Opinion

Carbon capture and storage is at a pivotal moment for decarbonization. Here's why

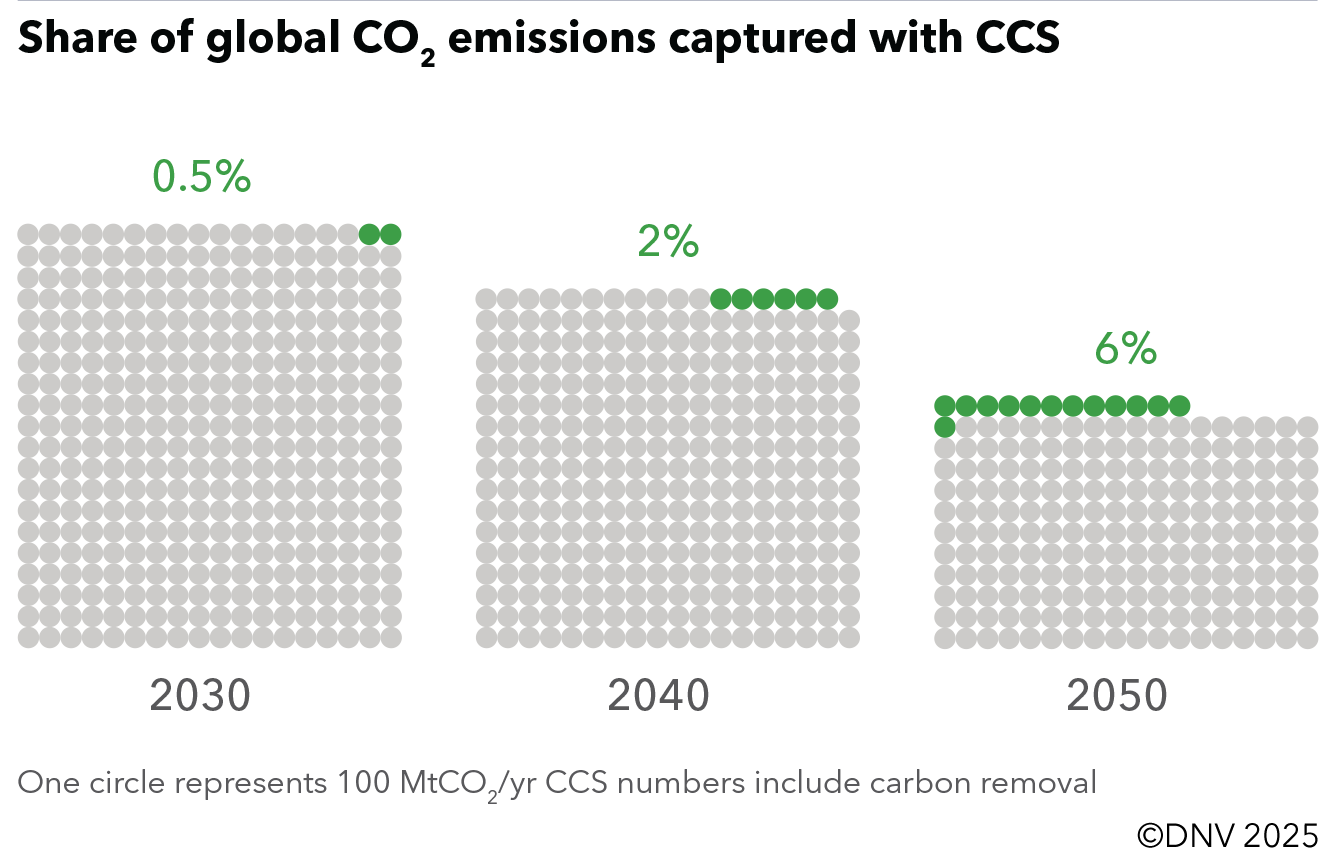

Carbon capture and storage will grow to capture 6% of global CO2 emissions in 2050, up from just 0.5% in 2030. Image: Reuters

- Carbon capture and storage (CCS) is often the most feasible decarbonization technology for industries such as cement, steel and chemical production.

- New research expects CCS to grow four-fold to 2030, a forecast backed up by developments in the wider carbon capture and storage industry.

- Technological developments will be key to the growth of CCS, but government approval and support will also be vital to help the industry grow and play an important role in reducing global carbon emissions.

Carbon capture and storage (CCS) is critical to the energy transition. It is often the most feasible decarbonization technology for process industries such as cement, steel and chemical production. Yet, it has failed to scale, until now.

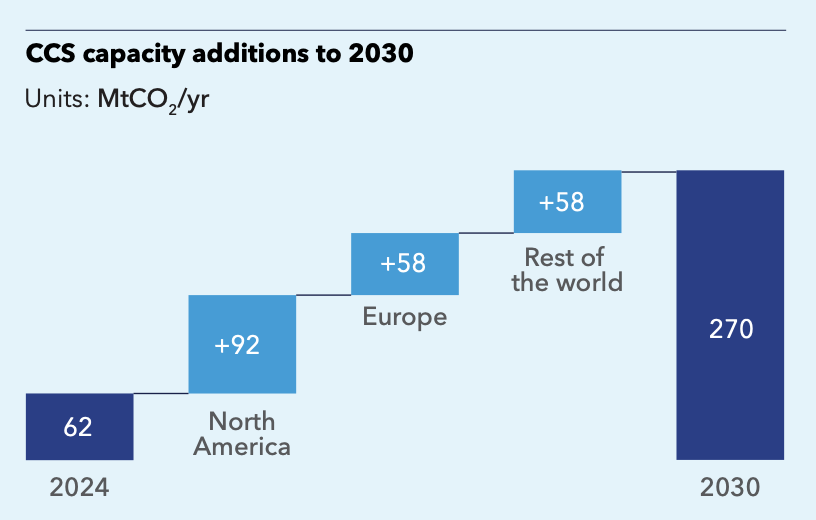

DNV’s recently-released Energy Transition Outlook: CCS to 2050 report shows that carbon capture and storage – which captures carbon dioxide (CO2) emissions at source, before being released into the atmosphere – is at a turning point. We expect it to grow fourfold to 2030 and this is backed up by developments in the CCS industry.

Northern Lights, the world’s first open-source CO2 transport and storage infrastructure, in Western Norway, received its first shipment of liquified carbon dioxide from Heidelberg Materials in May. Meanwhile, 1PointFive’s STRATOS facility in Texas is about to come into operation and it will be the world’s largest direct air capture (DAC) facility.

Here we demonstrate why DNV regards this as a pivotal moment for CCS.

Why the turning point on carbon capture and storage is now

Cumulative investments in CCS in the coming five years are expected to reach about $80billion. Approximately two-thirds of the projected capacity additions will occur in North America and Europe, with North America also being the present leader.

We expect policy-driven growth in CCS capacity to lower costs by about 14% by 2030, mainly due to reductions in capital costs for capture technologies and in transport and storage costs.

The hard-to-decarbonize sectors are where CCS has the most important role. Society will continue to need cement, fertilizer, steel and alike, which are produced through high energy processes that cannot be simply electrified.

The initial heavy lifting of CCS is being done by companies with their roots in the oil and gas sector. Northern Lights is a joint venture between Equinor, Shell and TotalEnergies while STRATOS is partly owned by Occidental, which is a reflection of the scale and complexity of the engineering involved as well as the investment required.

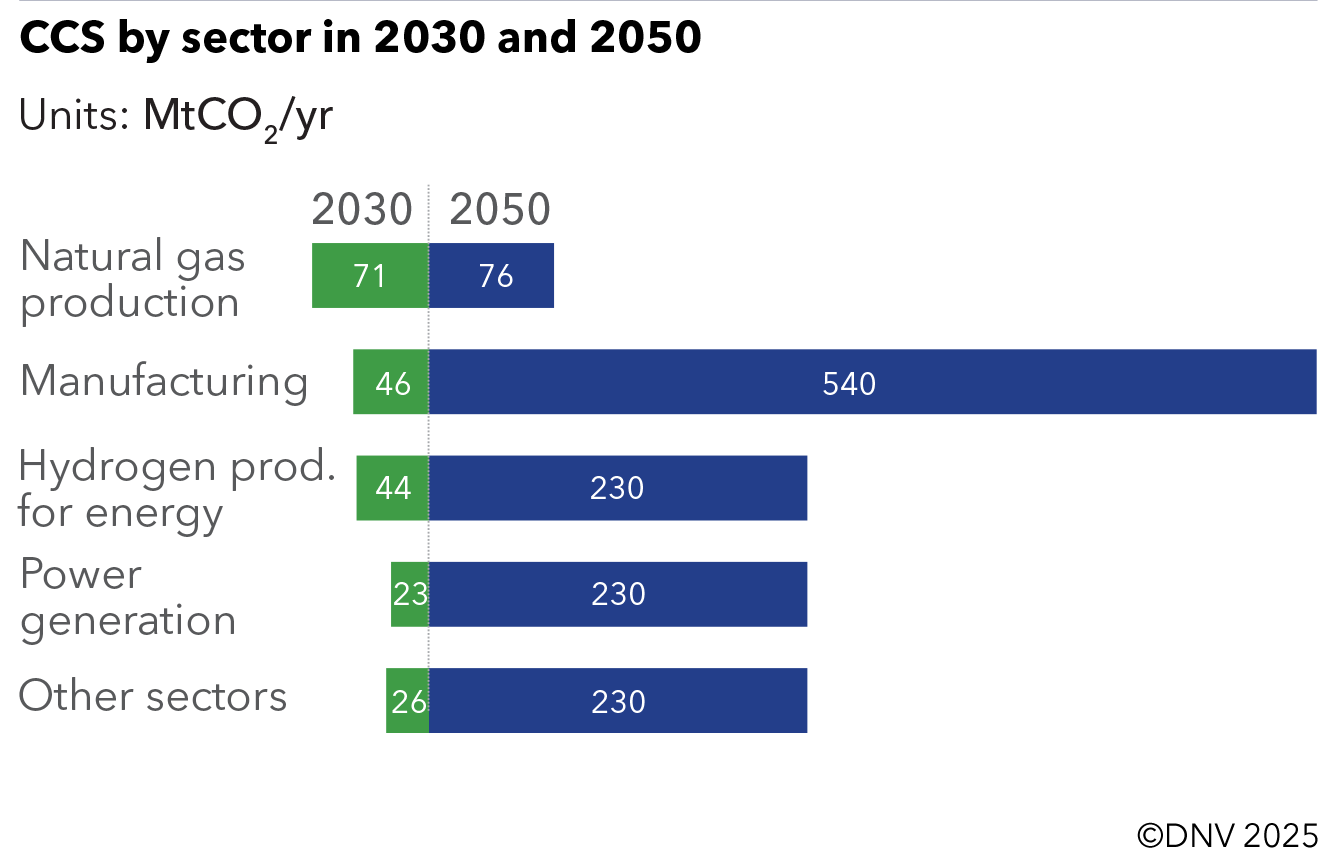

Most of the CCS deployment from known projects will be driven by decarbonizing the hydrocarbon production sectors (natural gas processing and low-carbon hydrogen and ammonia), where capturing carbon is generally cheaper due to higher CO2 concentrations and existing infrastructure.

After 2030, the strongest growth will be in hard-to-decarbonize sectors, with manufacturing accounting for 41% of annual CO2 captured by mid-century.

Manufacturing, particularly cement and chemicals, will be the biggest application of CCS in Europe; in North America and the Middle East, it will be hydrogen and ammonia; in China, coal power.

CCS will grow to capture 6% of global CO2 emissions in 2050 compared to just 0.5% in 2030, according to our estimates.

However, although this is impressive growth, it would have to grow six times more than forecast to achieve the volume needed for CCS in DNV’s Pathway to Net Zero Emissions by 2050 scenario.

It is much cheaper to reduce emissions now than to try and retrieve them in the future. However, we are a long way from achieving net zero emissions by 2050 and we will need carbon dioxide removal technologies, such as direct air capture – that extracts CO2 from the atmosphere at any location – to play an important role in reducing the carbon overshoot for the decades to come.

These technologies are expensive, but the carbon market will be supportive to growth. By 2050, about one-quarter of captured emissions will be captured through carbon dioxide removal.

Leadership key to carbon capture and storage growth

The growth of CCS is dependent on government leadership. The Acorn Project in Scotland recently secured government backing, however the opposition to the project demonstrates why advocates of CCS must navigate complicated political waters.

In the case of Acorn, there remains scepticism from the Green Party, who see CCS as a way of extending the influence of the oil and gas industry, and right-wing Reform UK, who do not see net zero ambitions as a priority.

Security has become the defining feature of energy policy around the globe. As the growth of CCS is reliant on government support, the shifting policy priorities provides a significant downside risk to CCS. There are though encouraging signs from the public sector, where we have seen major projects given the green light, and the business world.

The likes of ExxonMobil, Shell, BP, Chevron, and Aramco have announced individual CCS targets ranging from 10 to 30 MtCO2/yr by 2030. Major investments and acquisitions related to CCS are becoming more frequent and substantial.

In 2023, ExxonMobil acquired Denbury for $4.9bn, gaining access to its CO2 pipeline infrastructure. SLB acquired a majority stake in Aker Carbon Capture, while Occidental purchased Carbon Engineering for $1.1bn, followed more recently by its acquisition of a second DAC company, Holocene.

The political journey for CCS is maybe as complicated as the technological solution. But if we are to maintain a focus on ultimately reaching net zero emissions and continue to benefit from the goods produced by heavy industry then the world will need CCS. Now is the turning point for CCS and we should work together to accelerate it further.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

CO2 Capture, Utilization and Storage

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Energy TransitionSee all

Ryan Hardin

February 6, 2026