A silver bullet won't solve a green problem

Understanding risk can make renewable energy installations more attractive to investors Image: Eric Herchaft/Pool via REUTERS

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Climate Crisis

- The localized approach to climate change has been largely ineffective.

- We must take a methodical approach to every aspect of this challenge.

- Knowledge of the risks involved will be key to the success of this approach.

Recent developments on the climate front have been more cause for concern than celebration. The failure of COP25 delegates to put forward comprehensive rules for implementing the Paris Agreement for carbon reduction all but ensures more paralysis and represents a lost opportunity.

In addition, virtually all simulations which chart the path to keeping the temperature rise below 2°C relative to pre-industrial levels assume not just a sharp reduction in actual emissions, but also the removal of carbon dioxide from the atmosphere. On emissions reductions, little progress has been made on a viable action plan - and, worryingly, there is still no scalable solution for carbon extraction.

There are a few glimmers of hope. The European Green Deal pledges a carbon-neutral continent by 2050, and recently 65 countries committed to reducing their carbon emissions to net-zero within the same timeframe. Unfortunately, the member states of the EU represent just 17% of global emissions and the 65 UN signatories account for only about 10%. Collectively, that’s one-quarter of global emissions; meanwhile, the rest of the world continues to postpone action as it wrestles with political ramifications and corporations contemplate the potential consequences to their bottom lines.

The global community has historically taken a localized approach to climate change, which has proven largely ineffective because it lacks the power of consensus and public-private partnership. Goodwill pledges will only get us so far, and carbon pricing alone isn’t sufficient to effect the large-scale transformation needed to put us on the path to a low-carbon future.

On a positive note, the World Economic Forum's Mission Possible Platform and the Energy Transitions Commission are establishing shared roadmaps for several carbon-intensive industry sectors, such as transportation. Their research shows that the transition to net-zero emissions by 2050 is possible, and at a cost of less than 0.5% of global GDP. More support must come from the global business community because of the expectation of our employees and shareholders.

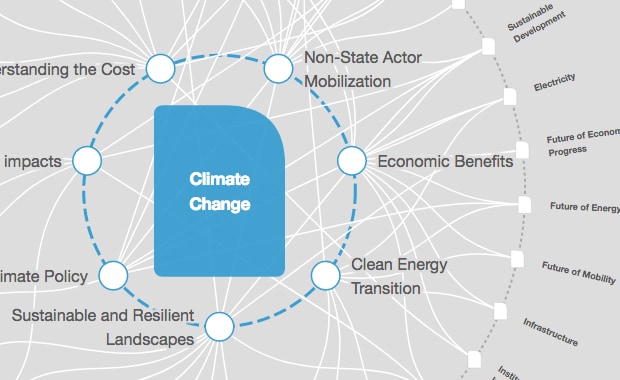

What’s the World Economic Forum doing about climate change?

We must move methodically – examining every sector and every carbon-emitting source, making an inventory of available technologies to reduce emissions, identifying what’s missing and figuring out how to channel investments accordingly. Indeed, investors are now recognising the profit potential in the transition to a zero-carbon world and the unprecedented opportunities that await post-transition.

Finance is a critical lever to this transformation, and a key example is found in reinsurance, which is poised to accelerate the transition to a more sustainable world. Reinsurance – with its ability to transfer risk and with its diversified portfolio – mitigates the negative effects of a changing climate and has the potential to remove financial volatility from carbon-free ventures such as renewable energy and emissions reduction. By transferring risk to reinsurers, enterprises can raise capital, secure loans, begin hiring and start innovating. If an event occurs that could potentially threaten or disrupt operations, the “insured” receives a payout so it can continue operating seamlessly. With the assurance of uninterrupted cash flows, investors and lenders have greater confidence.

Risk knowledge is a key asset in this endeavour. It gives us the insights to fully understand the risks – and opportunities – associated with novel technologies and enables the kind of risk-taking essential to drive innovation and investment.

Expectations of the corporate sector have never been higher and companies are under increasing pressure to demonstrate their sustainability performance. This is due to heightened shareholder activism, investor scrutiny and the exposure of balance sheets to environmental mishaps. The WEF Global Risks Perception Survey reveals that environmental risks are uppermost in CEOs' minds, while corporate boards are acting with more urgency on their obligation to uphold high standards on behalf of their shareholders.

As a result, corporates are turning to reinsurers for help. They are seeking financial mitigation of their sustainability risks such as extreme weather, excessive greenhouse gas emissions, chemical spills, drinking water pollution, the impact of negative environmental, social and corporate governance (ESG) activity by suppliers and competitors, and regulatory restrictions.

Swiss Re believes in the transition to a carbon net-zero world and is working with its partners to help the world arrive at this destination. We continually look for opportunities in both the public and private sectors and are developing partnerships that support scalable solutions to mitigate and adapt to climate change and close protection gaps.

A sense of urgency is imperative. Reinsurance is accelerating investment in low-carbon initiatives and proving to be a powerful enabler in mitigating the effects of climate change. Examples from the Swiss Re portfolio include:

Clean energy: Insurance for offshore wind installations in France and Taiwan, a solution which can be replicated throughout the world.

Sustainability/food supply: Coverage for farmers in underinsured nations such as Mexico, which guarantees replacement of lost income when extreme weather slashes crop yields.

Climate risk: Helping companies understand how their assets and supply chains could be exposed to severe weather from future climate scenarios.

For its part, Swiss Re is decarbonizing its business model. We have committed to net-zero emissions by 2050 on the asset (investment) and liability (underwriting) sides. As a global reinsurer, we can play a vital role in championing action on climate change far beyond our own industry.

It seems that 90% of what we read about the climate crisis addresses the problem itself, while only 10% puts forward concrete, feasible solutions. For every sector and every carbon-emitting source, we need to assess what technologies are available to bring down emissions and remove carbon dioxide from the atmosphere, what gaps need addressing and how to channel investments in the most impactful way. The business community needs to lead the way to a net-zero carbon world because it has the power of capital to fulfil the World Economic Forum’s mission: to improve the state of the world.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Climate CrisisSee all

Mette Asmussen and Takahiro Furusaki

April 18, 2024

Laia Barbarà and Ameya Hadap

April 17, 2024

John Letzing

April 17, 2024

William Austin

April 17, 2024

Rebecca Geldard

April 17, 2024