Reglobalization: Rewiring the world economy for a new era of growth

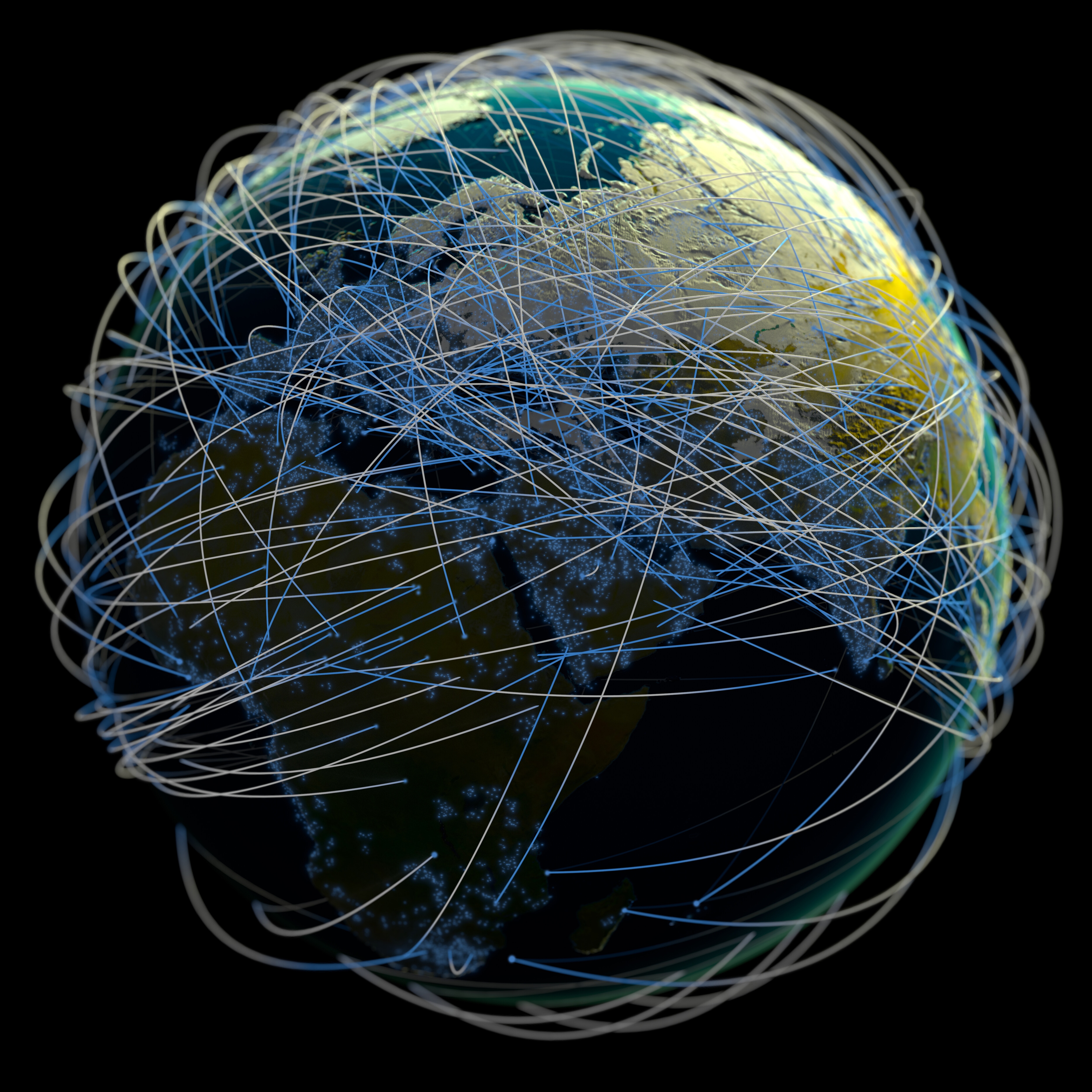

Reglobalization is rewiring the world economy according to security and resilience, over cost and efficiency. Image: Getty Images

- The current phase of 'reglobalization' is ushering in a realignment of trade, production and financial networks driven by resilience and security.

- Global corporations are adopting a dual-track operating model that both embraces geopolitical imperatives and seeks regional competitive advantage.

- Now more exposed to geopolitical risks, investors must look to different strategies to build their portfolios.

Global trade has entered a new phase after decades of globalization. Despite narratives of “deglobalization”, global trade has continued to expand and has reached record levels in recent years, even as geopolitical tensions, pandemics and wars disrupted the global value chain. Indeed, China announced that its 2025 trade surplus reached a record of over $1 trillion in just 11 months.

What seems to be changing is not the level of global integration, but its architecture. Recent US trade policy shifts have triggered a structural transformation in global supply chains and trade flows from pure cost optimization to strategic resilience – a transition better described as “reglobalization” rather than deglobalization.

At its core, reglobalization is a strategic realignment of trade, production and financial networks. In this transition, certain links may fragment through decoupling, reshoring and tighter export controls. At the same time, new forms of integration might appear elsewhere. Financial flows could also shift away from single-currency dependence without completely abandoning the centrality of the dollar. The outcome is a more multinodal, regionally and politically clustered network that still operates on a global scale, but with resilience and security prioritized alongside cost and efficiency.

For global corporations, this transition has catalyzed a dual-track operating model. On one track, they localize or “near-shore” production that is politically sensitive or essential for access to the US, such as advanced semiconductors, defense technology, strategic minerals or green manufacturing. On the other track, they rely on a broader set of regional hubs for scale, labour-cost advantages, and diversified demand. In other words, the logic of the operating model has changed from cost-only to resilience-based diversification and political alignment.

Similar shifts are happening at a country level. While direct US-China trade shrank by 30% in 2025, especially in sensitive sectors, many so-called “connector economies”, such as Mexico and Viet Nam, import intermediate goods from China, assemble or process them, and then export finished products to the US or Europe. At the same time, research from the Bank of International Settlements (BIS) has shown that trade between countries in opposing geopolitical camps has grown more slowly than trade within those camps. Investments followed a similar pattern, with greenfield FDI between geopolitically distant countries falling sharply, while intra-bloc investment and “friend-shoring” held up.

Still tethered to the US

Despite these realignments, the global system today continues to be deeply anchored to US demand and dollar-centric finance. The US still accounts for a disproportionate share of global consumption in many high-value sectors, and the dollar continues to dominate trade invoicing, cross-border lending and reserve holdings, though its edge is gradually eroding. A self-reinforcing loop of dollar pricing, lending and savings built up over the last five decades serve as a backbone of its role as the global hegemonic currency.

The US exceptionalism observed in recent years has persisted despite market turmoil triggered by Liberation Day tariffs earlier this year. State Street’s research, based on our proprietary investor flow data, indicates that the US continues to be the country where investor allocation to equities are higher than the benchmark, driven by the technology sector. Underneath this dominance lies a reinforcing system of innovation, business dynamism, deep capital markets and geoeconomic advantages, supplemented by countercyclical monetary and fiscal policies that worked effectively in previous crises.

Why this matters now: Strategic choices amid transition

What has changed, instead, is the perception of the US’s role in the global economic system. In a recent interview with the Financial Times, Laurence Wong, Prime Minister of Singapore, noted that “America is stepping back as the global insurer. The transition will be messy and unpredictable … the old rules don’t apply but new ones have not been written yet”. In other words, no single hegemon can unilaterally guarantee stability, yet no alternative architecture is mature enough to replace the existing one.

For businesses, this means today’s location, sourcing and partnership decisions could result in very different possible futures. The new alliances will be shaped by operational effectiveness and the strength of political and economic ties. A dual-track operating model can deliver both resilience and growth, but only if firms can successfully navigate the complex dynamics of reglobalization. Connector economies such as Mexico, Vietnam and Poland could offer opportunity, while second- and third-order dependencies within a reglobalized supply chain should also be considered.

For investors, the implication is that geopolitical factors could play a larger role in determining country risk beyond macro fundamentals like growth, inflation, jobs or fiscal policy. The impact is most directly transmitted in long-term sovereign yields and in their volatility; in a world of rising debt and unsettled inflation, the ability of long-term sovereign fixed income instruments to hedge risk is significantly diminished. As a result, real assets, currency strategy and explicit geopolitical risk premium frameworks could become central building blocks to portfolio construction. This also implies that the traditional concept of “emerging markets” would need to be rethought with the rise of connector economies.

For policy-makers, if reglobalization drifts toward bloc fragmentation, the long-run cost could increase due to lost efficiency and duplicated systems particularly for emerging markets. Steering toward a more managed, cooperative multipolar system where open channels of communication are maintained could continue to support growth.

How the Forum helps leaders make sense of regional, trade and geopolitical shifts

Reglobalization of global trade and financial networks is still in its early days. Actions taken in the next few years on industrial policy, supply chain relocation and financial flow realignment will set the course for a game that could last decades. Companies, investors and policy-makers should strategically navigate this rewiring of the global economy to secure resilient growth for the next generation.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Geopolitics

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Economic GrowthSee all

Sarah Sáenz Hernández

February 24, 2026