To save globalization, its benefits need to be more broadly shared

Image: REUTERS/Jorge Silva

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Economic Progress

Economists tend to be advocates of globalization. The benefits of specialization and exchange are evident within a country’s borders: no one would seriously suggest that impeding the flows of goods, labour and capital within a country would raise national welfare. Globalization extends the possibilities of specialization beyond national boundaries. Recent work suggests, however, that while globalization is great in theory, vigilance is needed about it in practice.

The three main components of globalization - goods, labour, and capital - are associated with different costs and benefits. The preponderance of the evidence suggests that trade has positive impacts on aggregate incomes, but many people do lose out. The economic benefits of migration are very high, but it too has distributional consequences and impacts on social cohesion.

The case for globalization is weakest when it comes to free flows of capital across national boundaries (“financial globalization”). The growth benefits claimed for these policies have proven elusive. At the same time, they are associated with an increase in inequality. Hence they pose a dilemma for proponents of globalization.

There are also interactions between financial globalization and other policies. In particular, financial globalization binds the conduct of domestic fiscal policy and leads to greater consolidation, which also has distributional effects.

Aggregate and Distributional Effects of Financial Globalization

As many have argued, economic theory leaves no doubt about the potential advantages of capital account liberalization. It can allow the international capital market to channel world savings to their most productive uses across the globe. Developing countries with little capital can borrow to finance investment, thereby promoting their economic growth without requiring commensurate increases in their own saving. But equally, there is little doubt about the existence of genuine hazards of openness to foreign financial flows. This duality of benefits and risks is simply a fact of life in the real world.

The experience of countries with financial opening/openness bears this out. As Ostry and others (2009) and many subsequent studies have shown, the link between financial globalization and economic growth turns out to be complex. While some capital flows such as foreign direct investment boost long-run growth, the impact of other flows is weaker and critically dependent on a country’s other institutions (the quality of its legal framework; protection of property rights; level of financial development; quality of financial supervision) and how openness is sequenced relative to other policy changes.

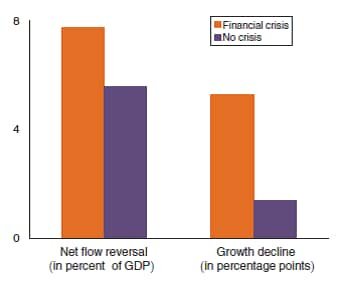

Moreover, openness to capital flows has tended to increase economic volatility and the frequency of crises in many emerging markets and developing economies. As a recent study (Ghosh, Ostry, and Qureshi, 2016) has shown, about 20% of the time, surges end in a financial crisis, of which one-half are also associated with large output declines—what one might call a growth crisis (see chart). The ubiquity of surges and crashes gives credence to the claim by Harvard economist Dani Rodrik that “boom-and-bust cycles are hardly a sideshow or a minor blemish in international capital flows; they are the main story.”

Capital Surges and Financial Crises

Notes: The chart at the top shows the total number of surges ending in a given year and those that end in a financial crisis. The second chart compares capital flow reversal and growth between surges that end in a crisis and those that do not. The analysis is based on data for 53 emerging market economies over 1980-2014.

Source: Ghosh, Ostry and Qureshi (American Economic Review, vol. 106 (5))

While the drivers of surges and crashes are many, increased capital account openness consistently figures as a risk factor—it raises the probability of a surge and of a post-surge crash. In addition to raising the odds of a crash, openness has distributional effects, raising inequality, especially when a crash ensues (Ostry, Loungani, and Furceri, 2016).

Financial globalization also interacts with other policies, notably fiscal policy. The desire to attract foreign capital can trigger a ‘race to the bottom’ in effective corporate tax rates, lowering governments’ ability to provide essential public goods. Fiscal consolidation has been shown to increase inequality.

Such direct and indirect distributional effects could set up an adverse feedback loop: the increase in inequality might itself undercut growth, which is what globalization is intent on increasing in the first place. There is now strong evidence that inequality lowers both the level and the durability of growth (Ostry et al., 2014). Hence, the existence of such a loop is not a theoretical curiosum but a very real possibility (Ostry, 2014).

The way forward: These findings suggest several steps to re-design globalization. The first step is to recognize the flaws in globalization, especially in relation to financial globalization. The adverse effects of financial globalization on macroeconomic volatility and inequality should be countered. Among policymakers today, there is increased acceptance of capital controls to restrict foreign capital flows that are viewed as likely to lead to—or compound—a financial crisis. While not the only tools available, capital controls may be the best option when it is borrowing from abroad that is the source of an unsustainable credit boom (Ostry and others, 2012).

Beyond this, in the short run, the extent of redistribution could be increased. This can be done through some combination of increases in tax rates (greater progressivity in income taxes; increased reliance on wealth and property taxes) and programs to help those who lose out from globalization.

· In the case of trade, programs of adjustment assistance do exist. That such programs have not always worked well in the past is an argument for fixing them, not for discarding them. “Trampoline” policies—including job retraining and assistance with search—to help workers bounce back from job displacement are essential.

· In the case of migration too, compensation to potential losers could be expanded by targeting areas of high entry of foreign workers. This can be done through more generous unemployment insurance benefits and greater resources devoted to active labor market policies to match displaced workers to jobs.

In the longer run, the solutions lie not in redistribution but in mechanisms that achieve ‘pre-distribution.’ More equal access to health, education, and financial services ensures that market incomes are not simply a function of peoples’ starting point in life. This does not ensure that everyone will end up at the same point. But the provision of opportunities to do well in life regardless of initial income level, combined with the promise of redistribution for those who fall behind, is more likely to build support for globalization than will simply ignoring the discontent with it.

The Inclusive Growth and Development Report 2017 is available here.

References

Ghosh, Atish, J.D. Ostry and M. Qureshi, 2016, “When Do Capital Inflow Surges End in Tears?,” American Economic Review, Vol. 106 (5).

Ostry, Jonathan D., A. Prati and A. Spilimbergo, 2009, Structural Reforms and Economic Performance in Advanced and Developing Countries, Occasional Paper 268 (International Monetary Fund, Washington, DC).

Ostry, Jonathan D., P. Loungani, and D. Furceri, 2016, “Neoliberalism: Oversold?,” Finance and Development, Vol. 53 (2).

Ostry, Jonathan D., A. Berg and C. Tsangarides, 2014, “Redistribution, Inequality and Growth,” Staff Discussion Note 14/02 (International Monetary Fund, Washington, DC).

Ostry, Jonathan D., “We Do Not Have To Live With the Scourge of Inequality,” Financial Times, Oped, March 3, 2014.

Ostry, Jonathan D., A. Ghosh, M. Chamon and M. Qureshi, 2012, “Tools for Managing Financial-Stability Risks from Capital Inflows,” Journal of International Economics, Vol. 88., 407-21.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Economic ProgressSee all

Joe Myers

April 12, 2024

Joe Myers

April 5, 2024

Pooja Chhabria

March 28, 2024

Kate Whiting

March 28, 2024

Joe Myers

March 28, 2024

Andrea Willige

March 27, 2024