Opinion

How to upgrade globalization for our age of turmoil

Since the end of the Cold War, globalization has been framed as a positive-sum bargain. Image: REUTERS/Maxwell Briceno

- Robert Muggah: the US-led unipolar era has ended, but no settled multipolar order with agreed shock absorbers has replaced it.

- Trade routes, financial systems and digital ecosystems are becoming battlegrounds, he says, while domestic politics are growing brittle and hard to govern.

- Among the solutions are accepting multipolarity while defending multilateralism, and practicing responsible economic statecraft.

Since the end of the Cold War, globalization has been framed as a positive-sum bargain. Trade would bind rivals, capital would circulate freely, technology would compress distance, and multilateral institutions would reduce frictions. That story is over. The world is entering an age of competition in which US-led unipolarity has faded, but no stable multipolar settlement has replaced it. The result is a fractured landscape of overlapping geopolitical, economic, environmental and technological shocks without an agreed way to absorb them.

Still, if governments, firms and citizens can rethink and strengthen interdependence, update institutions and build resilience, disorder need not harden into permanent and dangerous dysfunction. The point is not to mourn globalization, but to upgrade and manage it under harsher conditions.

Fatalism is tempting but misplaced. Risk assessments point not just to peril, but also pragmatic responses.

”When did globalization become a weapon?

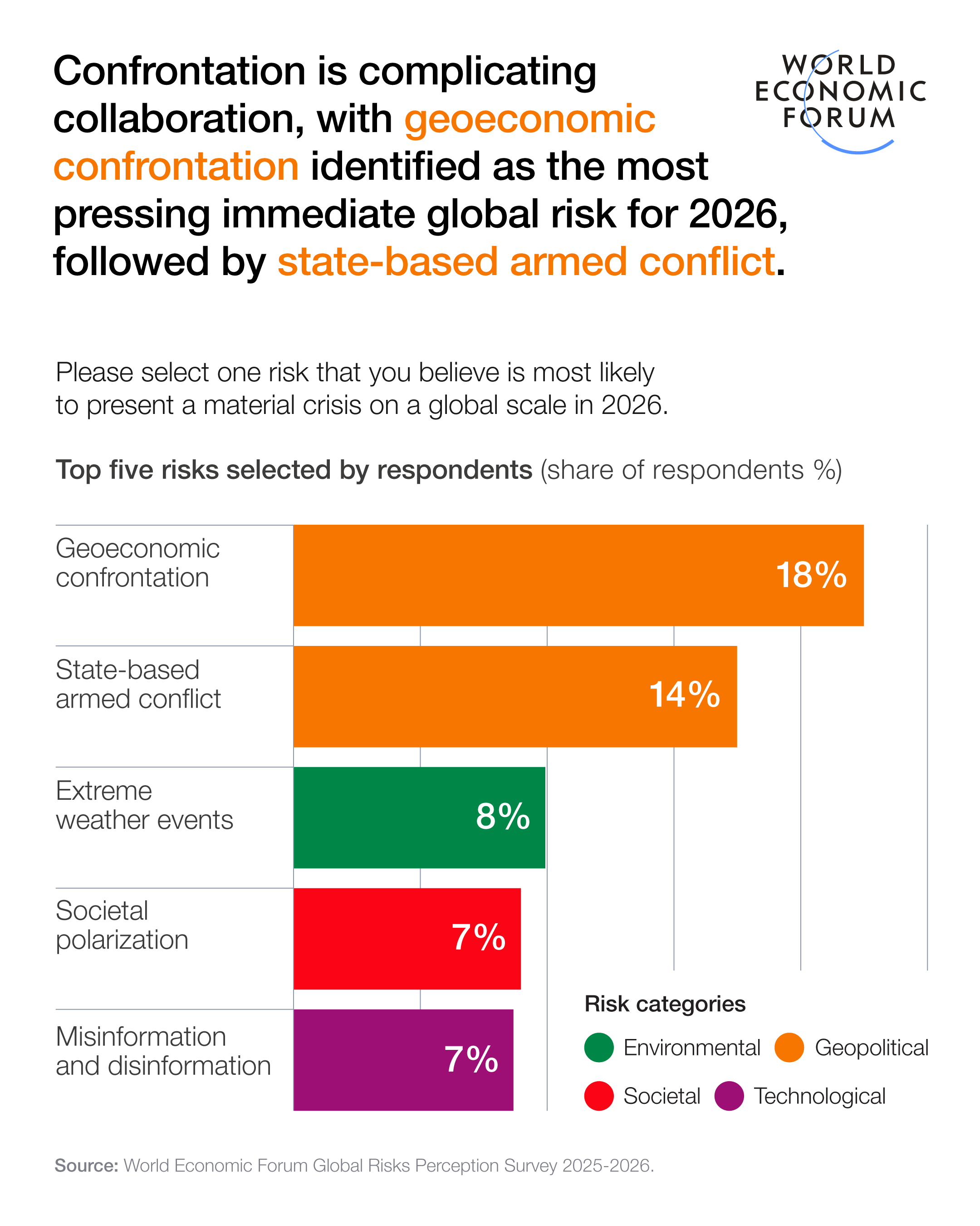

This new emerging era is defined by uncertainty and by the weaponization of economic, financial and digital interdependence. The World Economic Forum's 2026 Global Risks Report highlights geoeconomic confrontation as a central organizing principle of great-power rivalry.

Targeted sanctions, blanket tariffs, export controls, investment restrictions and financial coercion now rank among the most prominent near-term risks, alongside armed conflict and extreme weather. The aim has shifted from maximizing welfare for the many to imposing costs and securing advantage for the few.

At the heart of today’s turbulence is the fading of US dominance, with no clear framework to manage what follows. Washington remains powerful, but its influence is increasingly checked as China rises and other actors such as the European Union, India, Gulf states, Brazil and others pursue more independent paths.

Yet there is no shared blueprint for cooperative multipolarity. Instead, influence is negotiated through overlapping spheres, ad hoc coalitions and transactional alignments. In this environment, trust is scarce, and coercive tools become attractive. Geopolitical rivalry is now reshaping politics at home.

Why are governments finding it harder to govern?

Volatile domestic politics are amplifying external turbulence. Around the world, checks and balances are weakening in democracies and autocracies alike. Independent media and civil society face mounting pressure, and polarization makes compromise harder. Young people confronting stagnant prospects and exclusion from decision-making are mobilizing.

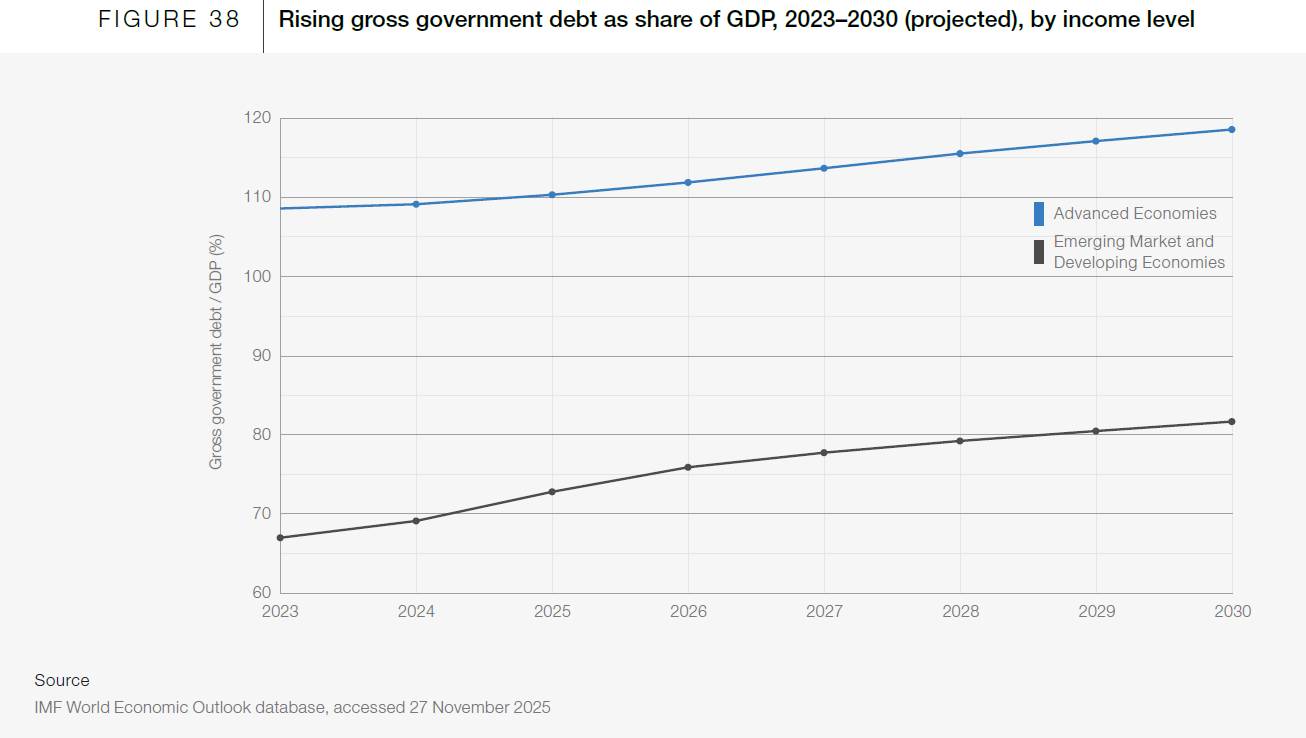

Worsening economic conditions compound the strain. Years of financial deregulation, followed by inflation and higher interest rates, have pushed many states into a fiscal bind. Debt burdens are rising as demands for welfare, defence, climate adaptation and industrial policy grow.

The 2026 Global Risks Report warns of “an economic reckoning” as countries deploy subsidies, export controls and reshoring, friend-shoring, or near-shoring strategies. Ageing populations and slower growth narrow the room for maneuver. Subsidy races feel politically irresistible even when they undercut the growth needed to manage debt.

Climate stress and technological upheaval add even more volatility. AI, quantum computing, advanced robotics and biotechnology offer promise, but also provoke fear. Controls on chips, quantum hardware and sensitive data are justified as security measures, but rivals interpret them as economic warfare. As climate shocks rise and technology accelerates, the space for compromise shrinks further.

What happens when the world’s wiring is weaponized?

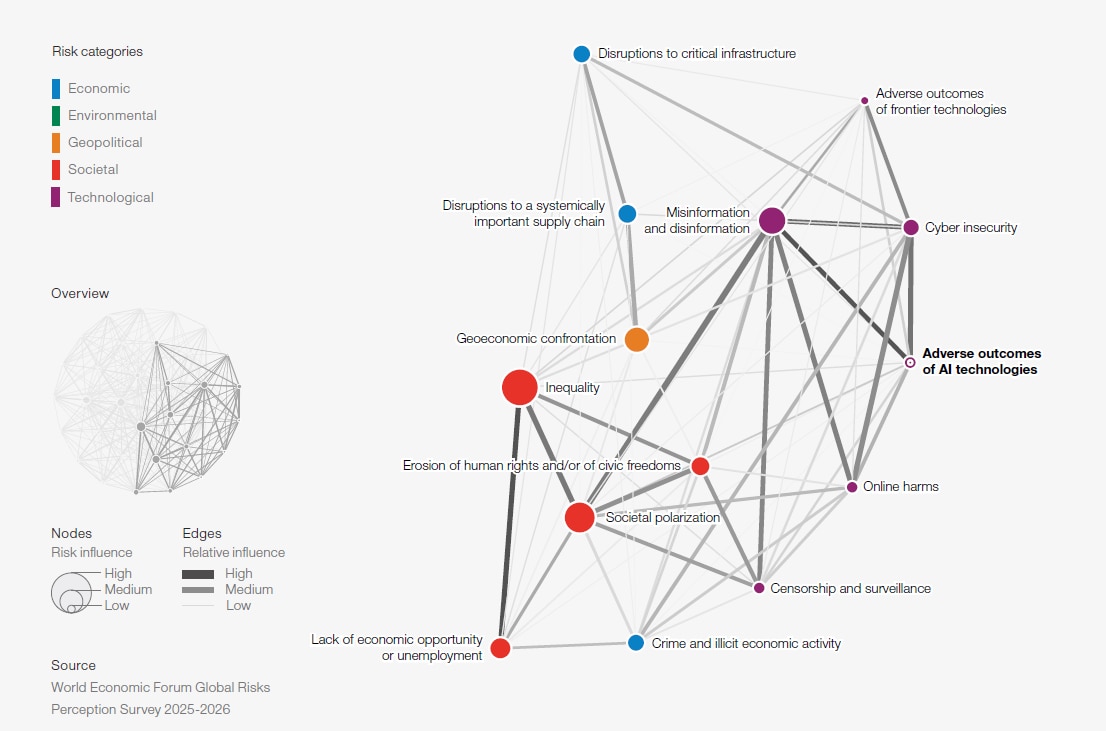

Digital systems are turning information into a battlefield. Deepfakes, bots and targeted disinformation erode shared reality, degrade trust, and make elections and crises contests over facts. All the while, extreme weather is disrupting supply chains, straining grids, and worsening food and water insecurity.

Trade and value chains face their sharpest disruption in decades. The WTO dispute-settlement system has been effectively paralyzed since the Appellate Body stopped functioning in 2019, pushing countries toward ad-hoc arrangements.

Attacks and threats around key trade corridors have rerouted vessels, raised insurance and freight costs, and exposed maritime fragility. Dependence on rivals for rare earths or semiconductors increasingly looks like vulnerability, so firms diversify even when it is costlier. Infrastructure is recast as strategic and is courted, fortified or sometimes sabotaged. Geography, once an inconvenience, is again destiny.

The financial system is now a domain of contestation. Dollar dominance and Western banking infrastructure give the US and allies powerful leverage. They can freeze reserves, constrain access to payments systems, and deter investment through secondary sanctions.

The freezing of Russia’s reserves after the Ukraine invasion showed the scale of this power. Repeated use, however, encourages workarounds such as alternative messaging systems, bilateral swap lines, crypto-assets and stablecoins, and louder calls for de-dollarization. What looks like leverage in the short run can erode the system’s neutrality over time.

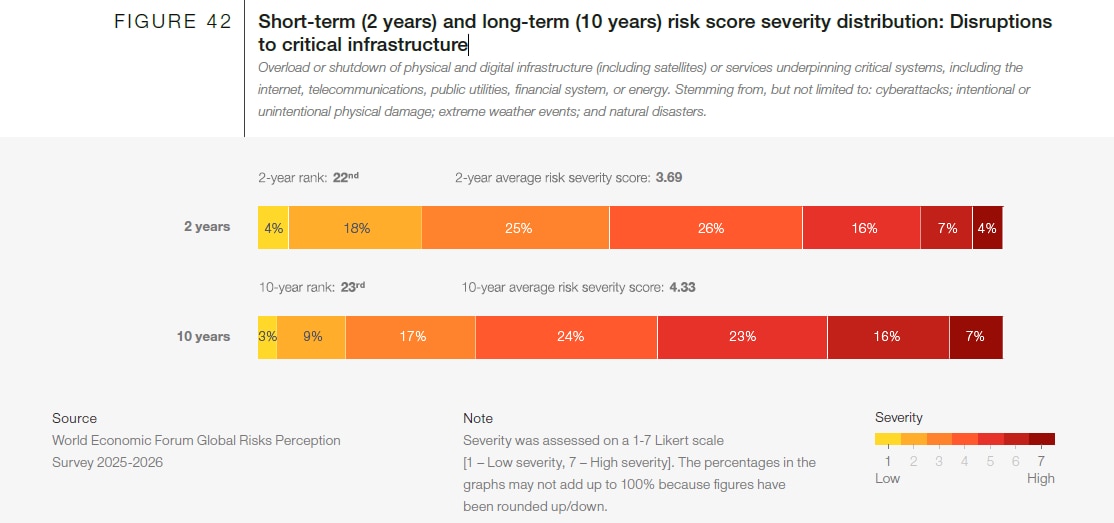

Digital interdependence is similarly double-edged. Undersea cables, cloud services and satellites connect economies, but also create vulnerabilities. Cyberattacks on grids, pipelines, hospitals and air-traffic systems are routine. Espionage and sabotage can be deniable and continuous. Reliance on a small set of platforms and networks raises fears that access to cloud services or connectivity could be used as political leverage.

Who can insure against systemic risk?

The costs of geoeconomic tensions are multiplying. Households and firms face more volatile prices, disruptions and weaker growth. Energy and food markets lurch when pipelines are attacked or grain corridors close. Export controls invite retaliation and chill investment. Subsidy races divert scarce fiscal resources toward favoured sectors while basic services lag. With rising debts and shakier confidence, a sharp repricing in AI assets or opaque private credit could trigger wider stress.

Societal cohesion and trust are also fraying. Populism, economic pressure, cultural polarization and organized disinformation push parties toward extremes. Central banks face pressure to finance governments or suppress rates regardless of inflation. Military spending keeps breaking new records. Citizens flooded with conflicting narratives risk becoming numb, which lowers the perceived cost of violence and adventurism.

Longer-run structural risks are mounting as well. AI and robotics could outpace education and training, displacing workers across all skill levels. Governments debate universal basic income or job guarantees without clear fiscal pathways. Meanwhile, large cohorts of under-employed youth can be mobilized by populists and war-makers.

If artificial general intelligence (AGI) and quantum computing mature, they could break today’s cryptography and concentrate informational and economic power even more in a small club of states and firms. In a connected world, no country can ring-fence itself from shocks that travel by code, capital or climate.

How do we harden societies without closing them?

Fatalism is tempting but misplaced. Risk assessments point not just to peril, but also pragmatic responses.

First, accept multipolarity while defending multilateralism. A more plural distribution of power makes agreed rules even more necessary. That argues for the reform of institutions governing security, finance, trade, climate and health. Rising powers need greater representation, and established powers must accept it. Flexible coalitions can also move cooperation forward on specific issues ranging from pandemic preparedness and AI safety, to phasing out fossil fuels and zero deforestation.

Second, build a doctrine of responsible economic statecraft. Sanctions, export controls and industrial policy can be justified – but without guardrails they backfire. Minimum standards include clear objectives and exit criteria, coordination with allies, credible humanitarian carve-outs, and a bias toward resilience measures such as diversification and redundancy rather than coercion alone. Payments and financial plumbing should be treated as shared infrastructure, not a routine weapon.

Third, invest in anticipatory governance. Governments and businesses need to strengthen foresight, stress-test infrastructure and supply chains, and protect regulator and statistical independence. Scenario-planning is urgently needed to prepare for AGI, quantum risks, crypto-assets and climate tipping points, so rules are shaped before crises. Central banks, competition authorities and data-protection bodies will sit closer to the centre of geopolitical risk management.

Finally, build resilience from the local level up. Shocks are absorbed in neighbourhoods and cities. Investments in grids, water, health systems and digital access reduce harm from disasters and disruption. Targeted social protection, inclusive education and space for civic organizing can blunt extremism. At a minimum, decision-makers need to empower local authorities while connecting them to international support and expertise.

Globalization will not be rewound. Too many ties are embedded in the world’s operating system. Interdependence can still be managed more wisely. The choice is not between a nostalgic return to the 1990s and a fatalistic plunge into zero-sum rivalry. It is between stumbling from shock to shock, or doing the hard work of turning rivalry into rules – and exposure into resilience.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Global Governance

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Global RisksSee all

Eric Usher

February 24, 2026