Africa’s AI moment: How coordinated investment in 'green' computing can unlock $1.5 trillion

Investment in green compute can help boost AI in Africa Image: Getty Images

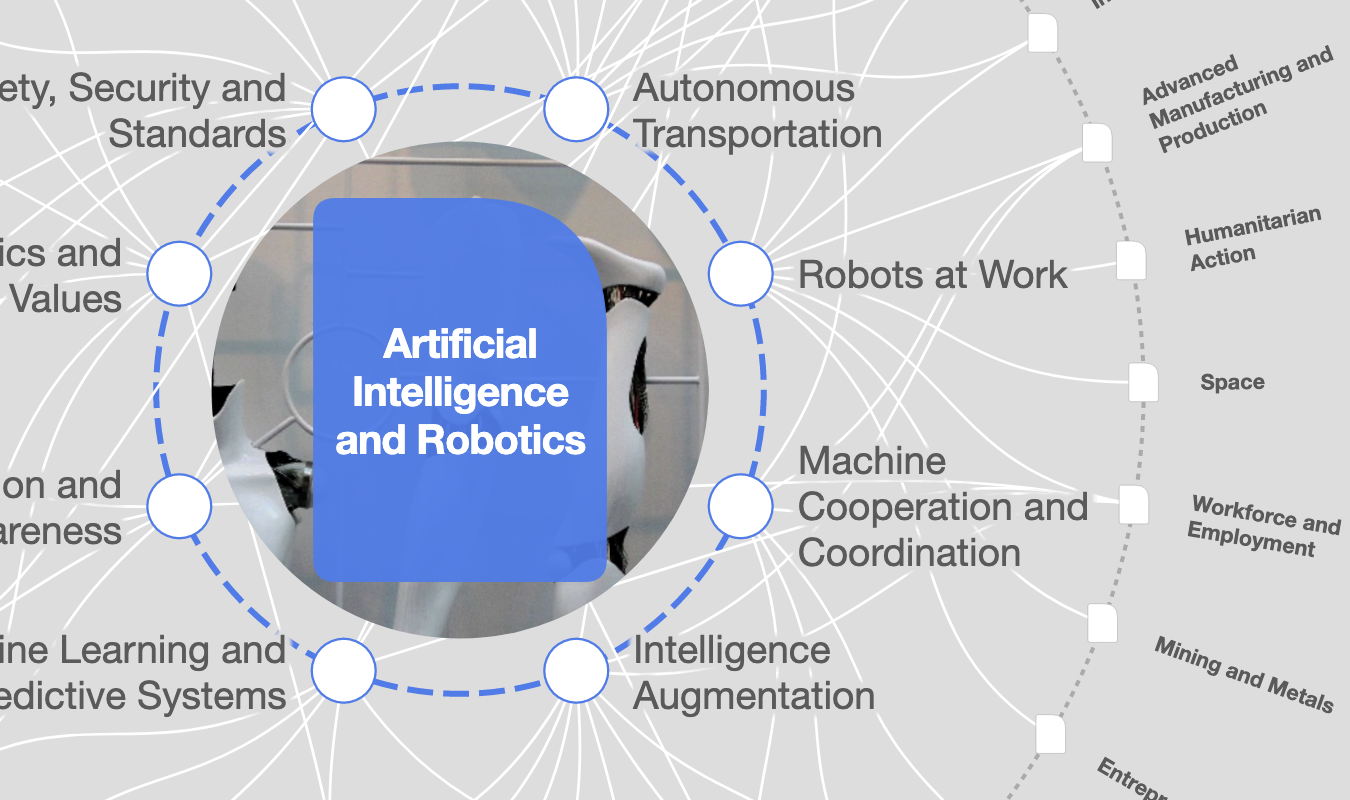

- AI innovation in growing, but without affordable GPUs, relevant datasets, aligned demand, reliable power and investment, new data centres risk sitting empty.

- The 'compute paradox' is systemic, requiring coordinated investment in GPUs, renewable energy, data infrastructure, demand, governance and skills.

- Breaking the compute paradox could unlock $1.2-1.5 trillion in economic value by 2030, with philanthropic and impact capital playing a catalytic role.

Africa’s talent, resources and vision for innovation in artificial intelligence (AI) are clear. Across the continent, innovators are already building solutions – from crop disease detection to medical imaging – that demonstrate AI’s transformative potential.

Yet without affordable graphics processing units (GPUs), relevant datasets, aligned demand and coordinated investment, new data centres risk sitting empty. GPUs are specialized computer chips originally designed to render images quickly. Today, they are essential for AI because their ability to process many tasks in parallel makes them ideal for training and running complex AI models.

Africa’s compute gap is less about new data centres and more about aligning GPU economics, power costs and demand orchestration.

”The stakes are immense: beyond the potential $1.5 trillion projected in economic value by 2030, AI offers tools to address development challenges while strengthening technological sovereignty. However, there is a fundamental constraint.

Despite housing 18% of the world’s people, according to the Africa Data Centres Association and the World Economic Forum, Africa accounts for less than 1% of global data centre capacity – and far less of the GPU infrastructure that powers AI.

Without accessible and affordable computing infrastructure, Africa risks being locked out of the AI economy, becoming a consumer of imported solutions rather than a producer of homegrown innovation. The question is no longer whether Africa has the talent or demand, but whether it can meet both – and build the sustainable AI infrastructure to unlock them.

Africa’s compute paradox

The challenge is one of simultaneous abundance and scarcity. On one side, demand for compute is rising fast. Researchers, startups and small- and medium-sized enterprises (SMEs) already face 7 million GPU hours of unmet demand for model training over the next three years, while only 5% of AI innovators have reliable access to advanced compute – a sign of latent demand held back by the absence of infrastructure rather than a lack of interest.

On the supply side, capacity is expanding.

Nairobi’s IXAfrica campus is operational and in 2025, entered a strategic partnership with Safaricom to deliver AI-ready infrastructure. Microsoft and Abu Dhabi-based G42 announced a commitment with the Kenyan government, with timelines still evolving.

Senegal’s Diamniadio National Datacenter, launched in 2021, and Cassava Technologies’ partnership with NVIDIA to deploy 12,000 GPUs through its AI Factory both signal increasing national and private sector investment in advanced compute.

While many of these projects are still scaling up, they illustrate growing momentum towards a more connected and capable African compute ecosystem.

Alongside these infrastructure developments, African-led organizations are helping to translate emerging capacity into accessible, AI-ready compute. Companies such as Udutech are pioneering GPU-as-a-Service models that allow impact-first researchers, startups and enterprises to access high-performance computing without the prohibitive cost of owning hardware.

Others, including Amini.ai, are building deep-tech infrastructure across Africa and the Global South, designed to close data and compute gaps. This infrastructure processes fragmented datasets, develops foundational models, and deploys insights that integrate seamlessly into business workflows, making data accessible and actionable.

Together, these initiatives complement the physical data centre investments by making advanced compute more usable, affordable and locally relevant – a critical bridge between hardware availability and real-world innovation.

Yet, many data centre operators still report under-utilized racks and slower-than-expected returns. The constraint is shifting from physical capacity to uncertain workload demand and the high cost of GPU access. Global supply dynamics continue to favour hyperscalers, leaving smaller African buyers facing steep prices and long delivery times.

In some markets, the cost of a single high-end GPU rivals the annual income of an average citizen, effectively pricing out local innovators. While many remain in the early stage of development, emerging GPU-as-a-Service platforms aim to lower these barriers by pooling demand and procurement.

In short, Africa’s compute gap may be less about new data centres and more about aligning GPU economics, GPU economics, data optimization, power costs and demand orchestration.

A system trapped in low equilibrium

The deficit persists because of self-reinforcing market failures:

- Capital mispricing: African infrastructure projects show low default rates, yet face borrowing cost premiums that deter long-term investment.

- Coordination failures: Compute requires synchronized investment across power, connectivity and regulation, along with mechanisms to define and activate market demand that remains fragmented and uncertain.

- Information asymmetries: Investors lack transparent data on demand; innovators lack clear supply options.

- Skills underinvestment: Declining training budgets leave GPU investments underutilized.

- Pricing barriers: High infrastructure costs mean innovators cannot access resources at sustainable rates.

- Business model uncertainty: Even globally, compute business models are unsettled. It remains unclear which workloads justify costs, how GPU time should be priced and who ultimately pays.

These failures keep utilization low, prices high and innovation suppressed – a cycle of underinvestment that risks leaving only the best-capitalized actors served.

The flywheel opportunity

Breaking this cycle could trigger the opposite dynamic: early access enables innovation; proven use cases reduce risk perceptions; higher utilization cuts costs; and renewable energy stabilizes supply. Early examples illustrate this potential.

Tunisia’s InstaDeep, later acquired by BioNTech, invested in an NVIDIA DGX system in 2018, catalyzing its growth to a $680 million valuation. The country’s leading incubator then shared a similar system among eight startups, which in turn attracted new capital. In Kenya, geothermal-powered facilities near Olkaria, while under development, aim to offer low-carbon, reliable compute for AI and cloud workloads.

These cases show that GPU infrastructure delivers a transformative impact when paired with talent development and demand aggregation. A call to coordinated action, Africa’s compute challenge is a systems problem requiring collective intervention.

Africa’s compute challenge is a systems problem requiring collective intervention. Strategic steps include:

- Coordinating GPU access, building datasets and activating demand across key sectors.

- Shaping markets through subsidies and blended finance to de-risk early facilities.

- Leveraging renewable energy to pioneer distributed, low-cost compute models.

- Strengthening governance frameworks so data sovereignty and public AI become demand drivers, with governments as anchor tenants.

- Building talent pipelines to ensure GPU investments achieve high utilization.

Why philanthropic and impact capital matter

Commercial investors recognize the opportunity, but face distorted risk signals and nascent demand.

Philanthropy and impact capital can:

- Absorb early risks through first-loss capital, guarantees, and FX hedges.

- Fund the “coordination glue”: demand aggregation platforms, observatories and venture builder funds.

- Provide anchor subsidies for GPU-as-a-Service until utilization reaches critical mass.

Market creation in infrastructure typically requires five to seven years. Catalytic capital is necessary to bridge this gap and prepare a viable market for commercial sustainability and scale.

The path to green compute

The route to Africa’s AI sovereignty runs through green compute infrastructure but progress depends on systemic investment. Africa has the renewable energy advantage, the talent and emerging solutions for data and demand. What is needed is coordinated investment that turns these assets into the backbone of Africa’s AI future.

The question is not whether Africa needs its own compute, but whether interests can be aligned to build the systems that unlock prosperity, sovereignty and innovation, or remain dependent on others.

This is the vision of the Africa Green Compute Coalition (AGCC) – a flagship of the AI Hub for Sustainable Development that is catalyzing research and development, as well as building new coalitions. AGCC aims to demonstrate how green, accessible compute infrastructure can unlock innovation and shared prosperity across Africa.

As a systems orchestrator, the coalition connects policy, finance, energy and technical capacity to ensure that infrastructure investments translate into real-world use cases, measurable inclusion and economic impact.

The authors would like to thank Tonee Ndungu, one of the founding members of the AGCC, for his contributions to this piece.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Artificial Intelligence

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.