Embedding ESG metrics: a time for companies to stand up and be counted

The conversation has shifted from reporting progress on ESG indicators to embedding ESG metrics into core business strategies. Image: Tyler Casey on Unsplash

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Davos Agenda

Listen to the article

- The conversation has shifted from reporting progress on ESG indicators to embedding ESG metrics into core business strategies.

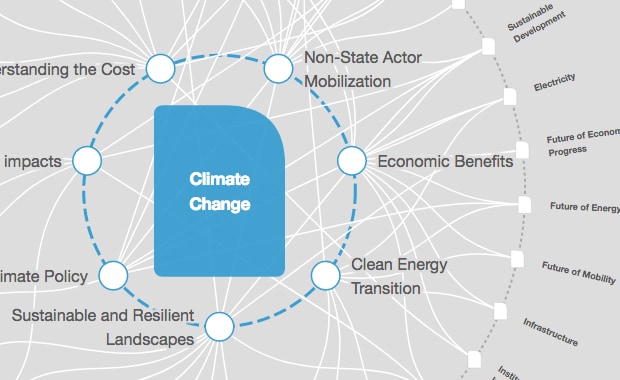

- The Forum’s International Business Council has identified 21 core stakeholder capitalism metrics – critical ESG indicators which companies can report on, regardless of industry or region.

- Companies that are true to their purpose and measure progress against these metrics are also positioning themselves to build long-term, sustainable value.

Purpose-led organizations must lead the change the world needs now.

Global society faces an array of challenges – the climate crisis, a pandemic, social inequality, the war in Ukraine with its attendant geopolitical risks. Addressing such complex, multidimensional issues requires collaborative solutions that bring together government, business, and social institutions. Investors and other stakeholders are calling on business to lead the way with meaningful, measurable, transparent action.

ESG metrics: address or embed

Answering the call to lead – and measuring progress against the World Economic Forum’s Environmental, Social and Governance (ESG) metrics – is not only the right thing to do, it’s the right business thing to do. As the pandemic made clear, business can only thrive if society thrives.

Edelman’s annual Trust Barometer tells us that people around the world rank business as the most trusted institution in society. However, they also believe that companies should do more to address the big issues. And business is feeling it. Deloitte’s recent CxO Sustainability Report, for example, revealed that a majority of respondents indicated feeling pressure from stakeholder groups to take action on the climate crisis.

Such advocacy is powerful – and it has produced results. Over a relatively short period of time, the conversation has shifted from reporting progress on ESG indicators to embedding ESG metrics into core business strategies. Calls by the investor community for transparent, comparable information have driven this change. Governments around the world are weighing in as well, including the US Securities and Exchange Commission, which recently proposed a rule requiring listed companies to disclose their climate risks.

As the CEO of an organization deeply committed to living its purpose of making an impact that matters, I recognize that this shift is critical to the future of our planet and our society. There are some in the political realm who would argue that business is overstepping its bounds by trying to deliver more to society than just profit. But I would argue that the global business community has too much of the know-how, influence, and scale to sit on the sidelines. Given the complexity of the issues, society is only going to get so far without our help developing much-needed solutions. And, as I’ve said, business can only thrive if society thrives, so we have skin in this game too.

I think what’s important is that companies have an authentic and persuasive story to tell about what they are doing and the social value they are creating. The imperative is to take action that is meaningful, measurable, transparent and tied closely to the organization’s purpose.

Focus on the purpose of ESG metrics; the profits will follow

Being “led by purpose” is a fundamental part of stakeholder capitalism. It encourages organizations to make ESG commitments and practice a core part of their business strategies and operations.

At Deloitte, our purpose guides decision-making across the organization, transcending business units, geographies and local cultures. It provides clarity and opens the door to greater impact, as we regularly ask ourselves: Does this action fit with our purpose? How will this decision impact our various stakeholder groups? What approach will create the most value?

Asking questions like these has been especially critical during the COVID-19 pandemic, a time that has tested the strength of many organizations’ commitment to societal impact. While some scaled back, Deloitte doubled down on our commitment. We launched our WorldClimate initiative and continued to give back a significant percentage of net income to the communities where we live and work. We also deployed significant resources toward fighting COVID-19.

For example, Deloitte’s “Sanjeevani Pariyojana” (“The Life Project”), a collaboration with Haryana state in India, leverages digital to provide virtual home care in rural communities to those with mild to moderate COVID-19, so they can recover at home. By increasing our overall investment to drive positive societal change, Deloitte has not only made an impact on societal challenges, but also achieved industry-leading performance. An added impact has been that Deloitte professionals see this as our organization living its purpose. In the current talent environment, this amounts to a critical differentiator and competitive advantage.

Who are the collaborating partners in this SGB Financing Initiative?

While every organization is different and we certainly do not have all the answers, I do believe that Deloitte’s experience with a purpose-driven strategy offers insights that can be useful to other companies.

Measuring impact requires verifiable metrics

As organizations advance on their purpose-led journeys, leaders that commit to actions that are measurable and transparent deliver greater value to their stakeholders. As a leading professional services organization with deep audit expertise, measurement is in Deloitte’s DNA. We know that only what gets measured gets done. Even as companies ramp up their ESG commitments, a critical aspect of their success will rest on having a consistent, universally agreed upon standard to measure and report their impact, so that investors and other stakeholders get clarity and comparability.

With the other Big 4 firms, Deloitte collaborated with the World Economic Forum’s International Business Council to identify existing ESG metrics used by leading standard setters and give businesses a common framework for evaluating impact. Together, we identified 21 core stakeholder capitalism metrics – critical ESG indicators companies can report on, regardless of industry or region. The metrics include nonfinancial disclosures organized on four pillars: people, planet, prosperity, and principles of governance.

These ESG metrics provide organizations with a clear roadmap of activities that should be measured to give markets greater transparency and improve comparability of information. Importantly, companies that are true to their purpose and measure progress against ESG metrics are also positioning themselves to build long-term, sustainable value.

Such disclosures are not meant to replace a company’s existing reporting, but rather to amplify critical topics in mainstream reporting. They also represent a stepping-stone to the ultimate goal: one set of globally consistent ESG standards.

Building a better future

The greater the number of organizations that adopt and report against ESG standards, the faster the world can make meaningful, lasting progress. The path to a more equitable, sustainable world is clear for those who choose to take it.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Davos AgendaSee all

Kate Whiting

April 17, 2024

Andrea Willige

March 27, 2024

Shyam Bishen

March 20, 2024

Simon Torkington

March 15, 2024

Miranda Barker

March 7, 2024