Opinion

How stablecoins can expand financial access to the most underserved and unbanked

Humanitarian agencies use stablecoins for relief in crisis environments such as Ukraine. Image: REUTERS/Clodagh Kilcoyne

- Once a niche experiment, regulated stablecoins are increasingly embedded in cross-border commerce, humanitarian aid and small-business finance.

- Digital currency can meaningfully reduce barriers to financial participation by enabling faster, lower-cost and more transparent ways to send, store and distribute money.

- Public-private collaboration can help ensure the benefits of innovation are fully realized, responsibly developed and sustainably invested in.

In his 2005 book, The World is Flat, Thomas Friedman noted how technological advances have jump-started a new era of globalization in which the economic gulf between developed and emerging markets has begun to rapidly shrink.

Friedman showed how people in developing economies, fueled largely by the internet’s democratized access to information, had used search engines, open-source software and more to uplevel job skills, enhance competitiveness and connect across borders.

In the 20 years since the publication of Friedman’s book, this trend has accelerated, with global internet use soaring and many economies in Asia and Africa outperforming many developed markets.

Against this backdrop of digital connections across borders and cultures driving opportunity and economic dynamism, the emergence of global stablecoins is striking. In just six years, the asset class has grown from essentially nothing to over $300 billion.

How stablecoins are being used at scale

Circulation of USDC – a stablecoin issued by Circle – has grown by 108% year-over-year, according to its third-quarter results, reflecting surging demand around the world.

As this transformation has unfolded, we have also seen how digital finance can widen access and increase resilience.

Stablecoins already support humanitarian relief and small business growth and they now anchor Circle’s expanding impact work, including the launch of Circle Foundation, focused on financial resilience and inclusion in the United States and around the world.

Stablecoins such as USDC are becoming the natural currency of a rapidly flattening, digitally connected global village. They are tokenized representations of government currencies, such as dollars and euros, that essentially act as digital cash.

Stablecoins travel on open blockchain “rails,” using the internet to move money at the same global scale, speed and cost attributes that have fueled the transformation chronicled in Friedman’s book.

The United States, Europe and other major markets have already brought stablecoins inside the regulatory perimeter by enacting clear rules that have accelerated their use in mainstream cross-border commercial flows.

However, they are already deeply ingrained financial lifelines in emerging markets, especially among people and businesses underserved by traditional finance seeking faster, easier access to dollars.

While mobile money has taken root in individual countries where banking and payments infrastructure are scant, stablecoins show the potential to scale this globally.

Expanding financial access through digital currency

More than a billion people worldwide are underbanked today, yet many of them have access to internet-connected devices. How might internet-native financial services improve access for these populations?

Providing the ability to send, spend and save dollars digitally at lower cost and without reliance on physical bank branches could address some of the structural barriers that limit participation in the formal financial system. These can be defining questions of our time and how we come together to answer them can help shape the world for the better.

While plugging stablecoins into everyday cross-border commercial flows worldwide represents a huge potential paradigm shift, it is not the only area of opportunity. We have also seen a significant impact from humanitarian organizations that leverage stablecoins to put dollars in the hands of vulnerable populations.

In Ukraine, the United Nations Refugee Agency (UNHCR) has enabled access to USDC for thousands of people displaced by war, providing critical assistance during times of extreme crisis.

In addition, through Circle’s Unlocking Impact Pitch Competition, startups such as Rahat in Nepal, Ensuro in Kenya and ATEC Global in Cambodia have demonstrated how they use USDC and open, digital infrastructure to build financial resilience before climate and economic shocks strike.

These projects have succeeded largely because stablecoins unlock efficiencies that are difficult to achieve with traditional aid distribution alone. Beyond the potential speed and cost benefits, they offer extra transparency and auditability that humanitarian organizations can use in their continued efforts to reduce waste and ensure aid reaches those most in need.

Turning early lessons into scalable solutions

Building on these early use cases, Circle Foundation has been established to support practical approaches to financial inclusion and resilience in the United States and internationally. Rather than creating parallel systems, the foundation focuses on strengthening existing institutions and delivery mechanisms where access gaps are most acute.

In the US, this work begins with support for Community Development Financial Institutions, which play a critical role in serving small businesses that struggle to access affordable capital. By providing grant funding to these institutions, the foundation aims to help expand lending capacity and reduce friction for entrepreneurs operating outside traditional banking channels.

Globally, Circle Foundation is working with humanitarian and development partners to explore how regulated stablecoins can improve the speed, transparency and reliability of aid delivery.

Collaboration with United Nations agencies will focus on practical questions, such as compliance, recipient protection and interoperability with local financial systems, so that digital disbursements complement rather than replace existing relief infrastructure.

These efforts remain early but they point to a broader opportunity: using internet-native financial tools to address specific, well-defined problems in access, efficiency and accountability. If implemented thoughtfully and in partnership with mission-driven organizations, stablecoins can offer one pathway toward a more inclusive and resilient global financial system.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

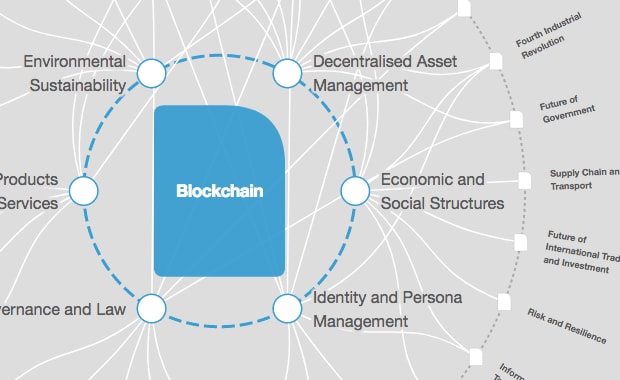

Blockchain

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Technological InnovationSee all

Tejpreet S Chopra and Ayushi Sarna

February 27, 2026