Why distributed ledger technology needs to scale back its ambition

In over a decade since its creation and despite enormous effort from large organizations, distributed ledger technology has yet to prove itself in real-world applications Image: Shubham Dhage for Unsplash

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Davos Agenda

Listen to the article

- Despite its promise, distributed ledger technology (DLT) has yet to prove itself in real-world applications.

- The problem is not with the technology itself, but with the ambition for distributed networks to replace existing systems.

- The industry needs to scale back its ambition and focus on adding value to financial markets.

Distributed ledger technology (DLT) has been hailed as a solution to many different problems, from economic risks present in financial services to mitigating insurance fraud. But over a decade since its creation and despite enormous effort from large organizations, DLT has yet to prove itself in real-world applications.

Recently, the Australian Securities Exchange (ASX) scrapped its blockchain project after the better part of a decade in testing. A lack of global collaboration also saw IBM and Maersk end their supply-chain management blockchain.

While many pilot projects, especially those spearheaded by the Bank for International Settlements (BIS), have been completed with promising results, many questions remain on replacing current infrastructure with a digital tokenized format. The European Central Bank’s (ECB) Director for Market Infrastructure and Payments, Ulrich Bindseil, recently noted that “these technologies have so far created limited value for society – no matter how great the expectations for the future.”

There is nonetheless an expectation that DLT can prove to be a net good for financial markets. Foreign exchange markets have an estimated $8.9 trillion at risk every day due to the final settlement of transactions between two parties taking days. This is why the Financial Stability Board and the Committee on Payments and Market Infrastructures have focused their efforts on enhancing cross-border payments with a comprehensive global roadmap. Part of this roadmap includes exploring the use of DLT and Central Bank Digital Currencies.

The problem may not be the technology itself, but the aim of replacing current technology systems with distributed networks. DLT networks are being designed to completely overhaul and replace legacy technology that financial markets depend on today. Many pilot projects, such as mBridge and Jura, rely on a single blockchain developed by a single vendor. This introduces a single point of trust, and removes many of the benefits of disintermediation. Although the completed projects have shown great promise, the ability for one blockchain to communicate and transact with another blockchain remains a key stumbling block.

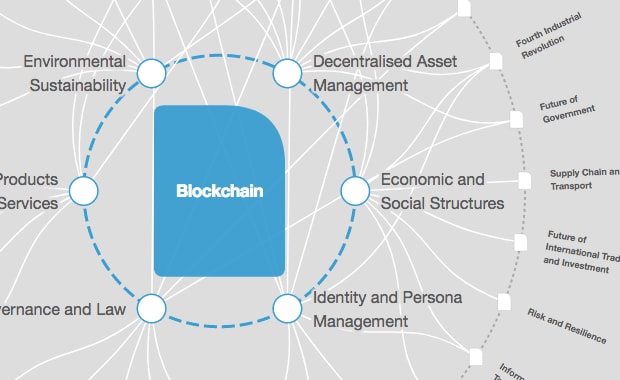

How is the World Economic Forum promoting the responsible use of blockchain?

Integration first

Integration between DLT and existing systems requires interoperability between the two, and this is extremely complex. The cross-custodial settlement of digital assets is likely to be the most powerful tool that can be used to improve the development and integration of financial markets without having to wait for breakthrough technology that addresses interoperability. Digital asset custody providers are the only market participants who are tech neutral and economically incentivized to support as many blockchains and DLT networks as possible.

With regard to issuance, transactions, custody and settlement of digital assets, we already have the appropriate tools for financial markets. We should take advantage of these, first and foremost.

A new starting point

The industry needs to scale back its ambition and begin to showcase the benefits of digital assets and distributed networks. The technology and development behind blockchains is extremely complex. But the basic principles upon which it relies – issuance of tokens, settlement and custody – have the potential to add a great deal of value to financial markets today, alleviating bottlenecks and counterparty risks.

The basic shared and validated ledger is one of the largest benefits of using a blockchain, as it increases transparency. It also dispenses of the need for many institutions that slow down the settlement and ownership process. While financial markets still rely on transactions being completed within two days, digital assets are settled almost immediately. This removes a great deal of counterparty risk on the structural level.

The problem, however, is that DLT industry participants are aiming to establish systems without the need for such institutions from the very start. Expecting to do it in one fell swoops is unrealistic – this kind of change will take years if not decades to establish on a global scale.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Davos AgendaSee all

Kate Whiting

April 17, 2024

Andrea Willige

March 27, 2024

Shyam Bishen

March 20, 2024

Simon Torkington

March 15, 2024

Miranda Barker

March 7, 2024