The new foundation of global finance: a dialogue between banks and blockchains

A convergence in the financial system is taking shape between banks and blockchain. Image: Getty Images

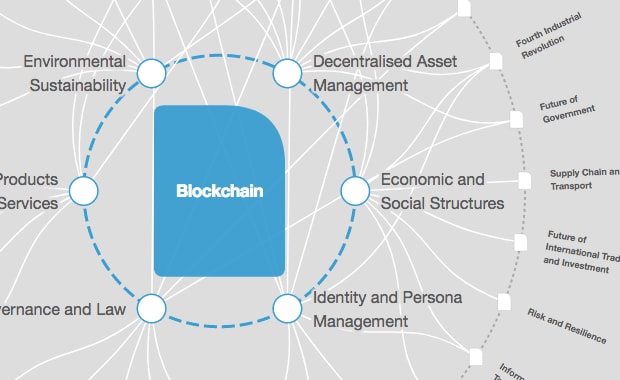

- A convergence is taking shape as banks adopt blockchain infrastructure, and blockchains evolve to the needs of regulated institutions and global enterprises.

- After years of experimentation at best, but mostly hesitation, the conditions are now finally in place for institutions to lean in.

- The industry’s next phase hinges on clearer global standards and mature, reliable infrastructure.

A convergence in the financial system is taking shape. It’s quieter than the hype cycles and far more durable: banks are adopting blockchain infrastructure, and blockchains are evolving to the needs of regulated institutions and global enterprises. The result isn’t a replacement for the old system or a wild leap into a new one – it’s a convergence.

We’re moving into a “systems phase,” where core financial infrastructure is being rewired in real time. Settlement, custody and payments are shifting from batch processes to always-on rails. Stablecoins now move value globally in seconds, anytime to anyone. Tokenization pilots are now in production. And the institutions that shape global finance – including wealth managers, brokerages, payments giants, banks – are all rolling out digital asset capabilities at scale.

None of this happens without a functioning dialogue between banks and blockchains. Each brings strengths the other simply doesn’t have, and neither can build the future alone.

How we got here: from experiments to infrastructure

The first wave of crypto adoption happened entirely outside the institutional world. Bitcoin wallets were clunky, on-ramps were fragile and consumers were the ones experimenting first. Institutions stayed back for predictable reasons: unclear rules, limited protections and infrastructure that wasn’t built for regulated environments.

That changed when regulators stepped in with clearer guidance. In the US, early Office of the Comptroller of the Currency and Federal Reserve letters made banks cautious. Recent actions, by contrast, outline how banks can incorporate digital assets safely and supervise them appropriately. Europe went a step further with its MiCA framework: a single licensing regime now covering 450 million people, which creates the kind of regulatory consistency institutions need to build multi-year strategies.

Better rules opened the door, but infrastructure providers pushed it wide open. Most banks aren’t set up to build blockchain rails from scratch – not because they lack the technical talent, but because regulated businesses move in precise increments. Infrastructure companies became the connective tissue: custody, liquidity, onchain transfers, compliance and settlement brought into a form that banks can deploy securely and programmatically.

Why institutions are moving now

After years of experimentation at best, but mostly hesitation, the conditions are finally in place for institutions to lean in.

1. Customer demand is now impossible to ignore

Roughly 55 million Americans hold crypto today, and that number continues to climb. Our own platform data, drawn from 6 million people across our partner network, shows users buying more frequently, making their first purchases faster, and dollar-cost averaging into the asset class. These are behaviours you don’t typically see in a passing fad.

Affluent individuals are also reshaping expectations inside wealth management. In our recent research, 61% already hold digital assets, but only 25% transact via their advisors. And 51% of high-net-worth investors have already moved assets away from advisors who don’t offer digital assets.

2. Stablecoins have become the first universal blockchain use case

Stablecoins have become the first truly universal blockchain use case, turning a technical breakthrough into something deeply practical. They move value instantly across borders, bypassing multiple intermediaries, with a singularity of value. You can already see that shift in how customers behave: lower-cost cross-border payments, real-time brokerage funding, and faster merchant settlement are becoming increasingly normal features of day-to-day finance.

The data backs it up. According to platform data from zerohash, stablecoin deposit volume surged 138% above the 2025 monthly average, and the average deposit size grew 51%. Users are treating stablecoins as a global, instant payment rail. Stablecoin adoption has become a signal of something larger: the underlying financial rails are starting to change.

3. Tokenization beyond dollars is the next frontier

The idea is simple: represent other real-world assets (beyond cash) as programmable digital objects. Institutions value tokenization not for novelty, but for operational speed: instant transfer and programmability. Inside banks and fintechs, tokenization isn’t seen as an experiment anymore. It’s no surprise that BlackRock CEO Larry Fink recently penned an entire byline to The Economist on this very topic. (Disclosure: zerohash works with BlackRock to help power their BUIDL product with our tokenization payment rails).

What each side brings to the table

A healthy financial system depends on complementary strengths. This new one is no different.

Banks contribute:

- Deep risk-management expertise

- Mature compliance and supervisory systems

- Customer trust built over decades

- Global distribution and scale

Blockchains contribute:

- Programmability

- Always-on settlement

- Transparent and verifiable transaction flows

- Lower cost structures for global and high-volume operations

Infrastructure providers like zerohash bridge the two. We deliver the “practical layer” that lets institutions operate safely on blockchain rails: onchain analytics, transaction monitoring, custody, liquidity and licensing frameworks that match institutional requirements.

The invisible future: blockchain as background infrastructure

If you zoom out, the most transformative technologies are the ones that eventually disappear. No one thinks about TCP/IP when they open a browser. They just expect pages to load. No one thinks about GPS protocols when their ride share shows up. They just assume the dot on the map is accurate. And no one thinks about HTML or CSS when they scroll a website. They just want the page to render instantly on any device.

Blockchain is heading toward the same invisibility. Stablecoins already offer a glimpse of this. Many platforms now let customers fund accounts instantly with a single click. Users aren’t choosing chains, examining addresses, or thinking about gas fees. They’re just completing an account-to-account transfer, the same way they do with any other digital service.

Chain abstraction products are making this seamless. Tokenization will follow this pattern. The assets will move faster. The settlement windows will shrink. The operational headaches will fade. Customers won’t care that blockchains are involved; they’ll only care that the experience is better. This is what a blended system looks like: traditional compliance frameworks running alongside blockchain programmability, creating financial services that are faster, cheaper and more global than what came before.

Where the industry should focus next

The industry’s next phase hinges on clearer global standards and mature, reliable infrastructure.

MiCA shows how unified rules accelerate adoption, giving institutions the confidence to build at scale. Banks also need dependable infrastructure. And the user experience must stay simple: intuitive authentication, clean abstractions and frictionless onboarding. When the front end feels effortless, the underlying transformation can finally take hold.

Finance is moving toward a shared future shaped by banks and blockchains working in tandem. Institutional momentum is real, and stablecoins, tokenization and digital asset rails are becoming part of everyday infrastructure. Customers will simply experience faster, more connected financial services built from both systems’ strengths.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Blockchain

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Financial and Monetary SystemsSee all

Kevin Werbach

February 27, 2026