Opinion

Knowing when consumers are online is as important as knowing who they are - here's why

Nearly half of the world’s daily spending happens in just three time zones. Image: Unsplash/Luis Cortes

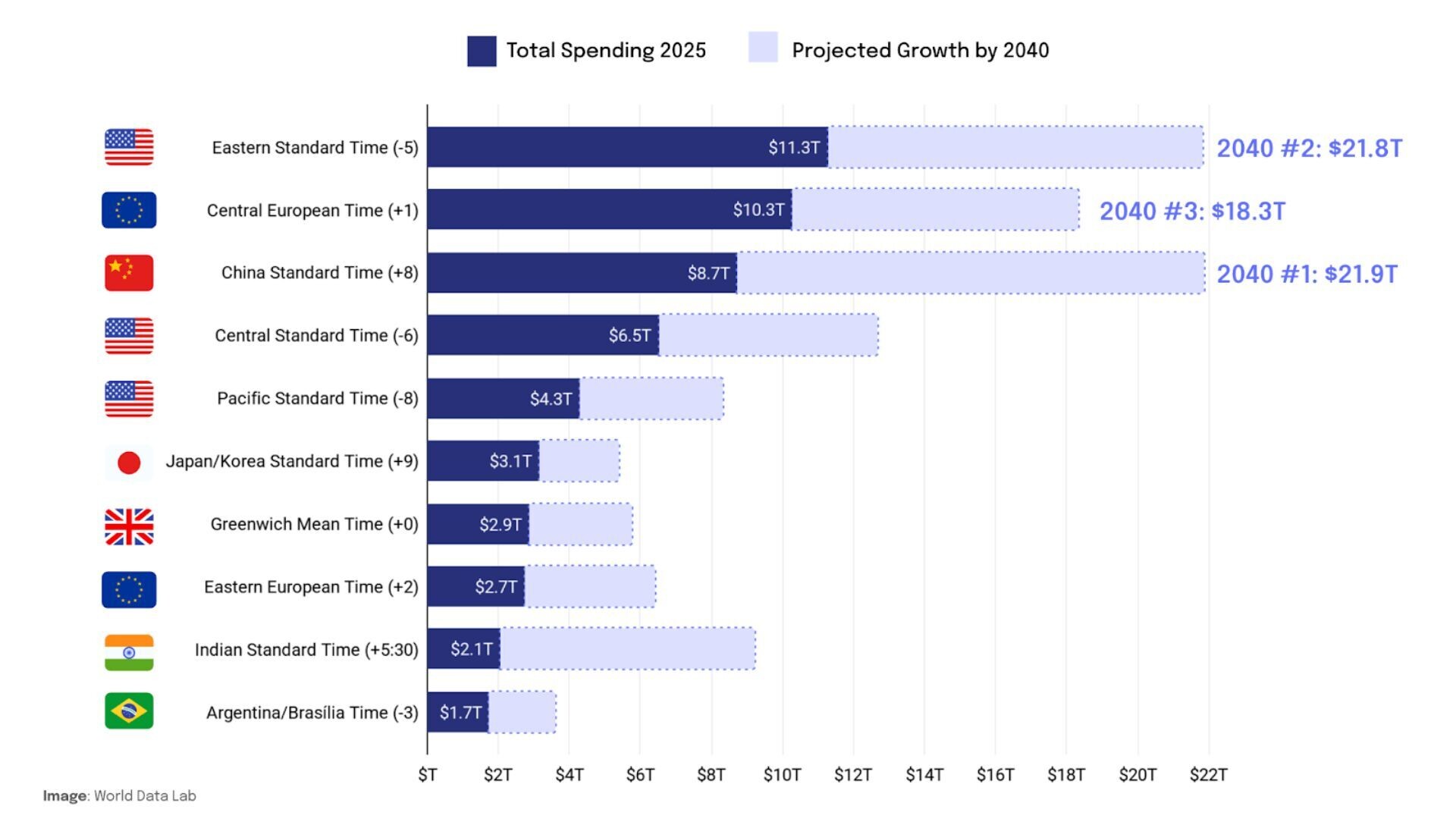

- Nearly half of the world’s daily spending happens in just three time zones; six zones account for almost three-quarters of global consumption. Economic activity peaks when major markets overlap.

- By 2040, China, India and Southeast Asia will add over a billion consumers and trillions in new spending, placing Asia at the centre of global demand and making China Standard Time the world’s largest consumer zone.

- When $7 billion moves every hour, knowing when consumers are online is as important as knowing who they are.

As dawn breaks over the Pacific, a handful of island economies stir. Then, economic superpowers start waking up. Japan, South Korea, China and the countries of the Association of Southeast Asian Nations (ASEAN) come online.

Eventually, the lights come on in Europe and then in America. By the time New York closes for the day, so does the bulk of humanity’s daily economy.

One way to think about economic activity is in terms of money spent. People spend most of it – around 60% – through consumption, while 40% is invested or paid in taxes.

Our lens here is on consumption, projected to reach $65 trillion by 2025, equivalent to $168 billion per day and averaging $7 billion per hour, according to World Data Lab's analysis. That spending is primarily on housing, food and beverages, transportation, healthcare and education.

Those who can afford it, the middle class and the rich, also spend on beauty services, entertainment, travel and dining out.

Further World Data Lab anaysis finds that each day’s spending is concentrated in very few time zones. Currently, the top three time zones – Eastern Standard Time, Central European Time and China Standard Time (which also covers most of ASEAN) – account for $31 trillion annually, nearly half of the global annual spending.

Add in three further time zones, Central Standard Time, Pacific Standard Time and Japan/Korea Standard Time, and you cover 72% of global consumption.

Asian time zones are expected to drive consumer growth through 2040. Today, the China Standard Time Zone accounts for about 14% of global spending, totalling $8.7 trillion. World Data Lab projects that by 2040, the China Standard Time Zone, which spans the Philippines, Malaysia and parts of Indonesia, will have the largest consumer market – after adding 260 million people to the consumer class and $13 trillion in new spending.

Indian Standard Time is expected to grow even faster by 2040, adding 639 million people and $7 trillion in spending. Eastern Standard Time (the US East Coast) will remain a top spending powerhouse, with $21.8 trillion in spending by 2040, just narrowly behind China, after adding 33 million new consumers, a fraction of Asia's population growth.

Japan/Korea Standard Time spending will rise by $2.25 trillion. The time zone UTC+3 (Coordinated Universal Time plus three hours), which covers Moscow, Arabia Standard Time and East Africa, will also break into the top 10, overtaking Brasília Time.

Why does this matter?

While much spending is local, such as grocery shopping or eating out, the digital economy is global – and operates unevenly across time zones. Timing shapes who buys, who watches and who clicks.

Not all hours – or time zones – are created equal when it comes to spending. Financial activity peaks when the world’s richest regions overlap; noon Eastern Time or 18:00 Central European Summer Time (CEST), and noon CEST or 18:00 China Time.

These windows mark moments when North America, Europe and Asia are simultaneously online, driving an immense share of global spending. For the financial sector, understanding these transaction “rush hours” is critical for infrastructure resilience, cross-border payments and forecasting digital demand.

Similarly, timing plays a crucial role in determining success in streaming, live events and advertising. A World Cup match at 21:00 in Europe may engage North American viewers but miss much of Asia, where a replay timed for 20:00 China Time could reach hundreds of millions across India and East Asia.

Companies that align with these time-zone spending windows will reach more people and the right people, at the right time.

”Advertisers face the same challenge: there’s no single global “prime time.” Eastern Standard Time leads in total spending, while China Standard Time leads in food and clothing, and Central European Time leads in alcohol and transportation.

Understanding these regional consumption rhythms is key to optimizing audience reach and maximizing engagement.

Behind these numbers lies a significant shift in how global consumers are perceived. In addition to people, timing and spending power are equally important. Increasingly, companies are asking more questions about their consumers: who they are, when they are active and what they can spend.

That’s why time-zone analysis is emerging as a powerful lens for determining where the largest markets are located, and when the most valuable consumers come online. Instead of viewing demand country by country, this approach looks at the daily rhythm of global consumption, from breakfast purchases in Tokyo to late-night streaming in New York.

This matters because the world’s consumer class – defined as those with enough disposable income to buy more than just basic needs – is growing fastest in Asia. Understanding where these consumers are and when they are most active will shape everything from live-event scheduling and ad placement to payment infrastructure and digital services design.

Companies that align with these time-zone spending windows – in digital advertising, streaming services, e-commerce and live entertainment, among others – will be able to reach the right people at the right time.

All figures from World Data Lab projections.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Economic GrowthSee all

Elizabeth Mills and Gayle Markovitz

January 30, 2026