Global COVID-19 data tracks FinTech's progress through uncharted waters

Image: Paul Hanaoka/Unsplash

Bryan Zheng Zhang

Executive Director, Cambridge Centre for Alternative Finance, the University of Cambridge Judge Business SchoolTania Ziegler

Lead in Global Benchmarking, Cambridge Centre for Alternative Finance, University of Cambridge Judge Business SchoolHerman Smit

Associate Director, Data & Analytics at Cambridge Centre for Alternative Finance, Cambridge Judge Business School

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

The Digital Economy

- The global FinTech industry is growing amid the pandemic, although results vary across geographies and verticals.

- FinTechs have been adapting to fluid market conditions by revamping product and service offerings but still face significant operational challenges.

- They have reported the need for more supportive regulatory measures and regulatory innovation initiatives for future success.

In recent years, emerging technologies coupled with innovation in business models have resulted in the development of new financial instruments, channels and systems. FinTech, or technology-enabled financial innovation, has begun to reshape the provision of financial services around the world, from digital payments and digital lending to InsurTech.

Since the onset of the COVID-19 pandemic, there has been speculation about how the still-nascent FinTech industry would fare in a sharp economic downturn.

Conversely, there has been anecdotal evidence suggesting that FinTech is playing an important role during COVID-19; providing finance to micro, small and medium enterprises (MSMEs), facilitating mobile payments and expanding digital financial services to reach unbanked and underbanked populations. However, empirical data to support this is still scarce.

Have you read?

To bridge that gap, the Cambridge Centre for Alternative Finance at the University of Cambridge Judge Business School, the World Bank Group and the World Economic Forum partnered to undertake the Global COVID-19 FinTech Market Rapid Assessment Study, supported by the UK Foreign, Commonwealth and Development Office (FCDO) and the Ministry of Finance of Luxembourg.

Between June and August 2020, the combined research team surveyed 1,385 FinTech firms operating in 169 jurisdictions, posing a series of questions to gauge their market performance this year in contrast to last.

FinTechs are growing during COVID-19, but unevenly so

Twelve out of 13 FinTech verticals surveyed reported growth in H1 2020 compared to the same period in 2019. Digital payments reported a 21% year-on-year growth in transaction volumes — perhaps not surprising, given consumers and businesses are resorting to digital channels for sending and receiving payments and remittances during COVID-19.

Growth was also seen in digital capital raising, digital savings, WealthTech and InsurTech, with declines reserved to digital lending which, similar to bank lending, tends to be procyclical.

FinTechs that facilitate digital lending also reported an overall decrease in the new loan issuance but a 9% rise in defaults on outstanding loans.

Geographic differences show Europe and Asia-Pacific to be lagging

The market performance of FinTechs also varied across geographies. Although all regions assessed reported year-on-year growth in transaction volumes, FinTech markets in the Middle East and North Africa, North America and Sub-Saharan Africa had an average growth rate of over 20%. In contrast, Latin America recorded just a 13% improvement — but even slower growth was seen in Europe and the Asia-Pacific region.

FinTechs in jurisdictions that have experienced more stringent COVID-19 lockdown measures also tended to report higher growth rates.

For example, those from high COVID-19 stringency jurisdictions report, on average, a 14% growth in transaction volume in contrast to the 9% reported by those in low-stringency jurisdictions.

Digital payment firms in high-stringency jurisdictions reported a twice-as-high growth rate in transaction volumes than those in low-stringency ones. The same pattern also holds true for FinTechs that engage in Market Provisioning activities (e.g. RegTech and Enterprise Technology); here, firms in high-stringency jurisdictions reported a much faster growth rate.

It would therefore appear that in some verticals and markets, COVID-19 has accelerated the digitalisation of financial services.

FinTechs are adapting but significant challenges remain

Why have FinTechs been able to continue growing? One possibility is their nimbleness and ability to adapt quickly.

Two-thirds of FinTechs surveyed have made two or more changes to their existing products, services and policies in response to COVID-19 — often in onboarding criteria and procedures, reducing or waiving fees or commissions and the provision of payment easements.

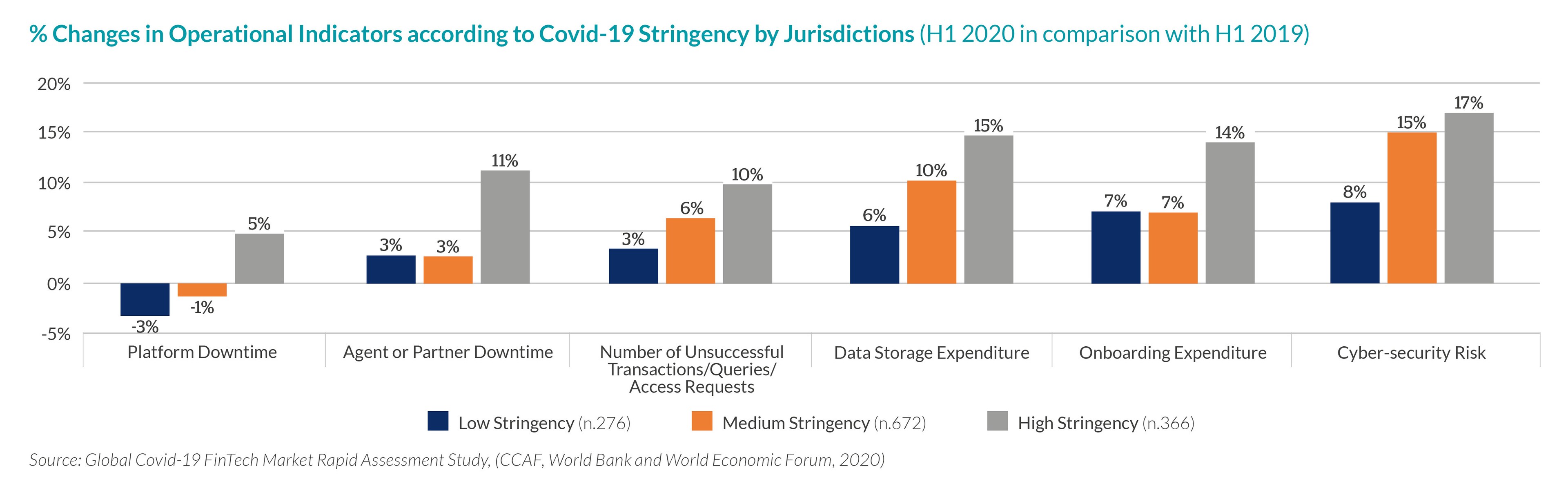

However, it’s not all rosy for all FinTechs. They also face headwinds in terms of operational challenges, rising costs and external risks. Globally, FinTechs report a 5% average increase in agent or partner downtime and a 7% average increase in the number of unsuccessful transactions, queries or access requests compared to H1 in 2019.

The lockdown effects are felt by Fintech too

FinTechs operating in jurisdictions with more stringent COVID-19 lockdown measures report facing more operational challenges and higher costs than firms from relatively low-stringency markets.

FinTechs in high-stringency jurisdictions are considerably more likely to report agent or partner downtime (11% vs. 3%), or experience unsuccessful transactions (10% vs. 3%) than FinTechs from low-stringency jurisdictions.

In line with these challenges, the financial position of many FinTechs has deteriorated during the pandemic. More than half reported that COVID-19 has had a negative impact on their capital reserves and 40% stated that their current valuation was negatively affected.

On the future fundraising outlook, FinTechs’ responses were more mixed, with 34% citing negative impacts of COVID-19 and 21% mentioning positive impacts.

FinTechs require even more regulatory support and innovation initiatives

Some FinTechs have benefited from receiving regulatory support during COVID-19, and the study's findings back this.

Such regulatory measures range from support for eKYC, simplification of customer due diligence and remote onboarding.

Firms engaging in digital payments also indicated that regulators have amended transaction limits; for instance, the Central Bank of Kenya doubled the daily transaction limits back in March 2020 to encourage mobile payments and subsequently extended the measure by six months.

And yet, FinTechs indicated that they are urgently in need of more regulatory support, such as faster authorization for new activities (indicated by 36% of FinTechs) and streamlined approval for products or services (31%).

Furthermore, it seems that FinTechs from EMDEs are more likely to report an urgent need for regulatory support than firms from AEs. The need is also higher in jurisdictions with more stringent COVID-19 lockdown measures than in lower-stringency jurisdictions (a 45% vs. 27% need of FinTechs asked, respectively).

There were also strong indications that regulatory innovation initiatives such as regulatory sandboxes and innovation offices would be helpful — reminiscent of findings from the Global COVID-19 FinTech Regulatory Rapid Assessment Study.

Further empirical research will only help shed more light on the fascinating development of FinTech in an increasingly digitalised world.

A full report on the study's findings is available here.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Emerging TechnologiesSee all

Ella Yutong Lin and Kate Whiting

April 23, 2024

Andre S. Yoon and Kyoung Yeon Kim

April 23, 2024

Simon Torkington

April 23, 2024

Thong Nguyen

April 23, 2024

Kalin Anev Janse and José Parra Moyano

April 22, 2024

Sebastian Buckup

April 19, 2024