Insurance and asset managers can trigger a virtuous cycle for climate action

The insurance sector has a crucial role to play in the fight against climate change. Image: REUTERS/Fred Greaves

- Climate change could cost as much as $38 trillion per year by 2050.

- The asset management and insurance industries can serve as role models for other sectors on how to innovate.

- A virtuous cycle is possible to benefit profitability and sustainability.

The world stands at a critical crossroads, where the intersection of escalating climate risks, economic instability and social inequalities calls for innovative solutions. The recent backlash against Environmental, Social and Governance (ESG) presents an urgent opportunity to align the necessity for sustainable practices with the unique strengths of profitable business models.

Amid these challenges, the financial sector can emerge as a powerful yet underutilized player for advancing sustainability. And the insurance sector, in particular, has a pivotal role to play.

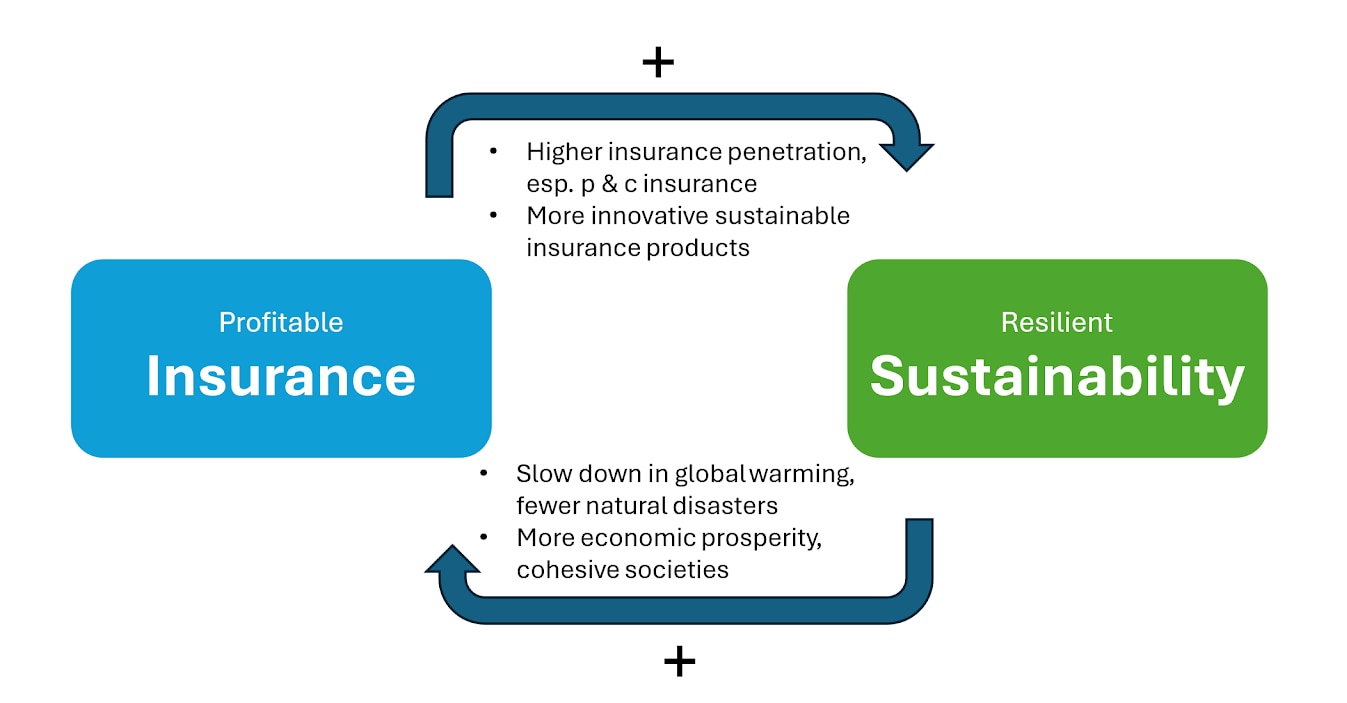

Within the financial industry, the insurance sector holds a unique position. It is affected by climate change in its core business model like no other industry, and so it can become a role model for other sectors showing how to turn tackling this huge challenge into a sustainable business opportunity. A new virtuous cycle of profitable insurance and resilient sustainability is possible.

The frequency of extreme wildfires has more than doubled over the last two decades, and global damages due to climate change could hit $38 trillion dollars per year in the future.

Traditionally viewed as a mechanism for financial risk transfer, the insurance sector is poised to redefine its role in global sustainability and work to mitigate and prevent this catastrophic scenario.

Our joint 2025 study by Allianz highlights how, despite the damages of climate change escalating, the insurance sector can carve out a role for itself in the solution.

The role of insurance in the fight against climate change

Insurers are responsible for managing a significant portion of the world's capital, making them pivotal players in directing investments toward sustainable initiatives. Moreover, the core business of insurance revolves around the identification, quantification and management of risks. Many of these risks – be it climate change, health pandemics or social unrest – are intrinsically tied to challenges captured by the UN Sustainable Development Goals (SDGs). Understanding the intersection between these risks and the SDGs offers insurers an opportunity not only to address their own material risks but also to influence sustainable outcomes in the broader societal context.

Significant correlations between insurance penetration and the SDGs, particularly in property and casualty (P&C) insurance, hint at the sector's potential. For every 1% increase in P&C insurance penetration, a country moves 5.8% closer to achieving the SDGs. Yet, current global trends reveal a vicious cycle in which low insurance penetration exacerbates fragile sustainability, fuelling economic instability and heightening climate risks.

The solution lies in fostering a virtuous cycle, where broader insurance coverage promotes resilience, slows global warming and fosters cohesive societies.

A virtuous cycle for insurance

A virtuous cycle emerges when higher insurance penetration protects households and firms from shocks and actively reduces the underlying drivers of those shocks.

When more risks are insured, insurers gain stronger incentives to invest in risk-prevention measures, because preventing losses is cheaper than paying for them. This, in turn, lowers the frequency and severity of climate- and disaster-related claims, stabilises premiums and strengthens public trust in insurance. As trust grows, coverage expands further, allowing a larger share of the population and economy to become resilient. This continuous feedback loop reinforces itself: resilience becomes profitable, and profitability funds even more resilience.

There are precedents for such dynamics. In many European countries, widespread adoption of fire insurance in the late 19th and early 20th centuries triggered major improvements in urban planning, building norms and fire-prevention infrastructure. Insurers financed fire brigades, supported early warning systems and lobbied for safer construction standards – this dramatically reduced fire losses over time while expanding the insurance market. A similar pattern has been observed in countries like Japan and New Zealand, where near-universal earthquake insurance has encouraged stringent building codes and proactive risk mitigation. These cases illustrate how insurance markets, when sufficiently scaled, can transform societal risk exposure.

Today, the same mechanism can be applied to climate and sustainability challenges. As insurers integrate climate science into premiums and underwriting, they can steer entire sectors toward low-carbon and climate-resilient technologies. Coastal communities with high insurance penetration, for instance, often invest more rapidly in flood defenses and nature-based adaptation solutions.

This virtuous cycle also has a social dimension. Broad insurance coverage reduces inequality by preventing vulnerable households from falling into poverty after shocks. As societies become more cohesive and economically stable, they are better able to invest in long-term climate mitigation, creating a reinforcing link between social resilience, economic productivity and environmental sustainability. In this way, the insurance sector can help transform the current vicious cycle of low coverage and rising risks into a self-sustaining engine of resilience and sustainable development.

Leveraging investments for systemic change

With over $30 trillion in managed assets, the insurance sector is uniquely positioned to direct capital into transformative initiatives. By prioritizing investments in green infrastructure, renewable energy and social impact projects, insurers can accelerate progress toward both environmental and social SDGs. For example:

- Investing in sustainable housing can support SDG 11 (Sustainable Cities and Communities).

- Funding microinsurance for low-income populations can reduce inequalities (SDG 10) and foster resilience against economic shocks.

- Flexible policy adjustments, such as waiving excess fees and issuing goodwill payments to support customers impacted by family violence can contribute to SDGs like gender equality (SDG 5).

Moving to action in the insurance industry

Allianz’s study proposes actionable strategies for maximizing the insurance sector’s contributions to global sustainability:

- Develop resilience-focused products: Insurers should innovate policies that incentivize climate adaptation and promote social equity.

- Expand access and inclusion: Design inclusive insurance solutions that extend financial protection to vulnerable populations, thereby enhancing resilience and reducing inequality.

Regulators are also pivotal in transforming the insurance sector into a driver of sustainability. By creating enabling regulatory frameworks, governments can incentivize insurers to align their underwriting and investments with sustainability goals. Initiatives like tax incentives for green investments or public-private partnerships for innovative insurance products can amplify the sector’s impact.

Regulators should also mandate transparent ESG reporting and establish standardized metrics for assessing insurers’ contributions to sustainability. This would ensure accountability and encourage insurers to integrate long-term social and environmental considerations into their core operations.

A collective responsibility for the insurance sector

Achieving the SDGs requires systemic transformation and collective action. Policymakers, insurers and cross-sector alliances must collaborate to create an ecosystem where sustainability becomes a competitive advantage. Regulators can facilitate this shift by enforcing transparent reporting and incentivizing sustainable practices, while insurers should embrace their role as stewards of resilience and innovation.

The insurance sector’s ability to manage risks, mobilize capital, and foster resilience makes it indispensable in addressing the challenges of our time. By expanding its vision and leveraging frameworks, the industry can lead the way in creating a sustainable, resilient, and equitable future for all.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

SDG 13: Climate Action

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Financial and Monetary SystemsSee all

Kevin Werbach

February 27, 2026