Opinion

India’s consumer growth is happening where you’re not looking

Businesses must look beyond India's major megacities to reach millions of new high-spending urban residents. Image: Tejj/Unsplash

- India is undergoing a massive urban shift, with 93% of consumer growth decentralizing.

- Nearly 500 consumer cities will emerge across the country as regional middle-class wealth expands.

- Smart businesses must look beyond major megacities to reach millions of new high-spending urban residents.

While global businesses concentrate on India's megacities, a fundamental shift in consumption patterns is underway. Over the next 15 years, 93% of the growth in India's urban consumer class will occur outside the country's five largest cities. This distribution requires a reimagining of how companies approach one of the world's most important emerging markets.

The megacity myth

India's megacities rightfully get a lot of attention. India is home to two of the world's 10 most populous cities: New Delhi with 29.5 million people and Mumbai with 22.1 million.

However, 93% of India’s urban consumer class growth through to 2040 will occur outside the five largest cities of New Delhi, Kolkata, Mumbai, Bengaluru and Chennai. While these centres remain major economic hubs, they will account for only 7% of new entrants to the consumer class over this period.

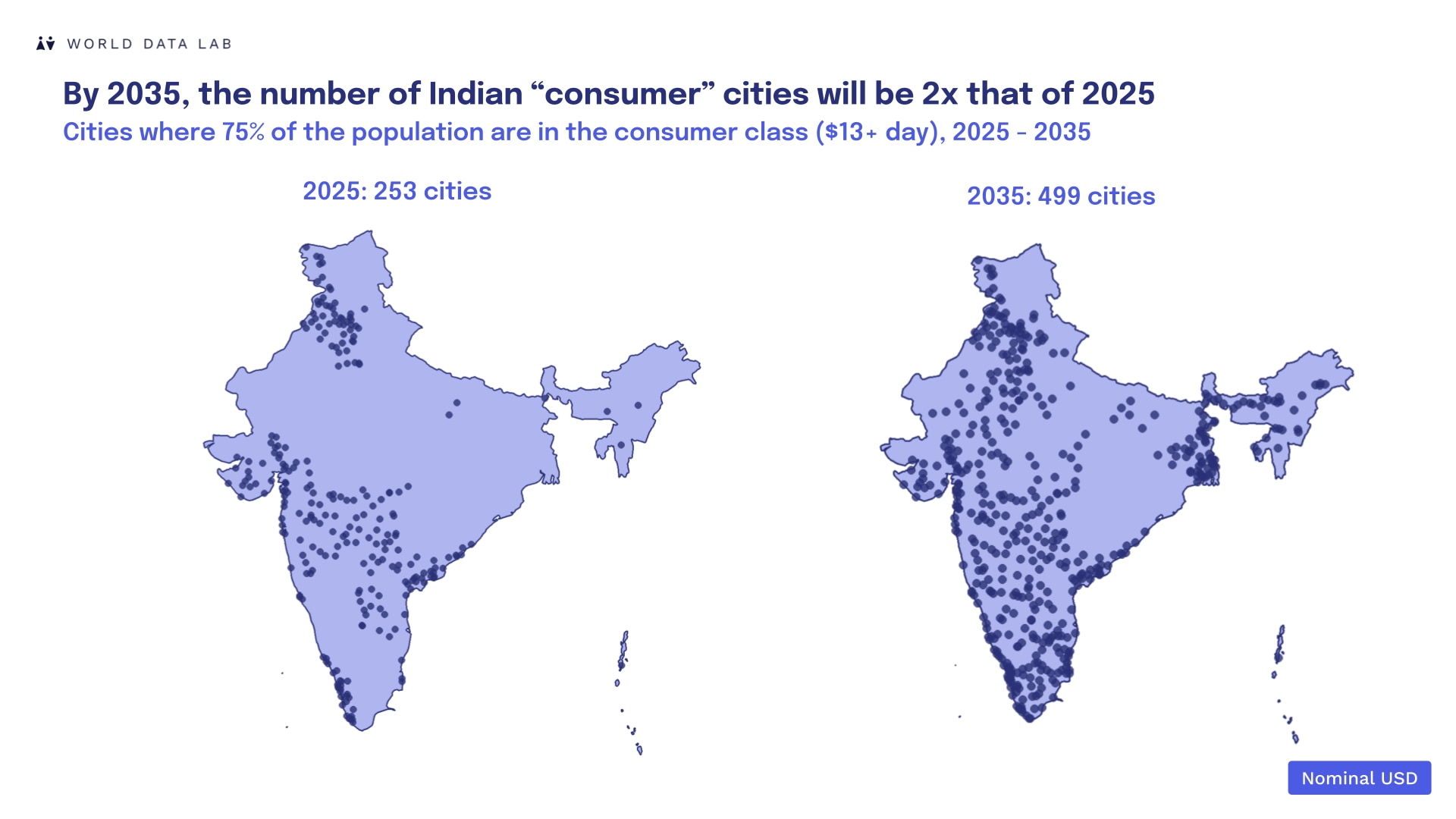

By 2035, India will have 499 “consumer cities,” defined as cities in which 75% of the population is in the consumer class (spending $13 or more per day), more than twice the number of such cities today. By 2040, there will be 149 cities in India with half a million consumers, compared to just 53 in the US and 112 in Europe. Only China will surpass India with 190 such cities.

This growth is not concentrated in second-tier cities alone, but is spreading across hundreds of rapidly developing urban centres throughout the country.

What New Delhi reveals about India's consumer future

While consumer growth outside major urban centres is most significant, New Delhi residents are still the highest spenders. Understanding today's patterns in major cities helps anticipate tomorrow's opportunities in emerging ones.

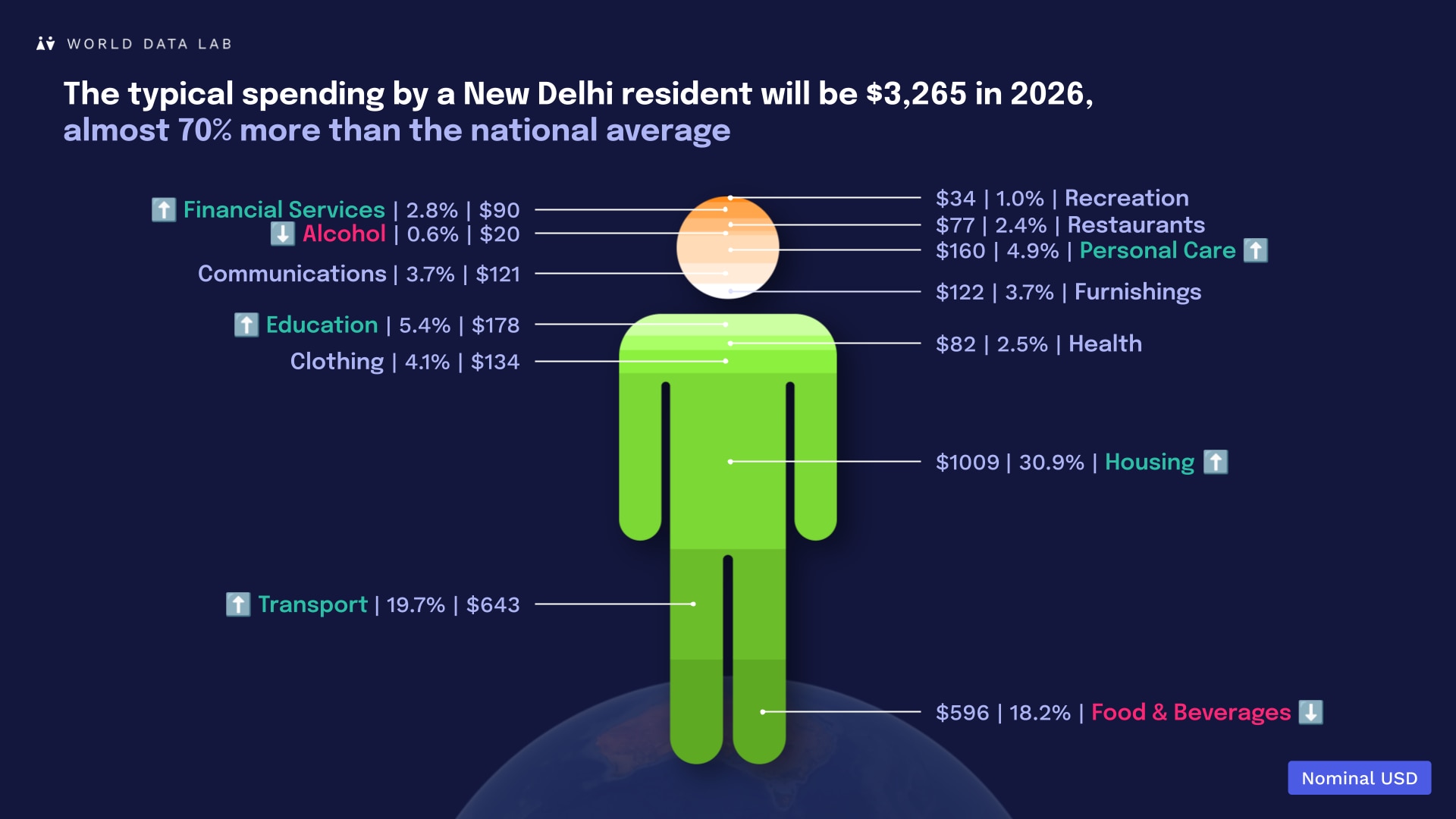

In 2026, the average Indian spends $1,927, while a resident of New Delhi spends $3,265, which is almost 70% more than the national average.

This spending premium reflects both higher incomes and distinct consumption patterns:

- Housing costs dominate the budget in New Delhi, accounting for 31% of spending compared to 14% nationally, reflecting higher living expenses. As cities develop, real estate and rental costs will increasingly shape consumer finances.

- Food and beverages account for a smaller share of spending in the city (18%) than the national average (29%). This follows Engel's Law: as incomes rise, the proportion spent on food declines, even though absolute spending remains the same or higher. Alcohol and clothing account for a smaller share of spending in New Delhi compared to the national average.

- Transport expenses are also higher in New Delhi, likely due to increased commuting needs and mobility costs.

- Spending on education, personal care, and financial services is higher in the city, indicating that investments in human capital and premium services play a larger role as incomes rise.

These patterns may signal what's coming as hundreds of smaller cities reach critical mass over the next decade.

Outside the city borders

City borders are more porous than traditional administrative definitions suggest, with important implications for market sizing and strategy development.

As consumer cities continue to proliferate across India, they will likely form similarly interconnected urban clusters, where consumption patterns and labour markets transcend city boundaries. Understanding these cities as economic regions rather than relying solely on administrative definitions will be crucial to developing an effective market strategy.

The growing middle class

Who exactly are these consumers filling India's expanding cities? By 2036, India's middle class and affluent consumers will account for 93% of all spending, up from 80% in 2026. By 2035, over 20% of each key generation in India (baby boomers, Gen X, millennials and Gen Z) will spend $45 or more per day. This creates opportunities for businesses to develop products and services that appeal to a wide range of age groups.

What this means for company strategy

1. A decentralized approach

Companies that limit their focus to the top five cities will miss 93% of consumer class growth. This requires distributed operations that can efficiently reach hundreds of smaller cities, as well as offerings tailored to the needs and preferences of local regional markets.

2. Thinking outside the administrative box

Administrative boundaries fail to capture economic reality. Strategies should take into account cities’ complete economic footprint.

3. Planning for Premiumization

Products and services should be designed for increasingly affluent and middle-class consumers, even in emerging cities.

4. Anticipate urban consumption patterns

As more cities reach critical mass, consumption patterns will likely shift towards those seen in New Delhi, such as housing-centric spending, the experience economy and mobility solutions.

The question for businesses is no longer whether to expand beyond India's megacities, but how quickly they can build the capabilities to serve the rapid growth happening across hundreds of urban centres.

All the data in this article is from the World Data Lab's peer-reviewed in-house tool and projections.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Cities and Urbanization

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on BusinessSee all

Wei Xue

February 10, 2026