Here’s how businesses can navigate border carbon adjustments embedded in trade

Border carbon adjustments could mean a wave of changes to global trade Image: Getty Images

Kimberley Botwright

Deputy Head of CRTG, Head of Responsible Trade & Governance, World Economic Forum- Border carbon adjustments are becoming part of the carbon pricing landscape.

- They introduce emissions visibility and pricing into trade flows, requiring greater emissions accounting and traceability by public and private actors.

- To help businesses better understand this landscape, we asked several thought leaders for their views on emissions in trade preparedness and accounting.

Border carbon adjustments are emerging in the carbon pricing landscape. These levy charges on embedded emissions of imported goods at a carbon price equivalent to what would have been applicable if the goods were produced under the policies of the importing country. They effectively introduce emissions visibility and pricing into trade flows, requiring greater emissions accounting and traceability by public and private actors.

This topic was a flashpoint at the recent UN climate talks, COP30, held in late November in Belém, Brazil. For some parties to the Paris Agreement, border carbon adjustments are unilateral trade measures, which may disadvantage developing economies and their businesses. They are indeed a place where the rubber hits the road between trade competitiveness and the UN climate principle of common, but differentiated, responsibilities with respect to the pace of decarbonization.

In the end, parties to the UN process agreed to hold three dialogues in relevant bodies on enhanced international cooperation, with the result of those exchanges due to be reported at a high-level event in 2028.

The European Union is a first mover in this area, introducing a Carbon Border Adjustment Mechanism effective from January 2026, with trial data submission already in place. Other major economies are scoping or developing similar measures.

Climate and Competitiveness: Border Carbon Adjustments in Action, a white paper developed by the World Economic Forum in collaboration with Climate Finance Asia, examines these shifts with particular attention to high-emission, export-intensive sectors in emerging economies. Drawing on case studies from Brazil, China, India and South Africa, it highlights how businesses are reshaping strategy and operations to compete in a world where carbon costs are a factor of trade. The paper offers pragmatic insights for a C-suite audience on how to leverage border carbon adjustments for decarbonization and competitiveness outcomes.

In these countries, for instance, many businesses are embedding carbon management policies and internal carbon costs into their global strategies. It is hoped that these will guide longer-term strategic decisions by anticipating cost exposure to domestic carbon prices and border carbon adjustment mechanisms. Others are rapidly investing in scaling their emissions monitoring, reporting and validation technologies and processes to accurately track their emissions and avoid using default values, which could inflate reported carbon costs.

Pathways to cooperation

There have been several attempts to foster cooperation on border carbon adjustments, even amid debate on their use. At climate talks in 2023, governments launched a Climate Club, an intergovernmental forum for exchange on industry decarbonization. The Climate Club has since agreed on voluntary principles to address so-called carbon leakage – where industry moves abroad to avoid mitigation costs – and commits to continued work on interoperable carbon accounting approaches. To date, their emissions measurement alignment has focused on steel and cement, considered particularly trade-exposed and emissions-intensive.

The club also hosts a Global Matchmaking Platform that has engaged nine emerging economies to date in responding to custom requests for financial and technical assistance around industry decarbonization. Greater efforts could be made to plug the private sector into this platform, considering the need for public funds to derisk private capital that can come in at scale and bring know-how.

In parallel, in Belém, 17 governments, including the EU, Brazil, China, the UK and Canada, among others, adopted a Declaration on the Open Coalition on Compliance Markets. Developed under Brazil’s leadership, the group commits to exchange experiences on carbon pricing mechanisms, monitoring, reporting and verification systems and carbon accounting methodologies. It also suggests that members may explore options for long-term interoperability of regulated carbon markets. In parallel, Brazil championed a new Integrated Forum on Climate Change and Trade to facilitate dialogue in the gap between the trade and climate regimes.

Worldwide, carbon pricing covers 28% of global emissions and jurisdictions representing two-thirds of global GDP have adopted carbon taxes or emissions trading systems. As such policies develop, they will inevitably impact trade and capital flows. Efforts to improve emissions measurement interoperability and help smaller businesses upskill their emissions accounting are vital to reduce unnecessary friction between markets.

To help businesses better understand this landscape, we asked several thought leaders for their views on emissions in trade preparedness and accounting. Here’s what they said.

It’s all about the data

"Businesses need to prepare for a future where emissions accountability is embedded in cross-border trade. One of the biggest mistakes we see companies make is to assume the only problem that needs to be resolved is how to collect accurate supplier emissions data. The reality is that any carbon-border-pricing framework will also require companies to know exactly what they are importing and to connect that with the supplier emissions data. Import data is very often fragmented and sits with third-party brokers in varying levels of quality and accessibility. I cannot underline enough how important it is for companies to work out how they will solve both the customs and emissions data challenges.

"And, of course, it's not just a compliance challenge, there is also a cost optimization opportunity. Forward-thinking companies will analyze how to reduce carbon-pricing costs, but will go further and assess the total landed cost of goods, considering product emissions, transport and customs tariffs. Leaders, like Maersk, are already helping customers address both the challenges and the opportunities. Proactive adaptation today will become tomorrow’s competitive edge in a decarbonizing global economy."

Lars Karlsson, Global Head of Trade and Customs Consulting, Maersk

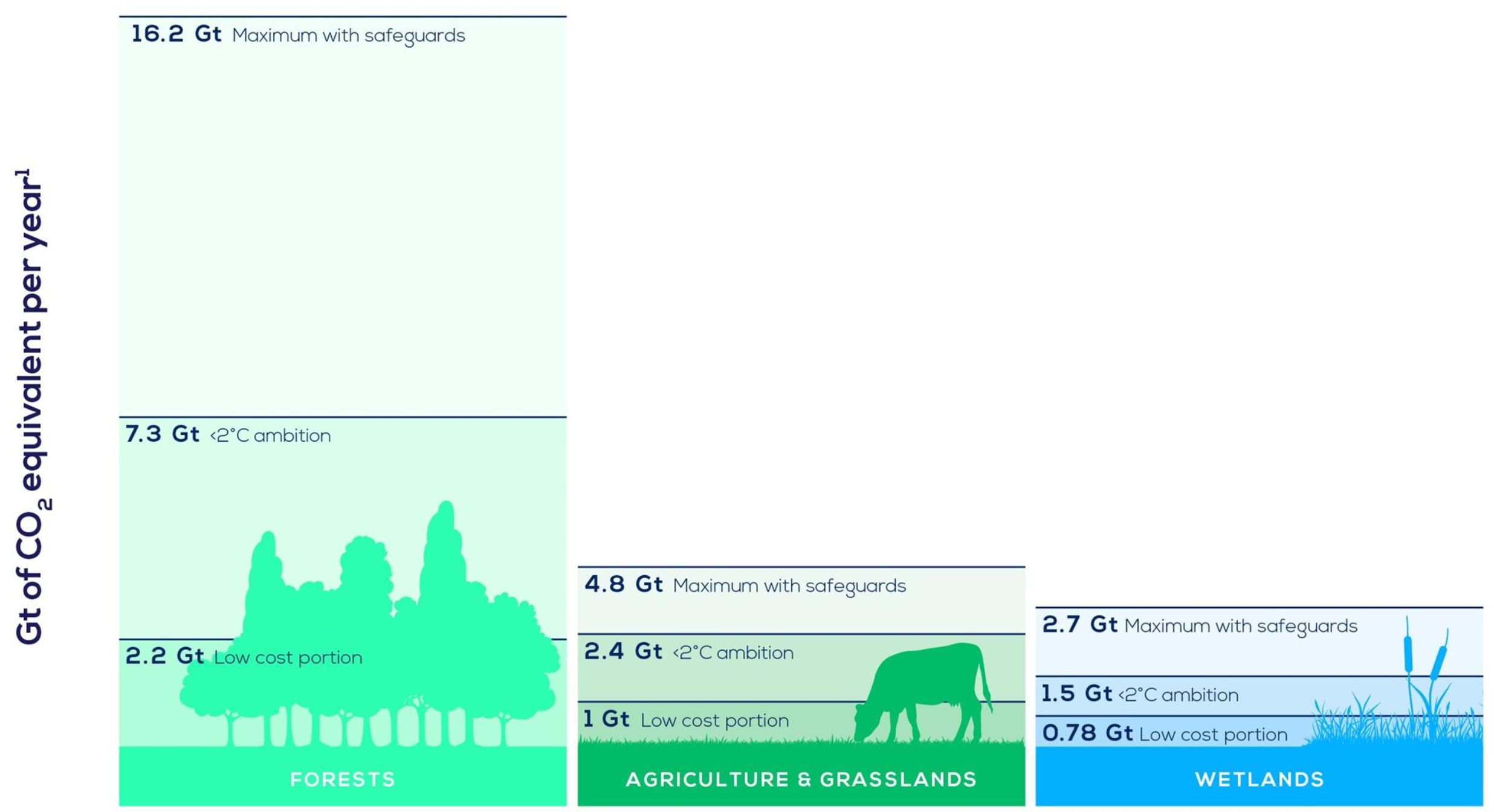

What is the World Economic Forum doing on natural climate solutions?

Getting the design right

"Border carbon pricing tools must be designed in ways that support and advance genuine deep decarbonization, not inadvertently undermine it. Design flaws that encourage resource shuffling, circumvention or market distortion must, therefore, be avoided and swiftly corrected by policymakers once identified. For companies committed to a green and just transition, like ours, this is a critical concern. Further, with the constantly evolving nature of border-carbon policies, companies should actively monitor regulatory developments and consider scenario planning to help navigate this uncertain landscape."

Sarah Hay, Climate Policy Lead, Norsk Hydro

Planning Ahead

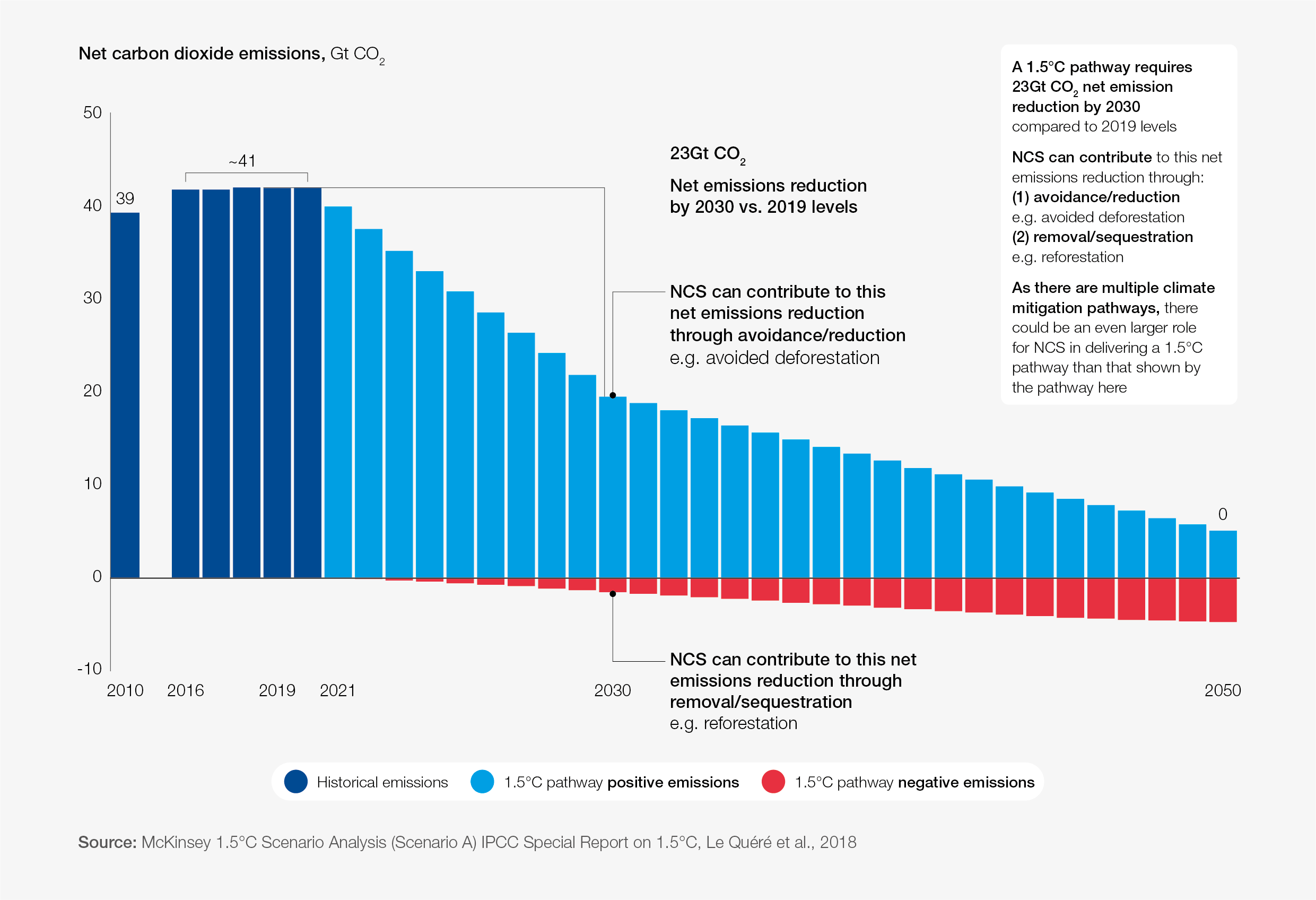

"The implementation of market mechanisms underscores the need for robust greenhouse gas accounting systems capable of meeting regulatory requirements. As part of our journey, Vale has invested in data science and integration, supporting importers and engaging suppliers to ensure compliance. Looking ahead, global alignment and recognition for renewable electricity consumption and regional decarbonization strategies, such as using biofuels and biomaterials, will be critical to building resilient, sustainable trade systems. Further policies are also needed to integrate carbon capture, both geo- and nature-based, to carbon border adjustments."

Grazielle Parenti, Executive Vice President of Sustainability, Vale

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.