Uniting Asia’s carbon markets: 5 steps for regional integration

Asia’s carbon markets are becoming increasingly integrated Image: Getty Images

Wee Kean Fong

Head of Nature and Climate, Content and Programming, Greater China, World Economic Forum- Asia’s carbon markets are becoming increasingly integrated, offering businesses the opportunity to revamp decarbonization plans and secure a competitive edge in the low-carbon transition.

- China’s new nationally determined contributions aim to reduce economy-wide net greenhouse emissions and to expand the national carbon emissions trading market to cover major high-emission sectors.

- Five steps help strengthen connectivity: a regional carbon market council, standards harmonization, digital infrastructure, a carbon trading corridor and an acceleration programme for regional champions.

Recent developments have shown significant progress in Asia’s carbon market landscape, which is rapidly developing and becoming increasingly interconnected. For businesses, this presents new opportunities to strengthen decarbonization plans, lower transition risk and gain a competitive edge in a low-carbon economy.

China’s new nationally determined contribution (NDC) aims to reduce economy-wide net greenhouse gas emissions by 7-10% below peak by 2035, and to expand the National Carbon Emissions Trading Market (ETS) to cover major high-emission sectors. This, combined with growing regional cooperation, signals a step change in Asia’s carbon market evolution.

Progress across the region illustrates momentum. Indonesia has proposed a two-way carbon market linkage with China and China-Japan-Korea strategic dialogues on carbon markets have been scheduled under the Asia-Pacific Financial Forum.

During the UN Climate Conference 2025 (COP30), the European Union and China agreed to join Brazil in a coalition aimed at improving collaboration on carbon markets. The coalition also includes the United Kingdom, Canada, Chile, Armenia, Zambia, France, Mexico and Germany.

As these markets mature, connectivity will be essential to ensuring scale, liquidity and integrity.

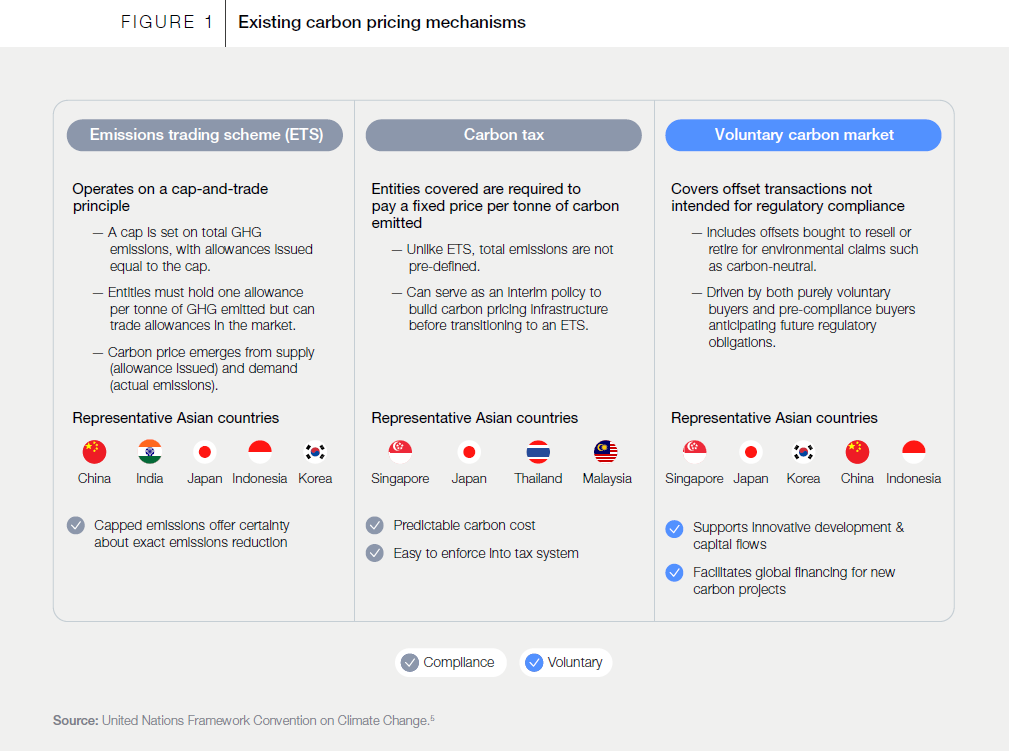

Carbon markets play a critical role in global decarbonization, enabling emissions reductions at the lowest cost while encouraging technological innovation and enhancing business competitiveness.

Asia’s evolving carbon market landscape

China: The anchor market

China’s carbon market is the backbone of Asian climate action. It is already the world’s largest by emissions coverage and has developed over the past decade through a dual-track system that combines compliance and voluntary markets. Its design draws global lessons while adapting to China’s industrial structure.

Key milestones include expansion of the ETS to steel, cement and aluminium for the first time. Its coverage now exceeds 800 million tonnes of carbon dioxide (CO2), representing more than 60% of the nation’s emissions. In the latest progress report, 1,334 new emitting entities had been added.

China’s Certified Emission Reduction programme also continues to underpin investment in innovative low-carbon technologies and nature-based solutions.

Advanced markets: Japan, South Korea and Singapore

Japan, South Korea and Singapore have already peaked emissions and are progressing towards absolute emissions reductions.

They have implemented mature carbon pricing systems and are now expanding voluntary and cross-border mechanisms to complement domestic action.

Emerging economies: Building capacity and integrity

Countries such as India, Indonesia, Thailand, Malaysia and Vietnam are at earlier stages. Their priorities include balancing climate ambition and development goals, safeguarding economic growth and industrial competitiveness, building demand, supply and integrity in voluntary markets and establishing credible infrastructure and governance.

Unlike the European market, Asia’s carbon markets feature diverse stages of development, rapid scaling potential and strong opportunities for regional collaboration.

Why Asia has a unique opportunity for cooperation

Three characteristics create a strong case for regional interconnectivity:

1. Price divergence and investment needs

Carbon prices across Asia vary widely. Price convergence and predictable pathways will stimulate private-sector investment in decarbonization.

2. Digital leadership

Asian markets are embracing digital innovation. Shared data infrastructure can strengthen market integrity through transparent data, monitoring using artificial intelligence and interoperable registries.

3. Integrated industrial supply chains

Asia’s role in global manufacturing and clean-technology supply chains means regional coordination can accelerate decarbonization across entire value chains.

Asia now hosts the world’s largest compliance market – China – advanced pricing systems, as in Japan, Korea and Singapore, and rapidly expanding voluntary markets across Southeast Asia.

5 steps to strengthen long-term connectivity

To turn ambition into an efficient and connected regional carbon ecosystem, Asia can prioritize five practical steps:

1. Establish a regional carbon market council

Create a formal platform to coordinate policies, align regulatory frameworks and build capacity. This can reduce fragmentation and support the adoption of shared standards across national systems.

2. Harmonize MRV and offset standards

Align measurement, reporting and verification (MRV) with Article 6 and integrity frameworks set by the Integrity Council for the Voluntary Carbon Market. Having harmonized standards ensures credibility, interoperability and scalability across borders.

3. Build interoperable digital infrastructure

AI-enabled, shared data infrastructure can improve transparency, reduce verification costs and support traceable carbon-linked products across supply chains.

4. Develop cross-border trading corridors

Article 6-compliant corridors can unlock liquidity, lower transaction costs and connect supply and demand. Countries should establish clear approval processes, corresponding adjustment rules and robust infrastructure.

If national linkages are initially complex, city-to-city or industry-specific pilots can provide early proof points.

5. Accelerate regional industrial champions

Launch acceleration programmes to support hard-to-abate sectors and scale technology deployment. Regional hubs, such as Singapore and South Korea, can facilitate best-practice exchange and drive industrial transformation.

Strategic imperatives for corporations

Carbon markets are a strategic accelerator for corporations to embark on a low-carbon transition journey and achieve sustainable business value. Corporations must prioritize three strategic imperatives:

1. Overcome challenges on the net-zero journey

Contemporary Amperex Technology's one core initiative for reducing carbon footprint across the value chain is through zero-carbon factories. Nine such facilities have been built, with zero-carbon electricity comprising 74.5% of battery bases’ power supply.

For its supply chain, it integrates carbon footprint assessments into supplier evaluations. This has raised zero-carbon electricity usage to 57% among anode/cathode suppliers and 45% among aluminium product suppliers.

It is critical to explore potential carbon-reduction benefit-sharing frameworks that cover the entire value chain, thereby promoting equitable distribution of carbon credits.

2. Capture new business growth opportunities

Compliance carbon markets, supported by industrial policies such as China’s green hydrogen initiatives, signal long-term opportunities and encourage early investment. Baofeng operates one of China’s first large-scale solar-powered hydrogen and oxygen production plants, which replaces traditional coal-based hydrogen and oxygen production.

The electrolysers in Baofeng’s plants, with a single-unit capacity of 1,000 normal cubic metre per hour (Nm³/h), can produce green hydrogen with a purity of over 99%. The generated green hydrogen and oxygen directly supply chemical systems to produce a series of chemicals, demonstrating new business opportunities and growth potential.

3. Actively build ecosystems

A successful decarbonization strategy relies on solid infrastructure and carbon management. This demands specialized expertise, such as emissions-reduction planning and low-carbon investment strategies.

In addition to its internal carbon market development, which is expected to cover 80 entities and approximately 30 million tonnes of CO2 equivalent (tCO2e) in the first batch in 2025, China Southern Power Grid (CSG) has supported capacity building across the market.

One key initiative is the co-investment of near-zero/zero carbon demonstration zones, where CSG provides end-to-end services such as carbon inventories, emissions reductions and evaluation standards.

The road ahead

Integrating Asia’s carbon markets will be a phased and collaborative multistakeholder effort.

With coordinated action, Asia can build a high-integrity, interconnected carbon market ecosystem that drives industrial transformation, channels capital into credible climate solutions and strengthens the region’s leadership in the global net zero and nature positive transition.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

SDG 13: Climate Action

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Climate Action and Waste Reduction See all

Laetitia Gardé and Marc Delobelle

February 26, 2026