Europe has the capital to compete – it just needs to fix its financial plumbing

Fixing Europe’s financial plumbing is no longer just a technical discussion for bankers – it is an urgent economic imperative. Image: Shutterstock

- Europe faces a staggering €1.2 trillion annual investment challenge to meet its strategic ambitions and remain globally competitive.

- The continent has the necessary capital but lacks effective mechanisms to channel it towards the long-term infrastructure needed.

- The Leveraging European Financial Markets pillar of the Forum’s Leaders for European Growth and Competitive initiative, in collaboration with Oliver Wyman, seeks to reduce these frictions.

Europe faces a staggering investment challenge. The Draghi report estimated that an additional €800 billion is needed from 2025 to 2030 for the continent to meet its ambitions for the energy transition, digital transformation and defence. More recent estimates have revised this figure to €1.2 trillion, reflecting intensifying geopolitical instability.

Failure to meet these targets risks undermining Europe’s strategic autonomy. It would constrain long-term economic growth, allow other regions to pull ahead due to heavy investment in frontier technologies, and leave Europe exposed to persistently high energy prices. Without action, a generation could be denied the ability to build wealth and subsequently fund a dignified retirement.

Europe’s untapped reservoir

Europe possesses deep capital pools. In 2023, European households held a massive €37 trillion in savings, yet this wealth remained and still remains largely idle. Some 32% of these assets were held in cash and bank deposits, more than double the 13% held by American households. Another 33% sits with pension funds and insurers, who are constrained by resilience-focused regulation to favour low-risk and low-yielding bonds.

While prudent regulation has enhanced Europe’s financial stability, it has also constrained the ability of investors to deploy capital – the ‘pipes’ connecting savers to funding channels and the real economy are clogged. Without targeted recalibrations to align incentives and risk appetite – such as those being undertaken in the UK and US – Europe will struggle to broaden investor participation and scale its capital markets. Crucially, the mechanisms must be put in place to enable efficient flows of capital, ensuring that risks sit with those best equipped to manage it.

A broken financing continuum?

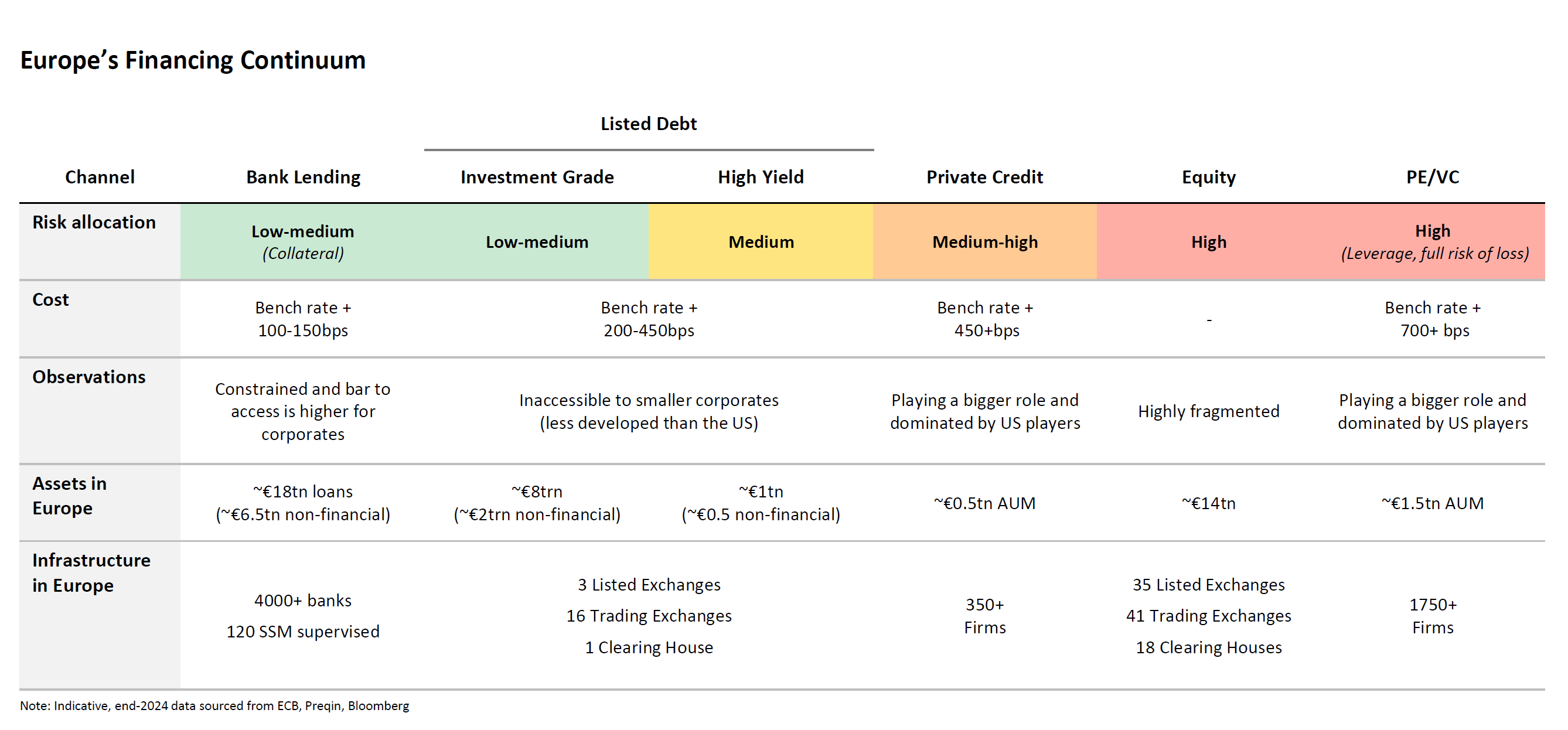

To unblock the reservoir, we must examine Europe’s ‘financing continuum’ – the spectrum of channels connecting supply and demand. Currently, every major channel faces structural friction:

1. Bank lending is the dominant source of debt financing for European corporates, with a share of 85% compared to 45% in the US as of 2025. Yet, while US banks free up lending capacity through securitization (i.e., through packaging loans and selling them to investors), European banks hold loans to maturity. Regulatory constraints and risk aversion thus hinder the funding necessary for high-risk, long-term growth.

2. Listed debt provides funding to corporates through publicly traded bonds. Investment grade bonds support low-cost financing for low-risk borrowers, whereas high yield bonds support risky firms to access capital at higher cost. However, small and medium-sized enterprises (SMEs) face high barriers to access these markets. Furthermore, fragmentation across multiple exchanges drains liquidity and creates costly inefficiencies that prevent risk from flowing freely across borders.

3. Private credit increasingly fills the void left by banks through meeting more complex borrowing needs. However, Europe’s market significantly lags the US. Conservative regulatory frameworks – such as Solvency II – constrain insurers and pension funds from deploying large pools of long-term capital into these markets.

4. Equity markets in Europe have performed strongly in the past 12 months, but they remain highly fragmented across multiple exchanges. Limited retail participation has also historically depressed valuations, often driving capital towards the US in search of higher returns. Similarly, European firms increasingly choose to list in the US rather than across Europe’s numerous exchanges.

5. Private equity and venture capital are essential for financing high-risk innovation. Europe has the talent to start companies but often lacks the mechanisms to scale them. Regulatory barriers and the lack of a unified ‘exit market’ drive promising startups to sell to US firms, draining Europe’s innovation potential and effectively exporting future growth.

Unclogging the pipes

To close the funding gap, Europe must enhance its financing continuum. There has never been better momentum to improve Europe’s competitiveness, but momentum requires action. Both the public and private sectors must work together to implement European Savings and Investment Union (SIU) proposals in full and at pace.

By increasing retail participation in capital markets through savings and investment accounts and boosting occupational pension systems, Europe can redirect a portion of its €37 trillion in household savings away from low-yielding deposits towards the financing channels appropriate to fund Europe’s needs, such as public equities. This would help to fund Europe’s strategic autonomy, grow household wealth, and support secure and dignified retirements.

National governments must also look to reduce market fragmentation across its 27 member states – this will enable capital to flow freely across borders towards where it is needed most. Further, member states should look to revive a transparent, high-quality securitization market. This will help scale financial markets and support economic growth, while enabling banks and other financial institutions – such as insurers and pension funds – to allocate capital more efficiently and channel funds towards Europe’s long-term infrastructure needs.

This is not about forcing undue risk onto households, but about offering them the returns they deserve. When a teacher’s pension fund invests in a European wind farm, or a nurse’s investment plan includes exposure to European startups, citizens can grow their wealth and Europe can secure its strategic autonomy.

Europe collectively has the capital to remain competitive with the world’s leading economies. The continent possesses the savings, the innovation and the industrial base. What it lacks is the seamless connection between them. Fixing Europe’s financial plumbing is no longer just a technical discussion for bankers – it is an urgent economic imperative.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Financial and Monetary Systems

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Economic GrowthSee all

Olumide Durotoluwa

March 6, 2026