The ‘Bermuda Triangle’ approach: How the small but mighty island innovates at scale

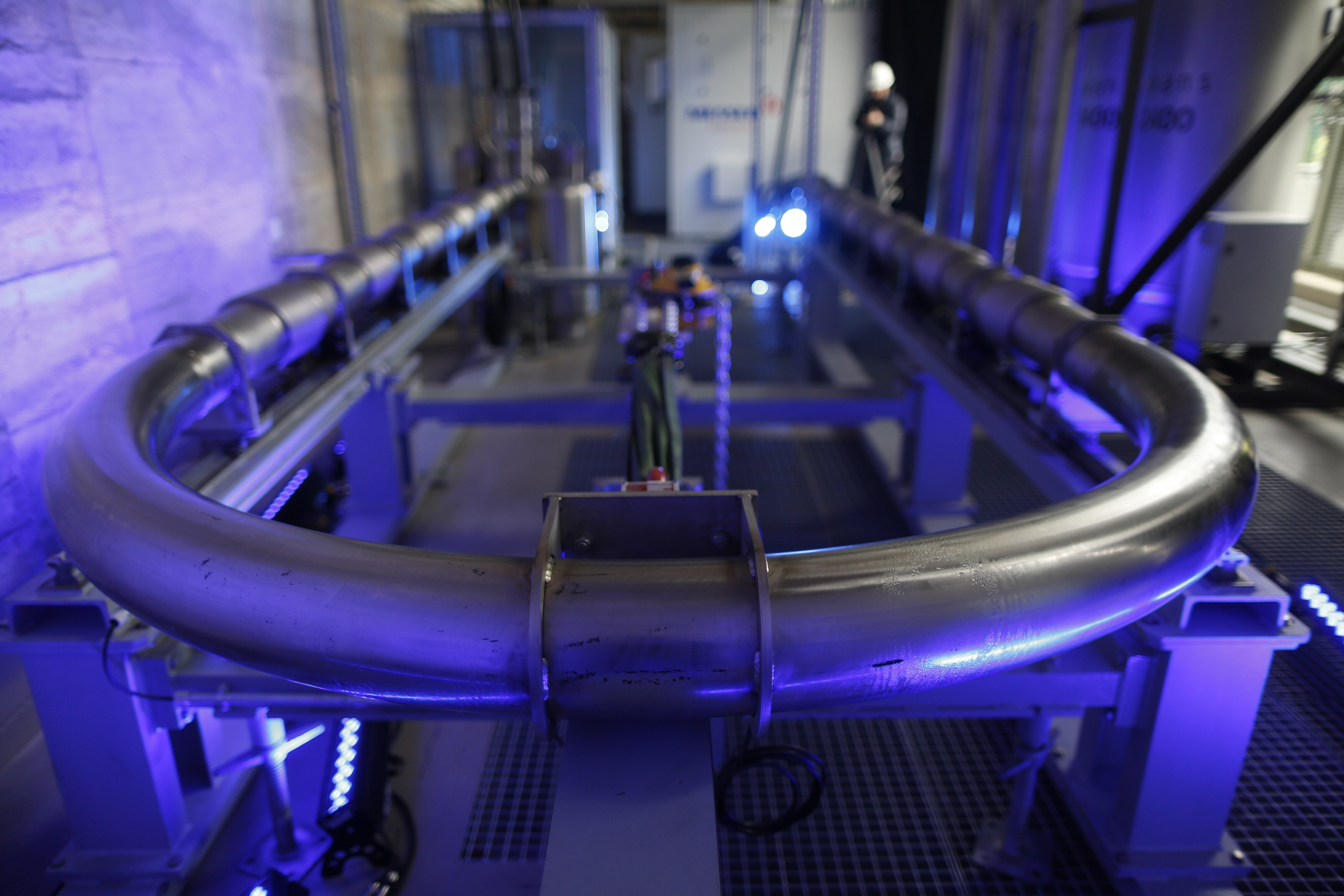

The Bermuda Triangle approach connects three pillars: government policy, independent regulation and private-sector execution. Image: Unsplash

- Bermuda has created a model for balancing risk assessment and agile innovation rooted in the collaboration.

- The approach connects three pillars: government policy, independent regulation and private-sector execution.

- As an island nation, Bermuda has no choice but to continue on its path of pioneering innovation.

When people think of Bermuda, they think of turquoise waters, pink sands and, yes, the mystique of the Bermuda Triangle.

Today, the Bermuda Triangle is no longer a phenomenon where ships and planes disappear, but instead it is a "Bermuda Triangle of Innovation", a model for balancing risk assessment and agile innovation rooted in the collaboration between government, regulator and industry.

Before entering politics a decade ago, I built my career within industry. As a technology entrepreneur I managed information systems, modernized digital infrastructure and saw first-hand how emerging technologies reshape markets. Those years instilled in me a conviction for action, evidence and iteration. They also taught me something even more important: progress through innovation happens when there is trust, accountability and dialogue that keeps people at the center of every outcome.

The new Bermuda Triangle: A model for innovation

Our Bermuda Triangle approach connects three pillars: government policy, independent regulation and private-sector execution. It is a system where ambition meets rigorous oversight and innovation moves quickly while credibly.

In a world where public trust is under strain and regulation often struggles to keep pace with technology, we take pride in our proactive approach to principles-based regulation.

Collaboration between the Government of Bermuda, Bermuda Monetary Authority and local industries has allowed us to test, regulate and foster innovation with a degree of agility that larger jurisdictions can rarely achieve.

Reinventing insurance and risk infrastructure from a small island

Bermuda’s track record of innovation began in insurance.

In the 1960s and 1970s, when corporations struggled to secure affordable commercial insurance, Bermuda pioneered the captive insurance company. This regulatory advancement allowed firms to self-insure by creating their own licensed carriers.

This breakthrough reshaped global risk markets. Captives scaled rapidly because Bermuda designed them responsibly: capital requirements were clear, regulatory expectations were high and industry was invited to co-design the framework rather than react to it. Open communication turned experimentation into standards, and standards turned Bermuda into an essential jurisdiction for global risk transfer.

Today, Bermuda has grown to become one of the world’s largest insurance and reinsurance hubs. About one third of all insurance and reinsurance capital passes through our shores as we underwrite over $2 trillion in global natural catastrophe risk, including a significant share of US exposures.

The island has come to play a pivotal role in managing global risks intentionally and strategically through sustained partnership cycles between government, regulators and global carriers operating locally.

Digital assets: Protecting insurance markets, catalyzing a global licensing leader

In 2017, when blockchains were often framed as threats to traditional finance, we did not take a defensive posture, but a protective one, ensuring that Bermuda remained well-positioned for continued success in this arena through accountability and regulatory leadership.

Our motivation to move into digital assets was to protect our insurance and reinsurance sector from unregulated disruption where innovation has the space to thrive with global credibility and relevance. Our digital asset leadership was a byproduct of proactively turning risk mitigation into economic strategy built on strong regulatory expertise and experience.

Bermuda quickly introduced the Digital Asset Business Act (DABA), the world’s first regulatory framework for digital assets. Herein lies a clear example of the Bermuda Triangle approach: clear policy and direction from government, independent regulatory oversight from the Bermuda Monetary Authority and practical application through the private sector. Mystery removed; progress achieved.

The spirit of innovation is, at its core, a human one.

”The regulatory regime was built to bring clarity and issuer oversight to a previously opaque sector. It gave firms a clear path to licensing, capital segregation, consumer safeguards and supervisory expectations. Today, Bermuda is home to over 55 licensed digital-asset businesses and insurers—more than any other country in the world.

Furthermore, we have regularly updated DABA supervision, introduced derivatives frameworks tailored to risk-managed digital exchanges, embedded yield-bearing stablecoin oversight via new regulatory classes, and are harmonizing international risk frameworks with global supervisory bodies.

Bermuda is also home to many global exchanges such as Coinbase and Kraken, stablecoin infrastructure providers like Circle, and traditional financial institutions entering the industry like Apex Group. These companies selected Bermuda because the island understands digital market structure deeply, regulated it thoughtfully and partnered to scale it responsibly.

Dialogue as a competitive advantage

The World Economic Forum's Annual Meeting in Davos reminds us that the spirit of innovation is, at its core, a human one. It is not a question of technology alone but of vision, coordination, and dialogue.

Just as regulatory clarity brought insurance innovation and economic growth to Bermuda, the digital asset sector is now repeating history as our shores have become home to most innovative digital finance businesses in the world.

The Davos 2026 theme, ‘A Spirit of Dialogue’, aligns with Bermuda’s ethos of collaboration between government, regulator and local industry.

In Bermuda, this dialogue is not just a formality; it’s an accelerator that brings those in the Bermuda Triangle to the table early and often. It has allowed us to move quickly without compromising credibility, and to welcome innovation while maintaining oversight.

It has also enabled us to lead on global standards from a small yet connected jurisdiction.

The next frontiers for responsible scaling

As an island nation, we have no choice but to continue on our path of pioneering innovation beyond insurance and digital assets in order to maintain our competitiveness in the global markets. We are actively exploring supervised digital-identity standards, engineering best-of-breed AI regulatory regimes and evolving regulatory frameworks that innovate alongside global standards rather than after them.

The "Bermuda Triangle of Innovation" is not limited to financial services. As AI and digital identity rise as the next frontier of global innovation, they will also require smart regulation and constant dialogue with industry. This same framework can guide our approach to emerging technologies, positioning Bermuda as a first mover in responsible innovation and supporting greater economic diversification.

The Bermuda Triangle framework keeps ambition aligned with accountability so that new industries can grow with confidence. We stand ready to foster such growth.

Have you read?

Google expands its subsea cable infrastructure with Nuvem, connecting the US, Bermuda and Portugal

Small Island Developing States can lead in digital transformation for climate resilience. Here's how

How different countries are navigating the uncertainty of digital asset regulation in a complex election year

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Bermuda

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Technological InnovationSee all

Tejpreet S Chopra and Ayushi Sarna

February 27, 2026