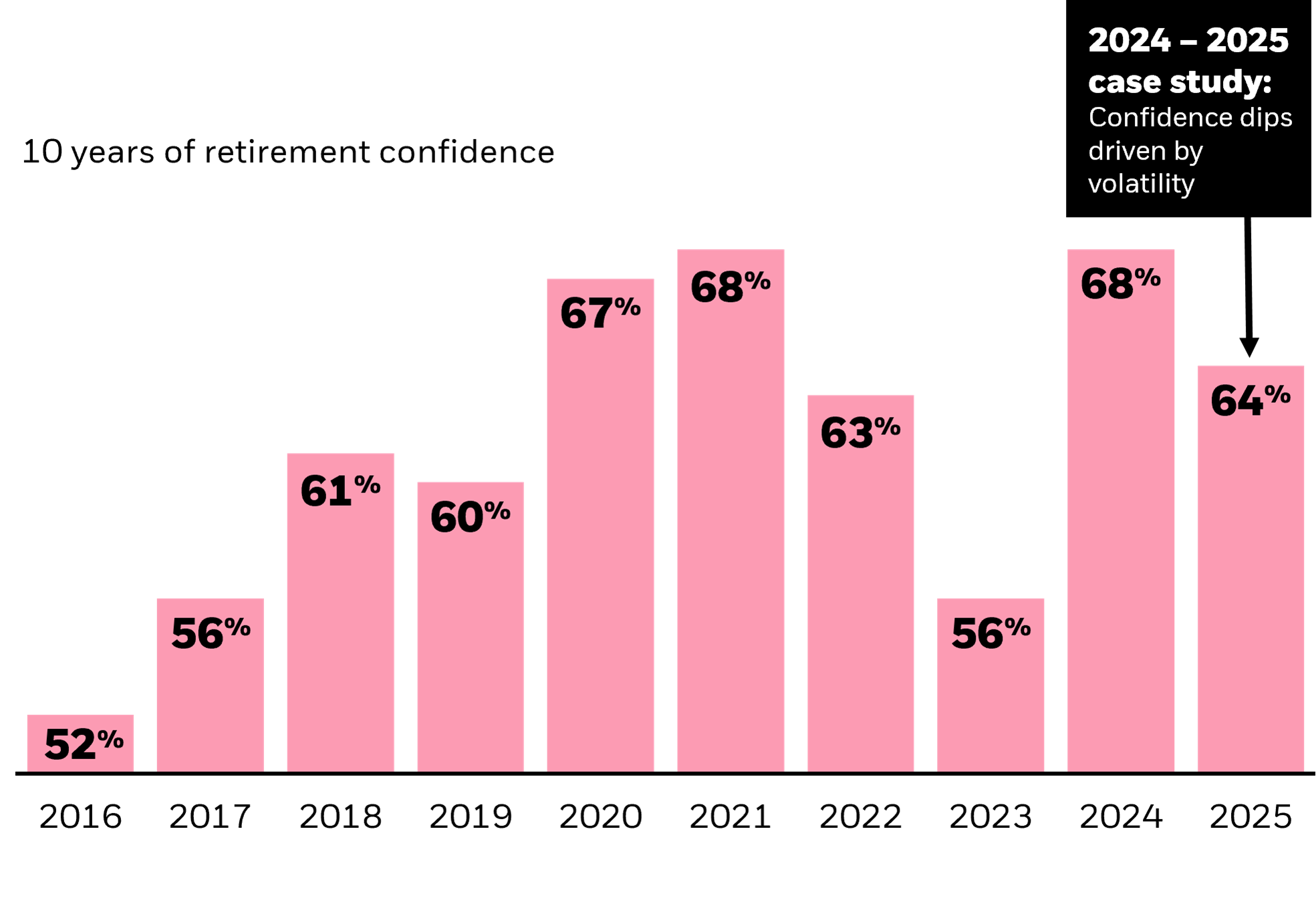

The US retirement market is making great strides: Retirement confidence is up 23% over the last decade, according to new research. Policy changes have played a significant role, helping pave the road for features like auto-enrollment and target date funds. And they continue to, with new legislation that has allowed innovation in guaranteed income solutions. These are among the findings from BlackRock’s annual Read on Retirement survey, now hitting its 10th year.

But one trend was telling: the significant confidence gap between workplace savers and employers. While 64% of savers feel on track with their retirement savings, just 38% of employers believe most of their employees are on track – a record low. Employers, we believe, can see the fuller financial picture a little clearer.

Retirees are reinforcing this caution. We surveyed them, too, and they revealed their retirements may be lacking some of the lustre they’d expect as income concerns prevail, especially as we are living longer lives. But this information is an opportunity to turn lessons learned into more retirement security for future generations.

Guarantees for golden years

We’ve probably all seen the stats: More than 11,000 Americans are turning 65 every day, and many of today’s 20-year-olds can expect to live to 100.

The need for more income certainty in retirement has never been clearer. There’s a tremendous focus on lifespans that are increasing thanks to medical advancements and wellness initiatives. “That's an incredible blessing,” BlackRock Chairman and CEO Larry Fink wrote in his most recent letter to shareholders. “But it also underscores something frustrating: We're great at extending people's lives, yet we hardly spend any effort helping them afford those extra years.”

64% of retirees say their money will need to last longer than anticipated – up from 52% last year and 46% in 2020. Meanwhile, the number of retirees worried about maintaining steady monthly income is on the rise – 28% this year, up from 16% in 2020.

Retirees see a solution: employers. 79% of retirees believe employers should help savers get through retirement, not simply reach it (up from 68% in 2020), and 91% believe employers should provide secure income options in their retirement plans. And those options are growing, with innovative target date strategies built into workplace plans that give participants the choice to annuitize when they retire. These are not your grandmother’s annuities.

Support for savers

“How much can I spend each year in retirement?” That’s the top question savers have for their employers. And the earlier they have an answer the better: “Well before retirement” is when they want to receive education on retirement income.

A key culprit for this spending uncertainty is market volatility. We’ve seen over the last decade that when markets waver, so does saver confidence. Nearly two-thirds (66%) worry they’ll run out of money in retirement – a 10% increase from last year – and indicate they’ll be too afraid to spend in retirement: One in five strongly agree that they plan to live off interest and dividends alone, while preserving their savings balance – even if it means cutting back. That’s up from just 7% in 2018.

Gen X, the next cohort to start retiring, is especially feeling the pressure. Just 54% say they are on track, the least of any generation, and their future well-being outlook has dropped.

Where do we go from here?

Now, we need to keep innovating on and advocating for solutions that address this demographic transformation:

- Savers want to be active participants in their own financial journey: 81% want to receive specific education around the investment options available to them. Let’s empower individuals with the resources they need to manage their own financial security – and go a step further by offering plan options like 401(k)s that include a choice to receive guaranteed income, all in service of helping savers invest better to retire better.

- Savings rates have decreased to 10% this year from 12% just a few years ago, and we see reasons why: 77% carry debt, mainly credit cards and mortgages, and more than half are now willing to take money from their retirement plan in an emergency – up from 33% in 2020. Let’s strengthen the financial wellness behaviours and resources that allow participants to save for both the short and long term, including plan enrollment “auto” features and emergency savings programmes. If workers can afford today, they’re in a better position to afford retirement, whether it’s tomorrow or 20 years from now.

How the Forum helps leaders understand change in global financial systems

Living longer is a remarkable achievement. But many cannot fund those extra years. It’s the work of financial institutions, employers and policy-makers to help give future generations the same level of retirement security that previous generations have had – and it starts with income.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Longevity Economy

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Financial and Monetary SystemsSee all

Rebecca Geldard and Spencer Feingold

February 23, 2026