US tariff update fails to rattle global markets, and other finance news to know

The updated report is expected to be shared with the G20 later in July, and comes a month after global finance officials clashed over how climate change should be treated as a financial risk Image: REUTERS/Bart Biesemans

- Catch up on the key stories and developments shaping the financial world.

- Top stories: Markets stay steady despite new US tariff threats; ASEAN adjusts to evolving trade risks; BoE: Higher tariffs could trigger a wave of business failures.

- For more on the World Economic Forum's work in finance, visit the Centre for Financial and Monetary Systems.

1. Muted market response to latest US trade tariff announcements

The latest US tariff announcements on imports from 14 countries – including Japan and South Korea – have produced only a limited response in global financial markets, reports widely suggest.

After an initial dip, US stock indices steadied, with the S&P 500 and Nasdaq recovering from early losses while the Dow closed modestly lower, as investors digested the tariff delay and new trade threats, according to CNN. European and Asian markets also remained stable, with investors showing little sign of panic or broad sell-offs.

Some believe the markets are hopeful President Trump may ultimately step back from imposing the full tariff regime. However, the Telegraph reported that government bond yields rose, reflecting some investor concerns over fiscal pressures.

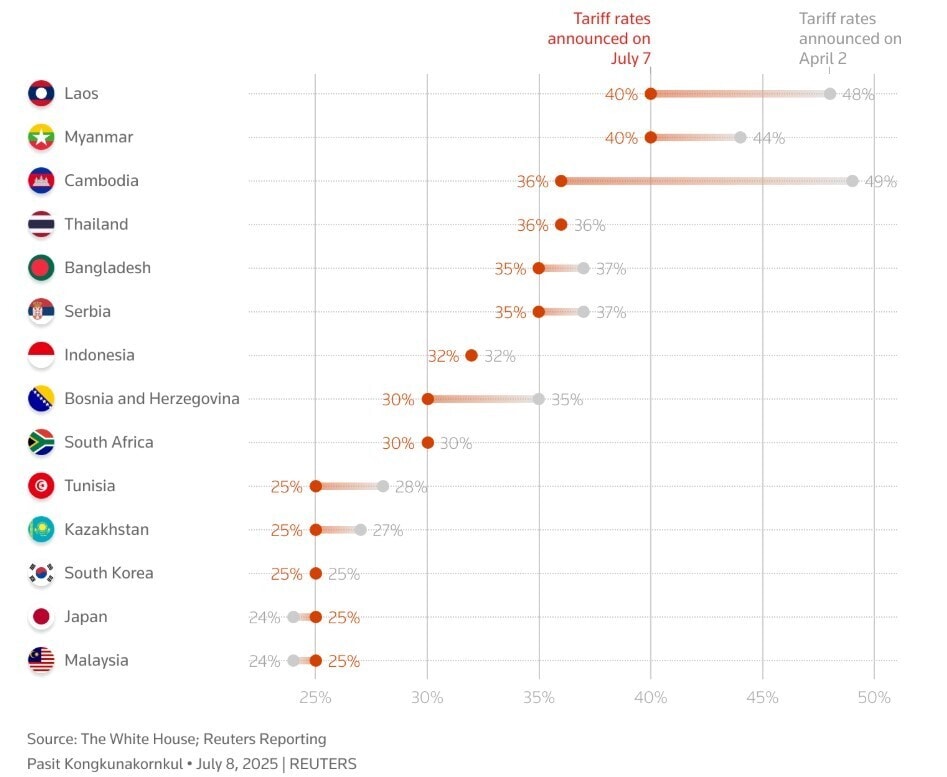

Trump confirmed that letters were sent to leaders of 14 nations, warning that new tariffs – ranging from 25% to 40% – would take effect on 1 August unless new trade deals are reached. He also warned of more letters to come. The White House stated that these rates are largely in line with those announced in April, though some countries face slightly lower tariffs after ongoing negotiations.

These are the key headlines highlighted in NPR's primer:

- A 10% minimum tariff applies to nearly all US imports; Chinese goods face 30%.

- Tariff revenue hit $30 billion in June – triple March’s figure.

- Trump plans up to 49% tariffs for countries without trade deals by 1 August.

- Japan, Cambodia and others face proposed tariffs of 24-49%.

- UK and Viet Nam reached deals; their rates are 10% and 20%, respectively.

- The European Union could face tariffs up to 50%; currently EU goods are taxed at 10%.

- Europe has not yet imposed retaliatory tariffs but may do so if trade tensions escalate.

- Steel/aluminium taxed at 50% (25% for UK); autos at 25%.

- New tariffs under consideration for copper, pharmaceuticals, semiconductors and lumber.

- Legal challenges to tariffs under the International Emergency Economic Powers Act are pending.

Any retaliatory tariffs could prompt even higher US duties, Trump warned. He also signalled that the 1 August deadline was final.

While the market response has been muted, some analysts caution that prolonged uncertainty could eventually weigh on business investment and consumer spending if no resolutions are reached. As one market strategist told CNBC, “We’ve seen this playbook before, and until there’s a clear escalation or a surprise, investors are taking a wait-and-see approach”.

How the Forum helps leaders understand change in global financial systems

2. US tariffs reshape ASEAN trade flows and investment priorities

Yet, while US and European markets have largely shrugged off the latest tariff headlines, the mood in Asia is one of strategic adaptation rather than complacency, Reuters reports.

Speaking at the Reuters NEXT Asia summit, corporate leaders and fund managers described a quiet shift in investment strategy, marked by Chinese firms diversifying production into Southeast Asia and rising foreign direct investment inflows into the region.

India emerged as a key beneficiary, seen by some as a structural hedge against China exposure. “We see more capital seeking diversification and resilience,” said one CEO, noting increased deal activity across ASEAN.

Talking to the Forum, Vijay Eswaran, Executive Chairman, QI Group of Companies, believes "this is not diplomatic hedging. It is deliberate diversification". The region grew by 4.6% in 2024 – far outpacing the US and EU.

Despite muted market reactions, the summit suggested Asia’s investment landscape is recalibrating for prolonged trade friction.

3. More finance news to know

US copper prices jumped 13% to a record high on 8 July following President Trump’s announcement of a 50% tariff on copper imports, reports the Financial Times. While prices on the London Metal Exchange dipped the next day, analysts warn demand may slow as buyers delay purchases. The US relies on imports for around 60% of its copper, widely used in electronics and construction.

Meanwhile, investors remained calm after Trump's warning of a potential 200% tariff on pharmaceuticals. European drugmaker shares initially dipped, but recovered on 9 July, while US pharma stocks rose 0.7%. India’s pharma sector, a key supplier of generics to the US, showed little reaction, with its healthcare index ending mostly flat.

Global banks are expected to report a 10% rise in markets' revenue for Q2, driven by increased trading activity amid shifting US tariff policies, according to analysis firm Crisil Coalition Greenwich. This follows a 15% gain in Q1, as tariff-related volatility boosted stock and US Treasury trading volumes.

The Bank of England (BoE) has warned that sharply higher tariffs could trigger a rise in corporate defaults and bank losses. In its latest financial stability report, the BoE said escalating global tensions and volatile trade levies risk deepening existing economic vulnerabilities. Heavily indebted global firms were highlighted as most at risk, with UK businesses broadly resilient despite potential earnings hits and rising borrowing costs.

The European Central Bank echoed concerns over rising global risks, saying it will also factor in security threats and potential restrictions on foreign investment alongside tariffs.

China’s central bank has surveyed financial institutions on the recent weakness of the US dollar, its causes and the outlook for the yuan, Reuters reports. The move comes ahead of key tariff deadlines with the US.

Japan's household spending rose 4.7% year-over-year in May, driven by auto expenses and dining out, beating forecasts. Analysts caution that recovery may be moderate amid ongoing global trade tensions and uncertainty from US tariffs.

India’s markets regulator, SEBI, has barred a US firm for allegedly manipulating the Bank Nifty index by simultaneously buying large volumes of bank stocks while shorting related derivatives to profit from price swings.

Global regulators should consider capping leverage and curbing the size of non-bank financial firms to reduce risks in core markets, the Financial Stability Board (FSB) has urged. The FSB said the fast-growing “shadow banking” sector, which includes hedge funds, private credit providers and insurers, held nearly $218 trillion in assets in 2022. The board warned that the sector’s opacity and scale pose increasing risks to market stability.

The FSB has also revised a report on its climate-related efforts, highlighting divisions among members, Bloomberg reports. The updated report is expected to be shared with the G20 later in July, and comes a month after global finance officials clashed over how climate change should be treated as a financial risk.

4. Read more on Forum Stories

The fintech sector is entering a phase of sustainable growth after rapid expansion during the pandemic, according to the World Economic Forum’s Future of Global Fintech report. Growth rates are stabilizing, with revenue and profits continuing to rise. The report highlights fintech’s crucial role in improving financial access for underserved populations and small businesses, while navigating challenges like economic uncertainty, evolving regulations and AI innovation.

Seth Borden and Daniel Tannebaum of Oliver Wyman explore how escalating tariffs are fragmenting the global financial system. With global growth projected to slow to 2.3%, financial institutions face rising geopolitical risks and cross-border challenges. The authors recommend strategies such as diversifying partnerships and clear communication to navigate this volatile landscape.

Are younger investors changing the future of retail investing? The World Economic Forum’s Global Retail Investor Outlook 2024, in partnership with Robinhood and BCG, shows that Gen Z and millennials are reshaping retail investing. With 45% starting earlier than previous generations, these investors favour AI-powered digital platforms and hybrid models that combine automation with human advice. This shift signals a major transformation driven by younger, tech-savvy, and diverse market participants.

US credit scoring agency FICO recently announced that it will begin incorporating Buy Now Pay Later data into credit scores for the first time, transforming how short-term digital borrowing shapes long-term financial outcomes. Microloans, however, can carry macro risks.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Financial and Monetary SystemsSee all

Eric Usher

February 24, 2026