Investing in women and diverse entrepreneurs to boost the post-pandemic recovery

What female and diverse entrepreneurs want is not favouritism but an equitable starting line. Image: Pexels

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Davos Agenda

Listen to the article

- Women and diverse individuals often run up against systemic challenges and resource scarcity when pursuing entrepreneurship and small business ownership.

- What female and diverse entrepreneurs want is not favouritism but an equitable starting line.

- The greater presence of women and diverse fund founders should mitigate some of the demographic and cultural biases in the distribution of financing.

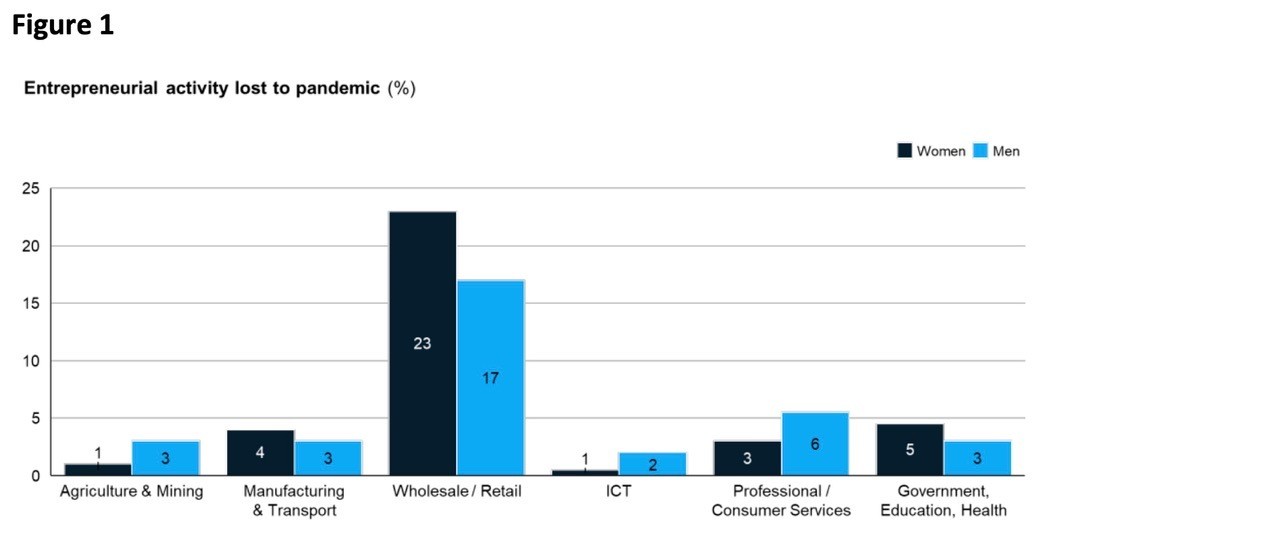

The COVID-19 pandemic has left no element of society untouched, exacting a tremendous toll on populations around the world, healthcare systems, and financial and labour markets. From a business standpoint, its impact has fallen disproportionately on women and ethnically diverse entrepreneurs and small business owners. A recent study by Global Entrepreneurship Monitor, for example, found women were 20% more likely than men to report business closures due to the pandemic (Figure 1) and nearly half of all female business owners in high-income countries reported closures.

Non-white business owners had to grapple with several additional challenges, such as a concentration in industries susceptible to disruption, including but not limited to retail, accommodation and food service, personal care, and laundry services (Figure 2). Since the financial health of these diverse entrepreneurs entering the pandemic already trailed their white counterparts, the disruption served to exacerbate negative outcomes and closures (Figure 3).

Women and diverse entrepreneurs' access to capital

According to a 2019 study, 61% of female founders opted to self-fund their venture. A closer look at women entrepreneurship in tech supports the notion of limited access to capital. A recent TechCrunch study of all venture funding found that female-backed ventures received just 10% of overall funding, with the remaining 90% going to male-backed ventures.

Limited capital is compounded for Black entrepreneurs due to their systemic exclusion from both venture and traditional banking. They are more likely to have bank loan applications rejected; when accepted, their applications are more likely to be subjected to heightened requirements. The unequal participation in financing systems prevents women and Black entrepreneurs from operationalizing and scaling their businesses.

Launching a new business requires the development of a variety of new skills and functions. Mentorship can not only help early-stage ventures access new markets, navigate financing options, implement the latest technologies, and learn managerial skills but also provide the ecosystem and vital support measures for launching a business.

Despite the need for mentorship in the entrepreneurial space, a recent study revealed women and diverse entrepreneurs were far less likely to have access to mentorship networks.

Implicit bias among consumers

US research suggests that companies of diverse entrepreneurs, especially those who identify as Black or African American, are grossly underutilized. While Black-owned businesses represent 2.2% of employer-run businesses in the US they generate only 0.33% of total revenues.

Several factors may contribute to the low utilization of Black and women-owned businesses, including inadequate resources to market goods and services to key target demographics. Still, research suggests a more nefarious force at play: negative biases associated with diverse business ownership and their subsequent influence on consumer purchasing decisions.

What female and diverse entrepreneurs want is not favouritism but an equitable starting line. To better understand why investing in diverse entrepreneurs is crucial in the post-pandemic world, we interviewed 20-plus diverse founders and investors. These conversations revealed benefits that extend beyond financial returns.

Efficiency at capital generation, despite limited access to funding

Our research suggests women and diverse entrepreneurs gravitate to non-traditional funding sources due to lower access to capital. Shirley Billot, founder of Kadalys, the first French-Caribbean natural cosmetic brand made with banana tree antioxidants, highlighted the fundraising challenge for businesses located in the Caribbean. Investors often view this region as a tourist destination, not a hub of entrepreneurship. To fill this funding gap, she pulled in local banana planters as company shareholders to raise funds while also giving back. Alternative sources such as the Women’s Funding Network and the Black Opportunity Fund also widen access to capital.

The commitment to creating socioeconomically impactful businesses is a key marker noted by the LEAP by McKinsey podcast panellists. In the health care space, Carla Robinson founded Canary Tech to improve access to care for underserved populations through remote medical support. This passion was ignited by her desire to support the elderly in Black communities who need regular help managing chronic conditions such as diabetes. Addressing gaps within these populations helps to create solutions that have an impact beyond initially identified targets.

Whether financing comes from private sources, corporations, or venture capital, familiarity or similar ethnic and gender demographics appear to help determine who secures financing, regardless of portfolio performance. Women and diverse entrepreneurs are poorly represented in the VC space, so in recent years these entrepreneurs have taken it upon themselves to launch their own funds. A Deutsche VC study found that from 2017 to 2020, women established 140 new funds, representing a 104% increase from 2010 to 2016 (Figure 4). Over the same period, 16 new Black- and Latino-led funds were launched, a 41% jump (Figure 5).

The need to support women and diverse entrepreneurs

The greater presence of women and diverse fund founders should mitigate some of the demographic and cultural biases in the distribution of financing while providing women and diverse entrepreneurs with invaluable networking opportunities when navigating the early stages of new business operations.

In addition, women and diverse entrepreneurs offer a unique perspective on underserved consumer segments. Recent studies suggest these demographics would be willing to shift brand loyalty if businesses were more focused on creating goods and services tailored to their specific needs and made a concerted effort to serve communities that have been historically excluded from mainstream outlets.

Investing in female and diverse ethnic minorities is a critical step in both taking reparative measures to mitigate the impact endured by disparaged communities and supporting the recovery of these communities in a post-pandemic world. Investors should take note.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Davos AgendaSee all

Kate Whiting

April 17, 2024

Andrea Willige

March 27, 2024

Shyam Bishen

March 20, 2024

Simon Torkington

March 15, 2024

Miranda Barker

March 7, 2024