Vigilant anticipation and a ‘good’ bubble: Chief economists read the global economy’s mixed signals

The latest Chief Economists' Outlook points to the surprising resilience of the global economy. Image: REUTERS/Suzanne Plunkett

- The World Economic Forum’s latest Chief Economists’ Outlook reflects a brightened mood, but no shortage of challenges.

- Christian Keller, Head of Economics Research at Barclays Investment Bank, recently joined the Radio Davos podcast to break down the new Outlook.

- AI’s promise has fuelled market optimism and sustained an investment boom, he notes, but a surprising resilience to tariffs and the ability to continue piling up public debt are likely finite.

“Vigilant anticipation.”

That’s not the title of an airport novel, it’s the prevailing mood when it comes to the global economy, according to the latest Chief Economists’ Outlook.

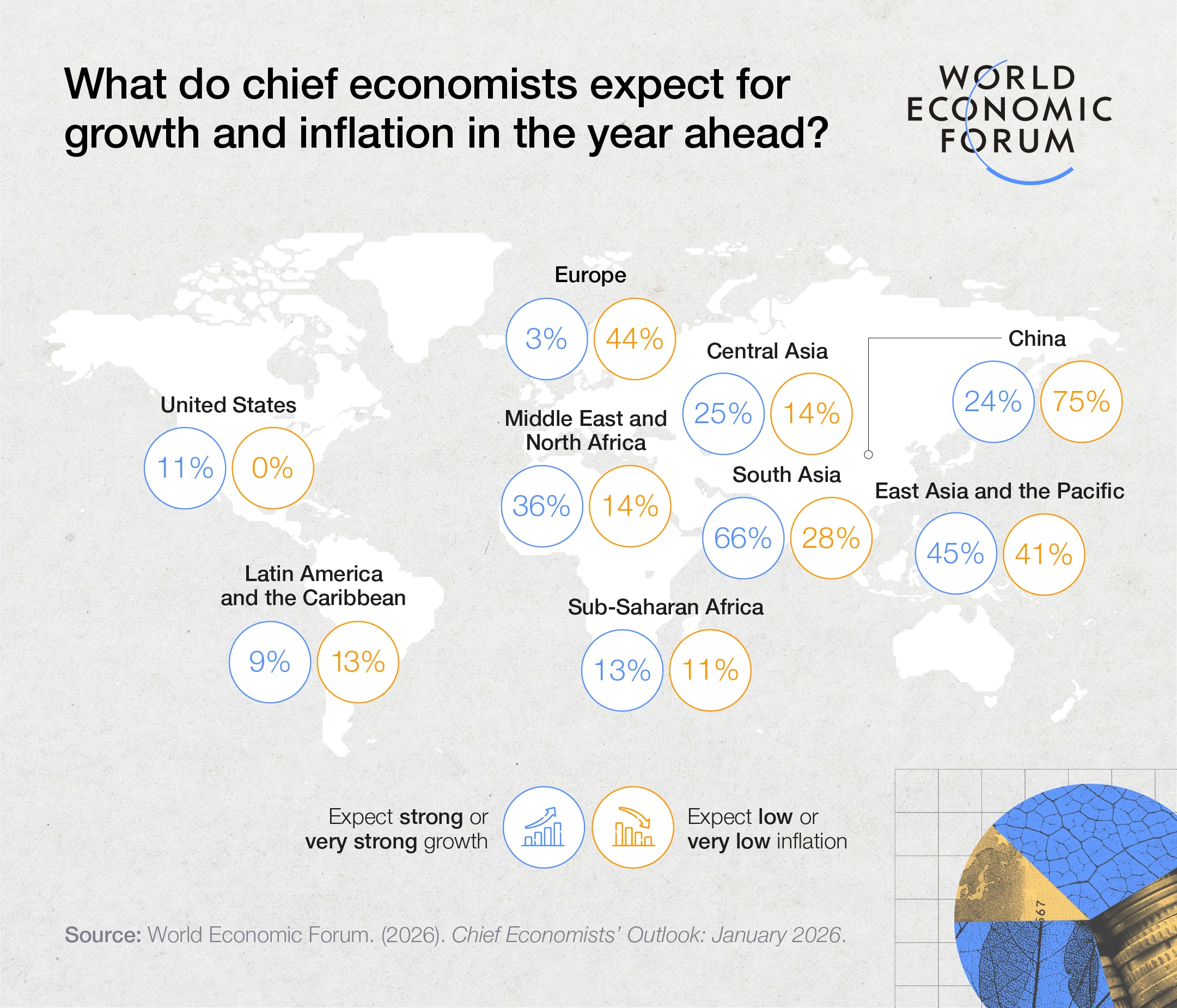

The triannual measure of where things stand now and where they’re headed in the future reports that slightly more than half of the chief economists surveyed see “weakened” conditions on the horizon – which is actually far less than the 72% who predicted the same grim future in the previous edition, published in September 2025.

“You look at fragmentation of global trade investment patterns, intensifying geopolitical tensions,” said Christian Keller, Head of Economics Research at Barclays Investment Bank, “and you would think that's pretty negative.”

Yet, financial markets have appeared relatively unbothered. Why?

“This big AI investment boom,” responded Keller, who joined the Radio Davos podcast to discuss the Outlook’s findings.

The technology’s promise of future productivity growth has been bright enough to outshine the many negatives weighing on economies, he said – like real or threatened tariffs, and levels of geopolitical uncertainty that can sometimes feel overwhelming.

More than half of the chief economists anticipate meaningful productivity gains in the US courtesy of AI in the coming year, and 42% see the same for China. Only a quarter predict an identical scenario for South Asia, though slightly more see it happening in that region within two years’ time. Just 16% see a meaningful gain in Europe within a year; nearly a third predict it will happen there in three years.

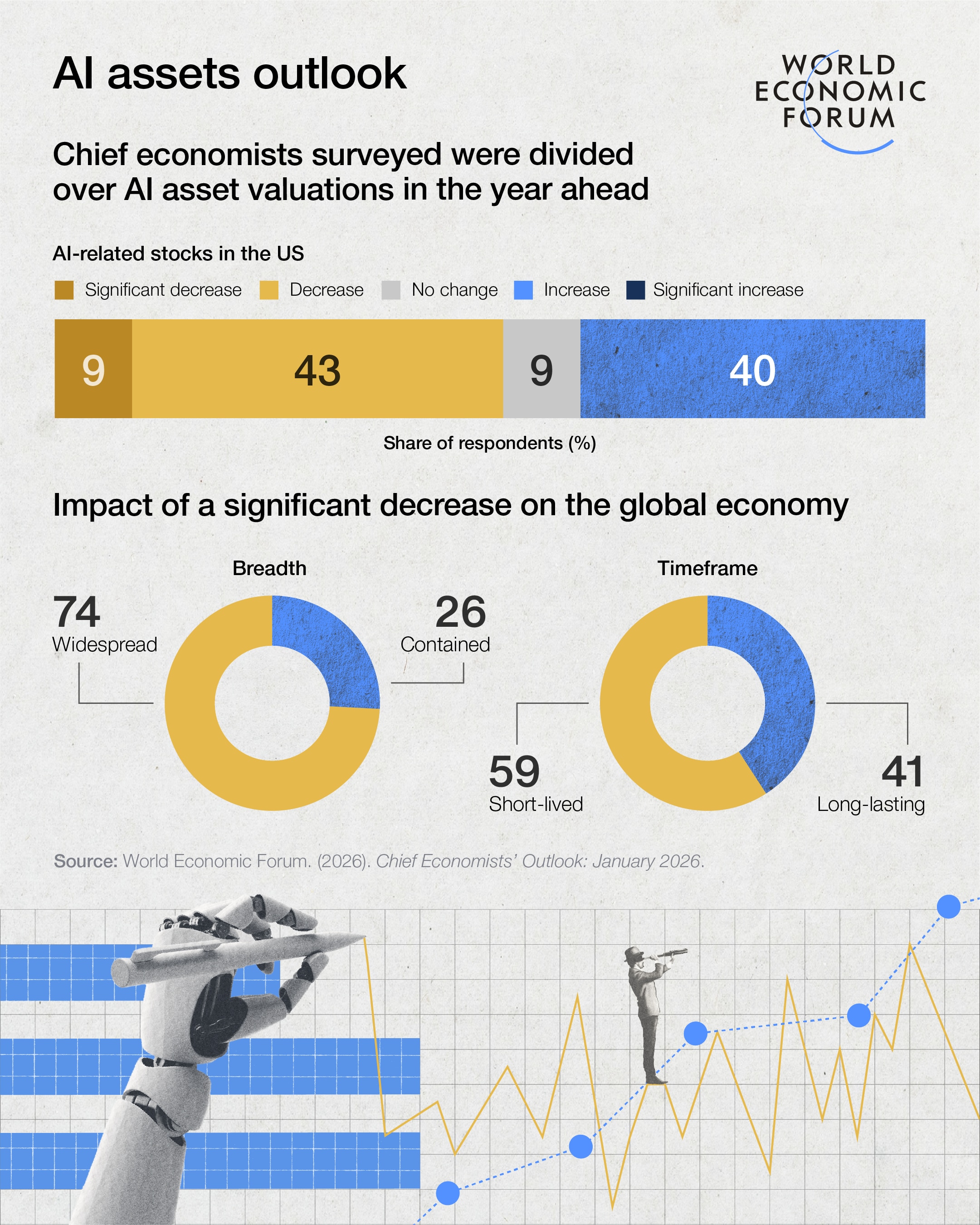

Those gains likely won’t come without a cost. 72% of the chief economists see related job losses in the next couple of years. There’s also the potential bursting of what many see as an investment bubble. Over half of the chief economists see the value of AI-related stocks in the US deflating in the coming year; most predict a widespread, yet short-lived impact on the global economy.

“It will affect probably everyone,” Keller said. Still, he added, the boom has largely remained separate from the banking and real estate sectors, and money is being poured into real things that could generate real productivity. “Those are the reasons why people say, look, even if it is a bubble, it's probably a good bubble.”

'It may now be wrong to be overly optimistic'

Among the many distractions for global economy watchers, the issue of central bank independence has recently come to the fore.

The people tasked with managing the money supply in any given country are generally, at least to some degree, shielded from the drama of day-to-day politics. Keller said there’s a good reason for that: history shows that independent central banks do a far better job of keeping inflation in check.

“It may sometimes be underestimated how much the global economy, or consumers, everyone, really, benefited from low and stable inflation,” he said.

Another distraction much-discussed is tariffs, though the rhetoric around these protectionist measures may have peaked in April. “Economists looked at this and said, well, this is going to be horrible,” Keller said. However, the US hasn’t so far implemented the measures to the extent many feared, and there have been a lot of exemptions.

There’s also been a lot of “front-running” (or “front-loading”) going on. That means many goods were transported pre-emptively, in anticipation of tariffs being implemented later – which can’t necessarily be effective forever. “The same way economists were probably wrong expecting things to immediately deteriorate, it may now be wrong to be overly optimistic,” Keller said.

Meanwhile much of the global economy has adapted. 94% of the chief economists surveyed for the Outlook foresee an increased number of bilateral trade agreements emerging in the coming year, and 69% see more regional trade deals on the way.

Another way in which things continue to change, though not necessarily for the better: governments continue to pile up debt. Globally, public debt levels are nearing parity with total economic output.

Nearly half of the chief economists surveyed for the Outlook see a sovereign debt crisis in emerging markets as “likely” (just 9% responded with an “unlikely”), and 31% see it as either likely or highly likely in advanced economies. So, what can governments do?

67% of the chief economists said it’s likely or highly likely that at least one strategy pursued by governments will be to simply let the winnowing effect of inflation decrease their debt burden. To try to “inflate it away” is no simple process, Keller said. A certain amount of financial repression would be in order to make the debt attractive to potential buyers. Better to focus on spurring new growth.

In the meantime, heavy debt loads are likely to force governments to make difficult spending decisions. The chief economists overwhelmingly see defence spending on the rise, and outlays for environmental protection decreasing.

Ultimately, Keller said, current debt levels simply aren’t sustainable.

“Maybe not in all economies, but in many, there will be a time of reckoning,” he said.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Economic GrowthSee all

Samaila Zubairu

March 3, 2026