The $5 trillion green economy is growing. Here’s how CEOs can turn opportunity into long-term growth

The green economy is projected to grow to $7 trillion by 2030 Image: Getty Images

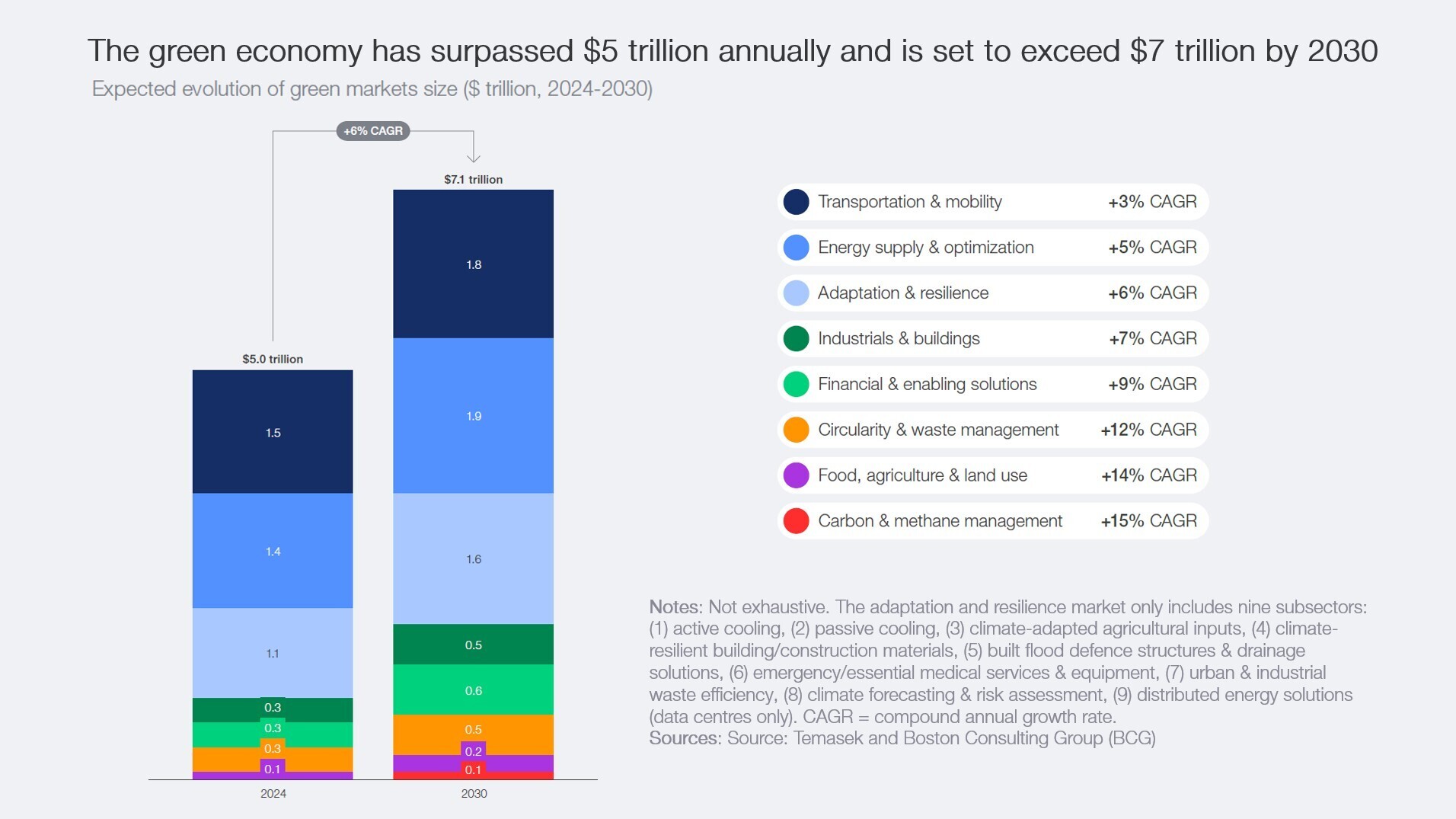

- Despite a diverging environment, the green economy is projected to grow from $5 trillion today to $7 trillion by 2030.

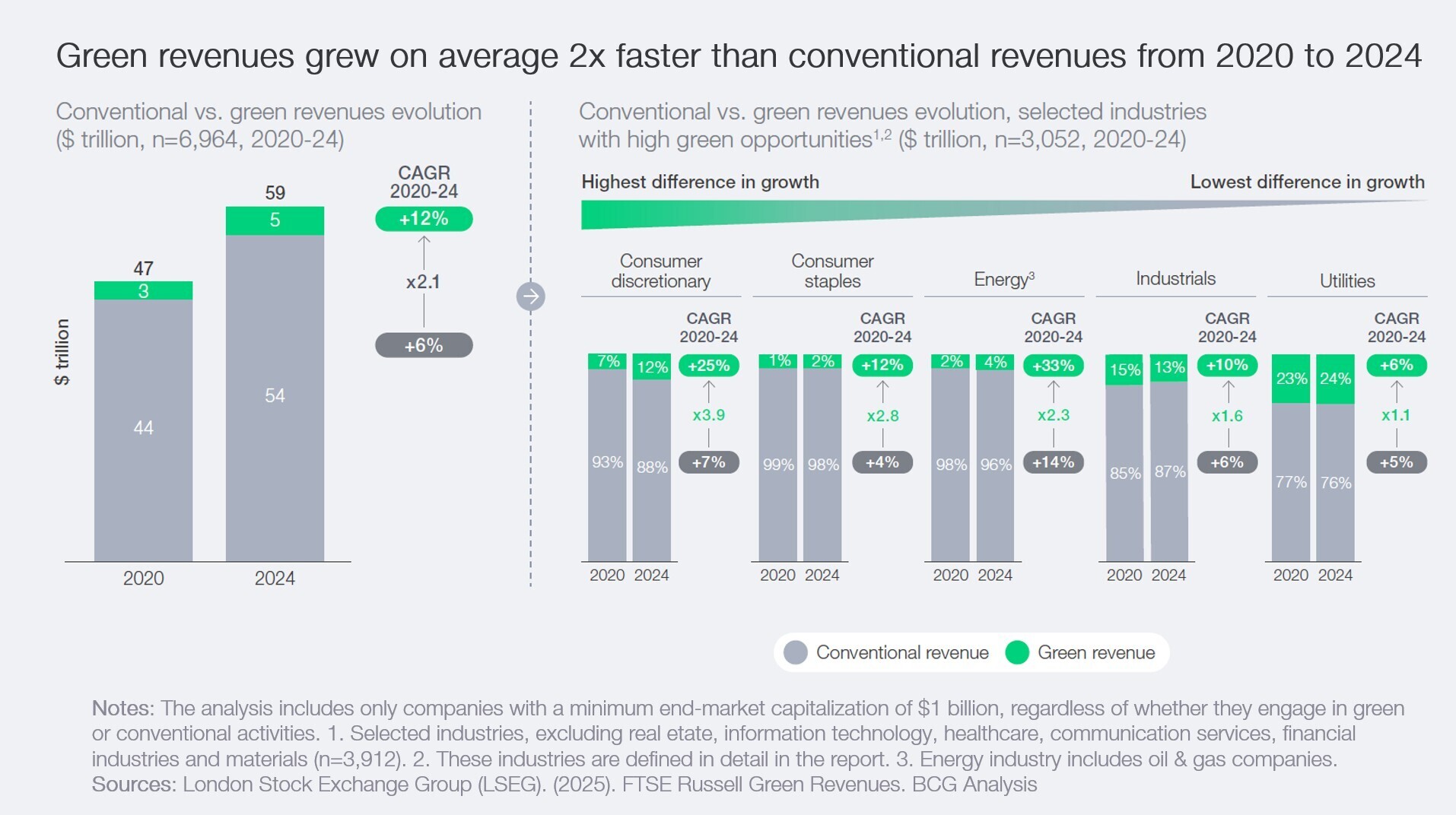

- Green revenues are growing twice as fast as conventional revenues on average, while companies involved in green markets often secure cheaper capital and typically enjoy valuation premiums.

- CEOs can apply strategies to thrive in green markets, including by pushing for cost maturity and tech efficiency, working with other stakeholders and attracting diverse sources of investment.

The global green economy is here. Once considered a niche, it has become a $5 trillion-dollar market shaping industries, innovation and investment flows worldwide. Over the last decade, it has become the world’s second-fastest-growing sector, outpaced only by technology.

While public attention has shifted amid inflation, trade disruptions and geopolitical tensions, underlying momentum has not slowed. The business case for climate and resilience investments is stronger than ever as technology costs fall and demand expands.

Still, entering and thriving in green markets requires overcoming distinctive challenges: improving technology maturity and cost efficiency of nascent solutions, navigating regulations and partnerships in new markets and securing access to capital.

The annual report from the Alliance of CEO Climate Leaders, Already a Multi-Trillion-Dollar Market: A CEO Guide to Growth in the Green Economy, in partnership with BCG, looks at green markets as a key driver of business growth and competitiveness and provides a framework for CEOs to lead in the green economy.

Here are key highlights from the report:

1. A growing multi-trillion-dollar market

The green economy is already a $5 trillion market and projected to grow 6% annually to exceed $7 trillion in value by 2030. So far, mitigation solutions to reduce emissions have driven this rapid growth, with the transport and mobility segments accounting for the largest portion at a third of total green revenue growth by 2024.

However, by 2030, innovative solutions related to carbon and methane management, agriculture and land use, and circularity and waste management will grow the fastest (over 10% annually).

Today, thanks to the explosive growth in electrification enabled by solar photovoltaics, wind power and batteries, over half of the total emissions reductions needed to decarbonize could be achieved through already cost-competitive solutions.

An additional 20% could come from solutions with a minor cost disadvantage, such as heat pumps and bioenergy, whose commercial case could improve significantly in the coming years through technology maturity and cost declines.

However, more immature “deep decarbonization” technologies critical for heavy industry, long-range transport and agriculture face major cost disadvantages. Reaching scale will hinge on government support that makes these solutions more cost-competitive.

In parallel, as climate extremes become more frequent and intense, demand for resilience solutions such as climate-proof building materials, cooling technologies and nascent services such as specialized climate analytics will continue to grow beyond the $1 trillion they represent today, becoming increasingly material beyond the Global South.

The future growth of the green economy will be uneven and determined by regional dynamics. Countries heavily betting on the green economy will see a greater share of growth opportunities in the coming years. Green growth is increasingly spearheaded by China, which is spending more, innovating faster and building on a larger scale than its global peers, particularly in clean energy technologies. The centre of gravity is increasingly moving from the West to the East.

2. An engine of business growth and competitiveness

Green solutions are an engine of business growth and competitiveness. For many leading businesses, climate action has moved beyond a compliance exercise to become a core engine of growth and competitiveness fuelled by market demand.

Analysis of thousands of publicly listed global companies by the London Stock Exchange Group (LSEG) revealed that, on average, green revenues grew two times faster than conventional revenues (12% vs 6%) between 2020 and 2024.

The report analysis also shows that companies with green revenues typically secure a lower cost of capital than those without.

Moreover, companies with over 50% green revenue often attract valuations 12-15% higher than those of non-green competitors, reflecting investor confidence.

Despite the persistent myth of a sustainability-profit trade-off, the message is clear: investing in the green economy is not a drag on the balance sheet but can be a proven driver of value.

3. CEO’s framework: Thriving in the green economy

Given the scale and breadth of the green economy, the CEO challenge is not whether to engage, but how to win.

This report has compiled 14 case studies and “lessons learnt” from leading executives from the Alliance of CEO Climate Leaders who have already managed to successfully expand with green growth.

According to them, successful CEOs anchor their strategies in purpose, treating sustainability not as a side initiative but as a core driver of long-term competitiveness.

Then they ensure a compelling value proposition for customers. The most successful companies met genuine customer needs with products that are not only sustainable but also superior in price or quality. They moved beyond “green for green’s sake” to deliver solutions that make business sense.

When it came to scaling, successful CEOs aligned their organizations for speed and accountability by fostering agile cultures, leveraging existing technology and strengthening supply chains to withstand disruption.

Beyond mastering the fundamentals, case studies show that winning leaders tend to leverage three key growth accelerators:

- They relentlessly push for tech maturity and cost efficiency to make green products competitive at scale.

- They worked with governments, peers and value-chain partners to not only navigate but shape ecosystems and regulation.

- Because scaling green businesses requires major investment, the best performers have attracted diverse sources of smart capital, ranging from traditional to blended public subsidies to green investment funds, development banks, and more.

There has long been debate over whether the green economy can deliver real financial returns. This report demonstrates that it is no longer a distant promise; green markets are here and growing. For those ready to capture value in one of the world’s fastest-growing markets, the report offers a practical guide.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

The Digital Economy

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Climate Action and Waste Reduction See all

Shantanu Srivastava and Tanya Rana

March 5, 2026