Why investing in Southern Africa’s critical minerals is key for the global energy transition

Southern Africa's minerals are a valuable resource that require careful management. Image: Getty Images

- The energy transition has turbocharged the global demand for minerals.

- The Southern Africa region holds nearly a third of the world's critical mineral reserves.

- The region has an opportunity to capture more value from its mineral resources, enhance its role in the global energy transition and unlock greater economic benefits.

The demand for critical minerals, essential for wind turbines, batteries and solar panels, has surged as the energy transition gains momentum.

According to the International Energy Agency’s Global Critical Minerals Outlook 2025, demand for lithium is set to grow fivefold by 2040, cobalt demand will double and copper demand will rise by 30%. The Southern Africa region – comprising Angola, Botswana, Lesotho, Malawi, Mozambique, Namibia, South Africa, Swaziland, Zambia and Zimbabwe – holds a significant percenage of the world’s critical minerals reserves. Given its mineral endowment, the region has the potential to play an even more significant role in the supply chain of critical minerals.

Untapped potential: Financing bottlenecks impact growth

Southern Africa’s vast mineral wealth remains under utilized. Although the region is ranked among the world’s top three supply hubs for most critical materials, production has not kept pace with its geological potential, constrained by factors such as limited investment and infrastructure gaps. McKinsey’s MineSpans analysis highlights the scale of untapped potential: over $9 billion in critical mineral projects are in the pipeline, yet less than 10% have secured financing and progressed to construction or feasibility stages. Out of over 60 identified projects spanning copper, graphite, lithium and manganese, less than a quarter are considered 'certain' or 'probable', reflecting investor caution and regulatory uncertainty.

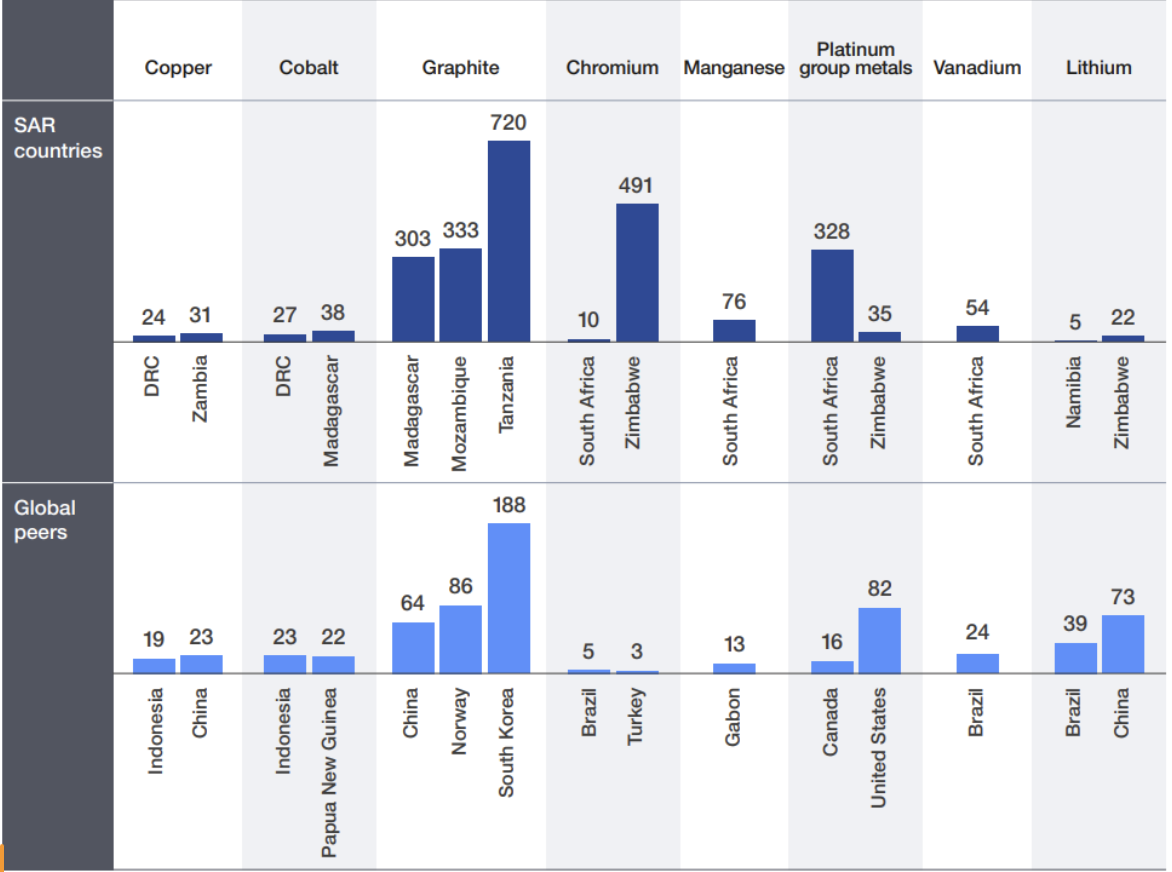

Compared to global peers, Southern African countries have higher reserves-to-production ratios for most minerals, underscoring the significant untapped extraction potential. Without significant investment to de-risk projects and build refining and midstream capacity, the region risks missing the opportunity to capture more value from its resources, strengthen its role in the global energy transition and create economic opportunities for local communities.

Regional cooperation is key to unlocking investment

Addressing these financing and infrastructure bottlenecks would likely benefit from strong regional cooperation. Regulatory uncertainty, fragmented infrastructure and inconsistent trade policies create challenges for investors, while landlocked mineral-rich countries face high transport and logistics costs.

Aligning regulatory frameworks, coordinating permitting processes and adopting common environmental, social and governance (ESG) standards could help make the region more attractive to long-term investors. Shared infrastructure planning and harmonized trade policies could unlock cost efficiencies and improve access to global markets.

Collaborating across borders would also allow for better integration into global value chains, enabling countries to capture more value from their mineral resources through local processing, manufacturing and industrial development. Such an approach could create jobs, generate revenue and support a more inclusive and sustainable economic future for the region.

How the World Economic Forum is advancing the critical minerals agenda

The Securing Minerals for the Energy Transition (SMET) initiative, led by the World Economic Forum with McKinsey & Company as knowledge partner, brings together governments, industry, finance and development partners to drive coordinated action on critical minerals.

This regional effort, in collaboration with the Development Bank of Southern Africa (DBSA), draws on discussions from recent multi-stakeholder convenings, reflecting regional and international perspectives on practical solutions to scale responsible mineral value chains in Southern Africa.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Africa

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Energy TransitionSee all

Lauren Smart and John Morrison

February 20, 2026