Opinion

Stablecoins as a bridge not a threat: why interoperability will define global finance

By treating stablecoins as a modern rail for value transfer, we can build a better financial system. Image: Getty Images/iStockphoto

- There are two distinct financial worlds: the fiat world and digital asset world.

- True interoperability means connecting three dominant endpoints where the world keeps its money: banks, mobile wallets and stablecoin wallets.

- By treating stablecoins as a modern rail for value transfer, we can build a financial system not only faster, cheaper but more resilient, inclusive.

We are witnessing a fundamental shift in how the world works, but how the world pays is struggling to keep up.

From gig economy freelancers in Buenos Aires to fast-growing small businesses in Nairobi, economic activity is increasingly borderless. Yet, for millions, the simple act of getting paid remains one of the most complex, expensive and slow aspects of operating globally. Traditional cross-border rails, built for a different era, often cannot match the speed of the modern digital economy.

This creates a gap, a friction point between how people earn globally and how money moves locally. Stablecoins have stepped into this gap, not as a speculative asset, but as a pragmatic utility. However, their potential will remain unrealised if they operate in isolation.

To understand the future of finance, we must look beyond the assets themselves and focus on how they connect. The key is interoperability.

The silo problem: fiat vs digital

There is a prevailing narrative that places traditional banking and crypto-assets in opposition, a zero-sum game where one replaces the other. I believe this view is fundamentally flawed. The future isn't about replacement; it's about integration.

Currently, we have two distinct financial worlds. On one side, the fiat world: highly regulated, trusted, but often slow and fragmented by borders. On the other, the digital asset world: instant, borderless and programmable, yet often volatile and complex for the average user to access.

The real challenge, and the massive opportunity, lies in building the infrastructure that allows these two worlds to speak to each other. We need a "financial translator" that allows value to move seamlessly from a traditional bank account in Europe to a digital wallet in Southeast Asia, instantly converting between fiat and stablecoins without the user ever needing to manage private keys or gas fees.

Connecting 3 pillars of modern finance

True interoperability means connecting the three dominant endpoints where the world keeps its money: banks, mobile wallets and stablecoin wallets.

- Banks remain the custodians of trust and the primary on-ramp for the global economy.

- Mobile wallets have become the de facto bank accounts for billions in emerging markets, driving financial inclusion where branches never could.

- Stablecoin wallets are the new rail, offering speed and cost-efficiency that traditional systems struggle to match.

For too long, these have been separate ecosystems. A mobile wallet user in the Philippines often couldn’t easily receive funds from a stablecoin holder in the US, for example, or a bank in London would struggle to make a payout to a digital asset wallet.

We are now breaking down these walls. We are moving toward a hybrid global payment framework. In this future, a payment might start as a stablecoin to cross a border instantly, settle into a mobile wallet for daily spending, or land in a bank account for long-term savings. The end-user doesn't need to understand the blockchain technology underneath; they just need to know their money arrived safely and instantly.

Trust is the currency of the future

However, utility alone is not enough. For stablecoins to become a reliable component of this interoperable network, they must address the elephant in the room: trust.

Stablecoins only work at scale when they are fully backed, transparent and regulated. The "stable" in stablecoin must be a guarantee, not a marketing term. Every digital token must be supported by tangible, high-quality assets that users can verify.

The industry must embrace firm reserves and transparent reporting. This is what transforms a risky digital asset into a safe option for everyday payments. When we combine the trust of regulated finance with the speed of digital assets, we create a system that is superior to the sum of its parts.

Building the bridges

The goal is not to rebuild the financial system from scratch. The goal is to add a rail that moves value faster and more efficiently, while preserving the stability and trust that regulated finance provides.

At Thunes, we see this convergence happening in real-time. We are integrating these worlds because we believe that financial inclusion isn't just about access to a bank account, it's about access to the global economy. By unifying banks, mobile wallets and stablecoins into one seamless network, we empower financial institutions and remittance operators to give their customers true payment freedom.

Digital assets are here. The challenge for leaders, regulators and innovators is not to block them, but to integrate them safely. By treating stablecoins as a modern rail for value transfer, we can build a financial system that is not only faster and cheaper but arguably more resilient and inclusive than what we have today.

Let’s stop debating whether digital assets have a role. Let’s start building the bridges that allow them to serve the real economy.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

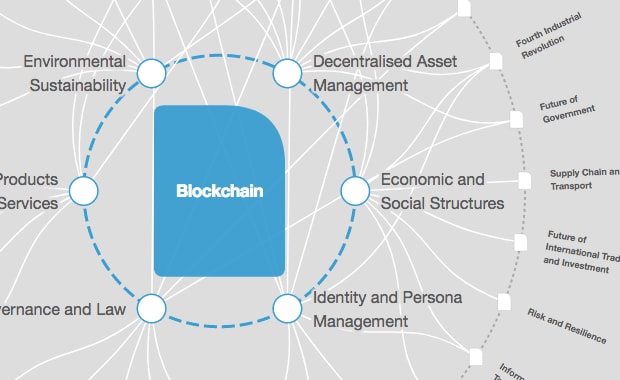

Blockchain

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Financial and Monetary SystemsSee all

Sebastián Serrano

February 23, 2026