Why global partnerships matter for scaling hydrogen

Hydrogen and its derivatives can be a critical enabler of the energy transition. Image: Getty Images

- Delivering on global net-zero commitments needs energy systems that can decarbonize sectors where existing alternatives are insufficient.

- Hydrogen and derivatives such as e-methane, green ammonia and low-carbon materials for steelmaking can be critical enablers of this transition.

- Japan's evolving approach shows how hydrogen can deliver impact when policy, capital, technology, supply and demand advance together.

Delivering on global net-zero commitments will require energy systems capable of decarbonizing sectors where existing alternatives remain insufficient. Hydrogen and its derivatives, among them e-methane, green ammonia and low-carbon materials for steelmaking, have emerged as critical enablers of this transition.

Yet the pace of scale-up remains uneven. According to the International Energy Agency (IEA)’s Global Hydrogen Review 2025, higher input costs, global inflationary pressures and persistent gaps between supply and demand have delayed final investment decisions worldwide.

Unless these challenges are addressed through more coordinated action, hydrogen risks remain a promising solution that does not translate into system-level decarbonization. Aviation, maritime transport, steel and heavy manufacturing illustrate the stakes: each requires not only cleaner fuels, but a new industrial architecture linking production, logistics and consumption.

As highlighted in the the Hydrogen Council's Global Hydrogen Compass 2025 report, hydrogen can deliver meaningful impact when policy, capital, technology, supply and demand advance together.

Japan at an inflection point on hydrogen

Japan finds itself at a significant inflection point in this emerging landscape. With a high concentration of hard-to-abate industries and a structural reliance on imported fuels, the country’s exposure to energy security and decarbonization imperatives is considerable.

Hydrogen, therefore, represents an industrial and strategic pathway. Progress, however, is not without friction. Infrastructure remains incomplete across production, transport and end-use. Green hydrogen and its derivatives still entail meaningful cost premiums.

Long-term offtake agreements, essential to investment certainty, have not yet materialized at the scale required.

While Japan’s updated Basic Hydrogen Strategy (June 2023) and the Hydrogen Society Promotion Act (October 2024) have provided policy direction, further mobilization of private capital and deeper international cooperation will be necessary to achieve commercial maturity.

These issues align with insights from the IEA’s Hydrogen Breakthrough Agenda Report 2025, which emphasizes that hydrogen markets cannot be built through isolated technological demonstrations alone.

Rather, they require coordinated, system-wide progress. Japan nevertheless possesses the industrial depth, engineering capability and end-user demand profile to play a distinctive role in shaping how hydrogen ecosystems mature globally.

How Japan is mobilizing policy, partnerships and capital on hydrogen

Several structural building blocks have begun to take shape. Japanese policy reforms have provided clarity on national intent, while the Japan Hydrogen Association, a cross-sector platform with more than 525 companies and municipalities, has created a mechanism for aligning stakeholders across manufacturing, energy, transport, finance and technology.

A further step towards institutional readiness occurred in 2024 with the launch of the Japan Hydrogen Fund (JHF). Established through collaboration between the Japan Hydrogen Association, Advantage Partners and Sumitomo Mitsui DS Asset Management, the fund seeks to channel domestic and international capital into technologies and projects fundamental to the development of a hydrogen economy.

Its mandate is straightforward – to create investable pathways for capital while supporting companies capable of delivering material progress in deployment.

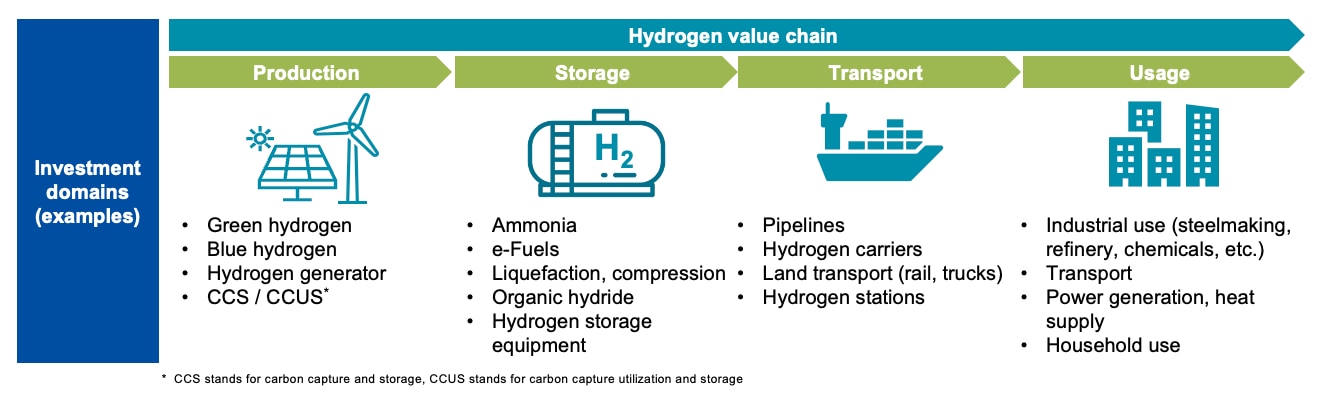

A defining feature of JHF is its ability to integrate industrial insight, investment capabilities and demand visibility within a single platform. Its activities are organized around three main pillars:

- Technology and industrial insight and demand

Access to the Japan Hydrogen Association’s broad membership base enhances visibility into hydrogen technologies, operational constraints and credible areas of near-term offtake demand. - Global sourcing and partnership development

Drawing on an international network of companies, funds and advisors, JHF identifies and secures financing for projects within and beyond Japan, ensuring alignment with global trends and standards. - Investment execution and value creation

Leveraging Advantage Partners’ (as co-operator of JHF) experience in infrastructure and corporate development, the fund applies rigorous due diligence, project management and commercial oversight to ensure investment execution with precision and long-term value creation in mind.

Through these pillars, JHF serves not only as a capital provider to the hydrogen value chain, but also as a coordinating mechanism capable of accelerating the emergence of a functioning hydrogen ecosystem.

How Japan’s hydrogen initiatives are moving towards market deployment

Japan’s hydrogen initiatives are moving beyond early demonstrations towards commercially relevant activity. With policy frameworks and investment platforms now in place, clearer pathways to scale are emerging. JHF has already committed capital to several early-stage and near-final investment decision projects, supporting infrastructure development and advancing technologies toward commercial readiness.

Strengthening ecosystem connectivity has been equally important. JHF’s knowledge-sharing forums and reporting structures have broadened collaboration across manufacturers, energy suppliers, logistics providers, financiers and technology innovators. As a result, demand visibility is improving, technology matching is more efficient and conditions for final investment decisions are gradually strengthening.

JHF is also serving as a bridge between Japan’s hydrogen ecosystem and global capital. The participation of a leading international player, TotalEnergies, as a limited partner underscores the growing relevance of Japan as a strategic market for early hydrogen deployment.

International technology leaders are also watching these developments with growing interest. JHF’s recent investments in Twelve, innovative CO₂ conversion technology provider and producer of eFuels, reflect the increasing alignment between Japan’s industrial demand and international innovation.

These examples highlight how reliable demand and sophisticated supply chain partners are key to commercializing carbon transformation at scale. Japan offers both – a strategic market with the industrial backbone and long-term commitment.

What Japan’s early progress reveals about building hydrogen markets

Japan’s early progress offers encouraging signals for how hydrogen markets can take shape globally. Hydrogen operates not as a single technology but as an integrated system in which production, logistics and end-use must advance together. When policy direction, capital flows, technological readiness and emerging demand align, the pathway to commercial scale becomes far clearer.

Strengthening long-term offtake commitments remains essential. Supply-side investment alone cannot unlock final investment decisions. It is durable demand visibility, especially in aviation, shipping, energy and steel, that gives developers and financiers confidence to proceed. Policy mechanisms such as Japan’s emerging contracts-for-difference and long-term decarbonization auctions can help bridge early cost gaps and accelerate capital deployment.

Japan’s approach shows how coordinated public ambition and structured private capital can reinforce each other. By pairing national frameworks with industrial capabilities and the Japan Hydrogen Fund’s ecosystem-wide perspective, early technological gains will begin to translate into broader market development.

Integrating policy, capital and global cooperation on hydrogen

Hydrogen will play a central role in global decarbonization. Japan’s evolving approach, grounded in policy alignment, industrial coordination and disciplined capital formation by JHF, offers a practical example of how countries can move from conceptual ambition toward system-level implementation.

For Japan, this represents both a domestic opportunity and an international responsibility. By illustrating how supply, demand, finance and policy can be integrated, the country is contributing a blueprint others may adapt as they progress toward net-zero goals.

Delivering a hydrogen society will require sustained leadership, investment and cross-border cooperation. Japan’s early progress indicates how these elements can converge and how a more resilient, diversified and sustainable energy system can begin to take shape – offering a pathway the international community can advance together.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Energy TransitionSee all

Roberto Bocca

February 24, 2026