Is Africa a global testbed for 21st century economic multilateralism?

Africa has a closer vantage point on the kinds of adjustments that economic multilateralism now requires Image: REUTERS/Thomas Mukoya

- The conditions currently unsettling global cooperation are ones that African policy-makers have worked within for decades.

- The continent is now attempting something unprecedented: integrating 54 economies into a single market to drive industrialization, job creation and inclusive growth.

- If the global system continues to move through cycles of volatility, the regions that have learned to negotiate coherence under constraints will offer the most practical guidance.

The global economy is moving through a period in which domestic policy has less room to act in isolation than it once did. That pressure stems from the way cross-border economic systems now bind markets more closely together.

Decisions in one jurisdiction are able to shape outcomes far beyond its borders, while cooperation shifts from a diplomatic gesture to an operational necessity for firms and governments. Yet, the mechanisms designed to facilitate this cooperation are struggling to keep pace with the speed and complexity of modern economies.

The number of harmful new policy interventions affecting global trade and investment has surged from 600 in 2017 to more than 3,000 annually in each of the last three years. In 2025, several major economies expanded protectionist measures and regulatory barriers in ways that unsettled supply chains and heightened volatility across markets, offering one of the clearest signs yet of how fragile economic multilateralism has become.

This has direct implications for economic development, because the prosperity of nations and their citizens depends on institutions – both public and private – that can support cross-border exchange, attract and channel investment, enable the movement of people and maintain regulatory environments that give firms the clarity they need to operate across markets.

The conditions now unsettling global cooperation are, however, ones that African policy-makers have worked within for decades. They have tried to align markets across jurisdictions where regulatory systems are fragmented and institutions develop at different speeds, often while absorbing external shocks that lie beyond their control. This accumulated experience gives the continent a closer vantage point on the kinds of adjustments that economic multilateralism now requires.

Based on that experience, the continent is now attempting something unprecedented: integrating 54 economies – most of them developing or emerging – into a single market to drive industrialization, job creation and inclusive growth. This push for unity shows a recognition that fragmented markets and barriers have long stifled Africa’s prosperity. Leaders are framing economic integration as not only an African priority but as a global opportunity: a chance to pilot new models of trade, investment and development finance that could be scaled more widely.

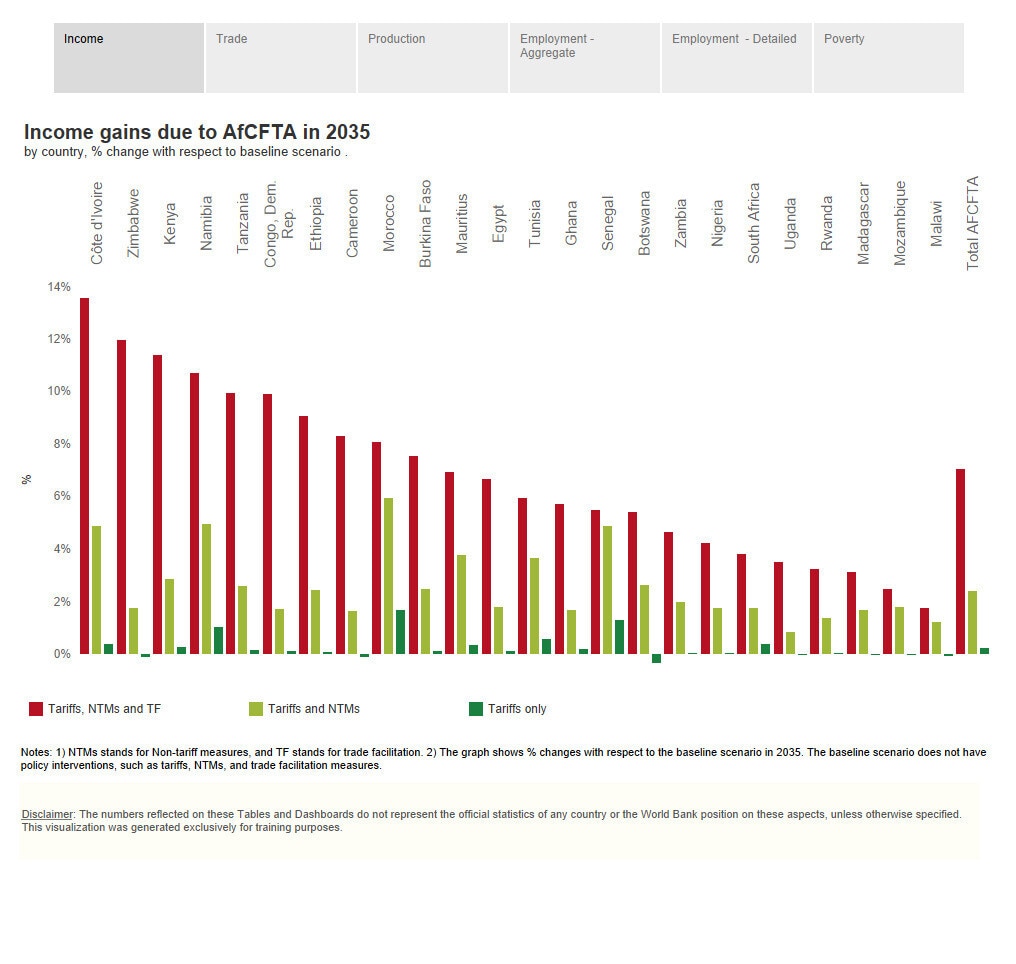

Central to this agenda is the African Continental Free Trade Area (AfCFTA), which aims to create a single continental market that builds scale and positions African economies to compete beyond commodity extraction and integrate more deeply into global supply chains. The agreement covers trade in goods and services, investment, competition policy and intellectual property rights, which places it among the most ambitious frameworks globally. If fully realized, the AfCFTA could raise regional income by 7%, or roughly $450 billion.

The reach of market integration among so many developing economies has no direct precedent, making the AfCFTA a testbed for modern multilateral trade cooperation.

Its success will show how multilateral cooperation can strengthen national economic development by giving individual countries a wider platform on which to expand production and build more resilient, inclusive sources of growth. It may also offer guidance for other regions with fragmented markets, such as South Asia or parts of Latin America, by clarifying the sequencing of agreements and the complementary policies required to translate integration into broad-based gains.

Realizing the promise of AfCFTA, however, is no easy feat and will depend primarily on closing Africa’s infrastructure deficit through coordinated investment.

Cross-border infrastructure is essential to connecting markets in practice. African governments and institutions are working with a wide range of global investors, from China’s Belt and Road programmes to the G7’s Partnership for Global Infrastructure, to finance major projects. The Lobito Corridor is one example: a partnership between Angola, the Democratic Republic of Congo and Zambia, supported by the United States and the European Union, to develop rail and transport links from central Africa to the Atlantic. Regional power pools and joint energy initiatives follow the same logic, with East African states rolling out interconnecting electricity grids and West African countries co-investing in transport corridors to stabilize supply and reduce costs.

These cooperative ventures – often facilitated by multilateral development banks such as the African Development Bank and the World Bank, as well as by partners including China and the Gulf states – are refining practical models for sharing risk and financing long-horizon infrastructure.

Commercial banks play an important role in this picture too, especially where projects need advisory services to structure financing programmes and reliable, cross-border payment channels. Their presence gives investors a clearer sense of how activity is moving on the ground and creates room for new ways for funding projects to emerge. They are becoming a proving ground for blended finance arrangements and for forms of partnership that bridge the interests of both developing economies and investors.

Taken together, these arrangements show Africa building forms of economic cooperation that extend well beyond trade, drawing on a mix of public and private actors to manage interdependence in ways that the global system now struggles to achieve.

The lessons learned from making cooperation workable in imperfect settings may prove more relevant to the future of economic governance than the older expectation that order comes from symmetry and predictability. If the global system continues to move through cycles of volatility, it is the regions that have learned to negotiate coherence under constraints that will offer the most practical guidance. Africa is already showing how that can be done.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Africa

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on BusinessSee all

Marcela Guerrero Casas, Mikhail Manuel and Shabari Shaily-Gerber

March 3, 2026