The adaptation inflection: Why bold action wins amid relentless disruption

This is the "adaptation inflection" now emerging. The companies pulling ahead treat disruption not as a storm to be waited out, but as a permanent feature of the landscape. Image: Marcus Woodbridge/ Unsplash

- Disruption has become the new normal in the global economy and the most successful companies are getting better at navigating it.

- AI has become the "great divider": companies that lead on AI adoption are feeling more optimistic about its impact and integration.

- AlixPartners and the World Economic Forum are collaborating on a Disruption Navigator to help companies visualize how disruptive forces interact, turning volatility into competitive advantage.

Disruption is no longer a series of shocks; it has become the baseline of the global economy. Yet the 2026 AlixPartners Disruption Index reveals a critical shift: executives report feeling less disrupted and more confident than last year, even as the underlying forces of change remain intense. The world isn't getting simpler – instead, successful companies are getting better at navigating complexity and even turning it to their advantage. In doing so, they are proving that dynamism and disruption are two sides of the same coin.

Our seventh annual study – based on responses from more than 3,200 senior executives across 12 countries and 10 industries – measures the number and impact of disruptive forces to calculate our Disruption Index. That score declined from 73 in 2025 to 70 in 2026, a 4% decrease. Simultaneously, the share of executives who describe their company as "highly disrupted" dropped from 57% to 48%. Yet, beneath these averages lies a sharp divergence in experience, confidence, and performance.

Executives are polarizing into two camps. This year, 37% say they are less anxious than a year ago – more than double last year’s figure – while 24% say they are more anxious, up from 17%. As this "middle" collapses, a clear divide emerges. For one group, persistent disruption has become normalized; they have built the muscle memory for change and are using disruption as a catalyst for growth. For the other, leaders may be slipping into complacency or, worse, decline.

To use a sailing metaphor: in rough seas, some companies read the weather, ready their ships and crews, and deliberately sail into the storm to capture emerging opportunities. Others, less bold or less prepared, stay close to shore or remain in safe harbours, accepting fewer rewards in exchange for reduced risk. The routes they choose mean that executives and their organizations will experience – and report – very different levels of disruption.

This polarization is especially vivid in the world's most dynamic economies. China and the United States report among the highest levels of disruption, yet they are also home to many of the most competitive, fast-growing, and innovative companies. High disruption is not the opposite of success; it is often the natural consequence of dynamism, innovation and creative destruction. The companies leading their industries are those that recognize this reality, leaning into disruption to find opportunity rather than retreating from it.

AI: the great divider

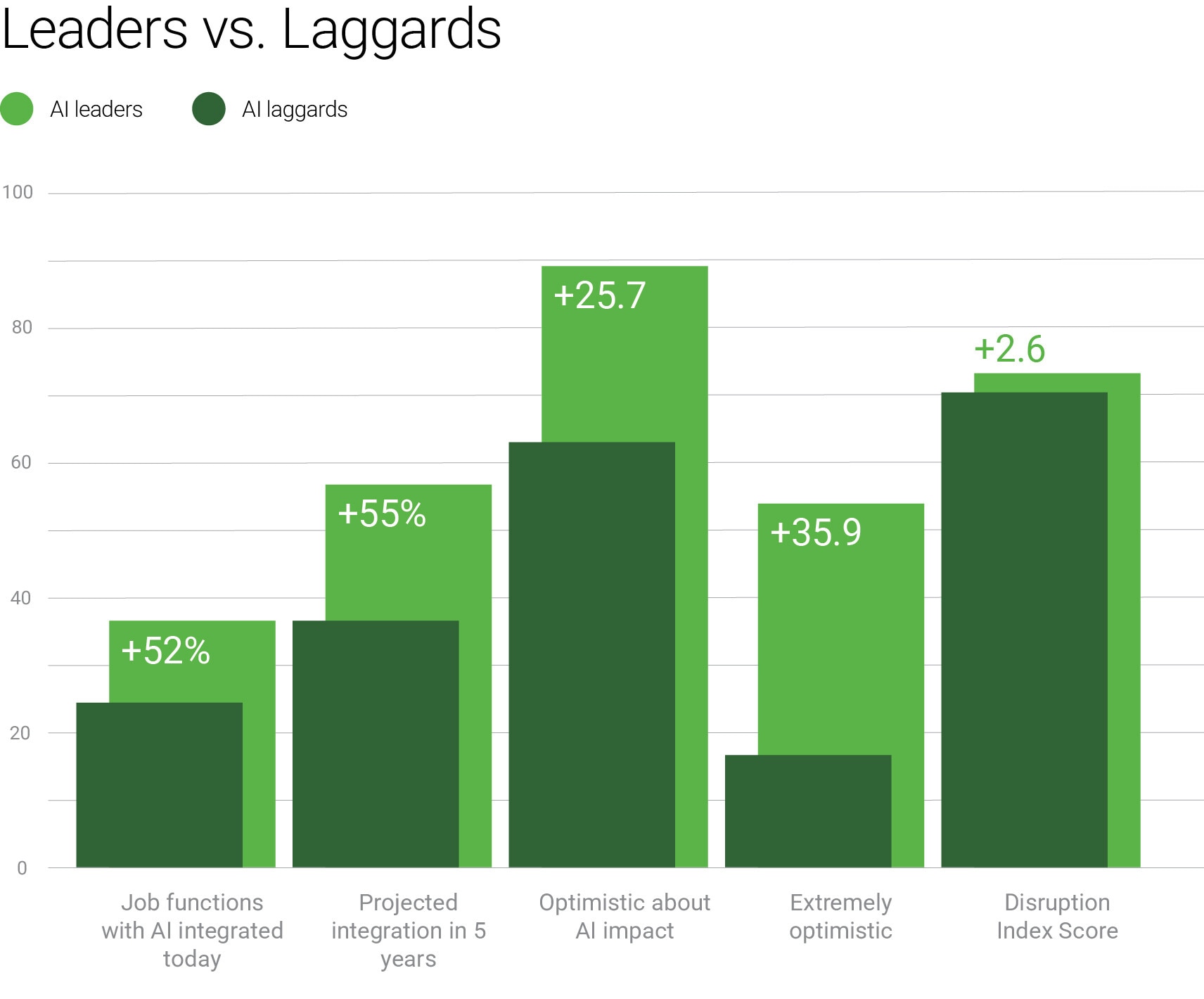

The defining line between these groups is not industry or geography, but adaptation, particularly regarding artificial intelligence. AI has become the "great divider". Companies leading in AI adoption report that 37% of job functions already have AI tools fully integrated, compared with 25% among laggards.

They are far more optimistic about the impact of AI (89% vs. 64%) and expect significantly higher levels of integration over the next five years. Crucially, they also express greater confidence in their ability to navigate disruption overall.

Paradoxically, these AI leaders are more likely to say they are highly disrupted. They see the pace of change more clearly, are more aware of gaps in culture, talent, and legacy systems, and feel intense pressure to maintain momentum. They are more likely to report that their organizations are not adapting fast enough and that resistance to change, misaligned leadership, and budget constraints remain major obstacles. These "paranoid optimists" are turning volatility into a source of competitive advantage.

Executives' objectives for AI underline this opportunity-led orientation. About two-thirds of respondents say their primary goal for AI investment is revenue growth, rather than cost reduction. In practice, AI’s immediate value stems less from headline-grabbing breakthroughs and more from tangible optimizations, such as better forecasting, smarter pricing, more targeted marketing and predictive maintenance. The differentiator is that leaders are deploying these capabilities at scale across the enterprise, with clear accountability for measurable impact.

The "adaptation inflection"

This is the "adaptation inflection" now emerging. The companies pulling ahead treat disruption not as a storm to be waited out, but as a permanent feature of the landscape. They are leaning into "continuous adaptation": investing in AI and digital tools, modernizing legacy systems, redesigning operations and supply chains, and rethinking portfolios and business models. They are more likely than others to expect substantial changes to their business model, to pursue transformative M&A, and to increase capital expenditures in response to uncertainty.

At the same time, these leaders pay close attention to execution. Productivity, flexibility and boldness emerge as a leadership triad for a disrupted world. Leading companies are aggressively improving labour and capital productivity, using AI to optimize core processes while upskilling their workforce. They are building flexibility by modernizing technology, freeing working capital, simplifying portfolios, and diversifying supply chains. Finally, they are being deliberately bold instead of relying on incremental tweaks.

High disruption is not the opposite of success; it is often the consequence of dynamism, innovation, and creative destruction.

”To help leaders make sense of this increasingly complex system of forces, AlixPartners and the World Economic Forum are collaborating on a Disruption Navigator – a new collection of Transformation Maps on the Strategic Intelligence platform, which serves as the Forum’s hub for curated, system-level insight.

The Navigator is designed to visualize how disruptive forces interconnect and reinforce one another, and to illustrate the shifting face of value creation and CEO decision-making. In an era where leaders struggle not just to see what is coming but to know where to start, tools like the Disruption Navigator can provide a shared map for action.

The 2026 Disruption Index makes one conclusion unavoidable: the middle ground is disappearing. Companies that wait for certainty, or that treat AI and other disruptive forces as side projects, risk slipping into a downward spiral – losing talent, eroding margins and watching more agile competitors seize the initiative. Those that act decisively, by contrast, are building a virtuous cycle in which investment, learning, and performance reinforce each other over time.

The winners of the next decade will be those who recognize this "adaptation inflection" and respond with clarity of strategy, speed of execution, and a relentless focus on building organizations that can change – continuously, confidently and at scale.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

The Digital Transformation of Business

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Economic GrowthSee all

Samaila Zubairu

March 3, 2026