The clean energy fast lane: How clusters speed up the industrial transformation

Industrial transformation will require an estimated $30 trillion in additional investment by 2050, yet many low-carbon projects struggle to reach financial close. Image: REUTERS/Bart Biesemans

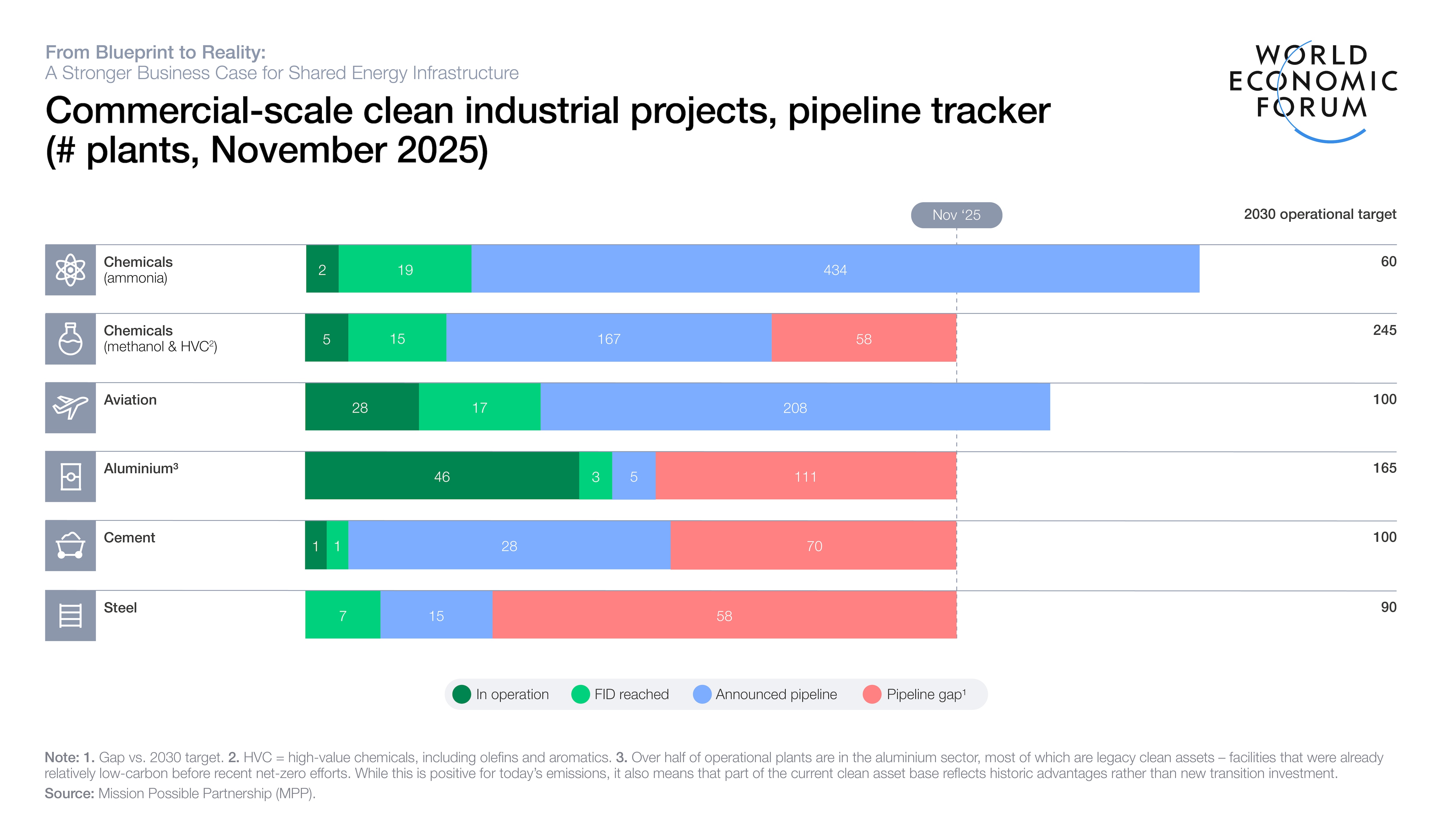

- Industrial transformation will require an estimated $30 trillion in additional investment by 2050, yet many low-carbon projects struggle to reach financial close.

- The industrial cluster model, where companies across multiple sectors co-locate under a shared vision and coordinated governance, provides valuable learnings around the conditions and business models under which low-carbon technologies can be deployed at speed and scale.

- By pooling infrastructure, resources and knowledge, industrial clusters create environments where innovation can move from concept to implementation quicker than it would in isolation.

A global industrial transformation is essential to decarbonize hard-to-abate sectors and drive sustainable, resilient growth. Delivering this transition will require an estimated $30 trillion in additional investment by 2050 and will depend on the establishment of effective mechanisms to reduce risk and strengthen market demand, as well as stable, enabling policy environments.

Amid persisting barriers related to technology and market readiness, high capital costs and policy and regulatory gaps, the industrial cluster model demonstrates how low-carbon technologies can be deployed at speed and scale. Industrial clusters are geographic areas where companies across multiple sectors co-locate under a shared vision and coordinated governance. By pooling infrastructure, resources and knowledge, industrial clusters create environments where innovation can move from concept to implementation more quickly than it would in isolation.

Recent success stories show that industrial clusters are highly effective at mobilizing capital for low-carbon technology deployment, offering valuable insights into the conditions that expedite final investment decisions for respective projects. As hubs of collaboration and shared risk, clusters provide several specific benefits that strengthen bankability for clean energy infrastructure projects:

- Cluster projects garner targeted support from governments, often through dedicated programmes.

- Companies within clusters share infrastructure associated with high-capital expenditure (carbon capture, transport, storage and green hydrogen production for example), thereby reducing the investment required from each user.

- Centralized cluster governance streamlines processes and risk allocation, reducing inefficiencies and shortening timelines.

- Clusters aggregate demand for and supply of energy and resources, generating larger production volumes and increasing credibility for commercial lenders.

- Bulk procurement and construction efficiencies within clusters unlock economies of scale, thereby decreasing costs.

- Cluster stakeholders share best practices and collaborate on research and development, reducing risks and enabling cost parity with traditional technologies to be reached more rapidly.

In a new report developed by the World Economic Forum in collaboration with Oliver Wyman, we analyse case studies of industrial clusters which take advantage of these benefits to advance low-carbon infrastructure projects to final investment decision. These examples show how locally tailored mixes of private capital, public support and risk-sharing mechanisms can further speed up industrial transformation – often following one of three models.

Model 1: regulatory clarity and a consistent policy framework

The first model is based on strong regulatory clarity and a consistent policy framework that provides investors with transparent insight into government support mechanisms. Such an environment enables projects to attract financing from diverse sources, combining commercial project finance with developers’ capex contributions.

For example, HyNet North West – one of the UK’s flagship low-carbon clusters – was able to secure a £2.5 billion financing package from more than 20 banks thanks to the UK’s favourable regulatory and licensing frameworks, which offered the certainty and market confidence required to attract private investment. This cluster integrates six priority projects: Eni’s Liverpool Bay project establishes the essential carbon transport and storage backbone, enabling five adjacent industrial players to develop capture projects that link into the system.

In addition to strong support from the UK government, Eni’s role as system operator – together with close collaboration with industrial emitters and cost efficiencies gained from repurposed infrastructure – has played a critical role in facilitating technology deployment, maturing the project to final investment decision.

Model 2: clear policy direction, but less certainty around long-term incentives

The second model is used in contexts with clear policy direction, but less certainty around long-term incentives. This increases the role of cluster administrators in convening stakeholders and deploying their capital and credibility to de-risk projects and draw in external finance.

Deployment of integrated carbon capture and storage (CCS), hydrogen and ammonia production in the Port of Rotterdam – Europe’s largest port – reflects this model. Respective projects benefit from substantial public support through grants and subsidies, but also from the Port Authority’s dual role as project orchestrator and critical infrastructure owner. It works with private-sector partners to mitigate risks and enable project delivery.

Another impactful example is the Mumbai Green Hydrogen Cluster – one of India’s most ambitious and strategically important green hydrogen initiatives, led by the Government of Maharashtra and supported by the national government and the Asian Infrastructure Investment Bank (AIIB).

Model 3: independently financed infrastructure

The third model relies on a single, large-scale organization whose balance-sheet strength, expertise and resources enable it to finance and deliver most of the infrastructure independently. This reduces the need for connections with governments and multilateral development banks.

The Chifeng Net Zero Industrial Park in China – the world’s largest green-hydrogen and ammonia production facility – is driven forward with limited domestic incentives by Envision Group’s investment in integrated renewables and green hydrogen. Its rapid execution has been enabled by a single commercial anchor through a long-term green ammonia offtake agreement with Japan’s Marubeni Corporation.

In Japan, as part of the Kawasaki Carbon Neutral Industrial Complex, one of the major industrial clusters in Japan, corporate players commit most of the financing for hydrogen and CCS deployment projects. Kawasaki City provides mostly non-capital support such as streamlined approval processes and enabling shared infrastructure.

The cluster model is not a silver bullet. Successful financing structures are extremely context-specific and still ultimately depend on commitment from first movers and offtakers, as well as the coordination of different stakeholders’ interests. With increasingly constrained public budgets, it is also crucial that risks are shared as efficiently as possible, with governments focusing strictly on risks that corporate players cannot absorb.

Yet, across different approaches, industrial clusters are generating valuable learnings around the factors that help expedite complex, capital-intensive low-carbon projects toward final investment decisions. By boosting credibility for corporate lenders through shared risks and infrastructure, better-aligned capital, aggregated demand and streamlined processes, they convert fragmented pipelines into investable portfolios. Ultimately, this will help establish proofs of concept required for technologies to reach investor confidence and market readiness – a crucial step toward the eventual objective of decarbonizing hard-to-abate sectors and driving sustainable, resilient growth.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

The Net Zero Transition

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Energy TransitionSee all

Namit Agarwal

February 25, 2026