Shockproofing the banking system is essential. Here's how to do it

Against this backdrop of uncertainty and transformation, one truth emerges: the resilience of a country is inseparable from the resilience of its banking system. Image: Unsplash

- The resilience of a country is inseparable from the resilience of its banking system.

- Shockproofing the banking system is, therefore, essential.

- When combined with digitization, sustainable finance becomes a powerful shield.

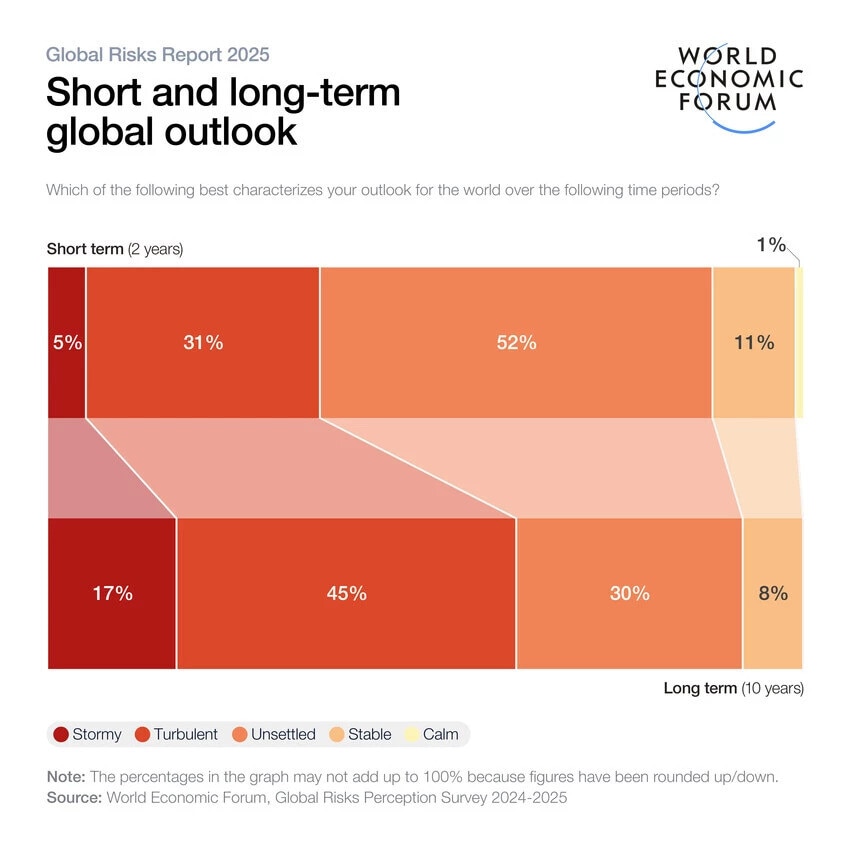

In today’s world, global volatility is the new constant. Geopolitical tensions, shifting alliances, supply-chain disruptions and financial instability exert sustained pressure on economies of every size. At the same time, technological advances are boosting productivity, reshaping customer expectations and redefining how value is created.

Against this backdrop of uncertainty and transformation, one truth emerges: the resilience of a country is inseparable from the resilience of its banking system. Resilience today requires a new architecture: the ability to shockproof the financial sector.

Banks are more than intermediaries; they are the circulatory system of any economy. They support growth, enable investment, fuel private enterprise, and increasingly offer digital infrastructure that connects consumers and businesses to the broader financial system.

When banks falter, economies are destabilized; when banks adapt and innovate, they become the anchors of national stability. Shockproofing the banking system, therefore, is not just prudent, but essential.

A new formula for resilience: technology and sustainable finance

Digitization has brought speed, transparency and enormous efficiency gains to financial services. The ability to process real-time payments, provide frictionless onboarding, automate risk management and deploy data-driven solutions has dramatically improved both customer experience and operational resilience. But technological transformation alone is insufficient.

To truly protect economies from external shocks, digital transformation must be integrated with sustainable finance. This means embedding sustainability metrics into every digital product, every partnership, every transaction and every innovation decision.

Sustainable finance ensures that capital allocation supports inclusive growth, environmental responsibility and social progress. When paired with digitization, it creates a model in which banks are not only moving faster but also moving in the right direction. This integration strengthens balance sheets, improves risk profiles, expands financial inclusion and creates long-term economic value.

Shockproofing individual banks

While the macroeconomic argument is powerful, the need for shockproofing is equally compelling at the institutional level. For banks operating in emerging markets, where volatility is part of the environment, resilience must be intentionally designed into the operating model. This involves four essential elements:

1. Strategic agility: the capacity to respond to economic disruptions in real time; reallocating resources as necessary; and adapting credit, liquidity and capital strategies.

2. Technological scale: taking advantage of digital capabilities to diversify income streams, reduce the cost of serving customers and build robust risk tools.

3. Sustainability-driven governance: ensuring that decision-making considers long-term societal impact, regulatory expectations and stakeholder trust.

4. Human capital development: empowering teams with skills, culture and leadership mindsets that strengthen execution, innovation and resilience.

A bank that masters these dimensions will do more than survive shocks – it will grow through them.

CIB’s experience: a case study in shockproof banking

In Egypt and across the region, the need for resilience is deeply felt. At Commercial International Bank (CIB), we have been building this capability for decades. Today, as we build our digital bank, sustainability is embedded across our products, operations, risk frameworks and partnerships. Our objective is clear: create value for our customers while simultaneously strengthening the Egyptian economy.

This long-standing approach has shaped the bank’s DNA. In 2003-2004, I was part of a small team working closely with the Central Bank of Egypt to build a functional and liquid market capable of absorbing systemic shocks. The work paid off: when the 2008 global financial crisis struck, Egypt’s banking sector remained stable. In the years that followed, the sector navigated two revolutions, multiple currency adjustments, Covid-19 and a series of external shocks.

This resilience was not a coincidence – it was engineered through discipline, foresight, and strong governance.

Transforming for the future: digital scale and customer-centric growth

CIB’s transformation story is rooted in understanding evolving market dynamics and anticipating customer needs. Our strategy has consistently focused on capturing the power of technology to broaden commercial activity, deepen client relationships and strengthen operational performance.

This has allowed us to achieve resilient growth, outperform peers across emerging markets and establish a reputation for reliability and innovation. At the same time, our commitment to responsible finance ensures that our success benefits the communities we serve. With our expansion into sub-Saharan Africa, we now carry this responsibility across borders. We are no longer just national bankers, but regional and global citizens contributing to financial stability and sustainable development.

Why sustainable finance determines the future

Sustainable finance is the cornerstone of long-term resilience. It determines whether an economy can withstand the next shock – whether that shock is geopolitical, economic, health-related or environmental. By guiding capital toward responsible investments, sustainable finance builds stronger communities, enhances productivity and improves national competitiveness.

When combined with digitization, sustainable finance becomes a powerful shield. The shock may arrive, but its impact is absorbed, mitigated and eventually transformed into opportunity.

This is what Africa and the region need most: durable, inclusive and technology-enabled growth that can endure the volatility of our times. Shock-proofing is not a defensive strategy. It is an investment in the future; a commitment to building systems, institutions, and economies that do not merely survive shocks but emerge stronger from them.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Cybersecurity

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on BusinessSee all

Neeti Mehta Shukla

February 27, 2026