Cities need financing to meet the global goals and fight climate change - here's why

Unlocking SDG financing sources for cities is key to tackling the climate crisis Image: Unsplash/Adrian Schwarz

Eugenie Ladner Birch

Nussdorf Professor and Co-Director, Penn Institute for Urban Research and Leadership Council Member, Sustainable Development Solutions Network- Cities bear the brunt of the climate crisis but mitigation mechanisms are falling behind.

- Finance, an enabling environment and political will are needed to get cities the proper infrastructure to fight the effects of and curb their impact on climate change in an inclusive, safe and resilient way.

- The international financial system must adapt to ensure cities receive significantly greater funding for sustainable development in the coming years.

The future of our cities is at a crossroads. Cities are home to half the world’s population and are on the frontlines of the climate crisis. They account for over 80% of the global GDP and more than 70% of global greenhouse gas emissions.

With cities bearing the brunt of the COVID-19 crisis and poverty levels falling slower in urban areas than in rural areas, achievement of the United Nations Sustainable Development Goal (SDG) 11 – “making cities inclusive, safe, resilient and sustainable” – has become even more elusive in recent years.

Moreover, for cities in emerging markets to mitigate and adapt to climate change, the International Finance Corporation (IFC) estimates the cumulative climate investment need at $29.4 trillion between 2018 and 2030.

Why are we in this predicament? The answer lies in three areas: finance, enabling environments and political will.

Why cities lack critical climate infrastructure

1. Financing gaps

Some $5-7 trillion is needed annually from multiple sources to achieve the SDG targets but the Global Financial Architecture – funding from the public, private and philanthropic sectors – is nowhere near meeting this need. Moreover, the quality and speed of the deployment of international cooperation are poor and the mechanisms for monitoring progress remain mired in systems designed for another era.

Delivering quality and sustainable urban infrastructure is one of the most pressing challenges for cities. Investment needs for urban infrastructure globally are estimated at $4.5-5.4 trillion per year, translating into an estimated funding gap of approximately $350 billion per year compared to current levels of infrastructure investment.

And yet, many of the world’s major cities vary significantly in their ability to allocate existing municipal budgets and attract external finance to fund sustainable infrastructure. Cities are often precluded from access to forms of private investment. Among 500 large cities in developing countries, only 5% have credit ratings recognized on international capital markets.

On the frontlines of delivering local services, city governments are best positioned to identify investment needs for sustainable urban infrastructure over the long term. Improving their access to sustainable finance will ensure their sustainability and resilience in the years ahead.

2. Enabling environments

Two-thirds of the 169 SDG targets require implementation at the subnational level, primarily in cities. Yet, many national governments still need to create an enabling environment to deliver funds and programmes to urban areas.

An enabling environment would include effective fiscal, legal and regulatory frameworks for cities to access affordable and sustainable finance, greater access to sufficient and predictable sources of funding to meet capital, operational and maintenance costs for infrastructure and to repay financing, as well as increased use of innovative and sustainable financing instruments, such as green bonds, for infrastructure investment.

In addition, many subnational governments need institutional capacity-building, technical assistance and local reform to undertake SDG-oriented programmes and policies.

3. Lack of political will

Nations often fail to recognize the two previous factors, as the Global Financial Architecture is primarily designed by and for nations.

Those controlling the Global Financial Architecture are unwilling to make key reforms, such as expanding multilateral development bank financing in cities and providing funding to encompass local capacity-building, particularly in establishing municipal creditworthiness.

Many nations are reluctant to make the necessary legal and policy reforms to equip subnational governments to implement the SDGs and climate change commitments.

Getting cities access to SDG financing

Achieving SDG 11 and the commitments in the Paris Agreement will require a radical transformation of the current international financial system to ensure that cities receive significantly greater funding for sustainable development in the coming years.

First, we must integrate an urban focus into the current efforts envisioning Global Financial Architecture reform and reinvention. Second, city governments need clear, actionable recommendations demonstrating viable mechanisms and tools to catalyze urban SDG finance.

Fortunately, there are encouraging efforts underway on these steps.

In June 2023, during President Emmanuel Macron’s Summit for a New Global Financial Pact, the Mayor of Paris, Anne Hidalgo, the Mayor of Rio de Janeiro, Eduardo Paes and Jeffrey Sachs, President of the UN Sustainable Development Solutions Network (SDSN) launched the Global Commission for Urban SDG Finance to advance a portfolio of recommendations to determine how to best unlock SDG financing sources for cities.

The Commission’s six task forces address critical areas of urban SDG financing, including:

- Reforming the multilateral development banks.

- Expanding existing and creating new funds or institutions.

- Attracting private sector participation.

- Developing an advocacy strategy.

- Recognizing geography and context.

- Balancing mitigation and adaptation.

What is the World Economic Forum doing to promote sustainable urban development?

Hosted at the University of Pennsylvania’s Institute for Urban Research and composed of finance experts representing the public and private sectors, more than 20 mayors from the Global South and North and scholars, the Commission will issue its final report by Autumn 2024 in advance of the UN Summit for the Future, the G20 meeting in Brazil and 2024 UN Climate Change Conference (COP 29).

And last month, the latest G20 Leaders’ Declaration mentioned cities for the first time. They endorsed the use of innovative urban planning and financing models and encouraging development financial institutions and multilateral development banks to follow the guidance outlined in the report on Financing Cities of Tomorrow by the Group of 20 (or G20) and the Organization for Economic Cooperation and Development. This acknowledgement is a promising step towards widespread recognition of the critical role of cities in shaping a more sustainable future.

By 2030, the global city population will have ballooned to five billion. Cities have a foundational role to play in how we will combat the sustainable development challenges over the next several decades. However, they can only live up to their potential through considerable expansion of access to SDG financing backed by the deep policy and legal reform of the Global Financial Architecture.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

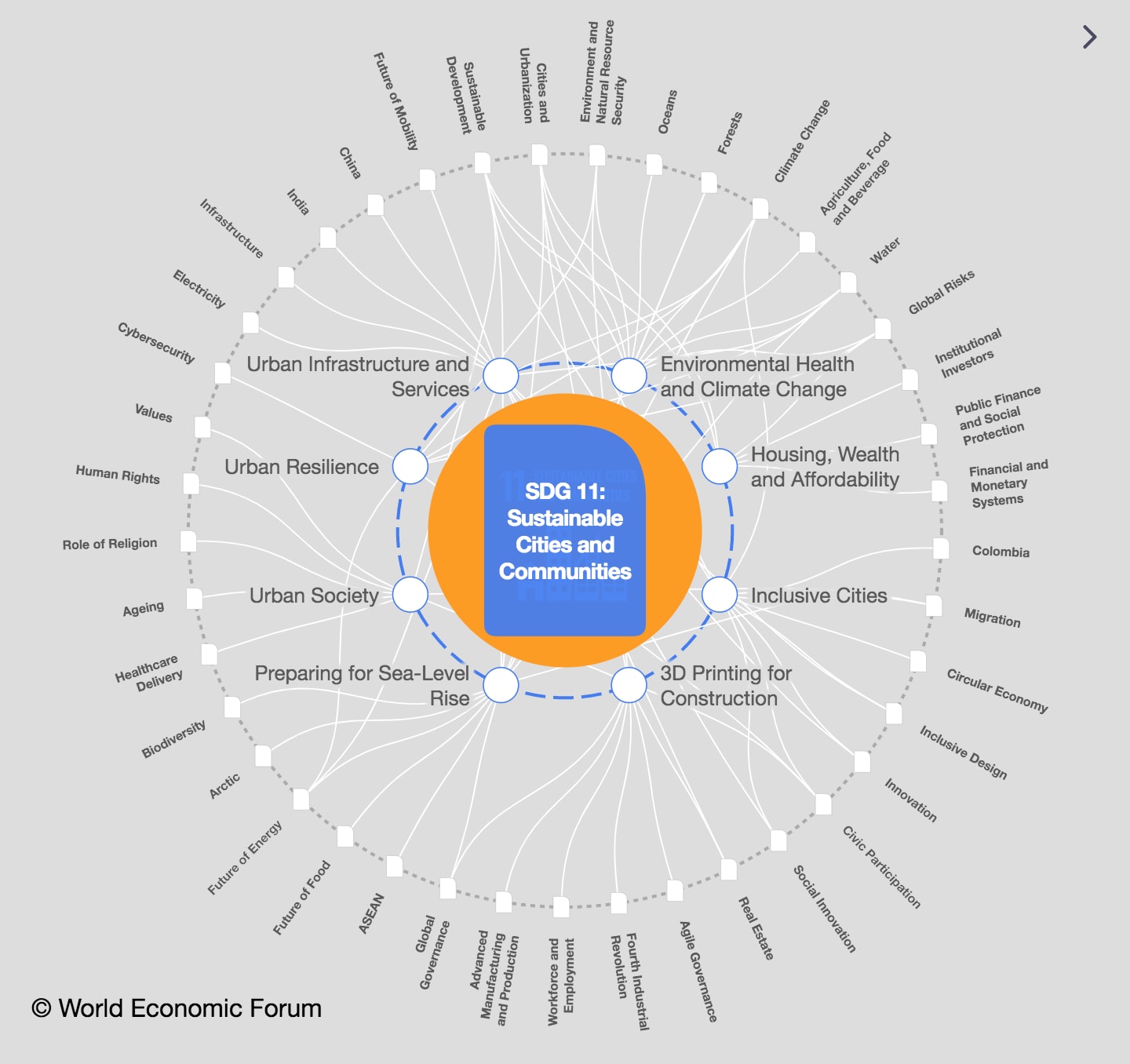

SDG 11: Sustainable Cities and Communities

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.