How trust drives Gen Z’s different approach to investing

Gen Z is likely to invest earlier in life and more likely to invest in complex products. Image: Unsplash/Austin Distel

- According to the World Economic Forum's 2024 Global Retail Investor Outlook, Gen Z is likely to invest earlier in life and more likely to invest in complex products, such as crypto or alternative asset classes, than other generations.

- Of those Gen Zers that don't invest, nearly 20% say it is because they do not trust financial institutions.

- How can businesses and financial institutions bridge this gap and earn Gen Z's trust?

When it comes to young investors and financial services, trust is complex. The Edelman Trust in Financial Services Barometer shows that Gen Z (adults aged 18-27) trusts financial services firms to roughly the same degree as other generations. Yet, the World Economic Forum’s 2024 Global Retail Investor Outlook suggests that overall trust in traditional institutions, including financial and technology, has fallen in the past two years.

There is also a small but growing cohort of Gen Zers who have lost trust in the financial system completely. They are individuals who do not see themselves owning a home or reaching other traditional financial milestones, creating a trend that has been termed economic or financial nihilism.

How is Gen Z investing differently?

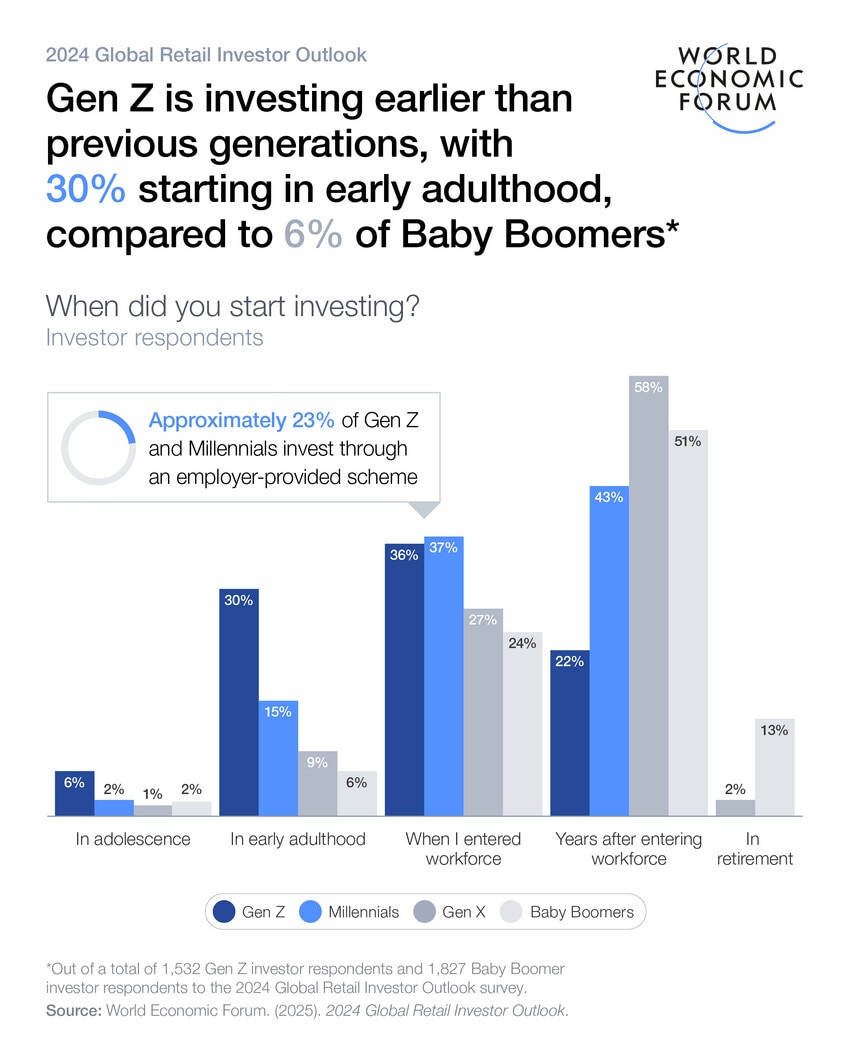

Gen Z invests very differently from the generations that precede them. About a third started investing in university or early adulthood, which is double the rate of Millennials investing at that age. Moreover, more than 50% of Gen Z individuals surveyed by the Forum said they started to learn about investing before entering the workforce, compared to only about 20% of baby boomers.

Many factors contribute to this. Firstly, Gen Z is navigating a world where they must shoulder more of the risk for their personal, long-term financial stability instead of relying on government social safety nets or workplace pensions. In addition, the ubiquity of smartphones and the proliferation of financial applications have made investing easily accessible around the clock.

Gen Z is also more likely to invest in complex products such as crypto or alternative asset classes than other generations. Crypto, for instance, makes up more than one third of the portfolio for 71% of Gen Z investors.

Comparatively, Gen X and Baby Boomers' investment portfolios tend to have more traditional compositions with higher levels of diversification and risk-hedging.

What does trust look like and how is it changing?

Most non-investors in Gen Z don’t invest due to financial constraints and fear of losing money, but nearly 20% also say it is because they do not trust financial institutions. Of the investors, most would invest more if they had more opportunities to learn, had more time and investing was easier. A majority also said they would invest more if they had more trust in their investment platform.

According to the Forum’s survey, the most important factors to establish trust in financial institutions are: security features and data protection, transparent fee structures, access to expert investment research and recommendations from friends or family.

This reliance on social and familiar networks goes beyond just trust: Gen Z really prefers learning by doing and learning from their networks. They turn to these networks for their personal finance needs beyond investing, in addition to consulting online resources and financial institutions, and prize ease of understanding, access and, increasingly, personalization.

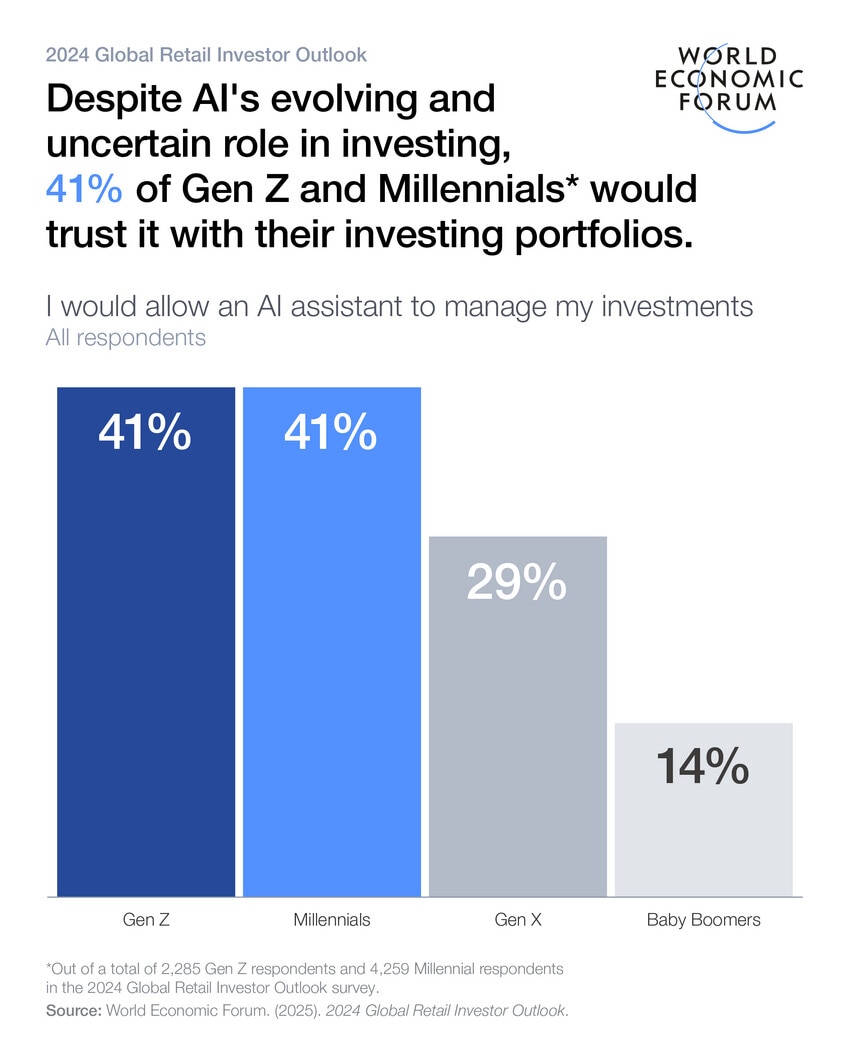

When it comes to sharing their data, they are more comfortable sharing with fintechs, AI chatbots and social media than older generations like Baby Boomers or Gen X are. In fact, more than 40% of Gen Z report they are comfortable having AI manage their investments, compared with 14% of Baby Boomers; while 43% would trust AI with their financial information, compared to 17% baby boomers.

Gen Z, trust and financial advice

As the Gen Z cohort invests at higher rates and in more complex products, it is even more important to have trustworthy advice and information – especially as the cohort has lower overall financial literacy compared to older generations.

While Gen Z relies on traditional financial advisors less often, they are far more likely to use tech-driven financial advice, such as AI advisors, budgeting apps or similar digital tools. Another source of financial advice for Gen Z is social media. Finfluencers (financial influencers) offer financial information that users, who tend to be younger, find straightforward, specific and typically free.

These trends are converging, creating an environment where Gen Z is curious to learn and invest more, interested in more esoteric products and interacting with the financial system in completely different ways than their parents or grandparents.

How to bridge the Gen Z trust gap?

1. Make trust a strategic business priority through transparency and access

In an era of AI, misinformation and information overload, ensuring trust is a strategic business priority for the financial sector. This can be done by expanding access to high-quality and affordable financial advice, which can include supporting digital advice models, such as robo-advisers, or hybrid options, so that tailored advice is available to all investors.

Financial services leaders can ensure they offer transparent, conflict-free pricing models and clearer disclosures about incentives. They should ensure that AI-enabled advice is comprehensible and includes additional oversight for higher-risk decisions.

2. Raise the baseline of financial literacy earlier in life

More than half of non-investors in the Gen Z cohort would feel more confident investing if they had learned about it in primary school.

But financial education should not stop there. Lifelong learning opportunities can help ensure individuals are consistently armed with education suited to their financial goals at every stage of life – something that is particularly important in societies where life expectancy is rapidly trending upwards.

Together with the public sector, business can encourage central banks and finance ministries to look at financial literacy programmes as a driver of economic stability.

3. Retarget communication to younger investors

Financial institutions should put the same scrutiny on the design and user experience of their services as they do on the financial products themselves and ensure they are accessible, easy to navigate and suited to Gen Z’s preferences.

Another option would be to improve the financial information that is available on social media. The top 10 finfluencers have more than six times the followers of the top 10 financial institutions globally. These institutions can directly partner with credible creators to disseminate fact-checked, impartial financial information.

Trust is difficult to earn and nearly impossible to measure, yet it is the must-have currency to succeed in a world where both consumer preferences and capital markets are quickly evolving. Industry and public sector leaders have an incredible opportunity to work together to ensure they are adapting to the needs and behaviours of future generations of investors and enable them to reach their financial goals.

The World Economic Forum’s Global Retail Investing initiative connects private and public sector leaders to create a better understanding of retail investing trends and develop solutions that can help ensure the financial system works better for all.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Youth Perspectives

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Financial and Monetary SystemsSee all

Kevin Werbach

February 27, 2026