Global companies need to build geopolitical muscle. Here’s how

Building 'geopolitical muscle' can help organizations anticipate and respond to shocks in this new multipolar world. Image: Getty Images

Sean Doherty

Head, International Trade and Investment; Member of the Executive Committee, World Economic ForumCristián Hernan Rodriguez Chiffelle

Partner and Director; Trade, Investment, and Geopolitics, Boston Consulting Group (BCG)- A new report, Building Geopolitical Muscle, examines how global firms are institutionalizing geopolitics as an organizational capability and embedding it in decision-making.

- The analysis identifies five building blocks that together define geopolitical muscle.

- In response to the importance and rapid evolution of this function, the Forum launched its Chief Geopolitical Executives Community.

The past year has shown how geopolitical disruptions can simultaneously raise risk levels and generate new opportunities across sectors. Trade fragmentation, intensifying strategic competition in technology, and pressure on supply chains have made geopolitics a central force shaping business performance. What once felt exceptional has become both pervasive and persistent.

An automotive company expects that new tariffs will cut roughly $4 billion from its bottom line, even after mitigation plans designed to offset about 35% of the impact. A pharmaceutical company doubled its US manufacturing investment to $50 billion following the 2024 US elections. An energy company opted for engagement with local authorities instead of litigation to secure permission to restart a major renewable project halted just before completion. A logistics operator proactively engaged with health ministries in several countries in Africa to bridge gaps in last-mile access to critical healthcare products, caused by USAID funding cuts.

In conversations with executives, these examples reflect several themes that surfaced repeatedly: volatility in global trade and industrial policies, the ongoing consequences of the war in Ukraine, deepening competition between the United States and China, and the weakening of multilateral economic institutions. While none of these developments are entirely new, many executives told us: “We knew the direction, but we were surprised by the speed and scale of the disruptions.” These are no longer distant political dynamics; they are shaping financing decisions, sourcing strategies, market access, and even innovation portfolios across industries.

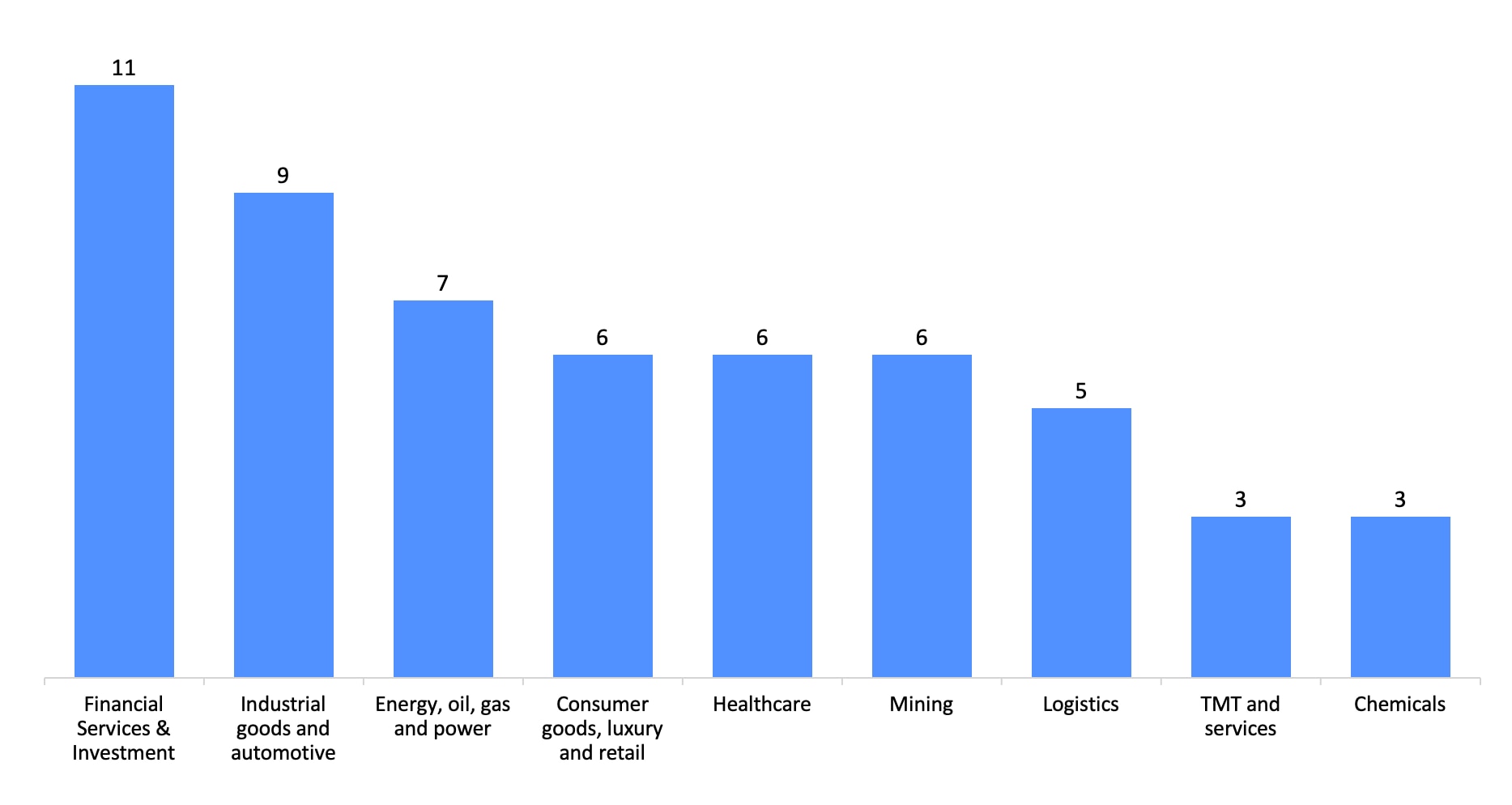

A new report by the World Economic Forum, IMD Business School and Boston Consulting Group, Building Geopolitical Muscle: How Companies Turn Insights into Strategic Advantage, draws insights from interviews with over 55 senior executives to examine how global companies are institutionalizing geopolitics as an organizational capability, that is, their “geopolitical muscle”, and embedding it in decision-making.

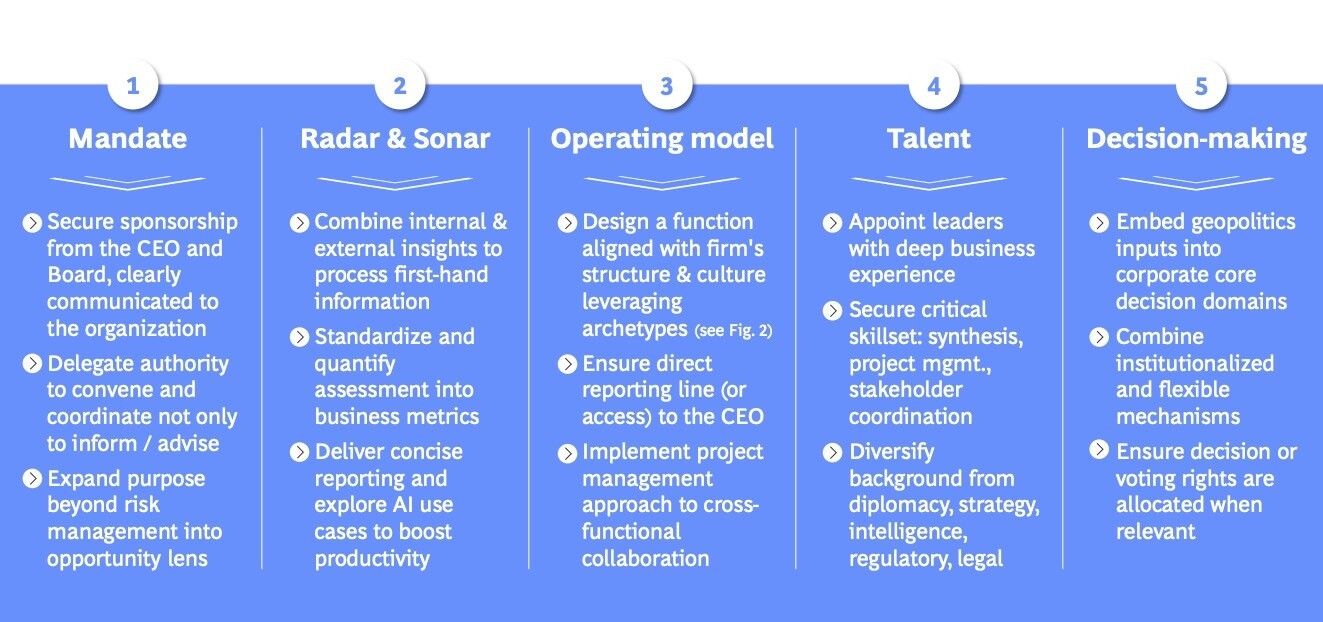

Building blocks that define geopolitical muscle

The analysis identifies five building blocks that together define geopolitical muscle. This capability enables organizations to sense, plan, and act systematically on cross-border developments. Each block represents a core element of readiness and maturity, forming a framework for companies seeking to turn awareness into sustained capability.

1. Establishing the mandate

Effective geopolitical functions start with a clear mandate anchored at the top. This is the most critical step that ensures the difference between a “wait and watch” approach versus a proactive approach. Board and CEO sponsorship establish priorities and delegate authority to act at speed and scale. This delegation can take several forms, however the best performers share a common purpose: to connect geopolitical awareness directly to business decision-making. Historically, companies have treated geopolitics mainly as risk management, reacting to crises via divestment and market-exit to minimize risk exposure. More advanced firms now act proactively, anticipating and mitigating exposure while also identifying and shaping commercial opportunities.

2. Activating radar and sonar

Geopolitical analysis requires disciplined intelligence gathering and synthesis rather than commentary. Competitive advantage results from combining: (i) the ability to source first-hand information directly from the field, and (ii) the organizational capability to aggregate and exploit that intelligence across the group.

Leading firms create internal channels to surface field intelligence from local teams, regulators and clients, and connect it to central functions. They also engage external sources to complement internal insights and develop broader perspectives. Synthesizing the information is equally important. Many companies use structured scenarios, in some cases quantified and tied to financial forecasting, that outline narratives, signposts and triggers.

3. Designing the operating model

Although fewer than one in five companies interviewed had a dedicated Geopolitics or International Affairs unit, more than half embedded the function within Government or Corporate Affairs. Four operating archetypes emerged across companies for how they build the geopolitical muscle.

These archetypes are not rigid with most organizations continually evolving their structure and blending features of at least two of the four archetypes. However, proximity to decision-makers within the company and strong project management emerged as key success factors across these archetypes.

4. Staffing the function

The credibility of the function depends on people who can connect external complexity with business logic. The most effective leaders combine deep knowledge of the company with the ability to translate geopolitical developments into commercial implications. Companies must be mindful of common biases in recruitment patterns based on which function hosts this responsibility. For instance, Government Affairs function favouring diplomatic or policy profiles, while Corporate Strategy recruiting consultants or analysts. The strongest teams blend expertise from policy, strategy, risk, intelligence and legal. They also balance seniority, pairing seasoned leaders with analysts.

5. Embedding in decision-making

Geopolitical insight creates value only when it influences business decisions in a timely manner. However, demonstrating value creation to justify capital investment and human resources required to build the geopolitical muscle, remains a significant challenge. Eight types of business decisions emerged as most affected by geopolitics:

- Procurement and supply chain: Assessing supplier exposure, inventory levels, logistics chokepoints and potential sanctions impacts.

- Risk reviews and Enterprise Risk Management (ERM): Reviewing geopolitical factors within ERM’s risk taxonomy and scenario planning.

- Policy advocacy and engagement strategy: Aligning engagement with policymakers based on market access priorities and regulatory exposure.

- Strategic planning: Incorporating geopolitics into market-entry or -exit, product-launch and pricing decisions.

- Capital allocation & investment: Guiding manufacturing localization, M&A, and capital expenditure allocation.

- Innovation and intellectual property: Identifying where to (re)localize R&D and intellectual property considering technology sovereignty and export controls.

- External communications & marketing: Ensuring that public messaging aligns with local political sensitivities.

- IT and cybersecurity: Connecting cyber risk to geopolitical exposure, prioritizing countries or business lines for tech stack modernization.

Defining the connection between analysis and decision-making is essential for effectiveness. Irrespective of the industry or region, these best practices emerged across companies:

Geopolitics has rapidly become a profound influence on business strategy. The firms that emerge resilient and successful over the long term will treat geopolitical readiness as a core competence.

In response to the growing importance and rapid evolution of this function across global companies, the World Economic Forum recently launched the Chief Geopolitical Executives Community to foster trust-based peer exchange and shared learning. As global uncertainty endures, the challenge is not to predict every disruption, but to build organizations capable of sensing, adapting and acting with confidence.

How the Forum helps leaders make sense of regional, trade and geopolitical shifts

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Geopolitics

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Geo-Economics and PoliticsSee all

Pooja Chhabria

February 27, 2026