What isn’t getting enough attention? These under-the-radar trends, according to chief economists

The latest Chief Economists' Outlook reflects a relatively downbeat view of the global economy. Image: REUTERS/Shannon Stapleton

- The latest Chief Economists' Outlook reflects a relatively downbeat view of the global economy.

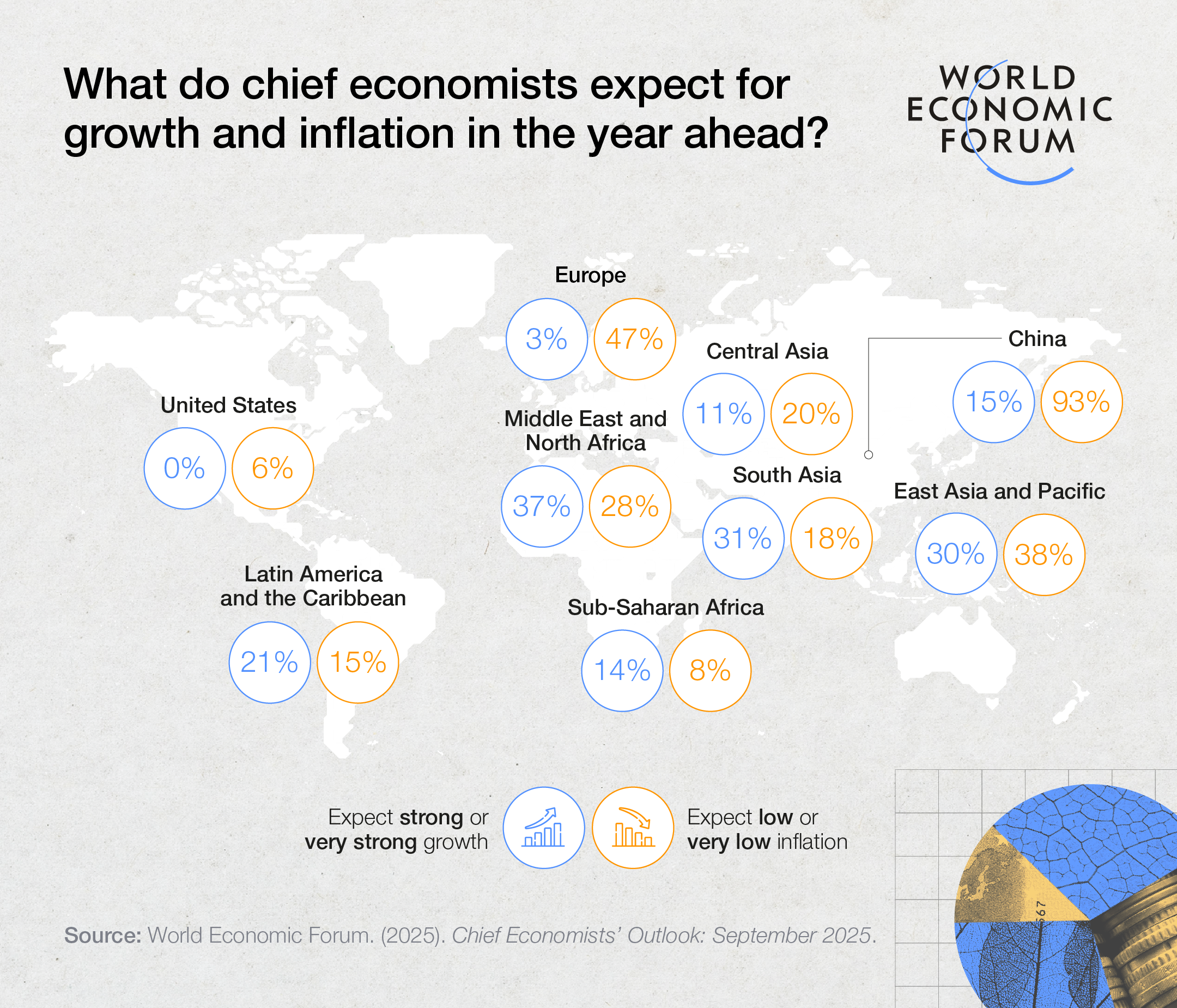

- But while some parts of the world are expected to endure higher inflation and lower growth, sentiment is far more positive for others.

- We asked leading chief economists about the most important-but-overlooked trends in different areas of the economy – including innovation and technology, labour markets, finance, and consumption.

Disruption, uncertainty, and long-term structural change are the big-picture trends shaping expectations for a weakened global economy, according to the World Economic Forum’s latest Chief Economists’ Outlook.

But what are some frequently overlooked developments likely to have a significant impact on specific areas of the economy in the year ahead? We asked leading chief economists for their thoughts.

Tariffs and trade tensions have realigned supply chains, the effects of a weakened US dollar are spreading, and the stunning pace of artificial intelligence development is creating uncertainty alongside new growth opportunities.

Still, there have been remarkable signs of resilience. While some parts of the world are expected to endure higher inflation and lower growth, sentiment is far more positive for others.

All of this will play out in particular ways in different parts of the economy. Below, chief economists break down what they see as generally underrated trends and developments in the areas of innovation and technology, labour markets, financial markets, and consumption.

Fabien Curto Millet, Chief Economist, Google

Topic area: Innovation, technology and data

“Most of the discussion around AI has been focused on its immense potential to raise productivity across the economy via its contributions as a “GPT” (General Purpose Technology). But its impact could go further still. As discussed by the late economic historian Nicholas Crafts, AI could actually also be an “IMI”: the Invention of a Method of Invention.

“In other words, AI could not just be a breakthrough, but a breakthrough in breakthroughs. This is a tantalizing prospect.

“In recent years, economists have worried that the burden of existing knowledge means new ideas are getting harder to find. Some estimates suggest that the United States needs to double the amount of research effort every 13 years just to sustain constant growth in terms of GDP per person. AI could greatly ameliorate the situation. Proof points are accumulating in areas as diverse as the understanding of proteins, the detection of gravitational waves, the deciphering of ancient texts, or the reasons why some superbugs are resistant to antibiotics.

“These breakthroughs have been celebrated individually; joining the dots across them has been done more rarely, and reveals AI’s potential to boost research productivity – helping to drive economic growth as well as advances in health and wellbeing.”

Svenja Gudell, Chief Economist, Indeed

Topic area: Labour markets and human capital

“The global economy will be shaped by a race between the effects of an ageing population with declining labour force participation, and the potential productivity boost represented by continued evolution and adoption of AI tools. Here are two key points to know about that race: It has already started, and we are already losing.

“Declining birth rates and shifting immigration policies have already begun chipping away at aggregate labour force participation rates in many nations, and the trend will only get worse over the next few years. Critical industries including construction and healthcare are currently dealing with worrisome labour shortages, despite a loosening labour market.

“The prospect of an AI-driven productivity boom that makes business more efficient with fewer workers is incredibly tantalizing. But our research shows that the “hands-on” economy of builders, farmers and care workers will see less impact from AI than the digital economy of developers and analysts. An ageing population will require more healthcare workers, not less. Improving housing affordability starts with mobilizing more workers to build more homes.

“While virtually every job will be impacted by AI to some extent, its impacts won’t be felt evenly across the labour market. Some industries will be wildly disrupted, others only mildly. The key challenge and opportunity represented by AI will be our own ability to harness the tools’ power to support human workers’ ability to adapt, reskill and upskill to meet not just tomorrow’s labour needs, but today’s too.”

Have you read?

Steffen Kern, Chief Economist and Head of Risk Analysis, European Securities and Markets Authority (ESMA)

Topic area: Financial markets and monetary policy

“As stablecoins go global, stability may falter.

“Geopolitics and technology dominate today’s headlines, but a quieter development could reshape finance in the years ahead: cross-country multi-issuance stablecoins (MISCs). At first glance, these seem like a welcome financial innovation, helping to take finance to a new level of efficiency between crypto and traditional markets.

“But things are not that easy. Stablecoins are not new. Their short history includes 23 failures in just over a decade, and earlier this year the Bank for International Settlements warned, as other expert have done before, of their fragile “redemption-at-par” promise.

“Yet just as this caution is becoming mainstream, MISCs mean that an even riskier variant is emerging. By issuing fungible coins in different jurisdictions backed by local reserve accounts, they propose to shift reserves across borders to meet redemption pressures.

“The incentive problems are clear. Cross-border reserve rebalancing is by design vulnerable to speculative attacks. Investors and supervisors may find reserves drained abroad before they can react.

“Today, the stablecoin market – about $250 billion – remains small enough to absorb failures. But projections suggest growth beyond $3.5 trillion within five years, with deep systemic ties to sovereign debt, money markets and beyond.

“A failure at that scale would not remain within crypto. It would gravely affect institutional and retail investors and hurt the wider economy. This risk is not worth taking.”

Wayne Best, Chief Economist and Senior Vice-President, Visa

Topic area: Private consumption and demand

“The labour market is changing and so too should our expectations.

“For years, economists have relied on a benchmark – around 150,000 jobs per month – to define healthy job growth in the United States. That number shaped expectations for consumer demand and economic momentum. But this benchmark is becoming less relevant. Structural shifts in the labour market are changing what “healthy” looks like.

“A generational shift is underway as baby boomers exit the workforce in large numbers. Meanwhile, a sharp slowdown in immigration is shrinking the foreign-born workforce. These forces are tightening labour supply. Unlike tariffs or hiring freezes, which reduce labour demand, retirements and slower immigration reduce labour supply. With fewer available workers to fill jobs, the unemployment rate can remain steady even if hiring slows.

“Using recent population projections from the Congressional Budget Office, our analysis shows that monthly job growth of just 40,000 to 50,000 could be enough to maintain a stable unemployment rate in 2026 – and possibly lower in 2027.

“Other recent data supports this. Monthly job growth averaged just 29,000 from June to August, down from 82,000 during the same period last year. Yet the jobless rate in August was 4.3%, only 0.1 percentage point higher than August 2024.

“Slower hiring will take some getting used to, but it won’t derail consumption in the year ahead. Income growth and wealth effects remain strong. Going forward, the measure of healthy job growth is not how many jobs are added – it’s whether the growth is enough. And increasingly, it is.”

Have you read?

Editor’s note: Responses from chief economists were lightly edited.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Economic GrowthSee all

Pooja Chhabria

February 27, 2026