From São Paulo to Davos: What needs to happen in climate finance

Scaling climate finance to meet global goals is not just an environmental imperative; it is an economic one. Image: Edson Junior/Unsplash

- COP30 has been hailed as an 'implementation COP', but a question remains about mobilizing capital for climate-aligned growth projects.

- As highlighted in São Paulo, Brazil, scaling climate finance to meet global goals is not just an environmental imperative, it is an economic one.

- Now is the time for governments, financial institutions and private investors to move from ambition to capital flows for climate action.

COP30's activities have stretched across Brazil – from Rio de Janeiro to São Paulo and ultimately to Belém. While the formal negotiations unfolded in Belém, São Paulo quickly became the gathering point for business and finance leaders.

The question around mobilizing capital for climate-aligned projects remained central to conversations at the UN Principles for Responsible Investment (PRI) conference, held from 4 to 6 November.

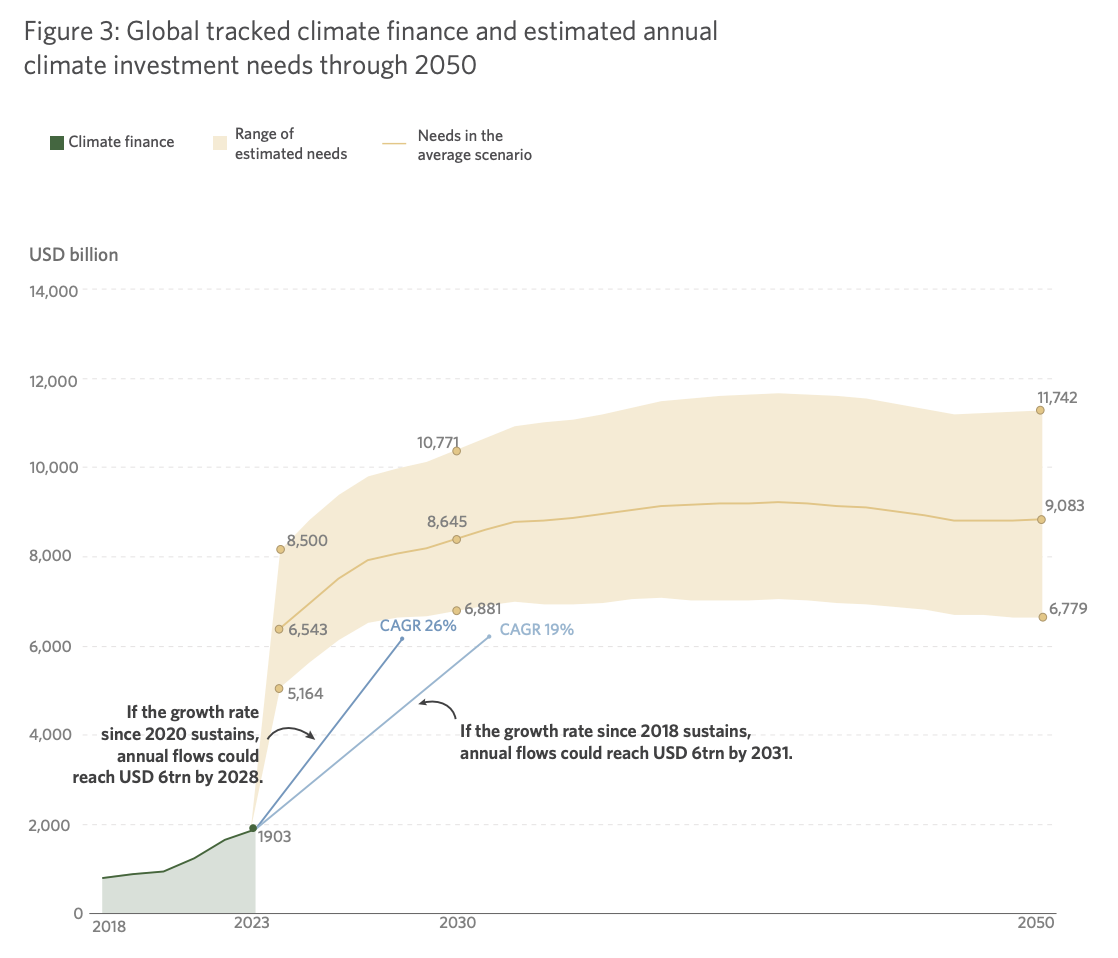

According to figures from the Climate Finance Initiative, global climate finance has more than doubled over the past six years but capital flows must accelerate to close the investment gap, particularly in emerging markets and developing economies.

The message at the UN conference was clear: The tools exist and the appetite for action is high. What is needed now is coordinated implementation – a concerted effort between governments, multilateral financial institutions and private investors to move from ambition to capital flows.

Here is what must happen to see capital flowing.

Development finance and climate finance must be on par

Climate finance is not only a development issue but a global financial risk. While development and climate finance were once treated as separate agendas, both face the same structural challenge: fragmentation. The systems that underpin them are dispersed across multiple funds, facilities and institutions that operate with overlapping goals but different procedures and timelines.

This lack of coherence slows delivery and increases costs, placing the heaviest burden on countries most in need of support. Each new declaration or coalition generates momentum but often without the institutional pathways needed for delivery. The outcome is that even well-intentioned initiatives compete for attention and capacity, while opportunities to align and scale remain underused.

The discussions at Principles for Responsible Investment (UN PRI), a global organization set up with the United Nations, reflected a growing recognition that progress depends on aligning these parallel systems within a coherent architecture, and a shared understanding that real progress will come not from new funding channels but from making existing ones work together.

Real alignment depends on clarity – about who leads, who enables and how different institutions work together. Once that is clear, the focus should shift to building efforts that operate as ecosystems rather than isolated initiatives.

Clarifying who does what and when on climate finance

Much of the global dialogue on climate finance has been about identifying barriers and challenges. The language of “who should do more” has often taken precedence over “who can do what”. Rather than expanding the list of needs, the focus must now be on leveraging and aligning capabilities.

The category of private investors is often used as a single term, but it covers a wide spectrum of actors with very different mandates, incentives and risk appetites. Pension funds seek stable, long-term returns. Commercial banks rely on predictable policy frameworks. Venture capital looks for innovation and growth. Insurers can act as both financiers and risk managers. Recognizing these distinctions is essential to designing solutions that work.

Insurance provides one of the clearest examples: Across multiple discussions this year, insurance has been identified as a critical lever for unlocking private capital. Yet its potential remains underused.

Many stakeholders continue to call for insurers to play a stronger role in de-risking investments, but insurers are rarely integrated early enough in project development to do so effectively. At UN PRI, several speakers highlighted that insurance is often brought in once financing structures are already set.

Yet involving insurers early in the project design process would enable them to apply their risk expertise from the start, improving how projects are structured and ultimately making them more investable. By understanding capabilities and coordinating at the right project stage, stakeholders can build an environment that enhances engagement and makes risk-sharing more effective.

The priority now is to define those roles with precision and to create mechanisms that connect them in practice. The pathway forward is clear: build an ecosystem that enables every actor to do what they do best, at the right time.

Standardize what works to get capital flowing

The next step toward increased capital flows is standardization. Progress will depend less on new mechanisms and more on applying what already works, consistently and at scale. Standardization makes replication possible – it enables successful models to be adapted across markets, institutions and regions.

Achieving that level of standardization requires transparency and comparability. Investors can only replicate and scale what they can measure and benchmark. Reliable, accessible data and shared templates for contracts, due diligence, and credit assessments reduce transaction costs and create confidence in outcomes. Together, these elements provide the foundation for turning individual projects into replicable portfolios that attract institutional investment.

Participants at UN PRI pointed to emerging platforms such as the GAIA project by the Green Climate Fund that provides long-term loans for mitigation and adaptation projects in 19 climate-vulnerable countries and serves as a replicable model for future investment platforms.

Scaling climate finance talks from COP30 to Davos

The priority now is to strengthen standardization across institutions and scale what works, turning proven approaches into the norm rather than the exception.

The upcoming World Economic Forum Annual Meeting in Davos, Switzerland, will be the first major global public-private forum after COP30, and will provide a further platform to strengthen collaboration on climate finance among governments, businesses and civil society.

From the Amazon in Brazil to the Alps of Switzerland, the message is the same. Scaling climate finance is not just an environmental imperative, it is an economic one. The next frontier is to make it flow at the speed and scale the planet demands.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Development Finance

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Climate Action and Waste Reduction See all

Paul Mottram

February 20, 2026