Metals at scale for AI at scale: securing the data centre materials backbone

Data centres can't function without critical metals and minerals. Image: Getty Images/iStockphoto

- Data centres depend on a backbone of minerals and metals, and the rapid scale-up of AI technologies is pushing their material intensity higher.

- As the forthcoming World Economic Forum Annual Meeting in Davos focuses on scaling innovation responsibly, this feature highlights growing pressures on minerals and metals supply chains, and the limited visibility many industries still have into their material risks.

- Building resilience requires coordinated action across value chains – with greater transparency, aligned standards and planning.

- Discover more in the new report From Minerals to Megawatts: Building Resilience for EVs, Data Centres and Power Grids.

Global demand for data centres is accelerating. By 2030, capacity could exceed 100 GW, almost double today’s installed base, with a sharp shift towards AI-optimized facilities that require more power, cooling and specialized equipment. Every added megawatt embeds tens of tonnes of metals and minerals, tying digital expansion to a complex global supply system.

Understanding this materials backbone – and its risk implications – is now essential.

The foundation of each data centre

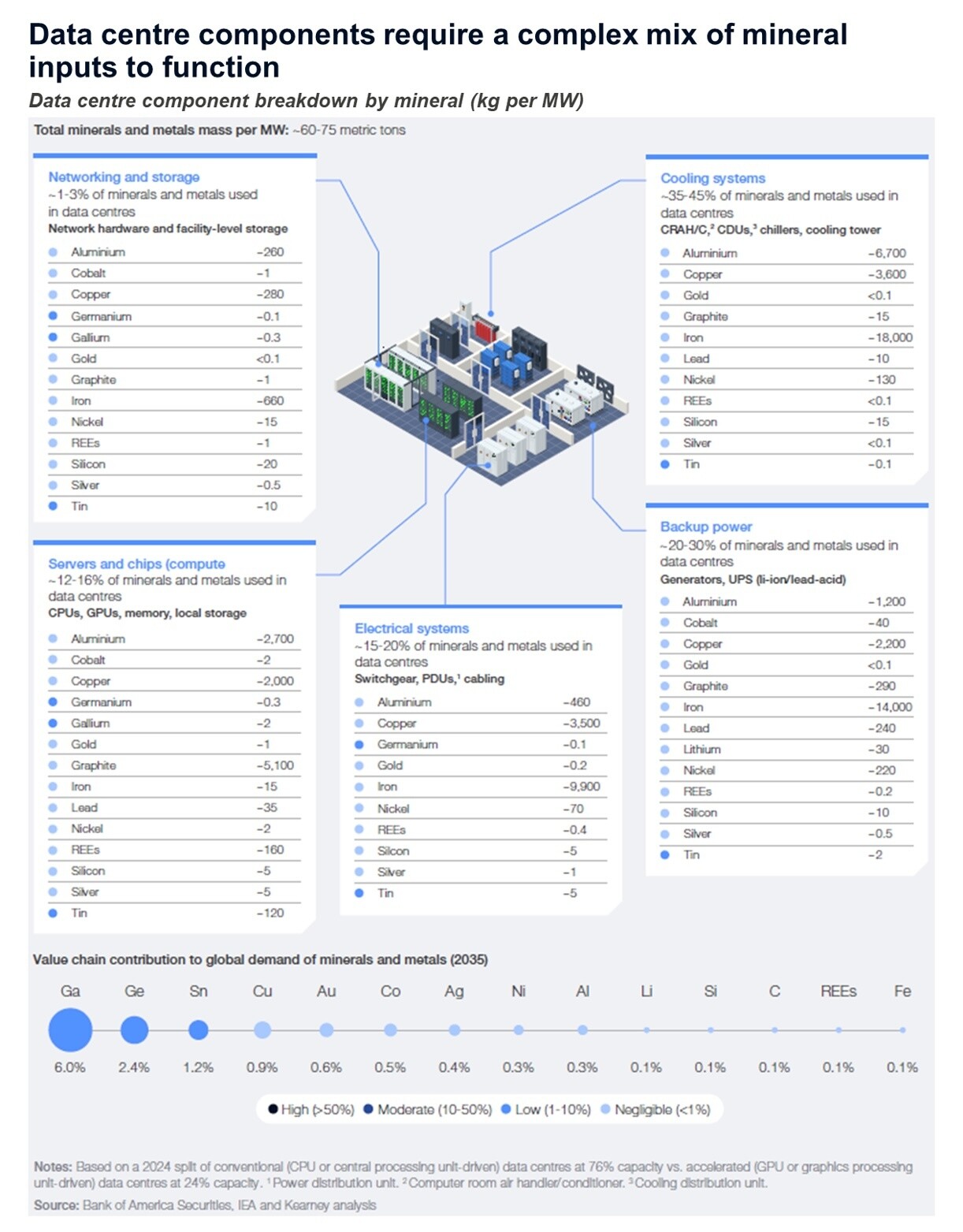

Each megawatt (MW) embeds around 60-75 tonnes of minerals, mainly in power and cooling systems, rather than servers.

Examples illustrate the scale:

- Microsoft’s 80 MW Chicago site used about 2,100 tonnes of copper – 26 tonnes/MW including on-site and near-site power connections; 'facility-only' is roughly 12 tonnes/MW.

- Large hyperscale campuses require 10,000 tonnes of steel for ~75,000 m2 facilities to over 200,000 tonnes for multi-building sites approaching ~1.7 million m2, depending on architecture and redundancy.

As AI-dedicated facilities rise – from ~25% today to more than 60% by 2035 – material intensity increases, with higher rack densities, heavier electrical backbones and more robust cooling.

This growing footprint links every facility to the full minerals chain – from mining to processing, manufacturing to end-product and the power systems behind it. Material dependence becomes structural exposure.

When mineral dependence becomes risk

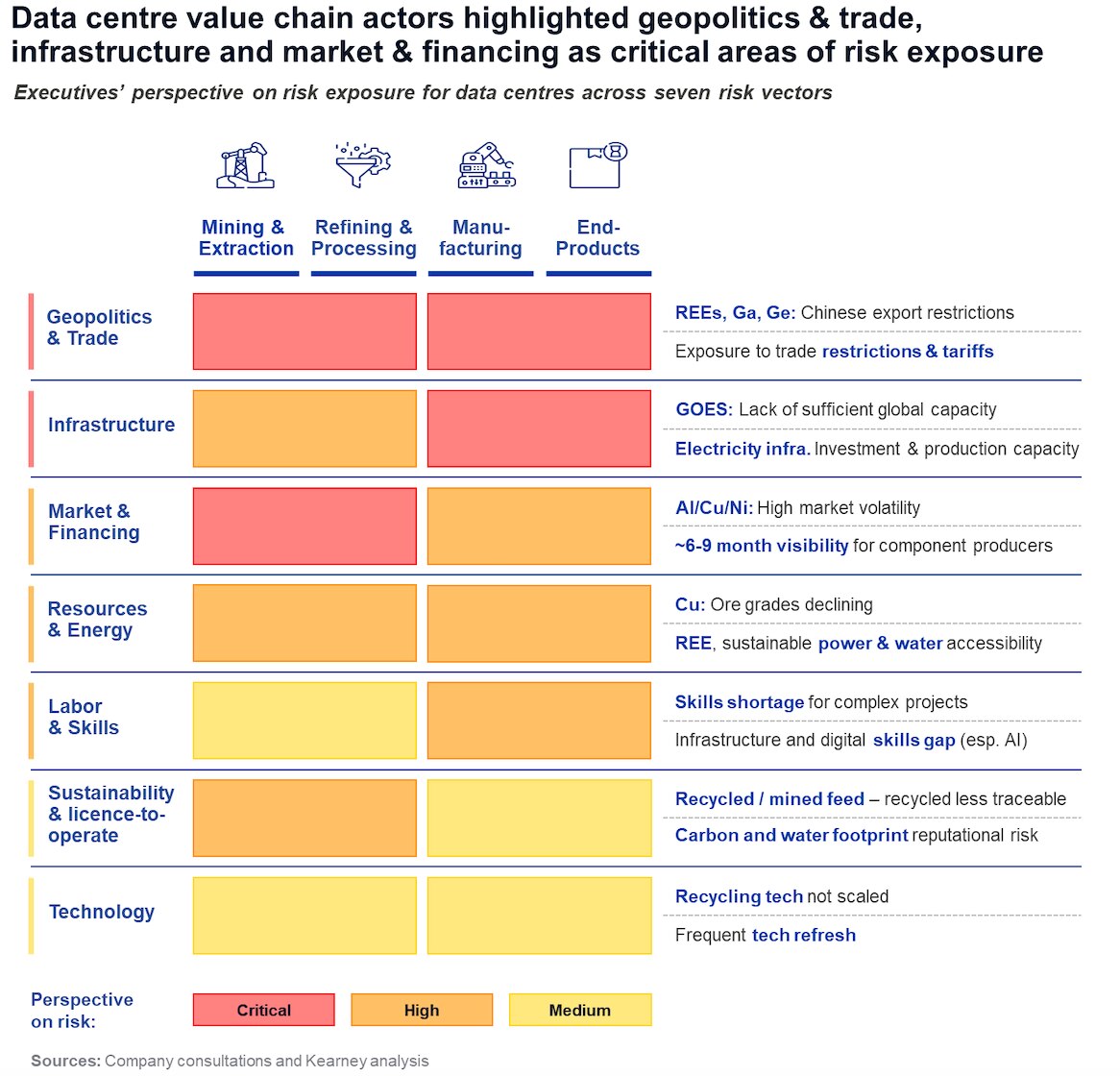

Mineral reliance appears through three exposure channels: access pressures, long-lead equipment delays and system-wide concentration risks.

Drawing on consultations with executives in the data centre value chain, these emerged as the most salient because they cut across geopolitics and trade, infrastructure, market, energy, skills, sustainability and technology.

Material access and price pressures

Access to critical minerals for servers, networking, cooling and power systems is increasingly unpredictable.

Gallium and germanium – vital for semiconductors and optical transceivers – experienced 25-30% price spikes following 2023-2024 export restrictions, illustrating how geopolitical decisions propagate through component supply. Copper and aluminium continue to swing sharply due to market volatility, tariffs and declining ore grades, influencing equipment pricing and supplier capacity.

While not dominating total spend, these fluctuations shape availability, timelines and design choices.

Long-lead equipment delays

Several essential components depend on minerals whose supply chains face bottlenecks. Limited output of grain-oriented electrical steel (GOES) constrains transformer production; similar bottlenecks affect generators and switchgear.

Large power transformers – critical for energizing new facilities – now require two to three years to procure, compared with weeks before 2020; backup generators often take one to two years. Labour shortages and long permitting cycles add to the delay.

Data halls can remain fully built yet idle for months while awaiting delayed grid-connection equipment, underscoring how upstream bottlenecks stall readiness.

Anecdotally, data centre component manufacturers note that testing equipment before shipping also requires considerable electricity input.

Integrated pressure across the value chain

As data centre build-out and grid-connection needs expand, demand concentrates across a narrow set of metals.

Estimates suggest over 4.3 million tonnes of copper could be associated with data centres and adjacent power infrastructure by 2035. Industry outlooks warn of a 25-30% copper shortfall by 2035, underscoring long-term exposure as facility and grid demand rise together and how resources and energy, sustainability, licence-to-operate and recycling influence future availability.

Material dependence has become a structural determinant of delivery timelines, equipment availability and long-term resilience.

Strengthening resilience through coordinated action

Because data centres represent a small share of global metal consumption, data centre operators cannot shape outcomes alone; they must contribute to broader efforts across miners, refiners, manufacturers, utilities, financiers and policymakers. Resilience depends on better coordination, planning and flexibility across the ecosystem.

A coherent response draws on five reinforcing capabilities to which different actors across the value chain can contribute:

1. Visibility

Visibility means building a shared understanding of where minerals sit across data centre subsystems and how supply dynamics are evolving.

Examples include: early mapping of material needs across power, cooling, IT hardware and grid-connection equipment, as well as strengthened monitoring of upstream mining and refining.

2. Legitimacy and trust

Legitimacy and trust refer to the ability of neutral platforms to convene operators, manufacturers, utilities and policy-makers, creating shared situational awareness.

Industry forums or public-private dialogues, for instance, can help align expectations on long-lead components or emerging bottlenecks.

3.Influence

Influence involves shaping interoperable standards or frameworks that reduce qualification delays and widen sourcing options.

Examples include: regional work to harmonize testing requirements, standardize specifications or define recycled-content thresholds that streamline procurement and enhance flexibility.

4. Execution capacity

Execution capacity reflects the ability to translate insight into delivery by expanding options and strengthening preparedness.

Illustrative practices include: earlier procurement of long-lead equipment, dual-qualification of suppliers and design choices enabling copper-aluminium substitution. Circularity also reinforces capacity. The Microsoft-Western Digital pilot, for example, shows how targeted recovery of high-value components (including rare-earth magnets) can diversify inputs and reduce exposure.

5. Technology enablement

Technology enablement provides the tools to anticipate bottlenecks and test scenarios before disruptions occur.

Traceability pilots, predictive analytics and system-wide modelling tools are being tested across several sectors to improve visibility and forward planning.

Together, these capabilities support a more resilient digital-infrastructure base that can scale with long-term demand, while withstanding volatility across the minerals system.

As the digital economy expands, its material foundations matter more than ever. The reliability of data centres increasingly depends on a minerals system characterized by concentrated supply, rising demand and long-lead cycles. Strengthening resilience through visibility, flexibility and coordinated action will be essential to enable digital infrastructure to grow at the pace the 21st century requires.

Read the report From Minerals to Megawatts: Building Resilience for EVs, Data Centres and Power Grids to explore this further.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Semiconductors

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Manufacturing and Value ChainsSee all

Frederik Kristensen

January 20, 2026